Crop insurance Decisions in 2022

Illinois farmers traditionally have used Revenue Protection (RP) at high coverage levels as their main choice of crop insurance. Continued use at high levels seems warranted in 2022, given the large increase in production costs. Adding the Supplemental Coverage Option (SCO) and/or Enhanced Coverage Option (ECO) endorsements can further limit risk exposure but will come at high premiums.

Historic Use

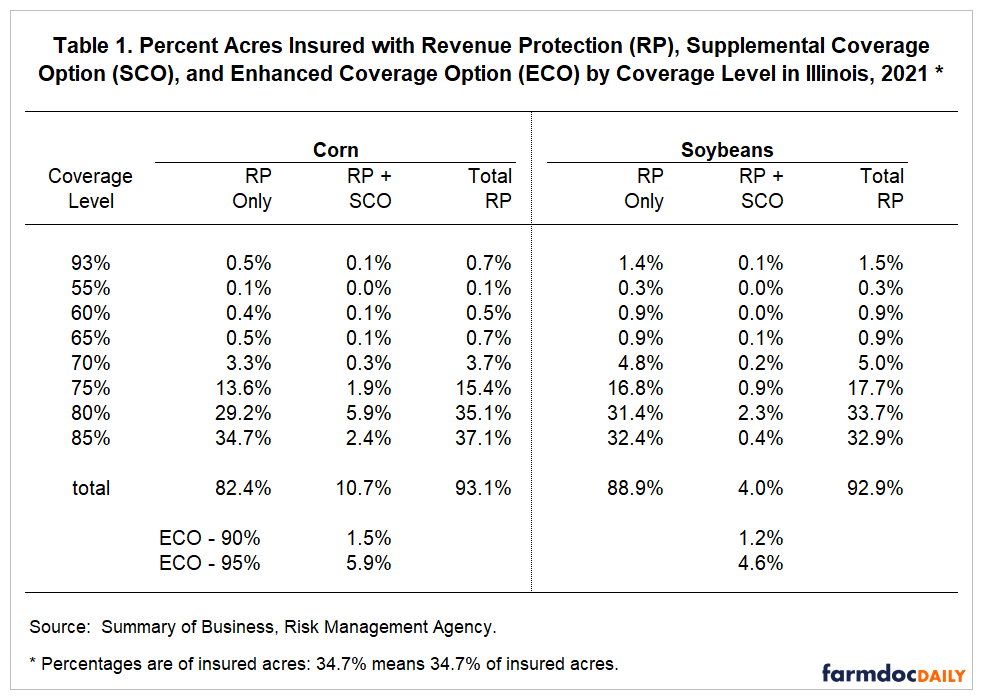

Over time, farmers have increased use of Revenue Protection (RP), making it the most used product in the Midwest (for historical trends, see farmdoc Daily, November 17, 2020). In 2021, RP was used on 93.1% of insured corn acres and 92.9% of soybean acres.

RP can be used in conjunction with the Supplemental Coverage Option (SCO). RP insures based on farm-level yields, while SCO is county-level insurance. SCO provides county-level protection from 86% down to the coverage level of the RP policy (see farmdoc Daily, February 12, 2021, for a description of SCO). For corn, RP was used without SCO on 82.4% of corn-insured acres in 2021, and RP was used in conjunction with SCO on 10.7% of acres (see Table 1). SCO was used less for soybeans: RP only was used on 88.9% of acres, and RP plus SCO combinations were used on 4.0% of acres.

Overall, RP was used at high coverage levels. For corn, RP at the highest coverage levels of 75%, 80%, and 85% was used on 15.4%, 35.1%, and 37.1% of acres, respectively. For soybeans, use was 17.7%, 33.7%, and 32.9% at 75%, 80%, and 85% coverage levels, respectively. Overall, 75% and higher coverage levels were used on 87.6% of corn acres and 84.3% of soybeans acres. These use trends were similar to 2020 values. The average coverage level was over 80% in northern and central Illinois counties and between 70% and 80% in southern Illinois counties (see farmdoc daily, May 4, 2021).

The Enhanced Coverage Option (ECO) was available for the first time in 2021. ECO offers county-level coverage from either 90% or 95% down to 86%, the top coverage offered by SCO (see farmdoc daily, November 24, 2020, December 10, 2020, December 15, 2020, December 22, 2020, February 23, 2021, March 2, 2021). On corn, ECO at the 90% overage level was used on 1.5% of acres, and ECO at the 95% coverage level was used on 5.9% of acres (see Table 1). On soybeans, ECO at the 90% and 95% coverage levels was used on 1.2% and 4.6% of insured acres, respectively.

Illinois farmers typically have used RP at high coverage levels. Continued use at high coverage levels seems warranted.

Estimating Farmer-paid Premiums for 2022

Farmer-paid premiums are available in the Crop Insurance Decision Tool, a FAST spreadsheet available for download. The farmer-paid premium for crop insurance will depend on projected prices and volatilities that will be set in February. Overall, premiums likely will be higher in 2022 than in 2021, as projected prices likely will be higher in 2022. The projected price for corn was $4.58, while soybean’s projected price was $11.87 in 2021. Current trading for 2022 harvest futures contracts suggests higher projected prices for 2022.

Table 2 shows estimated premiums for Macon County, Illinois, a high-yielding county in central Illinois. Premium estimates are calculated using last year’s volatilities (.23 for corn and .19 for soybeans) and projected prices based on futures trading in the week of January 17-21, 2021 ($5.50 for corn and $13.00 for soybeans).

For an 85% RP policy, farmers with a 220 Trend-Adjusted Actual Production History (TA-APH) yield should expect to pay $28.77 per acre (see Table 2). Adding an SCO policy protecting 86% to 85% has a premium of $1.66, giving a total RP and SCO premium of $30.43. Soybean premiums are lower at $18.26 for RP-85% plus $.97 for SCO, giving a total RP-SCO premium of $19.23.

For corn, ECO has a $14.43 per acre premium from 90% to 86%, while a 95% to 86% band has a $38.52 per acre premium. ECO at the 90% and 95% coverage levels for soybeans have premiums of $8.14 per acre and $22.63 per acre, respectively.

Final premium levels will likely differ from these estimates since they will depend on futures trading and volatility in February.

Continued High Coverage Suggested

Continued high coverage level use in 2022 seems warranted, particularly given the significant cost increases (see farmdoc daily, December 7, 2021). Even with high coverage levels, chances of significant losses exist. Illustrations for corn and soybeans for the Macon County scenario are given below.

Total costs, including an average cash rent, are projected at $1,050 per acre for corn. Currently, the projected price is $5.50 per bushel. Projected prices are futures prices. Cash prices typically are below the futures price by about $.30 per bushel. As a result, the $5.50 projected price represents a cash price guarantee of 5.20. An 85% coverage level has a cash guarantee of $972 per acre (.85% coverage level x $5.20 cash guarantee price x 220 guarantee yield). A farmer still has a chance of over a $100 loss ($1,050 costs + $28 premium – $972 guarantee).

Total costs, including an average cash rent, are projected at $785 per acre for soybeans. A $13.00 projected price has a cash guarantee of $12.70, given a $.30 basis. An 85% coverage level then has a $755 cash guarantee. With 85% RP coverage, the farmer has a chance of a $48 loss before crop insurance makes indemnity payments ($785 total costs + $18 premium – $755 guarantee).

Additional protection is available with SCO and ECO; however, this coverage is at the county level, meaning that there are possibilities that a farm will have a loss while the county does not. In addition, SCO and ECO have higher costs, as they will make payments at relatively small declines in prices or yields. Therefore, farmers may wish to consider adding ECO and SCO for additional protection, weighing the costs relative to the risk gains.

Summary

Traditionally, Illinois farmers have purchased RP at high coverage levels. Continuing this practice into 2022 seems warranted given the significant increase in production costs in 2022. In addition, the use of high coverage levels can limit losses if adverse events occur.

References

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "Historical Analysis of the Frequency of Triggering Enhanced Coverage Option (ECO) Payments." farmdoc daily (10):209, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 10, 2020.

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "The New Enhanced Coverage Option (ECO) Crop Insurance Program." farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Schnitkey, G., C. Zulauf, K. Swanson and N. Paulson. "2022 Updated Crop Budgets." farmdoc daily (11):162, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 7, 2021.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Crop Insurance Coverage Levels and ECO Use on Corn." farmdoc daily (11):71, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 4, 2021.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "RP, ECO, and SCO Tradeoffs." farmdoc daily (11):29, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 2, 2021.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Potential Payouts from Enhanced Coverage Option." farmdoc daily (11):27, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 23, 2021.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "Payment Examples Under Enhanced Coverage Option." farmdoc daily (10):215, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 22, 2020.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Years in Which Enhance Coverage Option Pays." farmdoc daily (10):211, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 15, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.