Conventional and Organic Enterprise Net Returns

Due to continued increases in demand for certified organic grains, crop farmers that have transitioned from conventional to certified organic grains report higher net returns per acre (McBride et al., 2015; Greene et al., 2017; Langemeier et al., 2020; Langemeier and O’Donnell, 2021; Center for Farm Financial Management, 2022). Despite this, certified organic land accounts for less than 2 percent of U.S. farmland (U.S. Agricultural Census, 2017). Information pertaining to the relative profitability of conventional and organic production is often lacking.

A farmdoc daily article written in October 2021 (October 1, 2021) compared net returns for conventional and organic crop enterprises using FINBIN data from 2016 to 2020. This article uses FINBIN data from 2017 to 2021 to update comparisons of crop yields, gross revenue, total expense, and net returns for conventional and organic alfalfa, corn, oats, soybeans, and winter wheat. The organic enterprise data represents farms that have already transitioned to organic production, and thus do not include information pertaining to the transition phase.

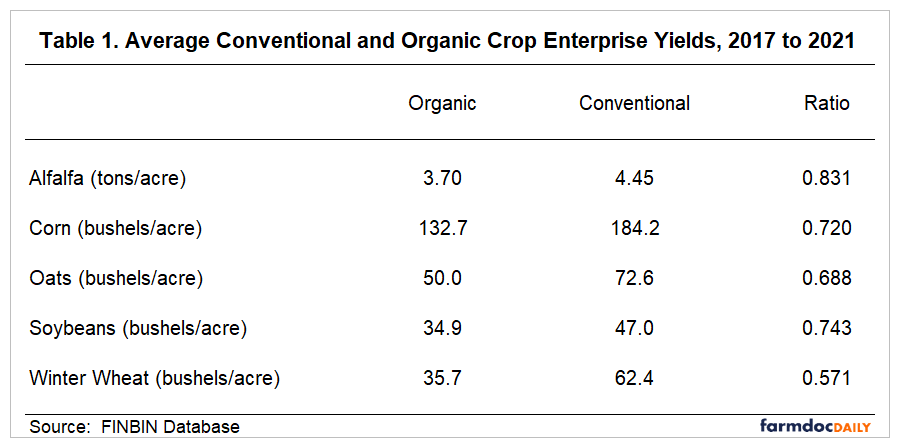

Crop Yields

Table 1 shows the average conventional and organic crop yields for alfalfa, corn, oats, soybeans, and winter wheat. The ratio illustrated in the last column of the table was computed by dividing the organic crop yield by the conventional crop yield. Alfalfa exhibited the smallest difference in crop yields between conventional and organic crops. The yield drags for corn, oats, soybeans, and winter wheat were 28 percent, 31 percent, 26 percent, and 43 percent, respectively.

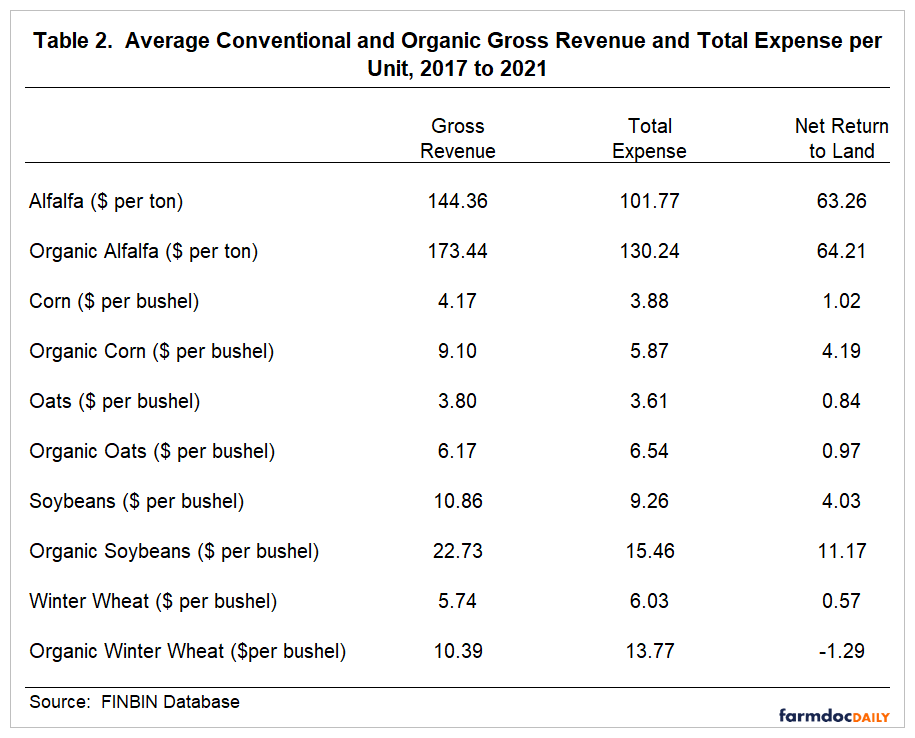

Gross Revenue, Total Expense, and Net Return to Land

Gross revenue, total expense, and net return to land per unit for alfalfa, corn, oats, soybeans, and winter wheat are presented in Table 2. Gross revenue includes crop revenue, crop insurance indemnity payments, government payments, and miscellaneous income. Total expenses include all cash and opportunity costs, other than those associated with owned farmland. Farmland costs included in the total expense reported in Table 2 were comprised of cash rent, real estate taxes, and interest, which would be lower than the full opportunity cost on owned land. Just to give the reader some idea as to how large this excluded cost may be, you would need to add an estimated $0.15 per bushel ($0.50 per bushel) to the total expense for conventional corn (conventional soybeans) if you wanted to account for the full opportunity cost on owned land. Also, note that the per unit net returns presented in Table 2 represent a net return to land rather than an economic profit.

Though conventional and organic crops face different market phenomena, it is common to compare conventional and organic gross revenue per unit and crop prices. Comparing organic to conventional gross revenue per unit reported in Table 2, the smallest ratio of organic to conventional gross revenue per unit was for alfalfa (1.20) and the largest ratio (2.19) was for corn. Organic oats and winter wheat gross revenue per unit were 1.62 and 1.81 times their conventional counterparts, while the organic soybean gross revenue per unit was approximately 2.09 times higher than the conventional soybean gross revenue per unit. It is important to note that the gross revenue per unit ratios reported in Table 2 represent five-year averages. The gross revenue per unit and crop price ratios for individual crops vary from year to year. For example, during the 2017 to 2021 period, the corn price ratio ranged from 1.76 in 2021 to 2.74 in 2017, and soybean price ratio ranged from 1.81 in 2019 to 2.38 in 2021.

Examining gross revenue and total expense per unit for each enterprise reported in Table 2, it is evident that economic losses occurred for winter wheat grown conventionally, and for oats and winter wheat grown in an organic rotation. The lack of profits for the organic small grains has important implications for organic crop rotations. Numerous organic crop rotations include a small grain in the rotation. Market opportunities for organic small grains vary substantially by region, and it can be difficult to find markets for these crops. It is also useful to examine differences in net returns per unit for each crop (e.g., corn versus organic corn). The largest differences in net return per unit occurred for corn and organic corn, and for soybeans and organic soybeans. The difference in net returns per unit between the two crop rotation systems was very small for alfalfa.

It is important to note that the net returns reported in Table 2 are on a per-unit basis. Given the differences in crop yields between conventional and organic crops, it is often more relevant to examine differences in per acre net returns than per-unit net returns. The average difference in net returns to land between the organic and conventional crops was $86 per acre. The largest difference was $367 per acre for corn. The difference for soybeans was $200 per acre. The differences for alfalfa, oats, and winter wheat were -$44, -$13, and -$81 per acre, respectively, indicating that the conventional alfalfa, oats, and winter wheat enterprises were more profitable than organic alfalfa, oats, and winter wheat.

Difference in Net Returns Among Farms

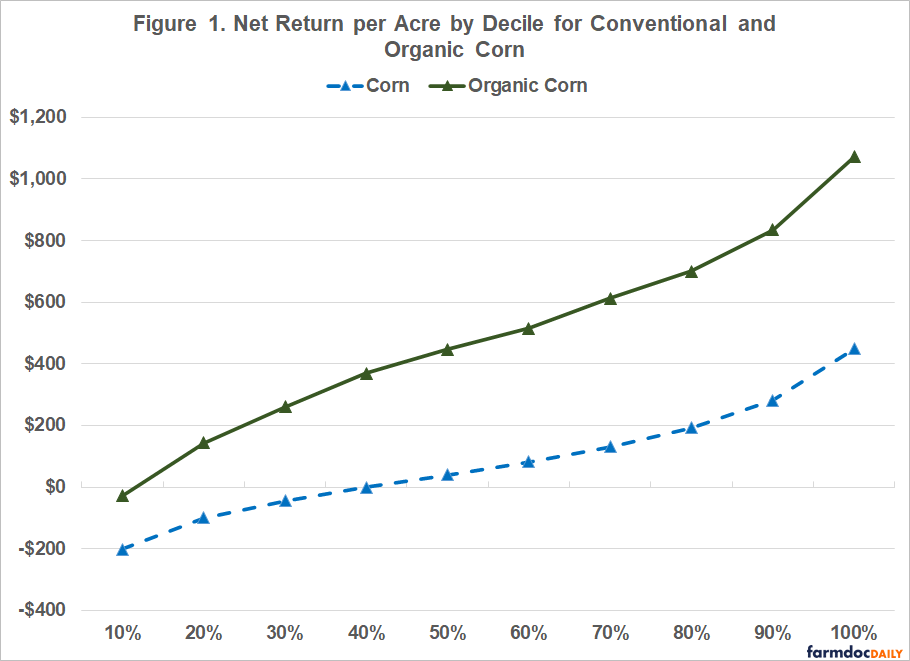

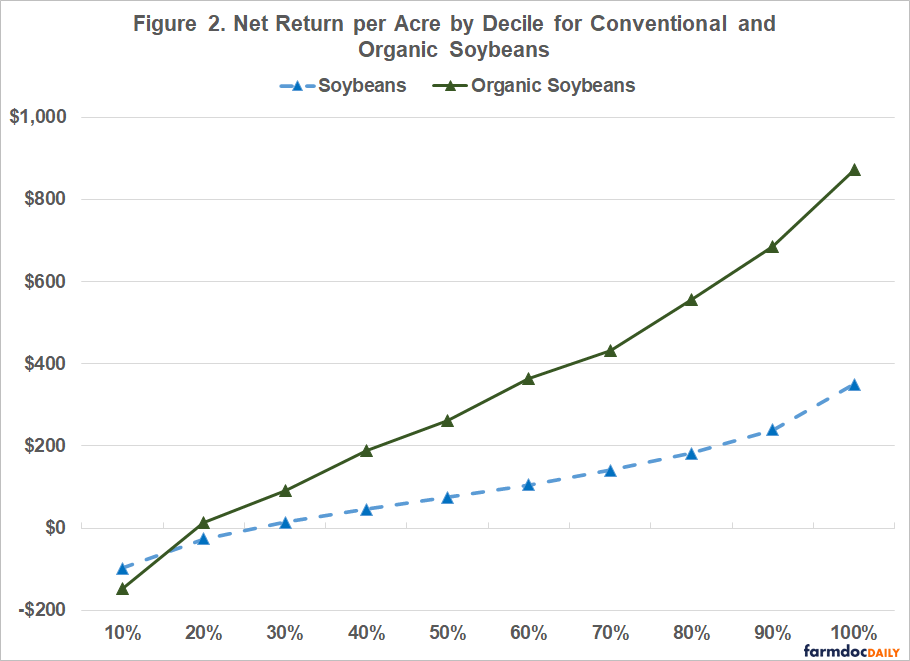

The results above focus on differences in average net return to land. Economists have long pointed out the large differences in financial performance among farms. To account for the differences among farms, we used the FINBIN database to examine net returns for conventional and organic corn and soybean enterprises.

Figure 1 presents the comparisons among enterprise deciles (ten equal groups) for conventional and organic corn using 2017 to 2021 FINBIN data. Net return in this figure was computed by subtracting land expenses from net return to land, and excluded government payments, operator labor, and a management charge. The median net returns per acre for conventional corn and organic corn were $61 and $472, respectively. The difference in net return per acre for the bottom and top deciles was $651 for conventional corn and $1,101 for organic corn. Despite the larger median net return, it is important to note that there were quite a few organic farms with lower net returns for corn than their conventional counterparts in the top deciles.

Comparisons among enterprise deciles for conventional and organic soybeans are presented in Figure 2. The median net returns using FINBIN data for the 2017 to 2021 period for conventional soybeans and organic soybeans were $91 and $323, respectively. The difference in net return per acre for the bottom and top deciles was $448 for conventional soybeans and $1,021 organic soybeans. Even though the median net return for organic soybeans is higher than the median net return for conventional soybeans, the organic producers in the lowest decile had lower net returns than the conventional soybean producers in the lowest decile.

What can we make of the results in Figures 1 and 2? First, there is a larger difference in net returns between the organic producers than there is between the conventional producers. This result could be due to learning effects or the more complicated rotations associated with organic crop production. Second, obtaining a boost in net returns from organic soybean production appears to be much more difficult than it is for organic corn. This could be due to weed control issues often encountered when producing organic soybeans. The results in figures 1 and 2 stress the importance of examining the sensitivity of budgeted net returns for organic crops to changes in price, yield, and cost assumptions before transitioning acres.

Summary and Conclusions

This article compared crop yields, gross revenue, total expense, and net returns for conventional and organic corn and soybeans. FINBIN data (Center for Farm Financial Management, 2022) were used to make the comparisons in this article. Consistent with previous work, organic corn and soybean enterprises had lower crop yields, higher crop prices and gross revenue, and higher net returns. However, there was a much wider difference in enterprise net returns among organic corn and soybean enterprises than there was among conventional corn and soybean enterprises. It is also important to note that the difference in net return to land for alfalfa and oats were relatively small, and that conventional winter wheat exhibited a higher net return to land than organic winter wheat.

This article summarized net returns for conventional and organic crop enterprises. It did not examine net returns during the transition period nor account for the fact that unlike many conventional rotations, organic crop rotations tend to include small grains and/or forages. Thus, it is very important to not just compare net returns for corn and soybeans grown conventionally and organically. For comparisons of conventional and organic crop rotations see Langemeier et al. (2020) and Langemeier and O’Donnell (2021).

References

Center for Farm Financial Management, University of Minnesota, FINBIN web site, accessed August 5, 2022. https://www.cffm.umn.edu/

Greene, C., G. Ferreira, A. Carlson, B. Cooke, and C. Hitaj. “Growing Organic Demand Provides High-Value Opportunities for Many Types of Producers.” USDA-ERS, Amber Waves, February 6, 2017. https://www.ers.usda.gov/amber-waves/2017/januaryfebruary/growing-organic-demand-provides-high-value-opportunities-for-many-types-of-producers/

Langemeier, M. "Conventional and Organic Enterprise Net Returns." farmdoc daily (11):140, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 1, 2021.

Langemeier, M., X. Fang, and M. O’Donnell. “Comparison of Long-Run Net Returns of Conventional and Organic Crop Rotations.” Sustainability. 12(Issue 19, 2020):1-7. https://doi.org/10.3390/su12197891

Langemeier, M. and M. O’Donnell. “Comparative Net Returns for a Forage-Based Organic Crop Rotation.” Current Investigations in Agricultural and Current Research. 9(Number 4, 2021):1256-1262. https://lupinepublishers.com/agriculture-journal/pdf/CIACR.MS.ID.000319.pdf

McBride, W.D., C. Greene, L. Foreman, and M. Ali. “The Profit Potential of Certified Organic Field Crop Production.” USDA-ERS, Economic Research Report Number 188, July 2015. https://www.ers.usda.gov/publications/pub-details/?pubid=45383

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.