Reviewing the Inflation Reduction Act of 2022; Part 2

The House of Representatives is considering the Inflation Reduction Act of 2022, the Senate substitute amendment that replaced all provisions of a bill previously passed by the House in November 2021 (Inflation Reduction Act of 2022 (H.R.5376), Engrossed Amendment Senate). Both versions are reconciliation bills, and both include provisions written by the House and Senate Agriculture committees. The bill includes a $43.7 billion infusion of funding to four categories of programs under the jurisdiction of the Congressional Agriculture committees. This is the second article providing an initial review of the legislation (farmdoc daily, August 11, 2022). Today’s article looks at the funding for rural development, FSA farm loan borrowers and forestry.[1]

Brief Summary

The Inflation Reduction Act has consumed more than a year of work and negotiations in the 117th Congress. As of this writing, the Senate has passed it as an amendment that replaces the House bill passed in November 2021; expectations are that the House will agree to the Senate amendment on Friday, August 12, 2022, and send it to President Biden to be signed into law. If so, the IRA 2022 will provide nearly $44 billion in funding to agricultural conservation, rural development and forestry programs as follows:

- $19.5 billion for farm bill conservation programs;

- $13.3 billion for rural development programs;

- $6 billion for FSA farm loan borrower assistance; and

- $5 billion for forestry programs.

Figure 1 illustrates the breakdown of funding by the Senate Committee on Agriculture, Nutrition, and Forestry.

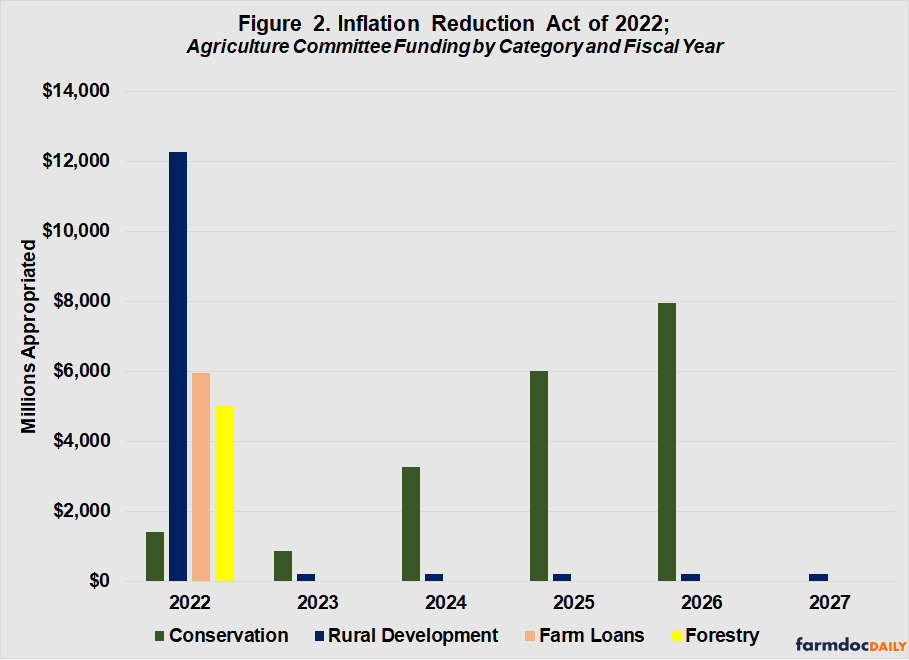

Figure 2 illustrates the appropriated amounts in each fiscal year as written in the legislative text. Notably, most of the funding is provided for FY2022 but conservation is the exception, as are some of the rural development funds. The conservation programs receive specified appropriations across multiple fiscal years, increasing to the maximum amount in FY2026.

Most of the total funds appropriated in the IRA 2022 are designed to rapidly advance efforts to respond to climate change, including by reducing greenhouse gas emissions from farming, capturing, sequestering, and storing greenhouse gases in soils, and advancing renewable energy in rural communities and on farms. All of the funds are in addition to funding authorized in the farm bill, and all appropriated through the complicated and controversial reconciliation process. To comply with the reconciliation instructions, the House and Senate Agricultural Committees wrote a form of multi-year appropriation, using “any money in the Treasury not otherwise appropriated.” The rest of this article will provide a detailed discussion of the reconciliation funding for rural development, FSA farm loan borrowers, and forestry programs.

Background: Reconciliation Review

The Inflation Reduction Act (IRA) of 2022 is not ordinary legislation, nor legislation in the ordinary course of business or the regular order of Congress. It is reconciliation legislation that operates under specific statutory authorities, and special procedural rules. Federal budget law provides for the inclusion of reconciliation instructions in a concurrent budget resolution (2 U.S.C. §641). Reconciliation consists of instructions written by the Congressional Budget Committees and agreed-to by both the House and Senate in the budget resolution, but not signed into law by the President. Congress instructs committees to take actions related to the budget, which are compiled into a single legislative vehicle that is considered under special rules. The IRA 2022 began as Senate Concurrent Resolution 14 which set budget levels for fiscal years (FY) 2023 through 2031; Title II provided reconciliation instructions that included the Agriculture Committees. The specific instructions to the Senate Committee on Agriculture, Nutrition and Forestry (Senate ANF) were to “report changes in laws within its jurisdiction that increase the deficit by not more than” $135 billion “for the period of fiscal years 2022 through 2031” (S. Con. Res. 14).

Detailed Discussion; Part 2

To comply with reconciliation, any changes in outlays by the House and Senate Agriculture Committees had to be within their jurisdiction and not merely incidental to the non-budgetary components. Moreover, all changes in outlays had to fit within the reconciliation window of FY2022 through FY2031; no spending provided in the bill could be scored by the Congressional Budget Office (CBO) to take place in any fiscal year after FY2031. The House and Senate Agricultural Committees wrote a form of multi-year appropriation, using “any money in the Treasury not otherwise appropriated.” The IRA of 2022 includes a grand total appropriation of $43.7 billion in the jurisdiction of the Senate ANF Committee. Yesterday’s article reviewed (a) the reconciliation process, and (b) the funding for conservation programs (Figures 4 through 6). The discussion in this article adds a review of the funding for (c) rural development (Figure 7), (d) FSA farm loan borrowers (Figure 8), and (e) forestry programs (Figure 9).

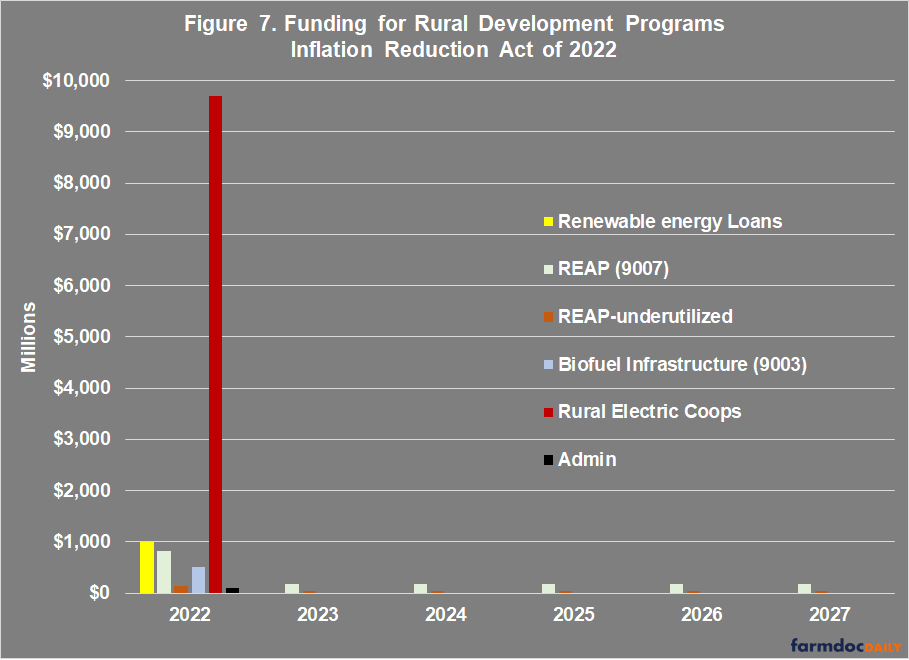

(c) Rural Development

The funds provided to rural development programs are for transitioning to and increasing renewable energy production in rural communities and regions. The bill amends Section 9003 of the Farm Bill (7 U.S.C. §8103) adding a provision to provide $1 billion for electric loans for renewable energy as authorized by the Rural Electrification Act of 1936 (IRA, Sec. 22001, at 547; 7 U.S.C. §940g). It adds funding for the Rural Energy for America Program (REAP) in Section 9007 of the Farm Bill (7 U.S.C. §8107), with $820.25 million made available in FY2022 and an additional $180.2765 million for FY2023 through 2027; all funds are to remain available through the end of FY2031. The bill also includes funding for underutilized renewable energy technologies and for technical assistance of $144.75 million in FY2022 and $31.8135 for FY2023 through 2027; all funds to remain available through FY2031 (IRA, Sec. 22002, at 548-49). The REAP program and the additional funding assist agricultural producers and rural small businesses become more energy efficient and adopt renewable energy technologies and sources.

The IRA provides $500 million of additional funding for biofuel infrastructure and agriculture product market expansion under Section 9003 of the Farm Bill (IRA, Sec. 22003, at 550; 7 U.S.C. §8103). The funds are for grants up to 75 percent of the cost to “increase the sale and use of agricultural commodity-based fuels through infrastructure improvements for blending, storing, supplying, or distributing biofuels, except for transportation infrastructure not on location where such biofuels are blended, stored, supplied or distributed” (IRA, at 550-51). This includes installation of new equipment or retrofitting existing fuel dispenser and storage equipment, as well as for home heating distribution systems to use biofuels and ethanol.

The IRA provides assistance to rural electric cooperatives with an appropriation of $9.7 billion (to remain available through FY2031) by adding a provision added to Section 9003 of the Farm Bill (7 U.S.C. §8103). The funds are “for the long-term resiliency, reliability, and affordability of rural electric systems” by providing loans, modifying loans or other financial assistance to “achieve the greatest reduction in carbon dioxide, methane, and nitrous oxide emissions associated with rural electric systems through the purchase of renewable energy” or similar systems (IRA, Sec. 22004, at 551-52). Rural electric cooperatives and utilities can purchase renewable energy, or new systems for renewable energy or zero-emissions, as well as carbon capture and storage systems. Finally, $100 million is provided to USDA Rural Development for the administrative costs of implementation (IRA, Sec. 22005, at 554). Figure 7 illustrates the funding appropriated to these programs.

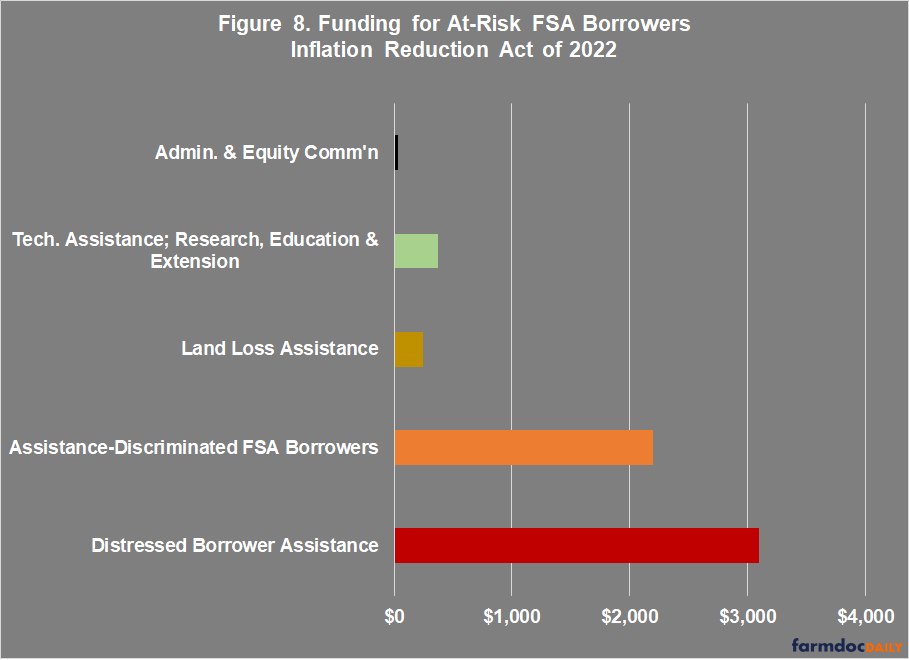

(d) FSA Farm Loans

Section 22006, 22007 and 22008 provides nearly $6 billion in funding for immediate relief for at-risk borrowers in the FSA farm loan programs, replacing the funding initially provided by the American Rescue Plan Act of 2021 (IRA, Sec. 22006-08 at 554-59). Specifically, $3.1 billion is appropriated for payments and the cost of loans or loan modifications for “distressed borrowers of direct or guaranteed loans” made by FSA (7 U.S.C. §1981 and §1922 et seq.). Congress also provides $125 million for technical and other assistance by USDA to help underserved farmers, ranchers, and foresters. Congress added $250 million for land loss assistance and $10 million for a USDA equity commission. $250 million is available for research, education and Extension, including scholarships, at certain institutions of higher education (e.g., 1890 and 1994 Institutions, etc.). Finally, Congress appropriated $2.2 billion for financial assistance to farmers, ranchers and forest landowners that experienced discrimination prior to January 1, 2021, and $24 million for administrative costs. All funding is made available in FY2022 and remains available through the end of FY2031 and is illustrated by Figure 8.

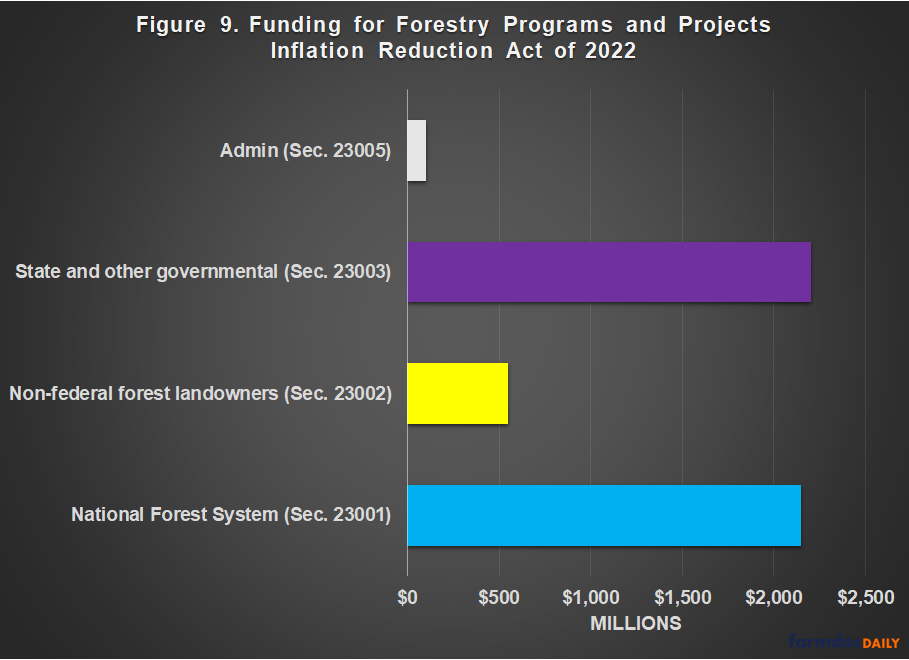

(e) Forestry

The final section in the IRA from the Senate ANF committee is for multiple forestry programs and projects. It appropriates a total of $5 billion in FY2022 to remain available through the end of FY2031 and divided across three categories: The National Forest System; non-federal forest landowners; and State and other governmental entities. Figure 9 illustrates the allocation to these three programmatic categories.

Section 23001 provides a total of $2.150 billion in funding for the National Forest System. Specifically, $1.8 billion is for hazardous fuels reduction projects within the wildland-urban interface (16 U.S.C. §6511), $200 million for vegetation management projects (16 U.S.C. §6542 or §6543), and $100 million for environmental reviews (National Environmental Policy Act of 1969 (42 U.S.C. §§4321–4370)) by the Forest Service at USDA. An additional $50 million is provided for protecting old-growth forests (IRA, Sec. 23001 at 559-63).

Section 23002 provides a total of $550 million for non-federal forest landowners, $450 million in total funding for competitive grants to non-federal forest landowners through the Cooperative Forestry Assistance Act of 1978 (16 U.S.C. §2109a) and $100 million for the wood innovation grant program (7 U.S.C. §7655d). Specifically, $150 million is appropriated for cost-share grants for climate mitigation or forest resilience practices for underserved forest landowners. In addition, $150 million is appropriated to support underserved forest landowners and $100 million for forest landowners owning less than 2,500 acres of forest land to support participation by these forest landowners in “emerging private markets for climate mitigation or forest resilience.” Finally, States and other eligible entities can compete for $50 million in competitive grants to pay private owners of forest land to implement best practices for increasing carbon sequestration and storage (IRA, Sec. 23002, at 563-66).

Section 23003 adds funding for State and private forestry conservation programs, including $700 million for competitive grants through the Forest Legacy Program (16 U.S.C. §2103c) and $1.5 billion for competitive grants to State and other governmental entities (including Tribal) or nonprofit organizations through the Urban and Community Forestry Assistance program (16 U.S.C. §2105) for tree planting and related activities (IRA, Sec. 23003 at 566-67). Finally, Section 23005 provides $100 million for administrative costs (IRA, at Sec. 23005 at 568).

Conclusion

As of this writing, the House of Representatives is expected to agree to the Inflation Reduction Act of 2022, which is a complete substitute amendment agreed-to by the Senate that replaced all provisions of a bill previously passed by the House in November 2021 (Inflation Reduction Act of 2022 (H.R.5376), Engrossed Amendment Senate). If it is signed into law by President Biden, the Act will provide $43.7 billion in additional funding to conservation, rural development, farm loans, and forestry programs that were last authorized by the 2018 Farm Bill. Congress is expected to debate reauthorization of all farm bill programs in 2023. The additional funding provided by the Inflation Reduction Act of 2022 adds to the issues for that farm bill effort, but the actual impact is uncertain at this point. These two articles have provided an initial review of the specific provisions in the Inflation Reduction Act from the Congressional Agriculture committees’ jurisdiction.

Note

[1] In the interest of full disclosure, please note that Jonathan Coppess was on partial leave from the University of Illinois from April 2021 to March 2022 to assist the Senate Committee on Agriculture, Nutrition, and Forestry with reconciliation legislation on a part-time basis as a special counsel; his partial employment with the committee ended prior to finalization of the Inflation Reduction Act of 2022.

References

Coppess, J., K. Swanson, N. Paulson, C. Zulauf and G. Schnitkey. "Reviewing the Inflation Reduction Act of 2022; Part 1." farmdoc daily (12):119, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 11, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.