Wheat Production Plunges in Argentina, on Record Pace in Brazil

Brazil has been harvesting a record wheat crop in the 2022-2023 season after growers planted the largest area in the past 32 years, according to the National Supply Company (Conab), the country’s food supply and statistics agency. The historic harvest is also a consequence of ideal weather conditions that fostered high yields. Conversely, Argentina is projected to have its lowest harvest in seven years, according to the local exchanges. Argentina’s production keeps declining because of severe drought and uncommon frosts in October and November. This article presents an overview of wheat production in the current marketing year in Argentina and Brazil, the primary wheat-producing nations in South America.

Drought Cuts Production in Argentina

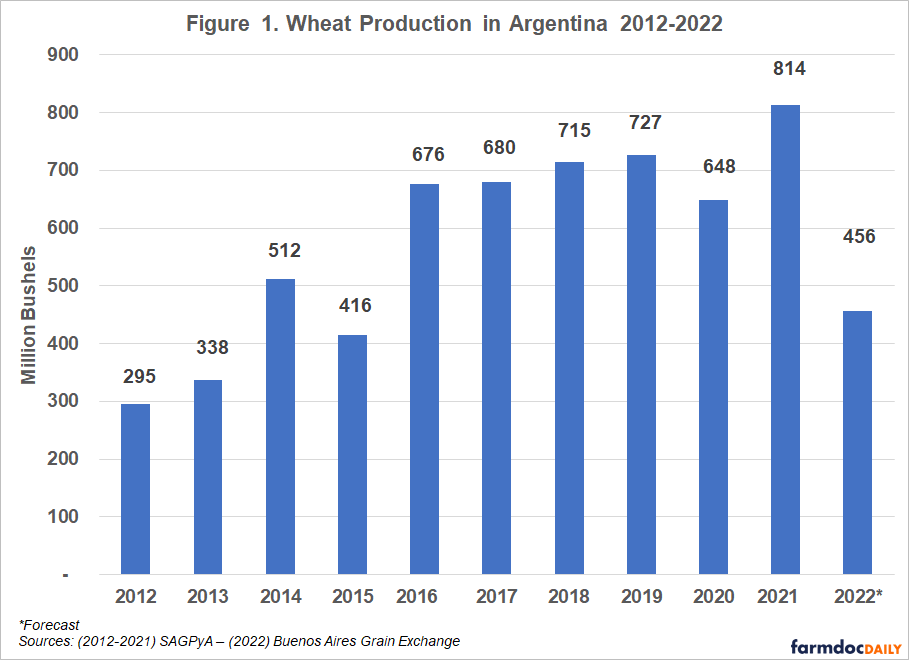

Wheat production estimates are declining weekly in Argentina, which conducts its harvest in December. The estimates are from the local exchanges at Bolsa de Cereales de Buenos Aires and Bolsa de Comercio de Rosario. With almost half of harvest completed, wheat production is estimated at 456 million bushels (equivalent to 12.4 million metric tons), according to the Bolsa de Cereales de Buenos Aires (see Figure 1).

This production level is just 56% of the previous harvest and represents a 36% decrease compared to the last 5-year average production (see Figure 1). Against a backdrop of what had been a significant positive trend in wheat production in the last 10 years, this year’s production represents an extremely low value – more than two standard deviations below the trend line.

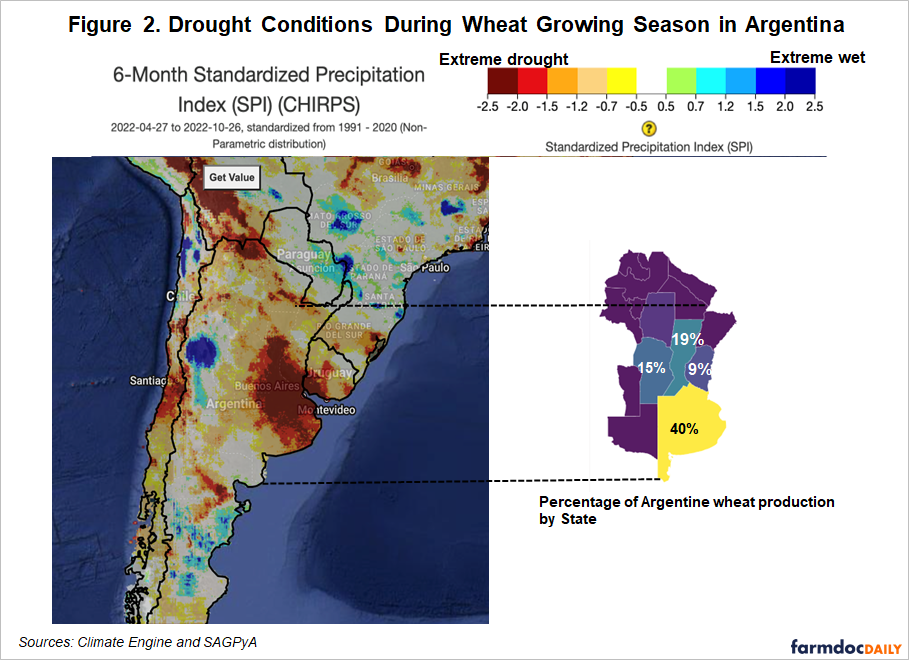

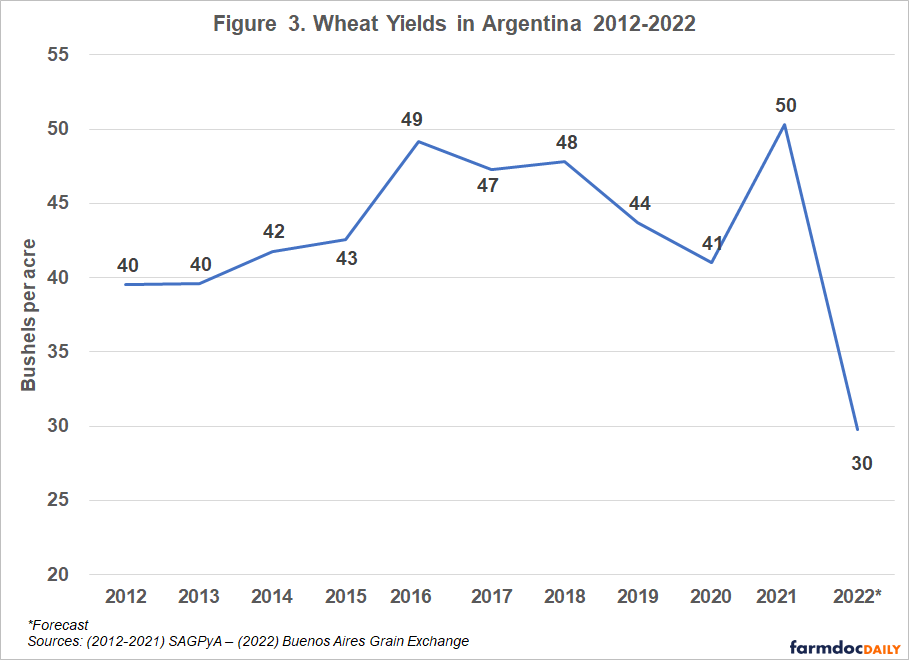

Minimal rainfall levels in the major wheat production areas during the growing season (see Figure 2) and late season frosts have contributed to extremely low yields (see Figure 3), and in some cases, the decision to leave the crop unharvested. Average wheat yield is estimated at 30 bushels per acre (2 tons per hectare), 40% lower than last season. This year’s wheat yields are similar to those in 2008, when the most severe drought in the last 20 years occurred.

A decrease in planted acreage, lower yields and 10-15% of wheat fields not being harvested explain the decrease in wheat production compared to expected values. The lack of water at planting time, high fertilizer prices and the fear of possible government intervention contributed to a decrease in wheat area.

High wheat prices partially compensate for farmers’ losses. The price at Rosario port in December 2022 is $9 per bushel ($332 per ton) (MATBA ROFEX), 36% higher than the last harvest price. However, many farmers won’t cover production costs this year, since the breakeven yield is around 33 bushels per acre at current prices.

Wheat Production Record Expected in Brazil

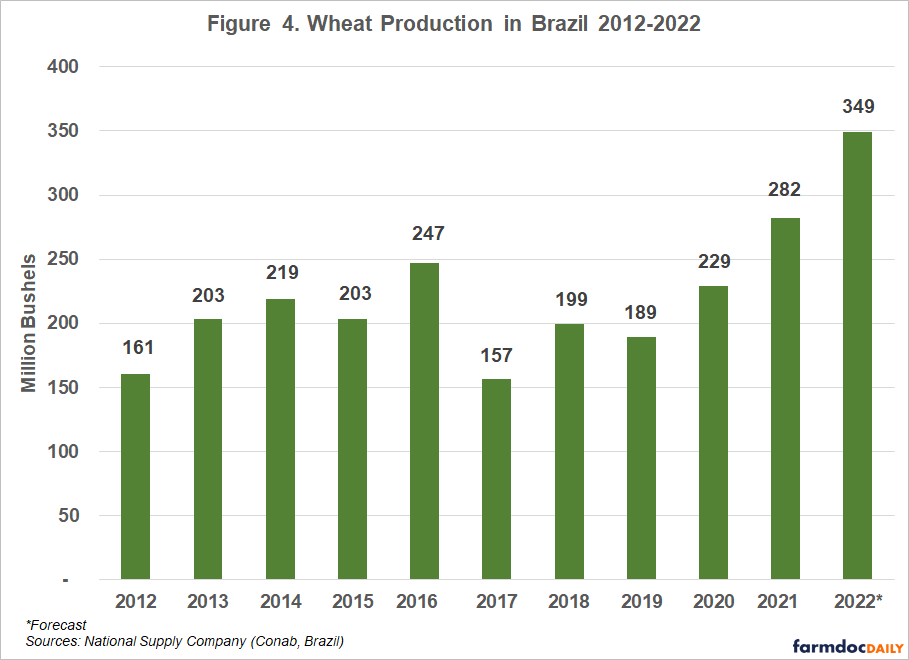

In contrast, Brazil is forecast to produce 349 million bushels (equivalent to almost 10 million metric tons) of wheat this season, 24% higher than last season (see Figure 4). It could be the best result in history. Brazilian wheat farmers typically plant their crop in the second quarter and, depending on the state, finish harvesting in December. The southern states of Parana and Rio Grande do Sul account for almost 90% of the wheat production in Brazil.

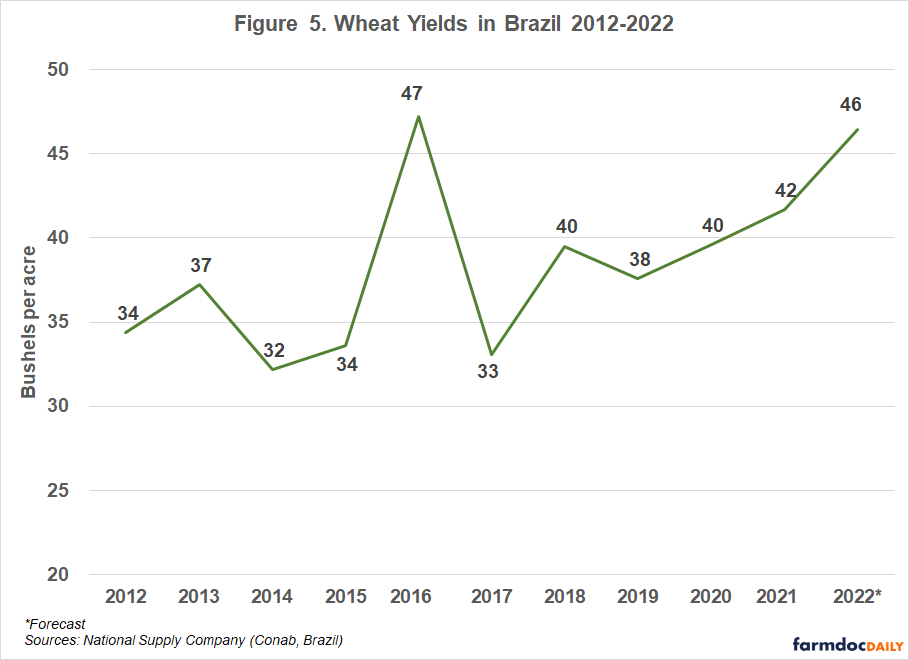

Ideal weather conditions in spring and winter also helped Brazilian farmers this year. Wheat yield is estimated at 46 bushels per acre (3.11 tons per hectare), up 10% from last year and the second highest yield ever. The last time Brazil reached more than 45 bushels per acre (three tons per hectare) was in 2016 (see Figure 5).

Brazil is on the verge of breaking a record in wheat production at the same time farmers’ interest in investing in this crop is on the rise. Brazilian producers increased the planted area by 12% this year because of the global supply disruption resulting from the war in Ukraine. Russia and Ukraine account for about 30% of global wheat exports. The war jolted commodity markets and caused a rise in the price of wheat, which was an incentive for increased wheat planting in Brazil (see farmdoc daily August 1, 2022).

Even though Chicago wheat futures eased to $9 per bushel with harvest progress, values remain elevated compared to historical averages. Prices continue to rise, influenced by expectations of low stocks in the United States and the difficulties generated by the ongoing conflict in the Black Sea. The depreciation of the Brazilian real relative to the U.S. dollar has kept prices in the Brazilian domestic market higher than the five-year average.

Changes in Wheat Trade Markets

In recent years, between 60 to 65% of Argentina’s wheat has been exported. Last year domestic wheat consumption was 240 million bushels (6.4 million tons). And exports to Brazil, the main trade partner in this crop, account for another 220 million bushels.

Before knowing the full impacts of drought and late frosts on wheat yields, Argentine exporters have signed sales statements for 330 million bushels (9 million tons). However, in November, the Argentine government authorized rescheduling grain sales within 2023, fearing that domestic demand could not be met. In the current marketing year (2022-2023), Brazil is likely to turn to alternative wheat suppliers in the Northern Hemisphere, such as the United States and Canada.

High production of Brazilian wheat could reduce its dependence on imports, which account for about 50% of the wheat consumed in Brazil’s domestic market. In 2021, for example, Brazil harvested 283 million bushels (7.7 million tons), exported 77 million bushels (2.1 million tons), and imported 257 million bushels (7 million tons). More than 70% of the imported wheat came from Argentina. Meanwhile, Brazilian wheat consumption surpassed 459 million bushels (12.5 million tons), according to the Brazilian government. Brazil is likely to turn to alternative wheat suppliers, despite a record output, to fulfill its domestic requirements.

Brazil is investing in becoming self-sufficient in wheat in 10 years by increasing its planted area, production, and yield. The development of new wheat varieties by the Brazilian Agricultural Research Corporation (whose Portuguese acronym is Embrapa) has allowed Brazilian farmers to cultivate wheat plants adapted to tropical conditions in the Cerrado biome – where growers traditionally plant corn and soybeans. This includes a production potential for 2.4 million acres (1 million hectares) in an irrigated system and incorporation of another 6.2 million acres (2.5 million hectares) in the rainfed system, doubling the current planted area of 7.4 million acres (3 million hectares).

Summary

Drought conditions have resulted in expectations for a major reduction in Argentinian wheat production in 2022. In contrast, good growing conditions and expanded planted acreage are expected to result in a record wheat crop in Brazil. While Brazil typically relies on Argentinian wheat as a main source of imports to fulfill domestic demand, this year may require Brazil to import larger amounts of wheat from suppliers such as Canada and the U.S. Investment is underway in Brazil to increase wheat production through new variety development, and increasing yields and planted acreage to move closer to self-sufficiency over the next 10 years.

Data Source and References

Climate Engine app: https://app.climateengine.com/climateEngine

Colussi, J., G. Schnitkey and S. Cabrini. “Wheat Outlook After Five Months of War in Ukraine.” farmdoc daily (12):112, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 1, 2022.

Companhia Nacional de Abastecimento (Conab). November 2022. Grain Crops. Brasília, Brazil. https://www.conab.gov.br/info-agro/safras/serie-historica-das-safras.

Estimaciones Agrícolas. Secretaria de Agricultura, Ganadería y Pesca, Argentina (SAGPyA) https://datosestimaciones.magyp.gob.ar/reportes.php?reporte=Estimaciones

Estimaciones Bolsa de Cereales de Buenos Aires (Buenos Aires Grain Exchange) https://www.bolsadecereales.com/estimaciones-agricolas

Estimaciones Bolsa de Cereales de Rosario. (Rosario Grain Exchange). https://www.bcr.com.ar/es/mercados/gea/estimaciones-nacionales-de-produccion/estimaciones

Matba Rofex, 2022. https://matbarofex.primary.ventures/futuros/agropecuarios

US Department of Agriculture, Foreign Agricultural Service. Brazil: Grain and Feed Update. November 28, 2022. https://www.fas.usda.gov/data/brazil-grain-and-feed-update-22

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.