Overview of the Production Capacity of U.S. Biodiesel Plants

Biodiesel production in the U.S. took off in the mid-2000s, driven by a plethora of federal and state incentives (Mattson, Wilson, and Duchsherer, 2007). Biodiesel capacity continued to expand after this initial period of explosive growth, but its potential has been threatened in recent years by the rapid buildout of renewable diesel production capacity. The boom in renewable diesel production in the U.S. has raised numerous questions about the impact on biofuel, grain, and oilseed markets. We recently began a series on the renewable diesel boom, with the first article (farmdoc daily, February 8, 2023) comparing the production processes and characteristics of biodiesel and renewable diesel, and the second (farmdoc daily, February 15, 2023) explaining the key role that policy plays in supporting production of both biofuels. This article provides an overview of the production capacity of U.S. biodiesel plants.

Analysis

Biomass-based diesel (BBD) has long played an important role in compliance with the U.S. Renewable Fuel (RFS) mandates (e.g., farmdoc daily, July 19, 2017). The two main types of BBD fuels used to comply with the RFS mandates are “biodiesel” and “renewable diesel.” Although biodiesel and renewable diesel are produced with the same organic oil and fats feedstocks, their production process differs substantially, resulting in the creation of two fundamentally different fuels (for details see farmdoc daily, February 8, 2023). Biodiesel uses a relatively simple chemical reaction production process known as transesterification, which typically results in a compound called fatty acid methyl ester (FAME). We refer to biodiesel in the remainder of this article as “FAME biodiesel” for this reason. Because of its chemical properties, FAME biodiesel must be blended with petroleum diesel to be used in modern diesel engines. In contrast, renewable diesel is fully refined and cracked using petroleum refining technology. This results in a “drop-in” hydrocarbon fuel that meets the same technical specifications as petroleum diesel, and as such, can be used as a complete replacement for petroleum diesel.

We begin by reviewing the location of FAME biodiesel production facilities in the U.S. as of January 2022 in Figure 1. The data are collected as part of an annual survey of nameplate production capacity by the Energy Information Agency (EIA). For the purposes of this survey, nameplate capacity is the amount of FAME biodiesel that a plant is capable of producing in a year, not necessarily the amount actually produced. There are currently 72 FAME biodiesel production facilities located in the United States. The total nameplate production capacity of these 72 plants is 2.3 billion gallons per year. Plants are scattered across the U.S., with the largest concentration in the eastern half of the U.S. and the far west.

The geographical dispersion of FAME biodiesel plants contrasts with ethanol plants, which are highly concentrated in the Corn Belt. Fortenbery, Deller, and Amiel (2013) argue that two factors explain the greater dispersion of FAME biodiesel plants. First, many of the early FAME biodiesel plants were developed by entrepreneurs that did not have strong ties to production agriculture. Second, FAME biodiesel can be blended and shipped in pipelines, which allows more flexibility in locating biodiesel plants. While not cited by Fortenbery, Deller, and Amiel, the widespread availability of biodiesel feedstocks, such as soybean oil and corn oil, in the eastern half of the U.S. also likely was an influential factor in plant location.

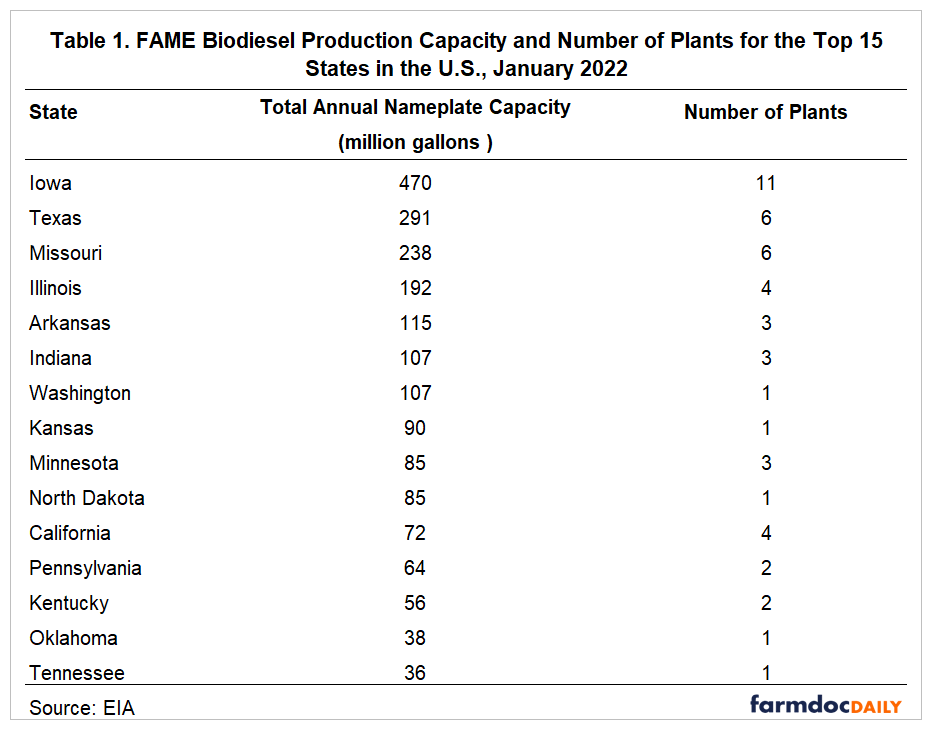

Table 1 shows that Iowa is the top FAME biodiesel production state, with 11 plants having a total production capacity of just under 500 million gallons. Texas is the second-ranked state, with 6 plants and about 300 million gallons of production capacity. Over 40 percent of FAME plants are located in the top five states of Iowa, Texas, Missouri, Illinois, and Arkansas.

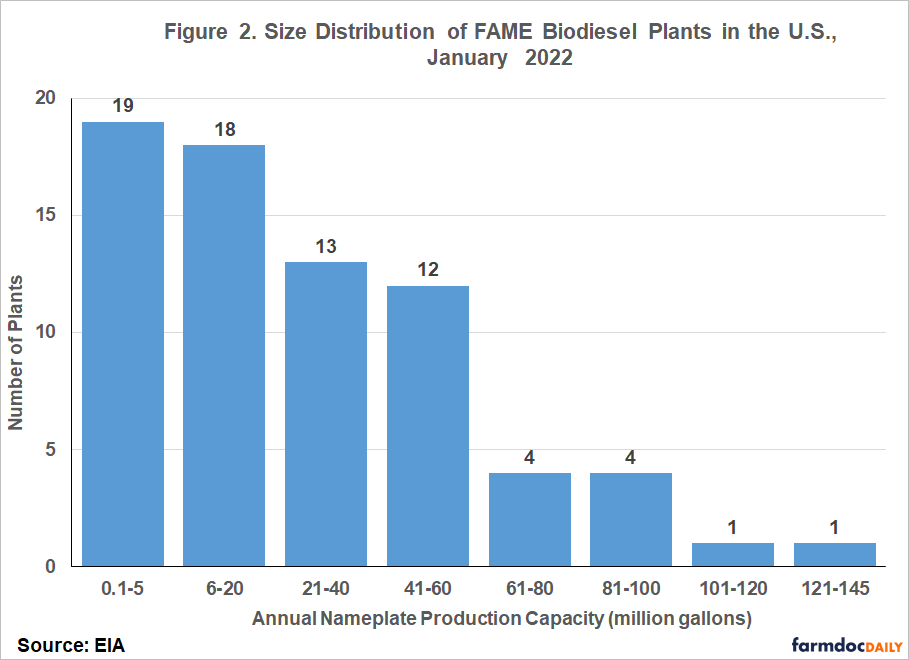

The size distribution of FAME biodiesel plants in the U.S. is presented in Figure 2. The industry is dominated by relatively small production facilities, with 85 percent of plants having a capacity of less than 60 million gallons per year. Half of FAME biodiesel plants have annual capacity less than 20 million gallons and a quarter no more than 4 million gallons. There are only two plants with a production capacity of 100 million gallons per year or more.

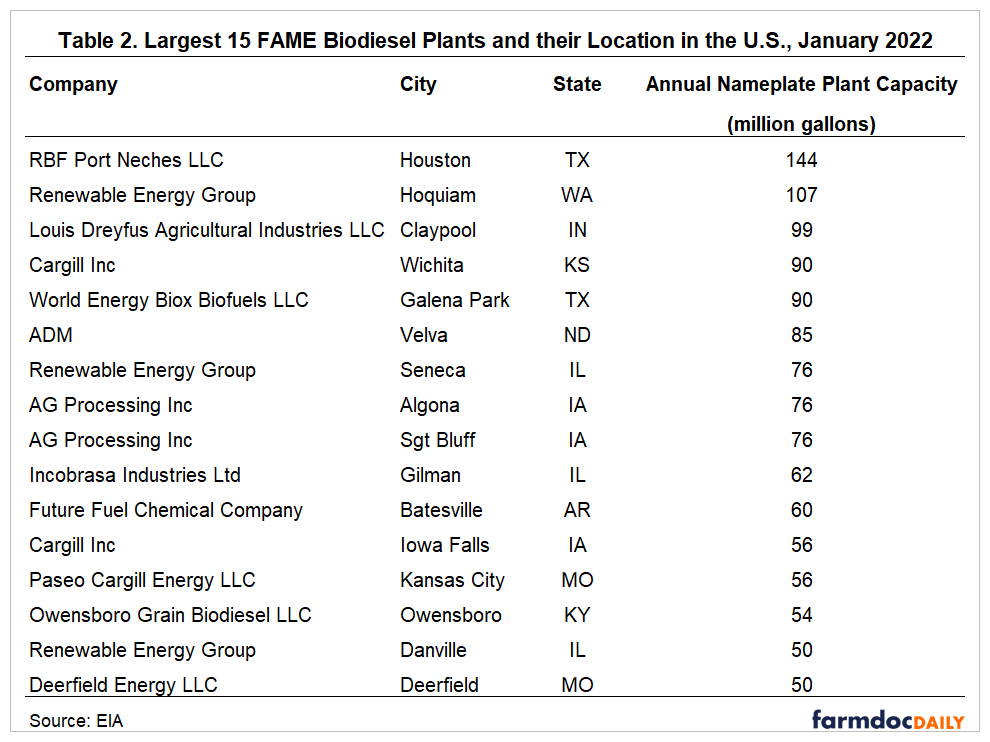

Table 2 lists the 15 largest FAME biodiesel production plants in the U.S. and their location as of January 2022. The largest plant, RBF Port Neches LLC, is in Houston, Texas and has a capacity of 144 million gallons per year. The second largest, operated by the Renewable Energy Group, is in Hoquiam, Washington and has a capacity of 107 million gallons. It is interesting to note that the two largest plants are not located in the Midwest, which has the largest concentration of facilities. The remaining plants on the list, with the exception of the World Energy Biox Biofuels LLC plant, are located in or near the Midwest.

Table 3 examines the distribution of production capacity by company, rather than by individual plant. The Renewable Energy Group (REG) is the largest FAME biodiesel producer in the U.S., with 5 plants and capacity of 432 million gallons. REG was acquired in June 2022 by Chevron (Ramon, 2022). The second largest FAME producer is Ag Processing Inc., which operates two major biodiesel production facilities in Iowa and Missouri, capable of producing up to 194 million gallons in 2022. The third largest FAME biodiesel manufacturer is Cargill Inc., which operates two plants with a total capacity of 146 million gallons. The top four firms control 40 percent of production capacity, which is a moderate level of concentration.

It should also be noted that a number of the larger producers operate soybean crushing facilities in association with their FAME biodiesel production plants. AGP, Cargill, and Louis Dreyfus have integrated FAME biodiesel production with their soybean processing capabilities that help them maintain a stable feedstock pipeline for production and may allow them to lower costs.

Up to this point, the analysis has been based on observations collected at one point in time, January 2022. It is certainly relevant to understand trends in production capacity over time. EIA conducts a monthly survey that collects data on the “operable” capacity of FAME biodiesel plants. This is a measure of capacity that is in operation, and it can differ from the nameplate capacity that was discussed earlier. The data are available from the Monthly Biodiesel Production Report for January 2009-December 2020 and the Monthly Biofuels Capacity and Feedstocks Update for January 2021-November 2022.

Figure 3 shows total operable FAME biodiesel production capacity for the U.S. over January 2009 through November 2022. From 2009 through 2015, operable FAME biodiesel production capacity generally was near 2.1 billion gallons. Thereafter, capacity began to increase and reached a peak of 2.6 billion gallons in 2018. The 500-million gallon expansion in capacity was driven by rising RFS mandate requirements for biomass-based diesel (farmdoc daily, September 14, 2017). From January 2018 to July 2020, production capacity remained stable near the historic peak level of 2.6 billion gallons. A sharp decline in production capacity began in 2020, which reflects the shut-down and/or idling of many FAME biodiesel plants during the COVID-19 pandemic. This was followed by an even more rapid idling of capacity during 2021 and 2022 in the face of a boom in renewable diesel production. Total biodiesel production capacity in the U.S. is now back to the average level of capacity over 2009-2016 of about 2.1 billion gallons.

Implications

U.S. FAME biodiesel production capacity is characterized by many relatively small plants, a few large plants, and most of the production concentrated in the eastern half of the country near feedstock producing areas, oil refining regions and transportation hubs. Iowa is the top FAME production state, with 11 plants having a total production capacity of just under 500 million gallons. Over 40 percent of FAME biodiesel plants are located in five states: Iowa, Texas, Missouri, Illinois, and Arkansas. The Renewable Energy Group (REG) is the largest biodiesel producer in the U.S., with 5 plants and capacity of 432 million gallons. Total FAME biodiesel production capacity has fallen rather sharply since 2020, with a total decline of more than 400 million gallons. The impact of COVID restrictions contributed, but the biggest impact by far has been rising competition from renewable diesel producers.

The next article in this series on the renewable diesel boom will examine the operating capacity for renewable diesel production in the U.S. through 2022 and how the renewable diesel industry structure differs from that of the biodiesel industry.

1The findings and conclusions in this publication are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy. This work was supported in part by the U.S. Department of Agriculture, Economic Research Service.

References

Fortenbery, T.R., S.C. Deller, and L. Amiel. “The Location Decisions of FAME biodiesel Refineries.” Land Economics 89(2013):118-136.

Gerveni, M., T. Hubbs and S. Irwin. "FAME biodiesel and Renewable Diesel: It’s All About the Policy." farmdoc daily (13):27, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 15, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "FAME biodiesel and Renewable Diesel: What’s the Difference?" farmdoc daily (13):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 8, 2023.

Irwin, S. and D. Good. "The Ethanol Blend Wall, FAME biodiesel Production Capacity, and the RFS…Something Has to Give." farmdoc daily (3):27, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 13, 2013.

Irwin, S. and D. Good. "Filling the Gaps in the Renewable Fuels Standard with Biodiesel." farmdoc daily (7):130, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 19, 2017.

Irwin, S. "The Value of Soybean Oil in the Soybean Crush: Further Evidence on the Impact of the U.S. FAME biodiesel Boom." farmdoc daily (7):169, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 14, 2017.

Mattson, J.W., W.W. Wilson, C. Duchsherer. “Structure of the Canola and FAME biodiesel Industries.” Agribusiness & Applied Economics Report No. 606, Center of Excellence for Agbiotechnology: Oilseed Development, Department of Agribusiness and Applied Economics, North Dakota State University, August 2007.

Ramon, S. “Chevron Completes Acquisition of Renewable Energy Group (regi.com).” Chevron Renewable Energy Group, California, June 13, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.