A Question of Priorities: Additional Context for Inflation Reduction Act Conservation Funding

Congress has passed legislation that will once again narrowly avert a shutdown of the federal government. Oddly enough, the temporary funding bill (known as a Continuing Resolution or CR) creates a two-tiered deadline that presents the potential for multiple partial shutdowns in early 2024, one of which, fittingly, would be Groundhog’s Day (Bogage, November 15, 2023; Perano and Emma, November 15, 2023; Carney, November 14, 2023; Bogage and Sotomayor, November 14, 2023). Farm Bill reauthorization, however, has achieved a longer reprieve with a one-year extension through the 2024 crop and fiscal years (H.R. 6363; Clayton, November 16, 2023; Hill and Downs, November 13, 2023). While the extension allows for more time, it does not alleviate the key impediments to reauthorization, among them the demand for reference price increases and the need to offset the projected spending increases over 10 years. As the committees continue to negotiate, this article builds upon previous discussions to add further context on the additional conservation investments made by the Inflation Reduction Act of 2022.

Background

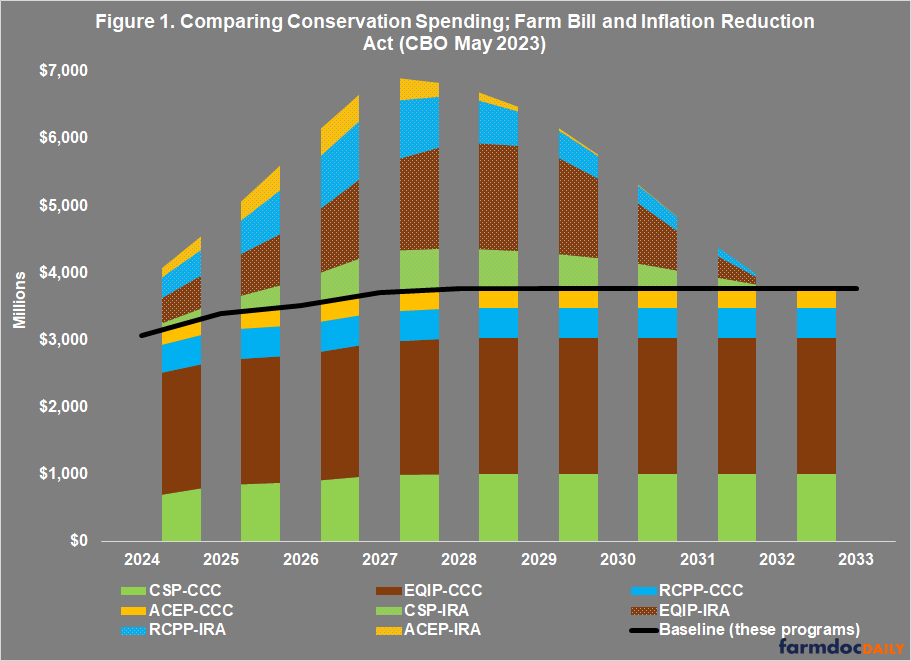

Between the Farm Bill and the Inflation Reduction Act (IRA), there are two separate sources of funding for four of the major conservation programs: Environmental Quality Incentives Program (EQIP); Conservation Stewardship Program (CSP); Agricultural Conservation Easement Program (ACEP); and Regional Conservation Partnership Program (RCPP). Figure 1 illustrates the two separate sources of funding for the same four programs. The Farm Bill authorizes spending from the Commodity Credit Corporation (CCC) which constitutes the spending in the ten-year baseline projections (solid bars; the line represents total baseline for these four programs) (16 U.S.C. §3841; CBO May 2023). In the IRA, Congress appropriated a total of $18 billion in additional funding for these four programs through fiscal year (FY) 2026 and provided that those funds would be available through FY2031 (P.L. 117-169). The IRA appropriations are in addition to the CCC baseline funds for these programs but are not a part of the baseline (pattern bars above the baseline). Adding confusion, the Congressional Budget Office (CBO) projects spending for both the CCC baseline and the IRA appropriations. CBO, however, projects that USDA will not spend the entire IRA appropriation by FY2031. Therefore, while Congress appropriated a total of $18 billion to remain available from FY2023 to FY2031, CBO projects a total of $15.99 billion spent from FY2023 to FY2031. Notably, USDA has reported that it obligated the entire appropriation for FY2023, which was not what CBO projected. While complicated and confusing, this has real implications because using the IRA funding for an offset in the farm bill would only net the lower amount in CBO’s scoring. In other words, if Congress rescinds or eliminates the IRA funding, CBO will only score $15.99 billion in savings, but the total amount of conservation funding for farmers that would be eliminated is $18 billion (minus what was obligated in FY2023).

The complicated and confusing interactions between policy authorizations and budget rules tend to obscure important issues. Large topline numbers add further opacity because most people do not typically encounter or easily comprehend amounts like $18 billion. The movement of such amounts under esoteric rules shrouds too much of public policy, removing it from the basic reality of the public. Therefore, the discussion below seeks to provide important context for IRA funding but is also limited by the challenges inherent in projecting into an unknowable future. Behind the large numbers is a critical point that should not be lost or obscured: each dollar appropriated by Congress in the IRA is available to be spent on payments to farmers, helping them adopt conservation on their farms. As the FY2023 data demonstrates, it is entirely possible that NRCS could spend all $18 billion appropriated by the FY2031 deadline and that the entire investment would go directly to farmers to assist them with adopting conservation on their farms. For those interested, a distilled version of the discussion is also available as an Issue Brief from the Policy Design Lab (https://policydesignlab.ncsa.illinois.edu/issue_whitepaper).

Discussion

To begin, Figure 2 provides an interactive map that estimates or projects total IRA spending among the states. Hovering over each state will provide the projected spending by the four programs for which the IRA increased available funds. The projected spending in each state and by program is based on historic obligations for those practices considered climate smart (NRCS, Inflation Reduction Act and Climate-Smart Mitigation Activities). The state’s average share of the national total for those practices was used for the projection, adjusted based on the reported spending from IRA funds for FY2023.

Of note, the projected obligations by program and state are conservatively low. These projections are based on the CBO outlay projections which, as discussed above, are lower than the total amount available. If NRCS obligates the entire appropriated amounts, these totals would increase as would the program-by-program amounts. Projections would also change depending on any changes to the practices that qualify for the IRA funding, as well as any deviations from historic allocations among the states. Finally, if Congress rescinds or eliminates the IRA funding all estimated spending would be eliminated and farmers in those states would not receive any of the assistance projected here.

The next step is to provide context by estimating the potential impact on farmers. As discussed previously, each year there are more farmers who apply for conservation assistance and are approved to receive it than there are funds to meet the demand for that assistance (farmdoc daily, September 28, 2023). The additional funding provided in the IRA would likely help many of those farmers who have been approved but not funded and are stuck in the conservation bardo. If Congress eliminates the IRA funding, then all farmers who could have received the assistance through the IRA will not. To that point, Figure 3 provides an initial projection of the number of applications that would not be funded if the IRA funds are no longer available. Each application in these estimates would represent an effort by a farmer to apply for conservation assistance from the IRA appropriations.

Note that in Figure 3, the totals only include projections for EQIP and CSP. Those two programs have the most complete data for the FY2023 payments and EQIP has historic backlog data. The totals illustrated are very conservative projections and understate applications on purpose. This is a result of the uncertainty in projecting applications and backlogs. For example, because the IRA funding is in addition to the funding authorized by the Farm Bill, there is the possibility that some applications that would have been funded by the IRA would be funded by the Farm Bill; it is just as likely that applications that would have been funded from Farm Bill funding will get funded by the IRA, freeing up Farm Bill funds for other farmers and applications. The key takeaway is that with the IRA funding available, we would expect more valid farmer applications for conservation to be funded; if the IRA funding is eliminated, we would expect fewer valid farmer applications would be funded, including those that receive Farm Bill funding and displace other applications. Figure 3 provides some measure of the total farmers in each state who likely would lose funding if the IRA funds were eliminated.

Figure 4 provides the final context in this discussion. It illustrates the excess demand for IRA funding in FY2023. It presents the total number of valid but unfunded applications for EQIP, CSP, and ACEP. In other words, this represents the conservation bardo for the first year of the IRA funding. It is further evidence that, even with the additional IRA investments, Congress is still not providing enough conservation funding to meet farmer demand.

Concluding Thoughts

In uniquely real time, this issue—rescinding or eliminating the additional conservation investments in the Inflation Reduction Act—offers a case study of the conservation question (see e.g., farmdoc daily, November 10, 2023). It also connects with and recycles from a long history that includes the Dust Bowl and the 1936 Soil Conservation and Domestic Allotment Act, the 1956 Soil Bank, and the 2002 Conservation Security Program. Public policy provides statements of priorities and each episode in that history produced agricultural policy that prioritized interests other than conservation. In the Madisonian system, developing public policy happens through a competition of interests and ideas or issues. It should not be surprising that one-sided or one-dimensional policy conversations and competitions produce one-sided or one-dimensional policies and that the priorities signaled tend to be self-reinforcing. For example, a one-sided or one-dimensional focus on crop prices signals priorities limited to crop prices. With that signal, what do we expect farmers to prioritize? Furthermore, if Congress deprioritizes conservation by eliminating funding for it (or limiting it unreasonably) what signal does that send and how do we expect farmers to respond in terms of their priorities? Can we expect farmers to prioritize the conservation of natural resources—given the uncompensated costs, managerial challenges, added risks, and the potential competitive disadvantages—if the policies we fund do not?

Before Congress in the current farm bill debate are competing priorities for public funds that provide direct financial assistance to farmers. The Inflation Reduction Act invested an additional $18 billion in assistance to farmers who adopt conservation. Eliminating or rescinding those funds could provide an offset for the projected costs of increased price-based farm program payments, but the actual outcome for any increased payments is uncertain and dependent on commodities markets over the next 10 years. If Congress chooses to protect the IRA investments, the public funds will be certain to reach farmers, payments will go to a more diverse population of farmers, and the public will receive benefits from the conservation practices implemented by farmers with the funding. The projections and estimates discussed above provide some indication of how those funds would be allocated among the states and how many farmers could benefit. If, however, Congress chooses to use the funds to cover the CBO projections for increasing reference prices, any payments are far less certain, will go to fewer farmers if they are triggered, and any benefits to the public are much less direct and far more questionable.

For policy in the public interest, it would appear an easy choice, but political reality does not so neatly conform. One reason could be that reality can be too easily obscured by large numbers ($18 billion over multiple years) and complex, complicated budget rules. Another could be a discussion or competition that is too one-sided or one-dimensional. To that end, the discussion herein seeks to provide some initial context and additional dimensions by projecting the state level allocations of total spending and the number of impacted farmers. While the exact amounts cannot be known at this time, we can be certain that eliminating the IRA investments will reduce the amount of assistance available to farmers in each state for conservation. Doing so will also send a clear message about actual priorities for agriculture and reinforce signals from history.

References

Bogage, Jacob. “Senate passes bill to avert government shutdown, sending it to Biden to sign.” The Washington Post. November 15, 2023. https://www.washingtonpost.com/business/2023/11/15/senate-vote-avert-government-shutdown/.

Bogage, Jacob and Marianna Sotomayor. “House passes bill to avert government shutdown, sends to Senate.” The Washington Post. November 14, 2023. https://www.washingtonpost.com/business/2023/11/14/government-shutdown-house-bill-vote/.

Carney, Jordain. “House passes Johnson’s bill to avert shutdown.” Politico.com. November 14, 2023. https://www.politico.com/live-updates/2023/11/14/congress/house-passes-johnson-bill-to-avert-shutdown-00127099.

Clayton, Chris. “Ag Policy Blog: Farm Bill, Budget Extension Go to President’s Desk.” DTN/Progressive Farmer. November 16, 2023. https://www.dtnpf.com/agriculture/web/ag/blogs/ag-policy-blog/blog-post/2023/11/16/farm-bill-budget-extension-go-desk-2.

Coppess, J. "The Conservation Question, Part 9: The Arrested Development of the Conservation Security Program." farmdoc daily (13):206, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 10, 2023.

Hill, Meredith Lee and Garrett Downs. “Johnson’s precarious farm bill extension dance.” Politico.com. November 13, 2023. https://www.politico.com/newsletters/weekly-agriculture/2023/11/13/johnsons-precarious-farm-bill-extension-dance-00126778.

Perano, Ursula and Caitlin Emma. “Senate passes stopgap spending bill, sending to Biden with time to spare.” Politico.com. November 15, 2023. https://www.politico.com/live-updates/2023/11/15/congress/senate-shutdown-vote-government-funding-00127494.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.