Brazil Cuts Its Soybean and Corn Production Projections for 2024

The National Supply Company (Conab), Brazil’s agency for food supply and statistics, revised its forecast for the next soybean harvest because of adverse weather in crucial growing regions. Conab, however, still anticipates a record crop. Soybean planting is behind schedule, which could mean lower global soybean and corn production in the coming months. The agency has also adjusted its corn production projections. Dry weather and low prices are expected to reduce the area planted for the second crop of corn, the safrinha. This article focuses on the latest estimates for Brazilian soybean and corn production for the 2023-2024 crop season, taking into account the influence of the El Niño weather pattern, which has negatively affected Brazil’s planting season.

Conab Reduces Forecast for Soybean But Still Expects a Record

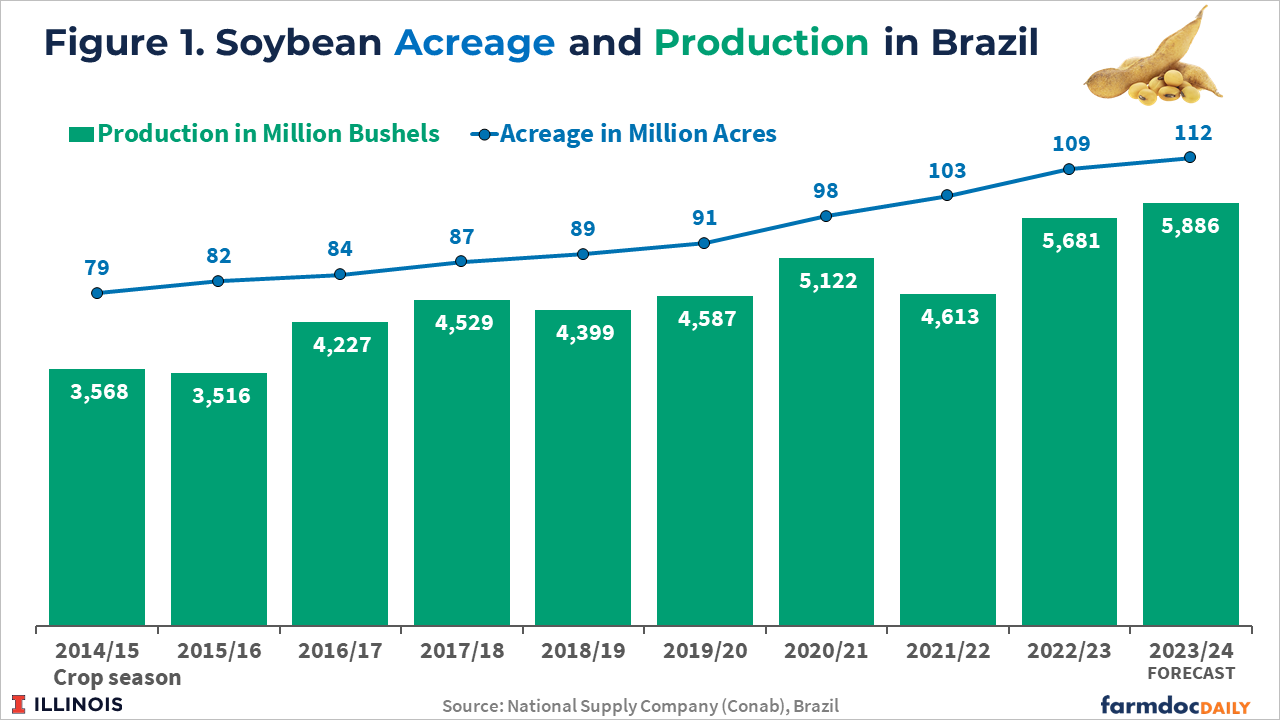

Conab reduced its soybean production forecast for 2023/24 to 5,886 million metric tons, down 1.4% from last month’s projection. Despite the adjustment, Brazil is still expected to produce a record crop, 3% greater than in the 2022/2023 season. However, some analysts are more conservative, projecting Brazil’s soybean harvest to be lower than last year because of the weather in key agricultural regions, such as Mato Grosso. Brazilian soybean acreage is expected to grow 2.7% to 112 million acres (see Figure 1).

The official national data indicates that, as of December 9th, 90% of the soybean crop is in the ground, compared to 96% at the same time last year. This is the slowest planting pace since 2015/16, when the soybean yields declined 5% compared to the previous cycle. Dry weather and high temperatures in the last two months have forced the replanting of soybeans in some areas. According to the Mato Grosso Institute of Agricultural Economics (IMEA), about 5% of the state’s soybean acreage must be replanted. Some private consultants are projecting replanted acreage as high as 10 percent.

Precipitation in October and November in Mato Grosso was 163 mm (6.4 inches), 53% below the 30-year average, according to Gro’s Climate Risk Navigator for Agriculture. In addition, November 2023 was the hottest and driest November in 30 years in Mato Grosso, according to data from WeatherTrends360. The combination of hot and dry weather has caused significant crop stress, leading some farmers in Mato Grosso to shift acreage into cotton rather than soybeans.

In contrast, too much rain has slowed planting progress in southern Brazil. November was the second wettest in more than 30 years in the state of Rio Grande do Sul, according to data from WeatherTrends360. Parts of southern Brazil have experienced flooding since September. This contrast between South and North is typically caused by El Niño – a climate pattern characterized by the warming of surface waters in the eastern tropical Pacific Ocean. During the growing season under El Niño influence, northern Brazil usually experiences below-normal rainfall, which can extend into areas of central Brazil, the main agricultural region.

Weather during planting for this crop season has differed significantly from the previous three growing seasons under La Niña, which is typically characterized by periodic cooling of ocean surface temperatures in the central and east-central equatorial Pacific. La Niña generated severe droughts in the southern states of Brazil and regular rainfalls in the Central-West states.

National Oceanic and Atmospheric (NOAA) models suggest El Niño will reach its peak in either late December or early January. Based on the latest forecasts, there is a greater than 55% chance of at least a “strong” El Niño persisting through January-March 2024 (NOAA, 2023), which could result in even larger negative impacts on Brazilian crop production.

Delays Increase the Risk of Second Crop of Corn

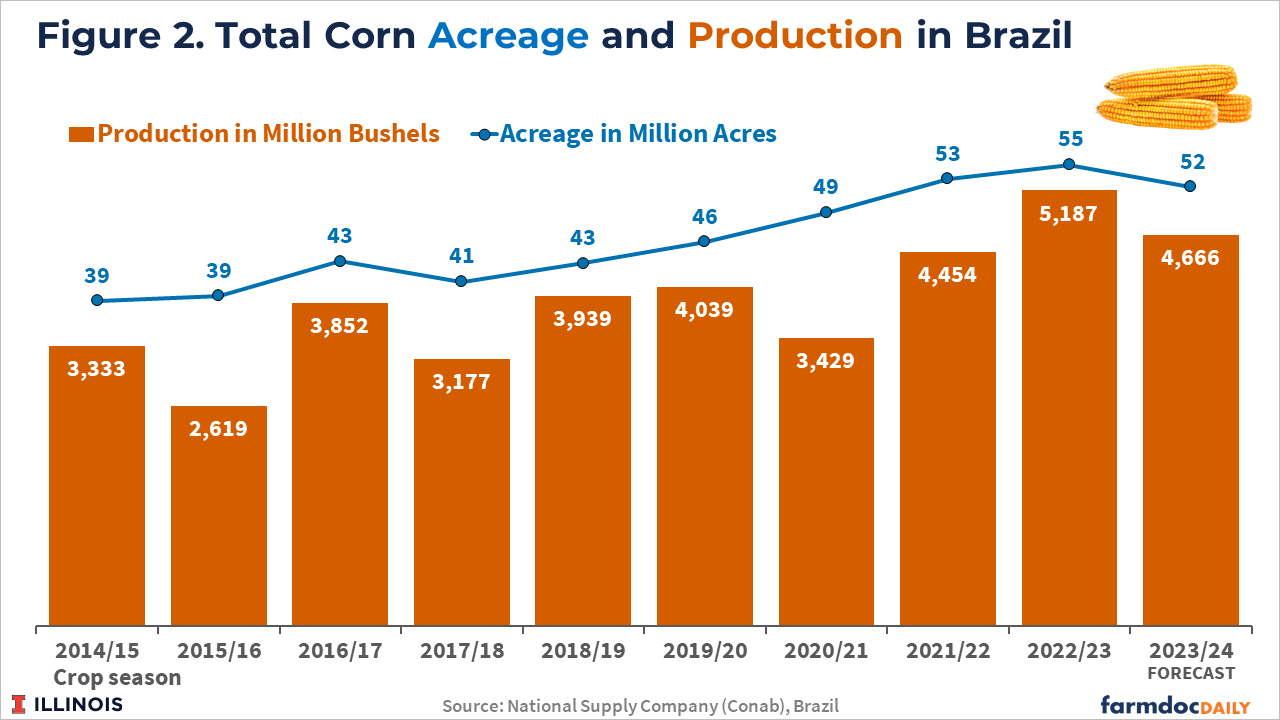

Slow planting progress in the central-west of the soybean crop increases the likelihood of planting delays and further problems for the second corn crop. The safrinha must be planted within a specific date range, typically from January to the beginning of March, to avoid the crop maturing in the dry season, which starts in mid-April. The current delay in the crop season, combined with a smaller acreage, led to a 10% reduction in the corn production forecast compared to the previous season. Total corn production is projected to be 4,666 million metric tons (see Figure 2).

Because of high production costs and relatively unattractive futures prices, Brazilian total corn acreage is expected to decrease by 5% to 52 million acres, according to Conab (see Figure 2). The lower expected earnings for corn led some farmers to plant soybeans instead of corn in the 2023/2024 crop season (see farmdoc daily, October 17, 2023). Faced with the increase in the risk of growing outside the ideal planting window, farmers could reduce corn acreage even more until January.

Meanwhile, the heavy rainfall in the country’s south has damaged and delayed the first corn crop. Brazil’s first corn planting reached 66% of the planned area as of December 9, compared to 77% at the same time last year. Brazil’s first and second crop corn production are expected to decline by 8% and 11%, respectively, in the 2023/24 cycle, according to the most recent Conab forecast. More than 70% of the corn produced in Brazil is from the second corn crop, planted typically in January and February in the Center-West states.

Final Considerations

The impact of the El Niño weather phenomenon on Brazilian agriculture is becoming increasingly evident. High temperatures and drought in the Center-West and wet conditions in the South have led to delayed soybean planting. Brazil’s soybean planting progress is nearing completion but still lags historical averages for this time in the season by about 10%. Concerns have also arisen for the second-crop corn because of the planting delays. As a consequence, Conab has lowered its forecast for the Brazil soybean and corn harvests.

While it is still early to estimate the potential reduction, there are several market factors that bear watching in the coming weeks that could potentially influence prices and markets in the United States. If Brazil’s soybean planting season continues to run far behind in December or if El Niño takes a bite out of Brazilian yields, U.S. producers could benefit from opportunities for U.S. corn and soybeans to be more competitive in export markets. Although Chinese interest in U.S. grain market has slowed in the past year, the lower projection of the Brazilian harvest could potentially allow U.S. supplies to regain a share in global trade.

References

Colussi, J., N. Paulson, G. Schnitkey and J. Baltz. "Brazil Expected to Expand Soybean Acreage and Reduce Corn Acreage." farmdoc daily (13):190, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 17, 2023.

https://farmdocdaily.illinois.edu/2023/10/brazil-expected-to-expand-soybean-acreage-and-reduce-corn-acreage.html

Conab, National Supply Company. Crops Time Series. Soybean and Corn Production. Brasília, Brazil. December 2023.

https://www.conab.gov.br/info-agro/safras/serie-historica-das-safras

National Oceanic and Atmospheric Administration U.S. Department of Commerce (NOAA). Climate Prediction Center (CPC).

https://www.cpc.ncep.noaa.gov/products/analysis_monitoring/enso_advisory/ensodisc.shtml

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.