Considering Low Prices, Yields, and Maximum ARC-CO Payments for 2024

As noted in recent articles, relatively high historical prices over the 2018 to 2022 marketing years have led to higher ARC benchmark prices for 2024 and, in some cases, PLC effective reference prices above the statutory minimum levels for 2024. For some crops, such as corn and soybeans, the 2024 ARC benchmark price is sufficiently above the effective reference price so that ARC-CO would trigger payments at higher price levels than the PLC program assuming the county yield is at the trend benchmark level in 2024. For other crops, such as wheat, PLC would trigger payments before ARC-CO at trend benchmark yield levels. See farmdoc daily articles from January 16, 2024 and January 23, 2024.

Today’s article takes a closer look at 1) price levels where ARC-CO would trigger payments, and 2) price levels where ARC-CO would reach the payment cap, for different county yield outcomes. We also examine how low price levels would need to be for PLC payments to exceed the ARC-CO payment cap, focusing on corn, soybeans, and wheat in Illinois.

ARC-CO payments may trigger payments at higher price levels than PLC, particularly for scenarios where county yields are at or below trend benchmark levels. However, if excellent growing conditions occur in 2024, resulting in county yields above benchmark levels, PLC could lead to larger payments at higher price levels than ARC-CO. Moreover, at sufficiently low price levels, PLC payments will exceed those from ARC-CO even if revenue losses occur due to the cap or limit on ARC-CO payments.

We encourage producers to examine ARC-CO and PLC payment outcomes for their specific farm situations under different price and yield scenarios using our updated Farm Bill What-If Tool.

ARC-CO Price Triggers at Different Yield Levels

ARC-CO is a county-revenue program that guarantees 86% of benchmark revenue. Thus, ARC-CO payments depend on both national marketing year average (MYA) prices and county yields while PLC payments are triggered only if the price falls below the crop’s effective reference price.

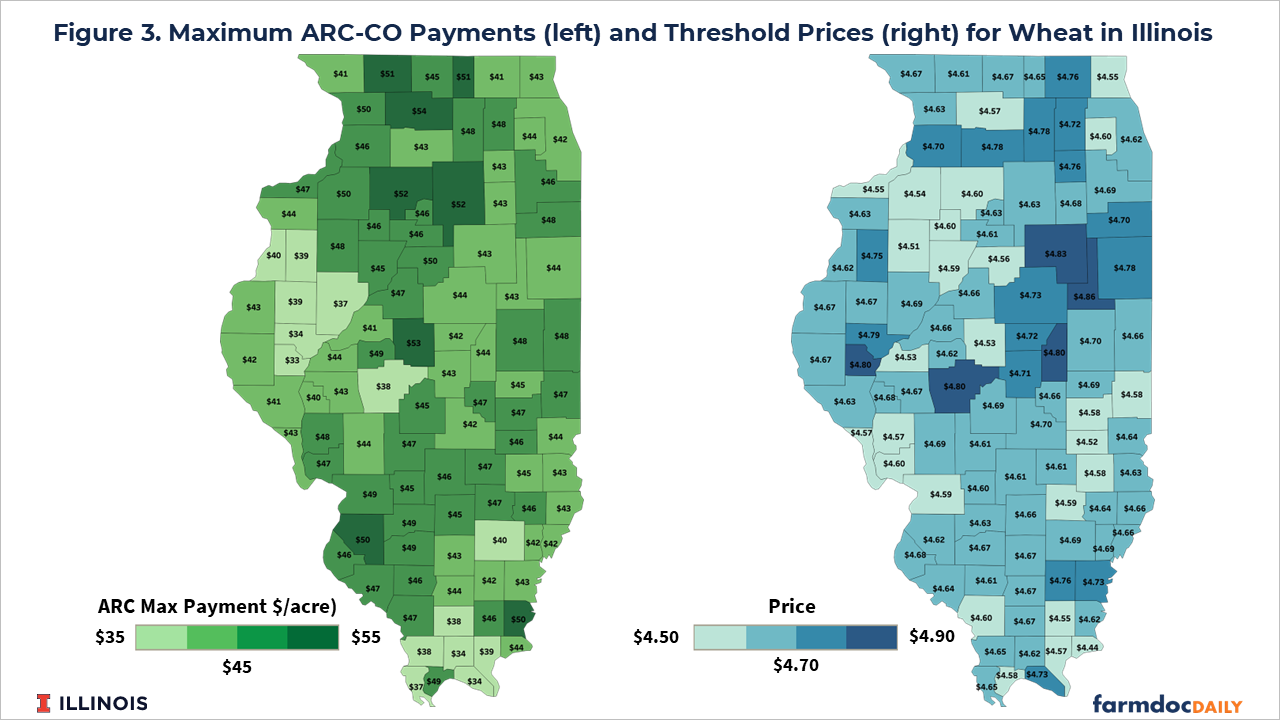

Table 1 illustrates price levels at which ARC-CO payments could be triggered for corn, soybeans, and wheat in 2024 for 4 different county yield scenarios:

- County yield is equal to the ARC-CO trend benchmark yield (columns in gray)

- County yield is 95% of benchmark, or a 5% yield loss (columns in orange)

- County yield is 105% of benchmark, or yields 5% above trend (columns in light green)

- County yield is 110% of benchmark, or yields 10% above trend (columns in darker green)

For corn, the 2024 PLC effective reference price is $4.01 and the ARC benchmark price is $4.85. Given the 86% revenue guarantee, ARC-CO would trigger payments at a MYA price for corn of $4.17 if the county yield is equal to the benchmark in 2024. A 5% county yield loss would mean ARC-CO payments would be triggered at $4.39. For county yields at or below the benchmark, ARC-CO would trigger payments at higher prices than PLC. With yields 5% or 10% above trend, corn prices would need to be below $3.97 and $3.79, respectively, to trigger ARC-CO payments. For these yield scenarios, PLC would trigger support at a higher price ($4.01) than ARC-CO.

Soybeans are similar to corn in that ARC-CO would trigger payments at higher prices than PLC if county yield is at or below the county’s benchmark yield. ARC-CO would trigger payments at a soybean price of $9.11 with county yield 5% above benchmark, and at $8.69 with yield 10% above benchmark – both of these ARC-CO triggers are below the PLC trigger of $9.26 for 2024.

For wheat, county yield would have to be below benchmark for ARC-CO to trigger payments at a higher price than PLC. The ARC-CO trigger prices at benchmark yield levels, or yield levels above benchmark, are lower than the PLC trigger price of $5.50 for wheat in 2024.

In summary, ARC-CO will trigger payments at higher prices than PLC on corn and soybean acres with county yields at or below trend benchmark levels. On wheat acres, PLC will trigger payments at higher prices than ARC-CO unless county yields are below the trend benchmark for the county.

The program which would trigger payments “first” – at a higher price level than the alternative – will also tend to provide larger payments than the alternative at even lower price levels. However, if prices were to reach a sufficiently low level, payments from the PLC program will become larger due to the cap built into the ARC-CO program – specifically 10% of benchmark revenue. The next section further analyzes the ARC-CO payment cap and provides guidance on price levels where it might become relevant.

ARC-CO Maximum Payments

Also included in Table 1 is the price level at which the ARC-CO program would reach its payment cap, or max payment, of 10% of the county’s benchmark revenue under each of the county yield scenarios outlined in the previous section.

ARC-CO payments on corn acres would reach their maximum at a price of $3.69 if county yield is at the benchmark level. The ARC-CO payment cap would be reached at a price of $3.88 if county yields are 5% below benchmark. For county yields at 5% or 10% above trend, the ARC-CO payment cap would be reached at prices of $3.51 and $3.35, respectively.

For soybeans, the max ARC-CO payment would be reached at a soybean price of $8.45 with yields at benchmark levels, and at $8.90 with a 5% yield loss. Yields 5% and 10% above trend would require soybean prices to reach $8.05 and $7.68, respectively, for ARC-CO payments to hit the maximum.

The max ARC-CO payment would be hit at a wheat price of $4.72 at benchmark yields and at $4.97 with yields 5% below benchmark. Wheat prices of $4.49 and $4.29 would result in the maximum ARC-CO payment for yields 5% and 10% above benchmark, respectively.

Low Price Scenarios Favoring PLC

How low prices would need to be for PLC to trigger payments larger than the max ARC-CO payment for a county depends on two things: 1) the maximum ARC-CO payment level for the county and 2) the PLC payment yield, which varies by farm.

The maximum ARC-CO payment is equal to 10% of the county’s benchmark revenue. Since the benchmark price is the same for all counties, variation in maximum ARC-CO payments is driven by variation in the trend-adjusted benchmark yields used in calculating the benchmark revenue. Counties with larger benchmark yields have higher benchmark revenues and ARC-CO payment caps.

The ARC-CO max payment ($/base acre) is:

0.10 x Benchmark Revenue = 0.10 x (Benchmark Price x Benchmark Yield)

The PLC payment ($/base acre) formula is:

PLC yield x (Effective Reference Price – Actual MYA Price)

For both ARC-CO and PLC, payments are made on 85% of base acres. PLC payments will then exceed the ARC-CO maximum payment for a farm when:

Actual MYA Price < Effective Reference Price – (ARC-CO Max Payment)/PLC yield

Below we show county-level averages for these price levels, referred to as threshold prices, by county for corn, soybeans, and wheat in 2024. We use the ARC-CO maximum payments and average PLC payment yields for each county as reported by the Farm Service Agency (FSA). Farms with PLC payment yields above the county average will have slightly higher thresholds. Farms with PLC payment yields below the county average will have slightly lower thresholds.

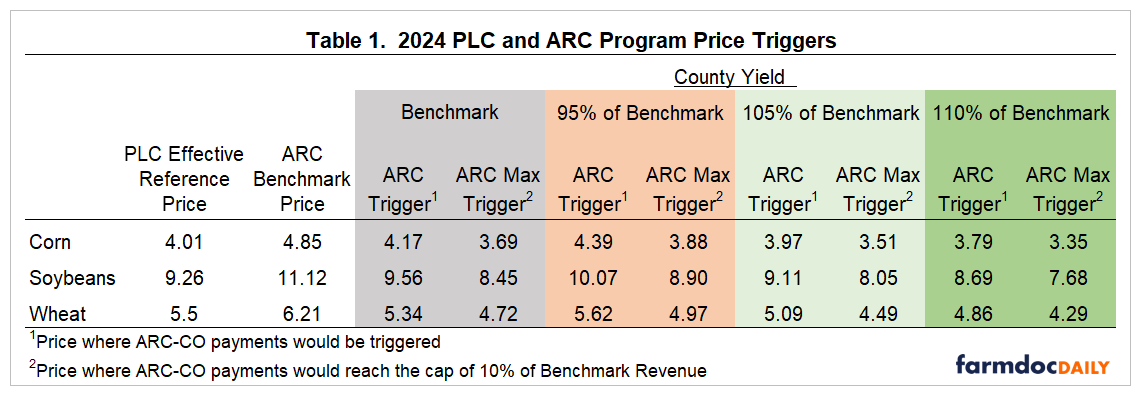

Corn

The average maximum ARC-CO payment across Illinois counties for corn is $98.57 per acre for 2024. The maximum ARC-CO payment for corn acres in Illinois ranges from $70.40 per acre in Hardin County to nearly $115 per acre in Piatt County. The ARC-CO max payments for each Illinois county are shown in the left panel of Figure 1. The average PLC payment yield for corn across Illinois counties is 146.7 bushels/acre, with a range from 99.6 to a high of 177.2 bushels per acre. Counties with higher max ARC-CO payment rates tend to have higher average PLC payment yields and vice versa.

We can use Champaign County as a specific example for how the threshold price is computed. The max ARC-CO payment for Champaign County in 2024 is $109.05/acre. The average PLC payment yield in Champaign County is 167.9 bushels per acre. The threshold price for Champaign County of $3.36 per bushel is then computed as:

$4.01 – ($109.05/167.9) = $3.36 per bushel

The right panel of Figure 1 shows the average threshold prices for corn across all Illinois counties. The average threshold is $3.33 per bushel. The smallest threshold is in Bond and Marion counties at $3.21 per bushel. The highest threshold is in DuPage County at $3.41 per bushel.

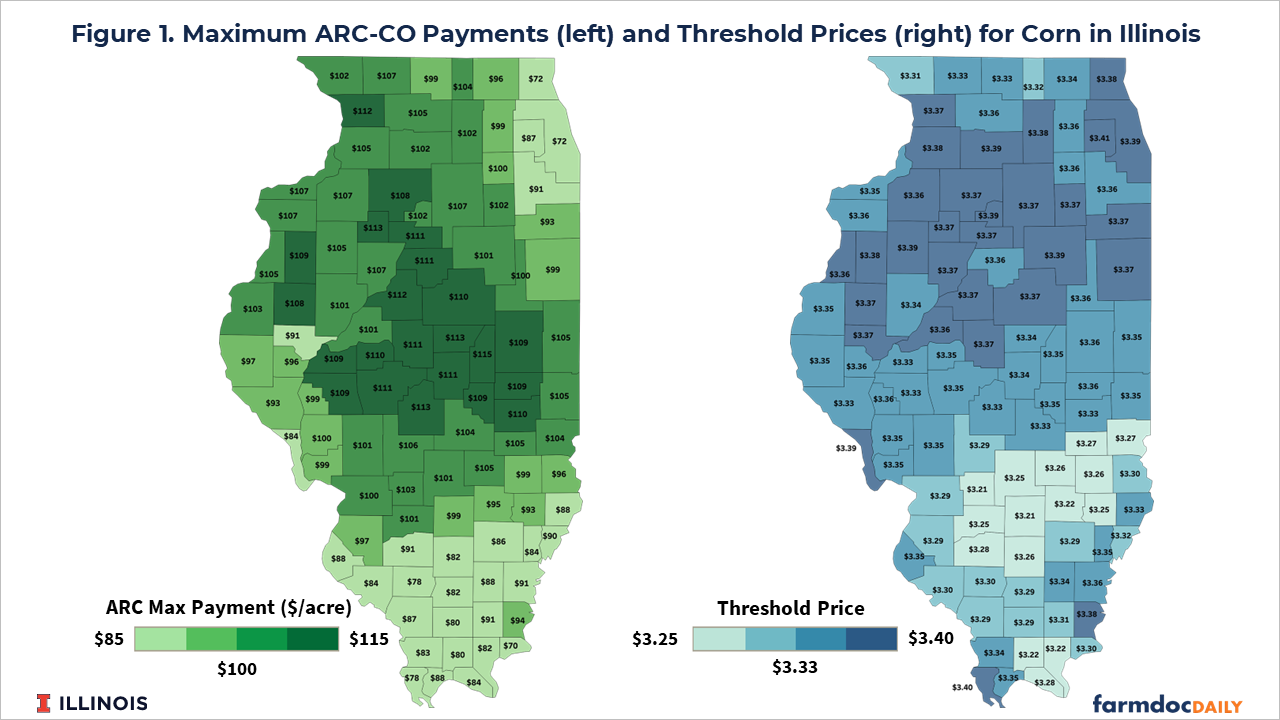

Soybeans

The average maximum ARC-CO payments for Illinois counties are shown in the left panel of Figure 2. The smallest max payment is $44.91 per acre in Hardin County while the highest max payment is $83.27 per acre for Piatt County. The average max payment for soybeans across all counties is $68.11 per acre. The average PLC payment yields for soybeans across Illinois counties is 44.7 bushels per acre, ranging from 32.5 in Johnson County to 54.1 in Piatt County.

The right panel of Figure 2 shows average threshold prices for soybean acres by county in Illinois. The average soybean threshold price is $7.73 per acre across all Illinois counties. The lowest average threshold price is $7.59 in Bond County while the highest average threshold price is $7.95 in Hardin County.

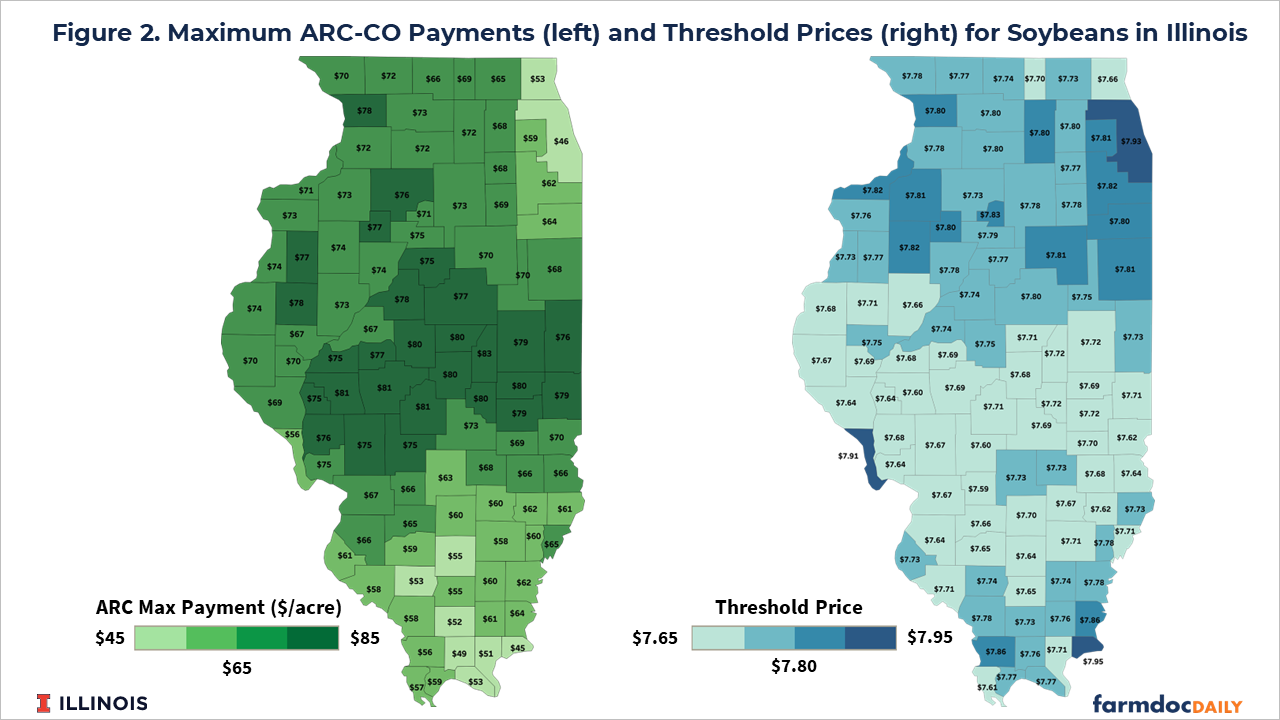

Wheat

The left panel of Figure 3 shows the max ARC-CO payments on wheat acres for all Illinois counties for 2024. The average maximum ARC-CO payment on wheat acres is $44.48 per acre. This ranges from a low of $32.71 per acre for Brown County to a high of $54.49 per acre in Ogle County. PLC payment yields average 52.7 bushels per acre across all Illinois counties. The lowest average PLC payment yield is 38.7 bushels per acre in Johnson County and the highest average PLC payment yield is 66.9 bushels per acre in Ford County.

The right panel of Figure 3 shows average threshold prices for wheat acres in Illinois. The average threshold price for wheat is $4.65. The lowest average threshold price is $4.44 in Hardin County while the highest is $4.86 per bushel in Ford County.

Discussion

Higher prices over the 2018 to 2022 marketing years have resulted in higher ARC benchmark prices for 2024 and, for some crops, PLC effective reference prices above statutory minimum levels. For corn and soybeans, the ARC benchmark prices are sufficiently above effective reference prices so that ARC-CO payments could be triggered at higher price levels than PLC, assuming yields are at or below benchmark levels in 2024. For wheat, the PLC reference price is above the price where ARC-CO payments would be triggered at benchmark yield levels, but county yield losses could result in ARC-CO payments triggered at higher price levels than PLC.

In general, ARC-CO will trigger larger payments for scenarios when county yields are at or below benchmark yield levels. PLC will trigger larger payments for scenarios where county yields are above benchmark levels and prices are moderately below effective reference price levels, and also for scenarios where prices are much lower and ARC-CO payments reach their maximum.

The price thresholds below which PLC payments would exceed the maximum ARC-CO payments vary across counties and farms based on the maximum ARC-CO payment levels (county-level) and PLC payment yields (farm-level). The threshold prices for corn in Illinois are in the $3.20 to $3.40 range. Threshold prices for soybeans in Illinois range from $7.60 to $7.95. Threshold prices for wheat in Illinois range from $4.44 to $4.86. Those price ranges also coincide with the range of prices where ARC-CO would hit the maximum payment level if yields are above benchmark levels for corn and soybeans, and at or above benchmark levels for wheat.

Price expectations for the 2024 marketing year generally remain above effective reference prices, and above ARC trigger price levels unless a county experiences a yield shortfall. Our Illinois crop budgets, revised in early January, assume expected prices of $4.50 for corn, $11.50 for soybeans, and $6.80 for wheat. USDA currently projects 2024/25 marketing year prices of $4.50 for corn, $11.30 for soybeans, and $6.80 for wheat. Current central Illinois fall grain bids are around $4.30 for corn and $11.30 for soybeans.

Producer crop insurance program preferences should also be incorporated into their commodity program decisions. We will begin to examine crop insurance choices, and how they interact with commodity program decisions, in the coming weeks as we enter the February crop insurance price discovery period.

References

Paulson, N., C. Zulauf, J. Coppess and G. Schnitkey. "Comparing 2024 Effective Reference and ARC Benchmark Prices." farmdoc daily (14):15, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 23, 2024.

Paulson, N., G. Schnitkey, R. Batts and C. Zulauf. "First Look at PLC and ARC-CO for 2024." farmdoc daily (14):11, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 16, 2024.

USDA, Farm Service Agency. ARC/PLC Program Data. Last accessed January 29, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.