Revisiting Biomass-Based Diesel Feedstock Trends over 2011-2022

One of the most discussed and debated aspects of the renewable diesel boom is its impact on feedstock markets. In a recent farmdoc daily article (December 11, 2023), we examined feedstock usage trends for FAME biodiesel, which competes with renewable diesel, and found that soybean oil dominated as a feedstock for production of biodiesel. In another recent farmdoc daily article (December 20, 2023), we examined feedstock usage trends for renewable diesel, and found that there has been a dramatic change in the composition of renewable diesel feedstock shares over time, with the share of soybean oil increasing rapidly in recent years. The purpose of today’s article is to investigate feedstock usage trends for biomass-based diesel over 2011 through 2022. Biomass-based diesel feedstock usage for the purpose of this analysis is simply the sum of FAME biodiesel and renewable diesel feedstock usage. The analysis in today’s article updates the biomass-based diesel feedstock usage estimates published in an earlier farmdoc daily article (May 1, 2023). This is the 16th in a series of farmdoc daily articles on the renewable diesel boom (see the complete list of articles here).

Analysis

The two main types of biomass-based diesel (BBD) fuels used to comply with the U.S. Renewable Fuel (RFS) mandates are “FAME biodiesel” and “renewable diesel.” Although FAME biodiesel and renewable diesel are produced with the same organic oils and fats feedstocks, their production process differs substantially, resulting in the creation of two fundamentally different fuels (for details see farmdoc daily, February 8, 2023).

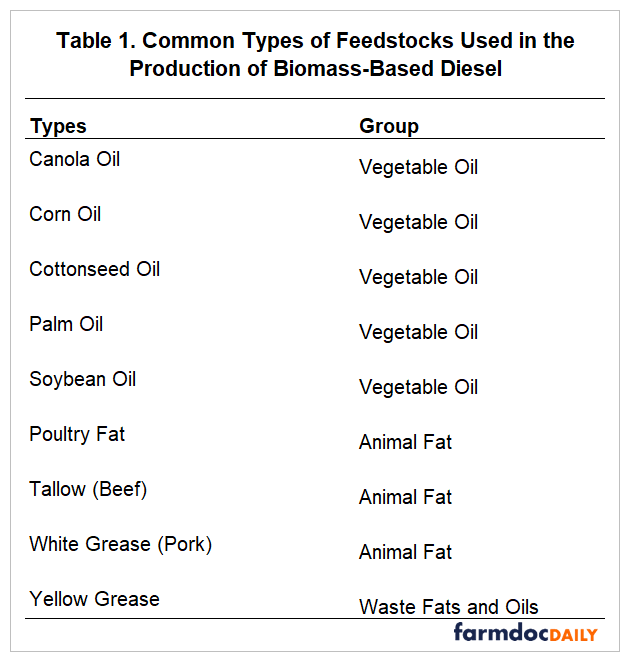

Table 1 lists the most common organic oils and fats feedstocks used to produce biomass-based diesel (FAME biodiesel and renewable diesel). The first group consists of vegetable oils that are produced by crushing vegetable seeds, such as soybeans and canola. The second group consists of animal fats that are by-products of slaughtering animals. Yellow grease is a unique type of feedstock because it can be made up of various kinds of fats and oils. A key component of yellow grease is used cooking oil; hence, the category “waste fats and oils.” It is not hard to grasp the diversity of fats and oils in yellow grease when one thinks about all the different vegetable oils and animal fats that are used for cooking in retail food businesses. This makes yellow grease something of a catch-all type of feedstock. Lastly, it is important to note that the list of feedstocks in Table 1 is by no means exhaustive.

A key difference between the biomass-based diesel feedstock estimates in this article and those in our earlier article (farmdoc daily, May 1, 2023) is that we now have a complete set of individual feedstock estimates for both FAME biodiesel and renewable diesel over 2011 through 2022. Hence, we begin the analysis with a brief review of our estimates of FAME biodiesel and renewable diesel feedstock usage. Please see the farmdoc daily articles from December 11, 2023 and December 20, 2023 for documentation of the data and procedures used to generate these estimates. A spreadsheet containing the FAME biodiesel, renewable diesel, and biomass-based diesel feedstock volumes presented in this article can be downloaded here.

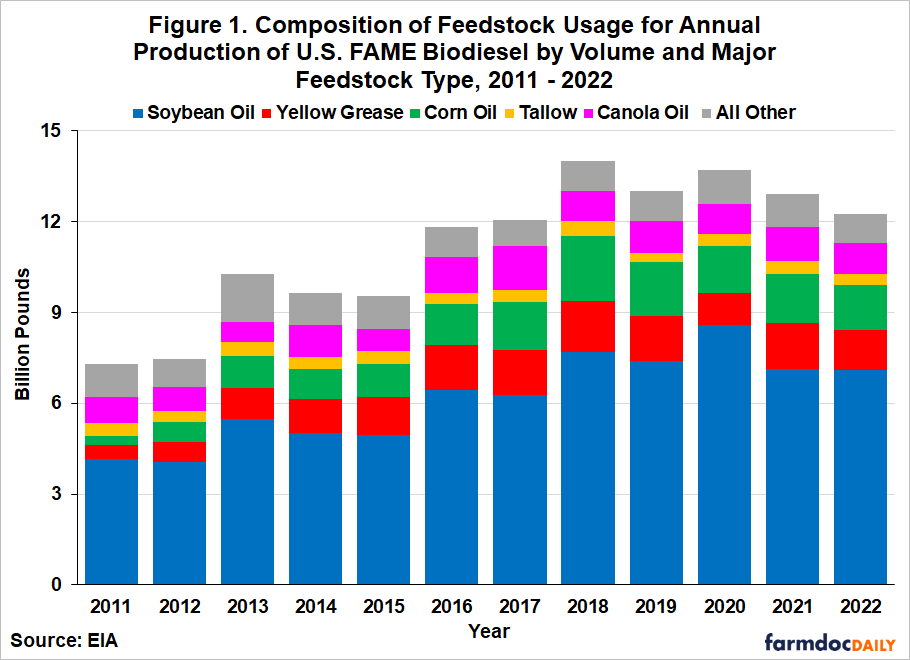

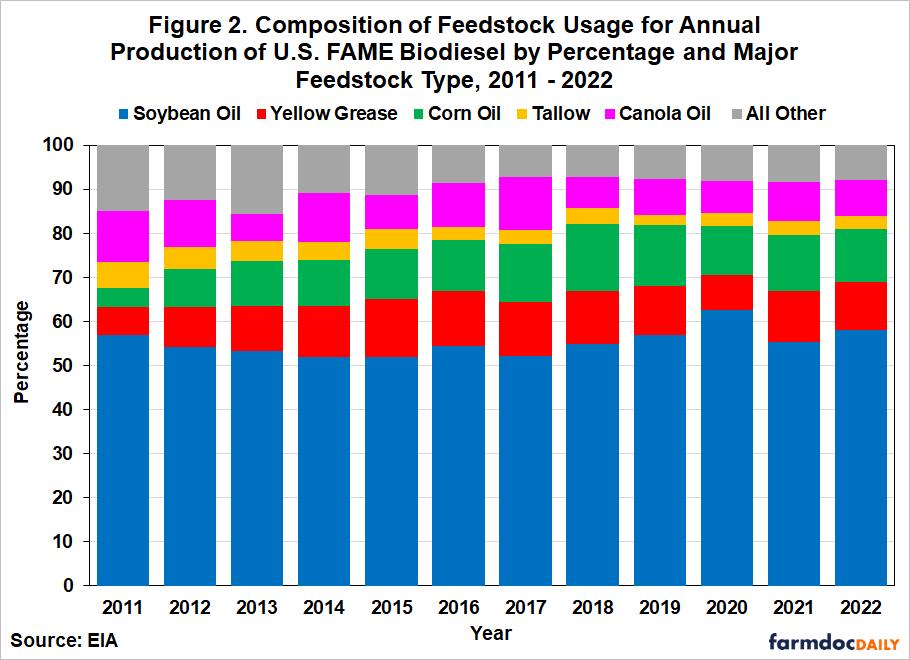

Figure 1 presents annual estimates of the allocation of total FAME biodiesel feedstock volumes to individual feedstocks over 2011 through 2022. The estimates show a stable pattern of feedstock usage, with soybean oil the largest source of FAME biodiesel feedstock in each year. Soybean oil usage peaked in 2020 at 8.6 billion pounds, and then fell back to 7.1 billion pounds in 2022. In most years, the next two largest feedstocks were corn oil and yellow grease. Figure 2 presents the allocation of feedstock usage in percentage terms to provide direct evidence on annual market shares. In every year over 2011 through 2022, soybean oil represented a majority of biodiesel feedstock usage, with an average share of 55.2 percent. The next largest category was corn oil, with an average of 11.2 percent. In general, percentage feedstock shares for biodiesel have been quite stable over time.

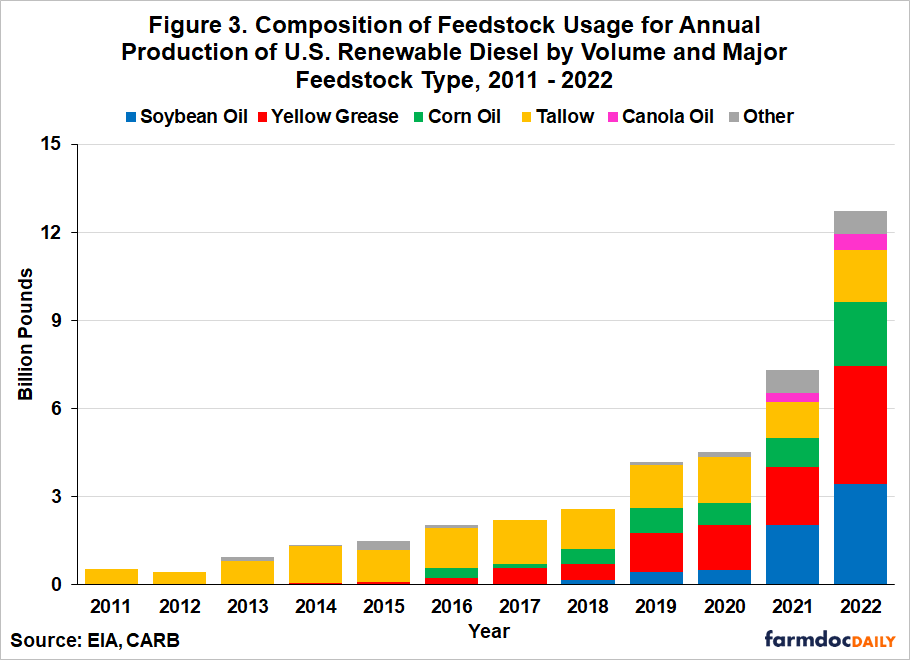

Figure 3 presents annual estimates of the allocation of total renewable diesel feedstock volumes to individual feedstocks over 2011 through 2022. The estimates show that tallow volume has been quite stable over most of the 2011 through 2022 period. After 2013, the minimum for tallow is 1.1 billion pounds and the maximum is 1.8 billion. Usage for the remaining categories grew rapidly as renewable diesel production boomed. Yellow grease feedstock increased the most, from under 100 million pounds in 2015 to over 4 billion pounds in 2022. Corn oil and soybean oil use also rose rapidly from low levels to over 2 and 3 billion pounds, respectively, in 2022.

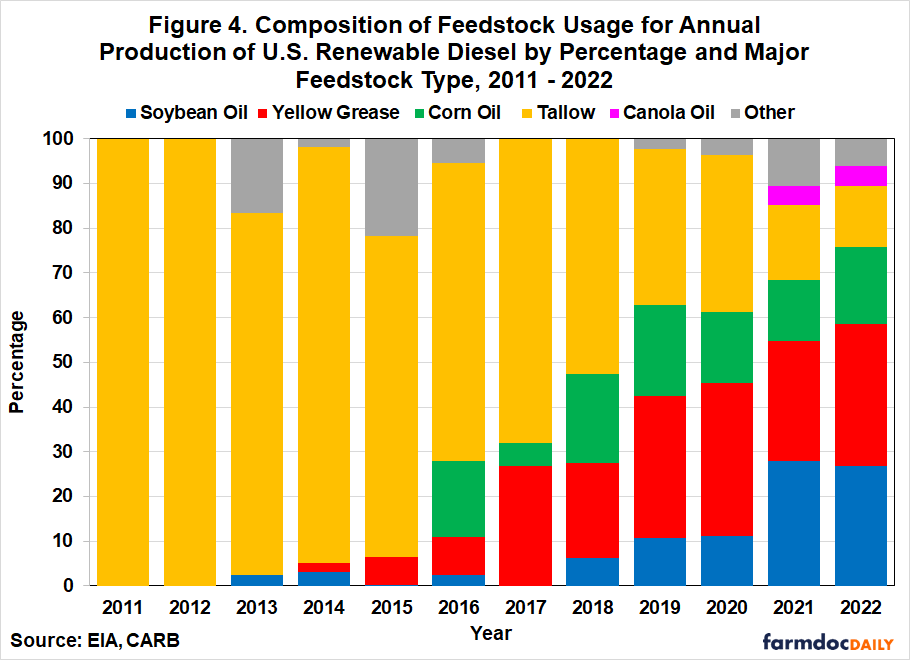

Figure 4 presents the allocation of renewable diesel feedstock usage in percentage terms. There has clearly been a dramatic change in the composition of renewable diesel feedstock shares since 2011. Shares were dominated by tallow from 2011 through 2018, when the tallow share averaged nearly 80 percent. As renewable diesel production and feedstock use increased, yellow grease shares rose in parallel. In 2016, the yellow grease share was only 8.4 percent, but then rose to 31.9 percent by 2019. Soybean oil feedstock shares increased even more rapidly. Almost no soybean oil was used to produce renewable diesel before 2018, yet by 2022 its market share had risen to 26.9 percent. The market share for corn oil was relatively stable after 2016, by comparison.

We now turn to our revised estimates of biomass-based diesel feedstock usage, which are obtained by simply summing the FAME biodiesel volumes in Figure 1 with the renewable diesel volumes in Figure 3. These annual estimates of total biomass-based diesel feedstock volumes over 2011 through 2022 are shown in Figure 5. The chart highlights the substantial increase in biomass-based diesel feedstock usage that occurred over 2011 through 2022, with usage more than tripling from 7.8 to 25.0 billion pounds. Given the dominant position of soybean oil in the production of FAME biodiesel, it is no surprise that soybean oil is the largest biomass-based diesel feedstock by volume every year. However, yellow grease has increased substantially and in 2022 reached over 10 billion pounds. Corn oil feedstock usage also grew rapidly during this time period, nearly exceeding 4 billion pounds in 2022.

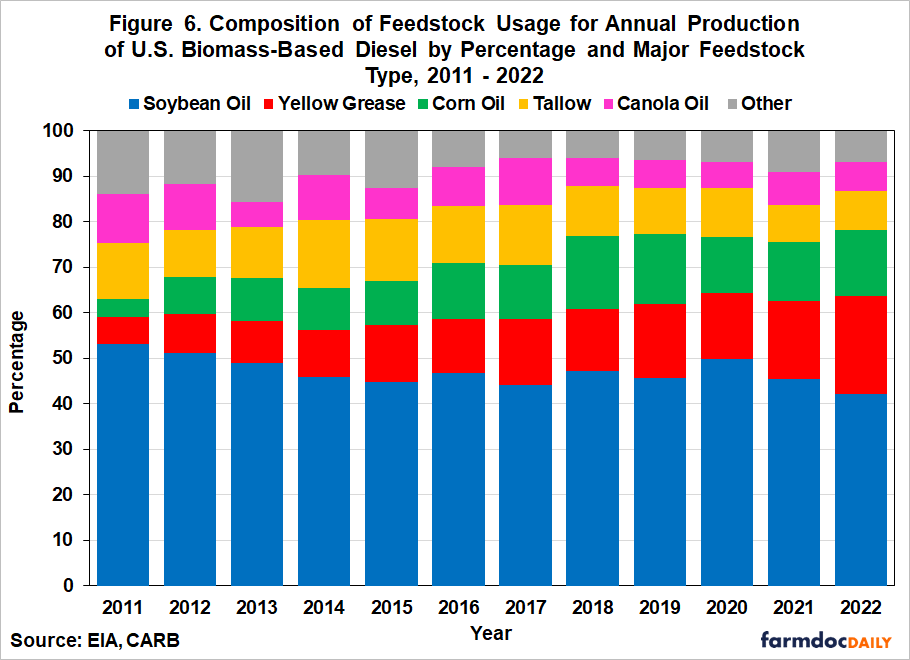

Figure 6 presents the allocation of biomass-based diesel feedstock usage in percentage terms over 2011 through 2022. The most surprising result is the decline in soybean oil feedstock shares over time, which peaked in 2011 at 53.1 percent. Outside of the pandemic year of 2020, the soybean oil feedstock share declined steadily and reached a low of 42.1 percent in 2022. The declining soybean oil feedstock share is due to a confluence of factors. First, soybean oil is the dominant feedstock for FAME biodiesel, and until recently, FAME production was much larger than renewable diesel production. Hence, as FAME production declined this had an outsized impact on the market share of soybean oil for overall biomass-based diesel feedstock usage. Second, while it is an important feedstock for renewable diesel production, soybean oil is not the dominant feedstock for renewable diesel production, representing only about a quarter of total renewable diesel feedstock usage in recent years. This means that as renewable diesel production boomed, the volume of soybean oil feedstock usage for renewable diesel production did not increase enough in relative terms to offset the decline in usage for FAME biodiesel production.

The biggest gainers in terms of biomass-based diesel feedstock shares were yellow grease and corn oil. The market share of yellow grease more than tripled, from 6.0 percent in 2011 to 21.5 percent in 2022. At the same time, the corn oil market share increased from only 3.9 to 14.7 percent. The biggest loser in terms of market share for biomass-based diesel was tallow, which declined from 12.2 to 8.5 percent. The shifts towards yellow grease and corn oil make sense given the relatively low carbon intensity (CI) scores given to renewable diesel made from these feedstocks in the California LCFS program. The lower CI scores translate into higher dollar credit values per gallon. Because of these incentives, more than 80 percent of the renewable diesel produced in the U.S. is routinely consumed in California (see Figure 2 in the farmdoc daily article from April 19, 2023).

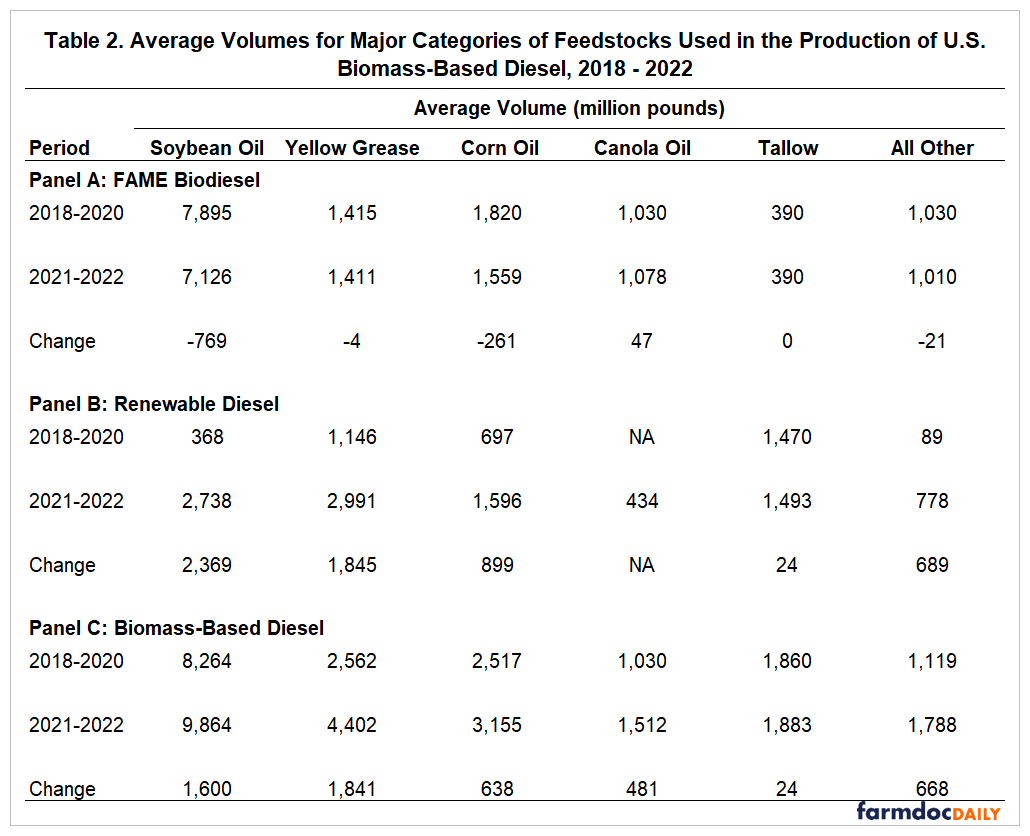

It is interesting to zero in on changes in feedstock usage patterns associated with the renewable diesel boom. Table 2 provides a summary view of the changes in feedstock volumes during the boom years. The base for comparison is the average feedstock volume during the three years over 2018 through 2020. The average volume over 2021 and 2022 reflects the renewable diesel boom years. Panel A of Table 2 shows that feedstock volume changes for FAME biodiesel were relatively modest during the renewable diesel boom years. The largest change is the decline in soybean oil feedstock use. Not surprisingly, the big changes are associated with renewable diesel. Soybean oil had the largest volume growth for renewable diesel, followed by yellow grease, and corn oil. It is not possible to compute the change for canola oil since data on this feedstock did not become available until 2021. When FAME and renewable diesel are combined in Panel C, a somewhat different picture emerges. The largest volume increase is now associated with yellow grease and soybean oil is a close second. The reason is that some of the increase in soybean oil use for renewable diesel is offset by the decrease for FAME biodiesel. The small net increases for corn oil and the “all other” category of biomass-based diesel were of similar size.

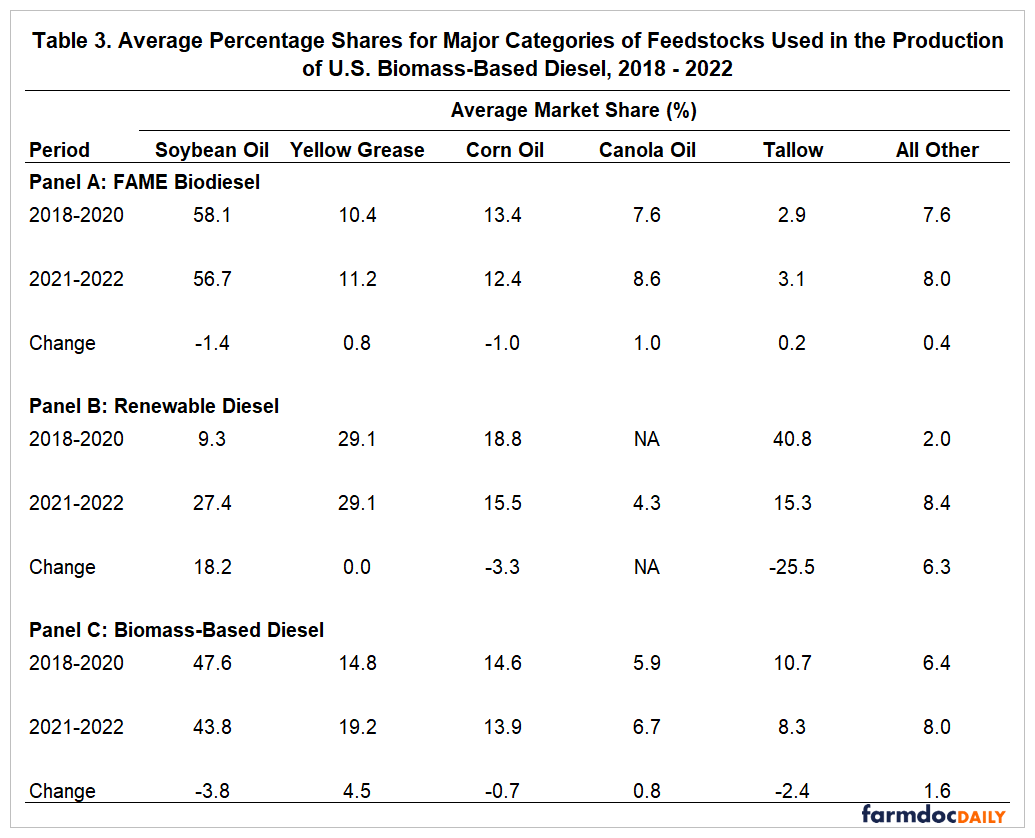

Table 3 repeats the computations of Table 2 but in terms of percentage feedstock shares. Once again, FAME biodiesel shares change very little during the renewable diesel boom. However, there are large changes in the shares for renewable diesel, with soybean oil gaining nearly 18 percentage points and tallow falling 25 points. The changes in feedstock shares are less dramatic for biomass-based diesel, but interesting, nonetheless. Soybean oil and tallow decreased, on average, 3.8 and 2.4 percentage points, respectively, during the renewable diesel boom, while yellow grease jumped the most, 4.5 percentage points. Once again, this reflects the important role that low CI feedstocks play in the ongoing boom in renewable diesel production.

Implications

This article examines trends in feedstock usage for biomass-based diesel in the U.S. over 2011 through 2022. We define biomass-based diesel as the sum of FAME biodiesel and renewable diesel for the purposes of this article. There has been a huge increase in biomass-based diesel feedstock usage because of the renewable diesel boom. Usage more than tripled between 2011 through 2022, growing from 7.8 to 25.0 billion pounds. Given the dominant position of soybean oil in the production of FAME biodiesel, it is no surprise that soybean oil is the largest biomass-based diesel feedstock by volume every year. However, yellow grease use increased substantially and in 2022 reached over 10 billion pounds. Corn oil feedstock usage also grew rapidly during this period, nearly exceeding 4 billion pounds in 2022. The biggest gainers in terms of biomass-based diesel feedstock shares were yellow grease and corn oil. The market share of yellow grease more than tripled, from 6.0 percent in 2011 to 21.5 percent in 2022. At the same time, the corn oil market share increased from 3.9 to 14.7 percent. The biggest loser in terms of market share for biomass-based diesel was tallow, which declined from 12.2 to 8.5 percent. The shifts towards yellow grease and corn oil make sense given the relatively low carbon intensity (CI) scores given to renewable diesel made from these feedstocks in the California LCFS program. Looking forward, it is important that projections of biomass-based diesel feedstock usage consider the very different composition of feedstock usage for FAME biodiesel versus renewable diesel. Renewable diesel feedstock usage is more skewed towards low CI feedstocks, such as yellow grease, and as renewable diesel production increases in the future this will skew overall growth of biomass-based diesel feedstock volume towards feedstocks with lower CI scores.

Disclaimer: The findings and conclusions in this publication are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy. This work was supported in part by the U.S. Department of Agriculture, Economic Research Service.

References

Gerveni, M., T. Hubbs and S. Irwin. "Renewable Diesel Feedstock Trends over 2011-2022." farmdoc daily (13):231, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 20, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Biodiesel Feedstock Trends over 2011-2022." farmdoc daily (13):224, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 11, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Renewable Diesel and Biodiesel Feedstock Trends over 2011–2022." farmdoc daily (13):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 1, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Renewable Diesel and Biodiesel Usage Trends over 2011–2022." farmdoc daily (13):72, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 19, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "FAME Biodiesel and Renewable Diesel: What’s the Difference?" farmdoc daily (13):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 8, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.