Integrated Risk Management: Developing an Asset-Based Business Strategy

Introduction

Integrated risk management is a comprehensive approach that addresses business, financial, and strategic risks collectively, safeguarding your organization against potential threats. This article analyzes the importance of integrated risk management for production agriculture, an industry which is highly susceptible to external shocks. We will discuss potential market shocks that farming operations should be prepared to handle, how organizational ambidexterity aids businesses in managing challenges today while preparing for the future, and how to create an asset-based business strategy that leverages farm resources and capabilities.

The Need for Integrated Risk Management

As a farm manager, responsibility extends beyond the current performance of your operation; it includes shaping its future performance over the next five, ten, or twenty years. Your current business strategy and management decisions play a vital role in influencing both your current and future investment opportunities, cash flow, and employee retention.

Business risk, financial risk, and strategic risk all pose major threats to every farming operation. Business risks encompass a range of factors, from price and market fluctuations to legal and regulatory challenges, production-related uncertainties, and human resources issues. Financial risks arise from various sources, including interest rate fluctuations, choices regarding debt and leverage, capital lease commitments, working capital management, and cash flow management. Financial risks are particularly critical to consider when creating farm budgets for the year, making major investments, or refinancing existing loans. In order to maintain a farm’s financial health, financial management decisions must be based on knowledge about current financial positioning and how interest rates or a new investment will impact the level of financial risk you carry. Strategic risks arise from the interplay between external forces, internal resources and capabilities, and the farm’s strategic positioning. Factors such as shifting customer preferences, the actions of competitors, and changes in the business climate can introduce substantial strategic risks.

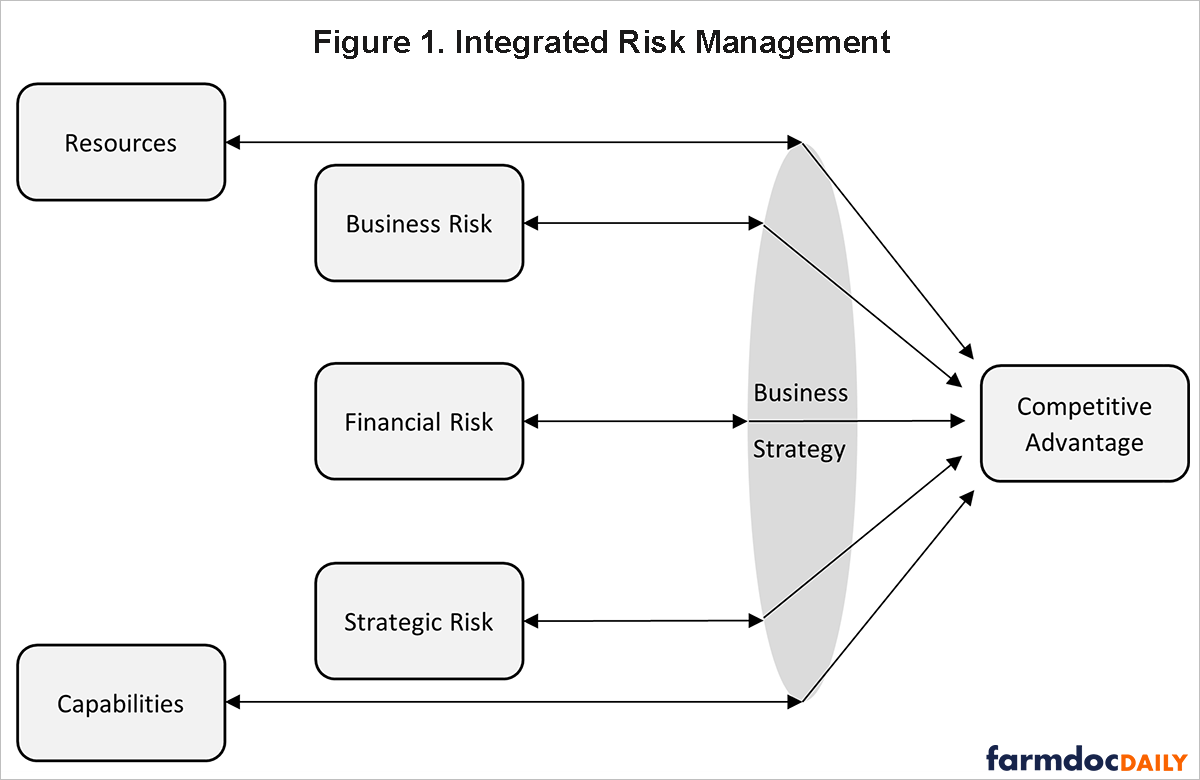

When a farm’s internal resources and capabilities become misaligned with external forces, it can lead to decreased production efficiency and reduced revenue potential, thereby increasing the businesses exposure to financial, business, and additional strategic risks. The extent to which these three major risks are interrelated emphasizes the need for an integrated risk management approach, a holistic approach which acknowledges the risk from each source, but manages them collectively. Figure 1 provides a visual representation on how to think about firm resources and capabilities, each of the risk types we have discussed, and the role of business strategy.

Business strategy must integrate all resources and capabilities of a firm as well as potential risks. Business strategy utilizes current resources and capabilities to create favorable positioning relative to risks which set your operation apart from competitors. A farm’s business strategy must accept some level of risk, using this acquisition of risk as a differentiator from other businesses, but also mitigate or deflect more sizeable risks which threaten the operation. This model encourages business managers to think carefully about the risk return tradeoff associated with each decision, which resources to use now, and how to maintain resources for future use.

Expected Structural Changes in Agriculture

Recent events have presented major disruptions in agriculture, placing immense pressure on supply chains for farm inputs, distribution systems, and price volatility in various markets. In a recent news report, the CEO of the foreign policy think tank Atlantic Council warned about the influence of growing bilateral relationships between China, Russia, Iran, and North Korea (Kong, 2023). He pointed out, that given the events of the past several years, with major external shocks including Covid-19, the war between Russia and Ukraine, and now the war between Israel and Hamas, we are at a major tipping point where risks like these continue to shape our future (Kong, 2023).

While future uncertainties remain unclear, realization of shocks will pose significant risks to farming operations, with both upside and downside potential. A farm’s business strategy, as alluded to previously, must align resources and capabilities to take advantage of these market shocks if new opportunities arise, or effectively deflect business, financial, and strategic risks which threaten the business.

Looking forward, there are three major changes which may significantly change the landscape of corn belt farming. These include a slowing in the farm economy, a potential change in production decisions as a result of strengthening demand for soybeans, and changes in farm technologies which present opportunities for reductions in farm inputs.

The United States Senate Committee on Agriculture, Nutrition, and Forestry recently discussed the potential for further slowing of the farm economy, fueled by lower crop prices, increased interest rates, and higher levels of uncertainty in coming years. Additional contributing factors include record high farm expenses paired with relatively weak prices (United States Senate Committee on Agriculture, Nutrition, & Forestry, 2023). Given the chance that these predictions come to fruition, producers must prepare for periods of lower net returns by evaluating their business strategy and setting aside sufficient financial capital in order to weather times of greater uncertainty.

Production capacity for renewable diesel and other biofuels increased 71% between January 2022 and January of 2023. Projections by the U.S. Energy Information Administration show the production of renewable diesel continuing to expand at a rapid rate, reaching 384,000 barrels per day by the end of 2025 (U.S. Energy Information Administration (a), U.S. Energy Information Administration (b), 2023). Major companies, such as Phillips 66 continue to invest heavily in renewable diesel refineries with the belief that demand for renewable diesel will expand in coming years (Kearney, 2023). This demand is primarily driven by environmental policies such as California’s Low Carbon Fuel Standard. In conjunction with this, external demand for U.S. produced soybeans continues to steadily increase. On average between 2015 and 2023, soybean exports grew by 18% (United States Department of Agriculture, 2023). Even if renewable diesel production only causes soybean demand to increase marginally, alongside strengthening foreign demand may create market stress and higher price points for soybeans, resulting in changes in farm production decisions. This is an example of how external shocks, due to both foreign demand and government regulation for renewable fuel, may influence a farm’s business strategy. Increases in demand may lead to increased prices, pushing producers to specialize in soybean production. However, with specialization comes substantial risk, including greater susceptibility to shocks from adverse weather conditions, changing government policies, and disruptions in international trade.

Finally, we’ll consider a change in on-farm technology that could cause a major shift in production costs. Solinftec is an agriculture technology company launching autonomous sprayers, with artificial intelligence technology to identify weeds, continuously monitor, and spray fields (Solinftec, 2023). Autonomous farm vehicles have the potential for significant cost reductions for row crop producers, with products offering up to 95% reduction in herbicide application rates, plus reduced need for labor (Solinftec, 2023). While these technologies are still being tested and are not widely used, farms adopting new technologies of similar scope may reap significant cost reductions compared to producers choosing to not adopt. Hence, producers who choose not to adopt may be at higher risk of losing their position as low-cost producers relative to competitors.

An Asset-Based Business Strategy

Reluctance or inability to react to structural change, such as those posed by advancements in technology, changing international relations, or changes in consumer demand, will eat away at profit margins and operational efficiency, increasing vulnerability to further financial, operational, and strategic risk. The three major risk types (business risk, financial risk, and strategic risk) present the need for an integrated risk management approach which encompasses the risk return tradeoff, accepting risks with the potential for return, and mitigating risk which poses excessive threats. But, as a farm manager, how do you create a business strategy that aligns risks with resources and capabilities to develop an integrated risk management approach?

We propose an asset-based business strategy which leverages current capabilities and resources to improve future farm resilience. For this concept to work, it is critical that as a farm manager, you are aware of changes in macroeconomic conditions and continually strategize on how to use changing market dynamics in your favor. An asset-based business strategy is not a one and done application, but an ongoing process which demands continual updating.

The concept of a needs-based versus an asset-based business strategy originates from applications in community development. Community development projects are often needs-based. For example, supplemental education programs are often put in place because students are unable to meet education standards, or the implementation of environmental protection initiatives like the Clean Water Act which was a response to environmental degradation events presented by the Rogue and Cuyahoga River fires. Communities often only make change when there is a pertinent issue at hand.

An asset-based strategy, on the other hand, identifies the current resources and capabilities in an area and leverages them to improve the community. Rather than waiting until a catastrophe is underfoot, preventative maintenance and long-term strategy is at the forefront of an asset-based strategy. When it comes to farm strategy, we want to encourage the same shift of focus, transitioning from an approach where business strategy revolves around current needs, to an organization with high levels of ambidexterity, able to manage in the present, but not lose focus on an asset-based farm strategy which improves long run business prospects.

To achieve an asset-based business strategy, we suggest farm managers make a sustained effort to assess and simultaneously manage business risk, financial risk, and strategic risk. Managers should actively survey and assess business positioning relative to exogenous shifts and make changes to their internal business structure accordingly. While this may seem like standard procedure for managers, all too often, managers become overly preoccupied with current issues, letting long-term strategic decisions take a back seat. This is exactly what we refer to as a needs-based management approach, where businesses develop a myopic view, working diligently to alleviate current issues, yet simultaneously losing focus on business strategy for five, ten, or twenty years from now.

Rather than extinguishing fires as they arise, the asset-based strategy works to reduce risks before they present major issues. By refining existing capabilities and leveraging resources a business can create and take advantage of sustainable growth opportunities. Success of an asset-based business strategy requires managers be aware of current available business resources, expected market trends, relative risks and returns for various production options. Managers must assess how well each opportunity aligns with available resources and with values of the farming operation. This approach does not reduce the need to confront issues as they arise, but encourages a focus on the long-term business environment, anticipating changes, developing contingency plans, and determining how their business should evolve alongside industry changes.

Conclusion

This article has discussed the extent to which financial, business, and strategic risks are intertwined with one another. Often external shocks create some level of misalignment between current business strategy and operational resources and capabilities, for example the case of improved technology which might render current equipment (resources) inefficient. However, market shocks may also materialize at different levels, creating volatility in prices (business risk) or changes in interest rates (financial risk). All too often, shocks increase financial, business, and strategic risks simultaneously. The interplay among risks emphasizes the need for an integrated risk management approach that coordinates with business resources and capabilities.

Business strategy simultaneously works to leverage resources and capabilities, accepting certain risks while mitigating others. The asset-based business strategy we propose achieves this by analyzing the risk/return tradeoff for each new opportunity, maintaining and investing in farm assets, surveying short-term and long-term business prospects, and performing ongoing scenario analysis. This business strategy positions the farm to successfully identify promising opportunities, improve farm resilience to external shocks, and provides a foundation for a business to evolve alongside the changing environment in which it operates.

References

Kearney, L. (2023, March 21). Huge Phillips 66 Biofuels Project Will Test the Industry’s Green Promises. Retrieved from https://www.usnews.com/news/top-news/articles/2023-03-21/huge-phillips-66-biofuels-project-will-test-the-industrys-green-promises

Kong, D. (2023). The 'biggest threat to global order since the 1930s' is underway and every CEO is talking about it. CNBC.

Solinftec. (2023, November). The Future of Field Maintenance. Retrieved from https://solix.solinftec.com/

U.S. Energy Information Administration (a). (2023, September 5). In 2023, U.S. Renewable Diesel Production Capacity Surpassed Biodiesel Production Capacity. Retrieved from Today in Energy: https://www.eia.gov/todayinenergy/detail.php?id=60281

U.S. Energy Information Administration (b). (2023, February 2). Domestic Renewable Diesel Capacity Could More Than Double Through 2025. Retrieved from Today in Energy: https://www.eia.gov/todayinenergy/detail.php?id=55399

United States Department of Agriculture. (2023, November). Standard Query. Retrieved from Global Agricultural Trade System Online: https://apps.fas.usda.gov/gats/default.aspx

United States Senate Committee on Agriculture, Nutrition, & Forestry. (2023, September 7). USDA Forecasts Sharpest Decline in U.S. Farm Income in History. Retrieved from https://www.agriculture.senate.gov/newsroom/minority-blog/usda-forecasts-sharpest-decline-in-us-farm-income-in-history

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.