The Dilemma of Actuarial Soundness, A Legislative History

On Monday, April 8, 2024, a swath of the United States experienced a total eclipse of the Sun as the Moon passed between it and Earth (NASA, 2024 Total Solar Eclipse). Humans have been predicting eclipses since at least the time of the Greek philosopher Thales, but science has drastically improved our predictive abilities, imaging, and understanding of this phenomena (Couprie, 2004; HistoryDaily, June 10, 2019; Frost, August 8, 2017; Mosshammer, 1981). The center line in the path of totality cut through the middle of a familiar field in Darke County, Ohio. Lying in the cool grass of greening spring, a once-in-a-lifetime experience; nearly four minutes of surreal darkness in the middle of the afternoon; otherworldly spectacle as the dark disc of the moon blotted out the face of the midday sun; a 360-degree horizon burning orange on fields waiting to be planted, a simultaneous sunset and sunrise in all directions.

The eclipse has nothing to do with the Farm Bill other than offering brief respite from the continuing impasse. Reality returns with deadlines and demands that merge in the unruly manner of selfish drivers on a crowded stretch of interstate highway. Traversing the otherworldly to the actuarial, this article begins a discussion of the actuarial soundness of the Federal Crop Insurance Program and builds on previous work (farmdoc daily, November 21, 2023; September 7, 2023).

Background

Since the 2008 Farm Bill, the Federal Crop Insurance Corporation (FCIC), working through USDA’s Risk Management Agency (RMA), has been statutorily required to operate the federal crop insurance program on an actuarially sound basis. Any dilemma begins with what Congress meant. Actuarial soundness is achieved by the setting of premiums “for all the plans of insurance of the Corporation at such rates as the board determines are sufficient to attain an expected loss ratio of not greater than” 1.0 (7 U.S.C. §1508(d)(1) (emphasis added)). However, it is also achieved by taking “such actions, including the establishment of adequate premiums, as are necessary to improve the actuarial soundness of Federal multiperil crop insurance . . . to achieve an overall projected loss ratio of not greater than 1.0” (7 U.S.C. §506(n)(2) (emphasis added)). In other words, FCIC must collect premiums (both the portion paid by farmers and the portion subsidized by the FCIC) in an amount that is adequate to cover the indemnities paid out for losses, but is the loss ratio required for each individual plan of insurance or for all plans of insurance in the program overall? Complicating matters, Congress also requires that FCIC “shall adopt, as soon as practicable, rates and coverages that will improve the actuarial soundness of the insurance operations of the Corporation for those crops that are determined to be insured at rates that are not actuarially sound, except that no rate may be increased by an amount of more than 20 percent over the comparable rate of the preceding crop year” (7 U.S.C. §1508(i)(1) (emphasis added)). This subsection also requires FCIC to periodically review the methodologies it uses to rate insurance plans and analyze the “rating and loss history” of its approved insurance policies “by area” and adjust any premiums it determines to be excessive. Between these provisions exists a potential dilemma for federal crop insurance, instructions that may well be conflicting or contradictory.

Discussion

The potential dilemma built into actuarial soundness for federally subsidized crop insurance dates to the early 1990s. The requirement for an overall 1.0 loss ratio was designed by Congress in two phases over the course of 18 years. It has not been modified since the 2008 Farm Bill. Much of the design was prior to the major reforms in the Agriculture Risk Protection Act of 2000.

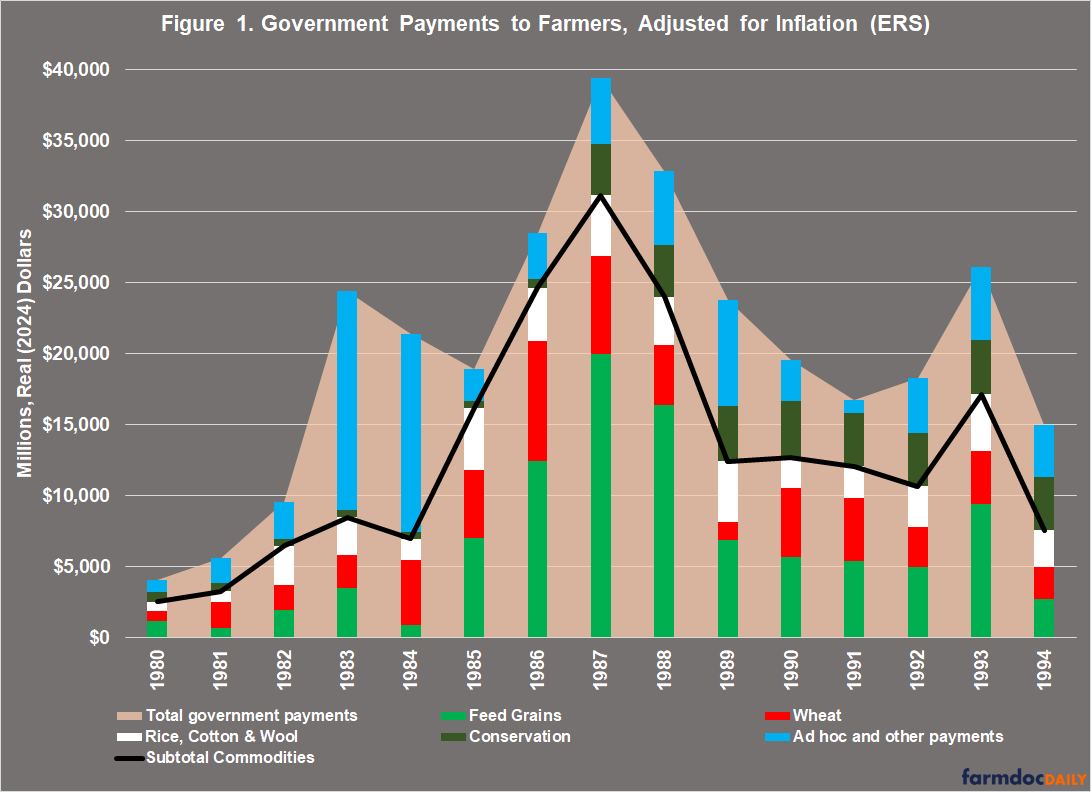

Congress sought to reform crop insurance in 1980, including requiring that premium rates should be “actuarially sufficient to cover claims for losses” and a reasonable reserve (P.L. 96-365; see also, Glauber, 2011). Actuarial soundness was subsequently required by Congress in the federal crop insurance program by the Food, Agriculture, Conservation and Trade Act of 1990, the 1990 Farm Bill (P.L. 101-624). The backstory of the time was that American farmers were beginning to emerge from the twin crises of the 1980s—an economic crisis drove many farmers into bankruptcy and nearly collapsed the Farm Credit System, combined with a soil erosion crisis centered in the Midwest. Both trace to an expansion of acres in the 1970s when millions of acres that had been removed from production with federal assistance were back under plows and planters within a few short years (see e.g., farmdoc daily, March 28, 2024). During the crises, Congress enacted the 1981 Farm Bill as well as the landmark 1985 Farm Bill, which included the first permanent investment in conservation policy. Congress also provided multiple versions of ad hoc or emergency supplemental assistance. USDA under President Ronald Reagan also contributed with the controversial 1983 Payment-in-Kind (PIK) program (Coppess, 2024; Coppess, 2018). Figure 1 illustrates the payments to farmers in this era, adjusted for inflation and reported by USDA’s Economic Research Service (ERS, Farm Income and Wealth Statistics).

As the shadow of crises faded in the early 1990s, USDA was spending billions on crop insurance at the same time billions more were being spent on ad hoc disaster assistance to farmers. The budget pressures of the Reagan years remained prevalent, driving an emphasis on disciplining Congressional spending and federal deficits and debts. In 1992, the General Accounting Office (GAO, today the Government Accountability Office) reported on the “bleak financial condition” of the crop insurance program and the major problems that had “contributed to the program’s inability to meet many of the major goals” Congress had established for it in the 1980 reforms (GAO report 92-25, January 1992).

(1) Designing the Foundation of Actuarial Soundness, 1990 to 1994

The 1990 Farm Bill added an actuarial soundness requirement to crop insurance but also included the limit that rates could not increase by more than 20 percent from the previous year (P.L. 101-624, at section 2204). Beginning a pattern of leadership on the issue in the Senate, the relevant provisions were accepted into the bill via two amendments on the floor (see, Congressional Record, July 26, 1990, at 19522-19530 and 19535; Congressional Record, July 27, 1990, at 19889). The final conference agreement retained the Senate provisions requiring FCIC to make available by crop and region the rates that would achieve actuarial soundness, as well as requiring adoption of rates to improve it but not increasing rates by more than 20 percent. The conference managers explained that actuarial soundness meant adequate premium to cover losses plus a reasonable reserve. They described these changes as “interim management improvements until more fundamental changes are implemented” that did not “represent an answer to the problems facing Federal crop insurance.” The managers added that a “more fundamental restructuring of the existing program is needed to prevent the continued financial losses, low participation rates, and other inefficiencies that have plagued this program and required the enactment of repeated ad hoc disaster bills during the 1980s” (H. Rept. 101-916, at 1183-84).

Congress returned to actuarial soundness in 1993, adding a subsection to the general powers of the FCIC (section 506) requiring it to achieve an “overall projected loss ratio of not greater than 1.1” after October 1,1995, in the Budget Reconciliation Act of 1993 (P.L. 103-66). This reform was again driven by the Senate and adopted by the conference committee (H. Rept. 103-213, at 433; H. Rept. 103-111, at 40). The Senate Agriculture Committee explained that crop insurance had experienced “chronic” losses since 1980 and an “aggregate loss ratio (dollars paid in indemnities over dollars received in premiums)” of 1.48. The 1993 reforms included requiring farmers to demonstrate their actual production histories and yields, creating alternative area or group plans of insurance, tracking “high risk producers,” and “other measures authorized by law to improve the actuarial soundness of Federal crop insurance while maintaining fair and effective coverage for producers.” The loss ratio goal of 1.1, however, was “not intended to eclipse Congress’s ultimate objective of a Federal crop insurance program that is fully actuarially sound (represented theoretically by a loss ratio of 1.0 over a sufficient number of years)” (S. Rept. 103-36, at 18-21). The reforms were projected to save $501 million over five years (equal to about $1.1 billion in 2024 dollars).

The Senate Agriculture Committee again took the lead a year later when Congress enacted the Federal Crop Insurance Reform and Department of Agriculture Reorganization Act of 1994 (P.L. 103-354). The Senate committee noted that annual costs of crop insurance were nearly $1 billion but in each of the previous eight years Congress had provided for disaster assistance, creating a conflict with crop insurance that contributed to low participation by farmers. The Senate committee established a goal for reaching actuarial soundness by October 1, 1998, by “achieving an overall projected loss ratio of not greater than 1.0” which it emphasized was “intended to be a performance standard” with flexibility for FCIC to accomplish it (S. Rept. 103-301, at 27). The House Agriculture Committee’s version of crop insurance reform had generally retained the 1.1 loss ratio requirement (H. Rept. 103-649). The final legislation compromised. It revised the projected loss ratio in section 506 to a requirement that FCIC reach an overall projected loss ratio of 1.075 after October 1, 1998, and added authority for a nonstandard classification system. In section 508, Congress continued the requirement for adopting actuarially sound rates but without increasing rates by more than 20 percent (P.L. 103-354).

(2) Remodeling Actuarial Soundness, 2000 to 2008

Congress next undertook a major rehaul of crop insurance in the Agriculture Risk Protection Act of 2000 (P.L. 106-224). Congress did not, however, revise the loss ratio goal or the provisions on actuarial soundness. The conference report indicates that the Senate had included a loss ratio requirement of 1.075 through the 2001 crop year and 1.0 beginning with the 2002 crop year. The House did not pass a comparable provision and the Senate revision was dropped in conference (H. Rept. 106-639, at 140). Notably, the Senate’s change to the loss ratio was not part of the bill reported by the committee but had been added on the floor in a comprehensive manager’s amendment (see, Congressional Record, March 22, 2000, at 3166 and 3175-3179; S. Rept. 106-247).

Congress finally enacted an actuarially sound loss ratio requirement in the 2008 Farm Bill, reducing to the 1.0 requirement in both sections 506 and 508 (P.L. 110-234 and 110-246). The Senate Agriculture Committee once again took the lead but explained little about the change. It reported that the bill moved crop insurance to a “fully actuarially sound basis, establishing a new statutory national loss ratio of 1.0” (S. Rept. 110-220, at 24 (emphasis added)). The House Agriculture Committee also required FCIC to achieve a projected 1.0 loss ratio, using it as an offset for increased spending (H. Rept. 110-256). The conference committee adopted the Senate provision (H. Rept. 110-627, at 966). FCIC has been required to operate the crop insurance program at an overall 1.0 loss ratio since 2008.

(3) Reviewing Actuarial Soundness in Operation

Actuarial soundness is a balance between total indemnities paid out and total premium received by the FCIC, which includes both the premium paid by farmers and the portion covered by the federal government in premium subsidy. This provides the insurance fund or pool from which indemnities are paid. Figure 2 illustrates total premiums (farmer paid and subsidy) and total indemnities back to 1989 as reported by USDA’s Risk Management Agency (RMA) in the Summary of Business report generator (RMA, Summary of Business).

The overall loss ratio equals total indemnities divided by total premium for all plans of insurance. Figure 3 illustrates the overall loss ratio based on the above premium and indemnities data reported by RMA. It also includes the statutory loss ratio requirements. Since the 2008 Farm Bill lowered the loss ratio to 1.0, the entire program has run at an overall loss ratio of 0.86.

The overall loss ratio is only one part of the equation, however. Individual crops, plans, and regions contribute to the overall loss ratio but do not separately achieve actuarial soundness or a 1.0 loss ratio. This presents questions for further review. For example, the program data exposes substantial differences among the States (see, Policy Design Lab, Crop Insurance). Figure 4 adds further examples presenting each State’s overall loss ratio since 2008, as well as each State’s share of the national totals of indemnities, premium, and premium subsidy.

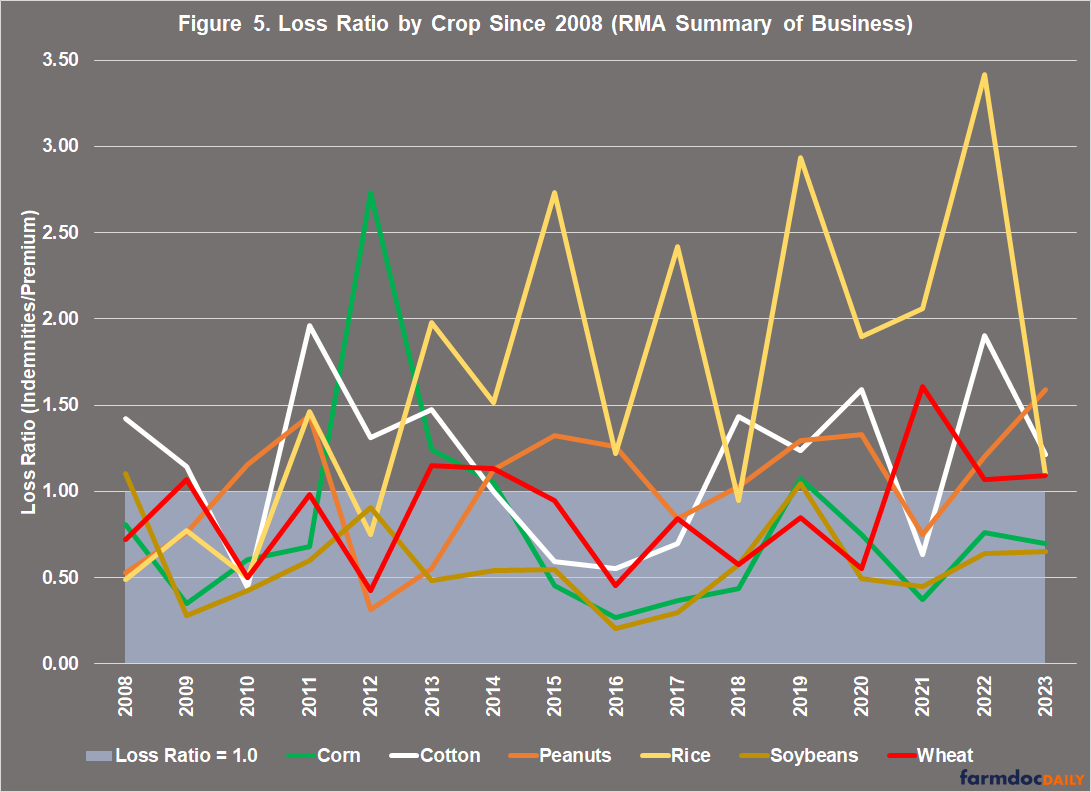

Finally, Figure 5 illustrates individual crop loss ratios since 2008, which modifies the loss ratio data previously reported (farmdoc daily, November 21, 2023). These differences must be worked out to achieve a national or overall loss ratio of 1.0 but that does not necessarily achieve actuarial soundness throughout the crop insurance program.

Concluding Thoughts

Thirty years into the experiment with actuarial soundness for federal crop insurance there is evidence of overall success; since the 2008 Farm Bill, RMA has operated the program at a total national or overall loss ratio of 0.86, below the 1.0 requirement enacted by Congress. By that measure, actuarial soundness has generally been achieved—no small accomplishment for a complex, complicated national program that covered more than $181 billion in liabilities last year—but crop insurance has neither eclipsed nor displaced farm payment programs or ad hoc and supplemental disaster assistance. The dilemma of actuarial soundness presents a conundrum at the heart of crop insurance. Unlike Title I payment programs and ad hoc or supplemental assistance, crop insurance indemnities require an annual infusion of sufficient funds—many must pay in for the program to pay out—and balancing that is difficult, a difficulty exacerbated by political reluctance to increase the premiums that farmers pay. To achieve actuarial soundness while not increasing any premiums by more than 20 percent likely limits any full adjustment of rates; some farmers pay more than they should (because they receive fewer and lower indemnities), while other farmers pay less than they should (because they collect more and larger indemnities). This can result in an overall 1.0 loss ratio but at the expense of actuarial soundness throughout the program, especially at the crop, state, or regional levels where loss ratios differ significantly. It may be that a significant part of this dilemma has been covered by the increases in premium subsidy enacted by Congress in 2000 but questions remain. These issues need further exploration and future articles will dive below the topline loss ratio.

References

Coppess, Jonathan. The Fault Lines of Farm Policy: A Legislative and Political History of the Farm Bill. (Lincoln: University of Nebraska Press, 2018). https://www.nebraskapress.unl.edu/nebraska/9781496205124/.

Coppess, Jonathan. Between Soil and Society: Legislative History and Political Development of Farm Bill Conservation Policy. (Lincoln: University of Nebraska Press, 2024). https://www.nebraskapress.unl.edu/nebraska/9781496225146/.

Coppess, J. "A View of the Farm Bill Through Policy Design, Part 5: Crop Insurance." farmdoc daily (13):162, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 7, 2023.

Couprie, Dirk. “How Thales Was Able to ‘Predict’ a Solar Eclipse Without the Help of Alleged Mesopotamian Wisdom.” Early Science and Medicine 9, no. 4 (2004): 321-337.

Flores, I., N. Paulson, J. Coppess, G. Schnitkey and B. Sherrick. "Understanding the Relationship between Loss Ratios and Crop Insurance Subsidies." farmdoc daily (13):212, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 21, 2023.

Frost, Natasha. “Was the First Eclipse Prediction an Act of Genius, a Brilliant Mistake, or Dumb Luck? It is hard to predict an eclipse when you think the world is flat.” Atlas Obscura. August 8, 2017. https://www.atlasobscura.com/articles/thales-predicts-eclipse-mystery-ancient-greece.

Glauber, Joseph W. “The Growth of the Federal Crop Insurance Program, 1990—2011.” American Journal of Agricultural Economics 95, no. 2 (2013): 482-488.

History Daily. “The Power Of An Eclipse: The Story Of The Eclipse Of Thales.” June 10, 2019. https://historydaily.org/the-power-of-an-eclipse-the-story-of-the-eclipse-of-thales/9.

Mosshammer, Alden A. “Thales’ Eclipse.” Transactions of the American Philological Association (1974-) 111 (1981): 145-155.

Ruppert, S., J. Coppess and M. Skidmore. "A National Menace Reconsidered, Part 3: Conservation Buffers." farmdoc daily (14):61, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 28, 2024.

U.S. Government Accounting Office. “Crop Insurance: Program Has Not Fostered Significant Risk Sharing by Insurance Companies.” GAO/RCED-92-25. January 1992. https://www.gao.gov/assets/rced-92-25.pdf.

U.S. House of Representatives. “Food, Agriculture, Conservation, and Trade Act of 1990.” H. Rept. 101-916. Conference report to accompany S.2830 (101st Congress, 2d Session; October 22, 1990).

U.S House of Representatives, Committee on the Budget. “Omnibus Budget Reconciliation Act of 1993.” H. Rept. 103-111, report to accompany H.R.2264 (103d Congress, 1st Session; May 25, 1993).

U.S. House of Representatives, Committee on the Budget. “Omnibus Budget Reconciliation Act of 1993.” H. Rept. 103-213, Conference report to accompany H.R.2264 (103d Congress, 1st Session; August 4, 1993).

U.S. House of Representatives, Committee on Agriculture. “Federal Crop Insurance Reform Act of 1994.” H. Rept. 103-649, report to accompany H.R.4217 (103d Congress, 2d Session; August 1, 1994).

U.S. House of Representatives, Committee of Conference. “Agricultural Risk Protection Act of 2000.” H. Rept. 106-639, Conference report to accompany H.R.2559 (106th Congress, 2d Session; May 24, 2000).

U.S. House of Representatives, Committee on Agriculture. “Farm, Nutritioin, and Bioenergy Act of 2007.” H. Rept. 110-256, to accompany H.R.2419 (110th Congress, 1st Session; July 23, 2007).

U.S. House of Representatives, Committee of Conference. “Food, Conservation, and Energy Act of 2008.” H. Rept. 110-627, conference report to accompany H.R.2419 (110th Congress, 2d Session; May 13, 2008).

U.S. Senate, Committee on the Budget. “Reconciliation Submissions of the Instructed Committees Pursuant to the Concurrent Resolution on the Budget (H. Con. Res. 64).” S. Rept. 103-36 (103d Congress, 1st Session; June 1993).

U.S. Senate, Committee on Agriculture, Nutrition, and Forestry. “Federal Crop Insurance Reform Act of 1994.” S. Rept. 103-301, report to accompany S.2095 (103d Congress, 2d Session; July 1, 1994).

U.S. Senate, Committee on Agriculture, Nutrition, and Forestry. “Risk Management for the 21st Century Act.” S. Rept. 106-247, report to accompany S.2251 (106th Congress, 2d Session; March 22, 2000).

U.S. Senate, Committee on Agriculture, Nutrition, and Forestry. “Food and Energy Security Act of 2007.” S. Rept. 110-220, report to accompany S.2302 (110th Congress, 1st Session; November 2, 2007).

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.