How the EU Deforestation Rule Will Affect Agriculture in Brazil

Agricultural producers with goals of continuing exports to the European Union (EU) have six months to comply with new rules set by the EU to curb deforestation. The new legislation takes effect on Dec. 31 and is part of a larger package of regulations within the Green Deal, an agreement approved by the European Parliament in 2019 and designed to achieve the goals of the Paris Agreement on climate change. Companies and traders planning on selling soybeans, beef, coffee, palm oil, cocoa, wood, and rubber to the EU market will have to be able to prove that their supply chains have not contributed to deforestation any time after Dec. 31, 2020. No product covered by the EU Deforestation Regulation (EUDR) produced in a deforested area after that date will be permitted to enter the EU market.

Brazil is a leading exporter of most of the commodities in the scope of the legislation. The EU is Brazil’s second-largest trading partner, accounting for 16% of Brazil’s total trade. Brazil is the EU’s 11th-largest trading partner. The products specified by the EUDR account for 30% of the total value of Brazilian trade in 2023, with Europe purchasing more than a third of these exports. This article examines the potential implications for Brazilian agribusiness, looking into seven commodities covered by the new European anti-deforestation law.

EUDR Background

In June 2023, the European Union introduced a new regulation regarding deforestation-free products, allowing 18 to 24 months for the regulation to take effect. The legislation seeks to prohibit the import and trade within the European bloc of products derived from seven commodities — soybeans, cattle, coffee, cocoa, palm oil, rubber, and wood — from areas deforested after December 31, 2020. The EUDR is one of more than 50 regulations within the Green Deal.

The new regulation will impose its primary obligations starting Dec. 31, 2024, for large and medium-sized importing companies and beginning June 30, 2025, for small and micro-importing companies. Only deforestation of forests will be initially considered, but the EU could include other native areas within one year after the regulation takes effect.

The EUDR requires importers to establish a due diligence system for their supply chains, and they must conduct this due diligence before importing the affected products. The process for European importers must involve:

- Collection of production information (including geolocation);

- Risk assessment based on the information collected;

- Risk mitigation if a non-negligible risk is identified;

- Due diligence declaration submitted to European authorities at the product’s entry; and

- Annual reports on their due diligence efforts.

This due diligence system will be required even if a product meets all sustainability requirements and applicable local standards, because proving compliance through due diligence is mandatory. Non-compliance will result in sanctions, such as fines and restrictions for European importers. Additionally, the names of those not complying and the nature of non-compliances will be made public.

The regulation establishes a risk classification system that will categorize countries and regions based on their level of deforestation risk: low, standard, or high. This classification will determine the type of due diligence required and the level of scrutiny that European authorities will apply to the due diligence declarations submitted by importers. The European Commission will conduct and announce the classification following the measure’s implementation on Dec. 31, 2024.

Possible Implications for Brazilian Agribusiness

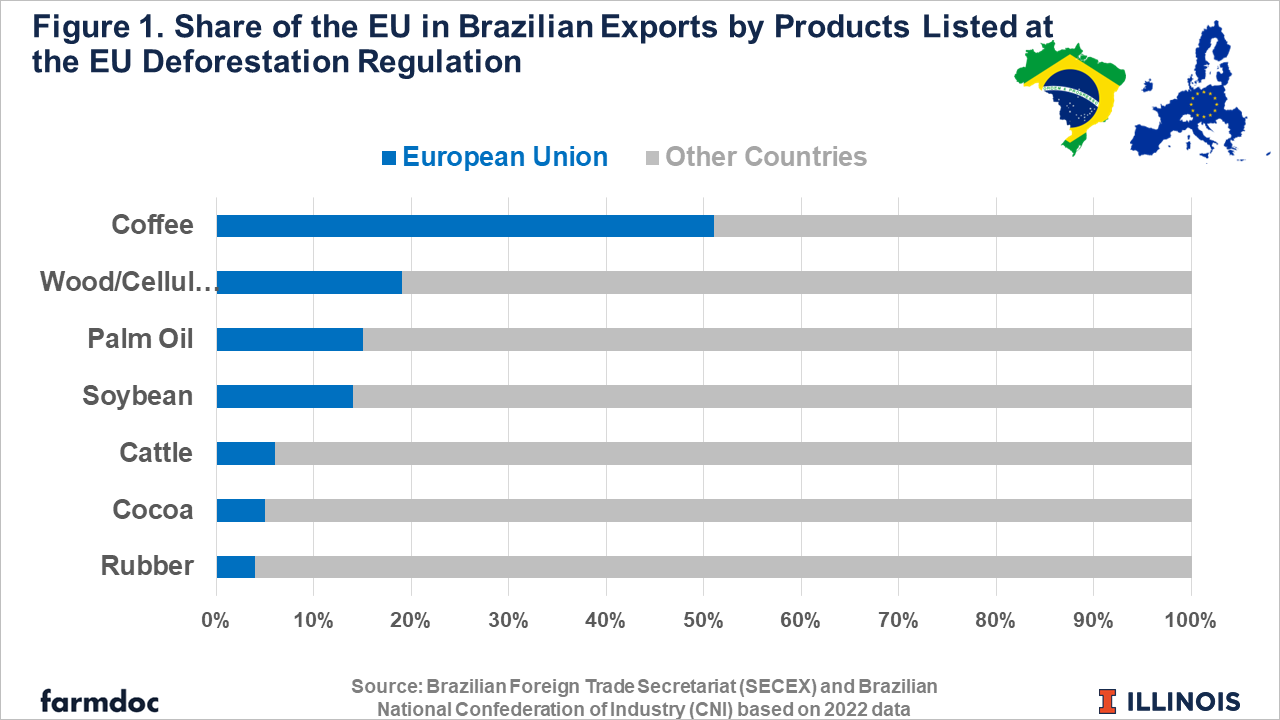

The EU is Brazil’s second-largest trading partner, behind only China. The EUDR regulation, which affects about 350 products, including seven agricultural commodities and their derivatives, could affect about 30% of Brazil’s total exports to the EU, according to the Brazilian Confederation of Agriculture and Livestock (CNA). Figure 1 illustrates the representation of the EU in Brazilian exports by commodity and the corresponding set of derived products using data from the Brazilian Foreign Trade Secretariat (SECEX) and Brazilian National Confederation of Industry (CNI).

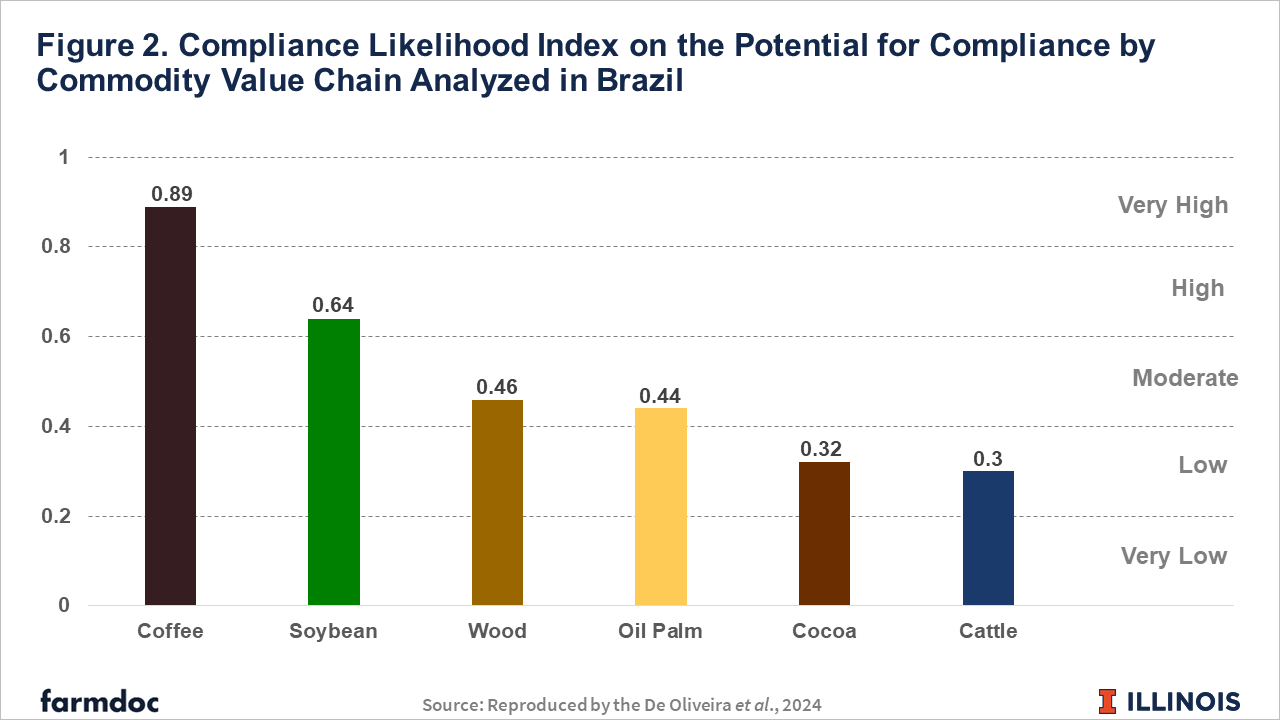

Brazil is the world’s largest coffee producer, with more than 60% of its production exported. The EU accounts for more than 50% of Brazil’s total coffee exports (see Figure 1), including coffee beans and soluble coffee, amounting to $4.3 billion in 2022. The second main destination for Brazilian coffee exports has been the United States, with a 20% share. Coffee cultivation primarily takes place in areas of old pastures that have not been recently deforested or in native vegetation. Nevertheless, the sector must prove that the product is not linked to deforestation. According to a recent study using the construction of a “Compliance Likelihood Index” (De Oliveira et al., 2024), Brazil’s coffee sector may currently have the greatest likelihood of not being majorly impacted by the regulation, registering a very high score of 0.89 (see Figure 2). The Council of Coffee Exporters of Brazil is testing a platform with remote sensing data and producer locations, currently covering about 94% of producers who export to the EU.

Most of Brazil’s soybean production is also exported – almost 70% in 2023 (Secex, 2024). The EU is the second-largest market for Brazilian soybean and derivative exports, accounting for 14% of these exports in 2022, valued at $8.8 billion. With significant growth in both planted area and production in recent years (see farmdoc daily, March 30, 2021), along with the potential for converting new agricultural lands (see farmdoc daily, April 9, 2024), Brazilian soybean production is likely to be affected by the European regulations. The primary concern is that the regulation will prohibit soybeans cultivated in legally convertible areas under the Brazilian Forest Code. Despite that, soybeans presented a high “Compliance Likelihood Index” based on the great capacity of large commercial producers to cover implementation costs (see Figure 2). It’s important to note that the European regulation does not cover the Brazilian savannah, the Cerrado, where more than 60% of Brazil’s soybeans are currently grown.

Brazil exports nearly 50% of its production of wood products included in the EU legislation. The EU ranks as the third-largest destination for Brazil’s wood, cellulose, and related product exports. In 2022, the EU accounted for nearly 20% of Brazil’s total exports in these categories, totaling $3.3 billion. The primary destination for Brazilian wood and cellulose exports is the United States. The Brazilian Tree Industry Association reports that 100% of the cellulose exported has been certified as deforestation-free since 1994, the benchmark year the international certifier uses. Wood has the third highest compliance likelihood (see Figure 2).

Brazil is a relatively minor global palm oil producer, exporting only 14% of its production. The EU is the second-largest destination for Brazilian palm oil and its derivatives. In 2022, the EU received 15% of Brazil’s total palm oil exports, amounting to $44 million. Although production is increasing in the Amazon region, palm oil has not been a key driver of deforestation since government initiatives and sustainable certification programs regulate the industry.

Conversely, the transition to deforestation-free supply chains in the beef sector might be more challenging than the other commodities analyzed. Brazil is one of the largest beef producers in the world, with approximately 25% of it being exported. The EU is the third-largest destination for Brazilian beef and leather exports, receiving 6% of Brazil’s total exports in 2022, amounting for approximately $920 million. Cattle has the lowest Compliance Likelihood Index score (see Figure 2). Despite several sustainability initiatives in the beef sector, there needs to be more voluntary sustainability standards addressing linkages to deforestation (De Oliveira et al., 2024).

Among the sectors covered by the European regulation, cocoa production is likely the least affected. Brazil exports very few cocoa beans, with shipments of cocoa derivatives primarily destined for South America, the United States, and Canada. In 2022, the EU imported $17.2 million of Brazilian cocoa and its derivatives, representing about 5% of Brazil’s total annual exports. Similarly, most of Brazil’s rubber production is consumed domestically. Consequently, the European regulation is expected to have a minimal impact on Brazilian rubber exports. In 2022, the EU imported rubber and its derivatives valued at $73.5 million, accounting for about 4% of Brazil’s total exports.

Final Considerations

The EU is an important trading partner for Brazil, so the EUDR is certain to affect Brazilian agribusiness in 2025. The Brazilian commodity production systems addressed by the European legislation have unique characteristics, and each sector faces distinct challenges and opportunities in transitioning to a deforestation-free environment. Brazil’s coffee sector currently has the greatest likelihood of ready compliance. At the same time, cattle may be the sector for which the regulations pose the most significant challenges, requiring a longer transition period and investments.

Because the rules will be enforced beginning Dec. 31, the deadline is considered too short for all Brazilian producers to meet the due diligence requirements. Other countries face the same issue. In June, the United States asked the European Union to delay its upcoming ban on imports of commodities linked to deforestation because, the U.S. says, the EU “has not provided clear implementing guidance” on the policy.

Another challenge is related to the additional costs on supply chains, even those with no connection to deforestation, as the importer must provide proof of compliance through a due diligence system. These additional costs will have a more significant impact on small producers’ finances than bigger ones. The new regulation, however, could benefit countries that deforested their native vegetation in the past, prior to 2021. In contrast, countries who continue to expand agricultural production areas, even those which carefully regulate the expansion to preserve native areas like Brazil, may face more difficulties with compliance.

On the other hand, Brazil has technological tools that will assist European operators in gathering information when conducting the due diligence process on Brazilian products, with georeferenced information on forested areas and areas used for agriculture (Lopes, Chiavari & Segovia, 2023). The EUDR could presents an opportunity for Brazil to move forward in implementing the Forest Code, strengthen policies combatting deforestation, meet its goal of zero illegal deforestation by 2030, and develop national monitoring and traceability systems for commodity chains. With that, Brazil could ensure an even larger share of its products in the European market and new markets as well.

References

Colussi, J., N. Paulson, G. Schnitkey, C. Zulauf and J. Baltz. "Potential for Crop Expansion in Brazil Based on Pastureland and Double-Cropping." farmdoc daily (14):69, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 9, 2024.

Colussi, J. and G. Schnitkey. "New Soybean Record: Historical Growing of Production in Brazil." farmdoc daily (11):49, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 30, 2021.

CNI, Brazilian National Confederation of Industry. Regulamento da União Europeia condiciona importação de determinadas commodities agrícolas e seus derivados a due diligence de desmatamento. Análise de Política Comercial, n 10, Brasília, Brasil. July 2023. https://static.portaldaindustria.com.br/media/filer_public/78/99/78990af4-d034-4897-8013-252abe5b3ec2/apc_regulamento_ue_desmatamento_ano_2_n_10.pdf

De Oliveira, S. E. C., Nakagawa, L., Lopes, G. R., Visentin, J. C., Couto, M., Silva, D. E., ... & West, C. (2024). The European Union and United Kingdom's deforestation-free supply chains regulations: Implications for Brazil. Ecological Economics, 217, 108053. https://doi.org/10.1016/j.ecolecon.2023.108053

Lopes, C.L., Chiavari, J., Segovia, M. E. “Brazilian Environmental Policies and the New European Union Regulation for Deforestation-Free Products: Opportunities and Challenges.” Climate Policy Initiative, October 3, 2023. https://www.climatepolicyinitiative.org/publication/brazilian-environmental-policies-and-the-new-european-union-regulation-for-deforestation-free-products-opportunities-and-challenges/#_ftn2

SECEX, Brazilian Secretariat of Foreign Trade. Exports Report. http://comexstat.mdic.gov.br/en/geral

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.