The Arithmetic of Commodity Title Programs

Farm Bill negotiations are influenced by their impacts on Federal outlays. Increasing per-acre corn payments for commodity title programs will have a much more significant effect on total Federal outlays than other crops because corn has many more base acres than other crops. Seed cotton, rice, and peanuts have lower base acres; hence, spending increases tend to have much less impact on total Federal outlays. As a result, seed cotton, rice, and peanuts often have larger per-acre increases in spending than does corn. This process is illustrated with the House Proposal for the next Farm Bill.

Congressional Budget Office Baseline for the 2018 Farm Bill

At least once a year, the Congressional Budget Office (CBO) estimates Federal outlays for mandatory farm programs. These projections typically are made for the next eleven years. In its June 2024 estimates, CBO estimated outlays for the fiscal years from 2024 through 2034. These estimates serve as a baseline for evaluating proposals during farm bill negotiations. CBO will estimate outlays from re-negotiated portions of the farm bill, a process typically called scoring. Given current congressional rules, any increases in spending must be accompanied by spending offsets from other programs. If, for example, there is an increase in outlays for commodity programs, then the offset likely comes from programs associated with other farm bill titles, including nutrition, crop insurance, conservation, and research. In rare instances, offsets from the farm bill outlay increases can come from Federal spending outside the farm bill.

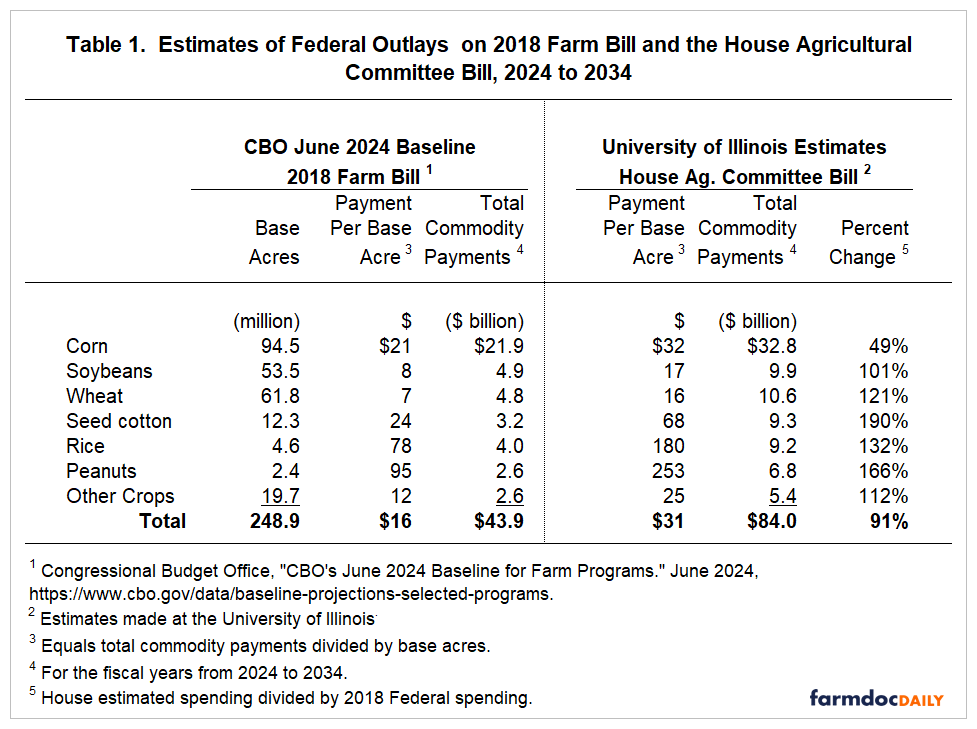

Table 1 shows the CBO projections for the commodity title programs, Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC). Those estimates assume that the 2018 Farm Bill’s commodity title programs will continue through the end of 2034. The CBO estimated total commodity title outlays at $43.9 billion from 2024 to 2034 (see Table 1).

Two items to note in Table 1. First, Federal outlays on corn total $21.9 billion, or 50% of the $43.9 billion outlays on commodity title programs. Corn represents a high proportion of the total expenditure because of its large base acres. Commodity title payments are made on base acres, which differ from planted acres. Base acres are specific to a Farm Service Agency (FSA) farm and do not change over time unless authorized by Federal legislation, usually through a farm bill (see farmdoc daily, May 7, 2024). The 93.5 million base acres for corn represent 38% of the total base acres. As it has many base acres, any change to corn per acre expenditures will significantly impact the total outlays associated with commodity title programs.

Second, note that three crops have higher per base acre payments than the $21 payment for corn: seed cotton at $24 per base acre, rice at $78 per acre, and peanuts at $95 per acre. These three crops have 19.4 million base acres, or 7.8% of base acres. While having 7.8% of base acres, these three crops account for a much higher percentage of commodity title outlays at 22%; $9.7 billion on seed cotton, rice, and peanuts compared to $43.9 billion in total outlays.

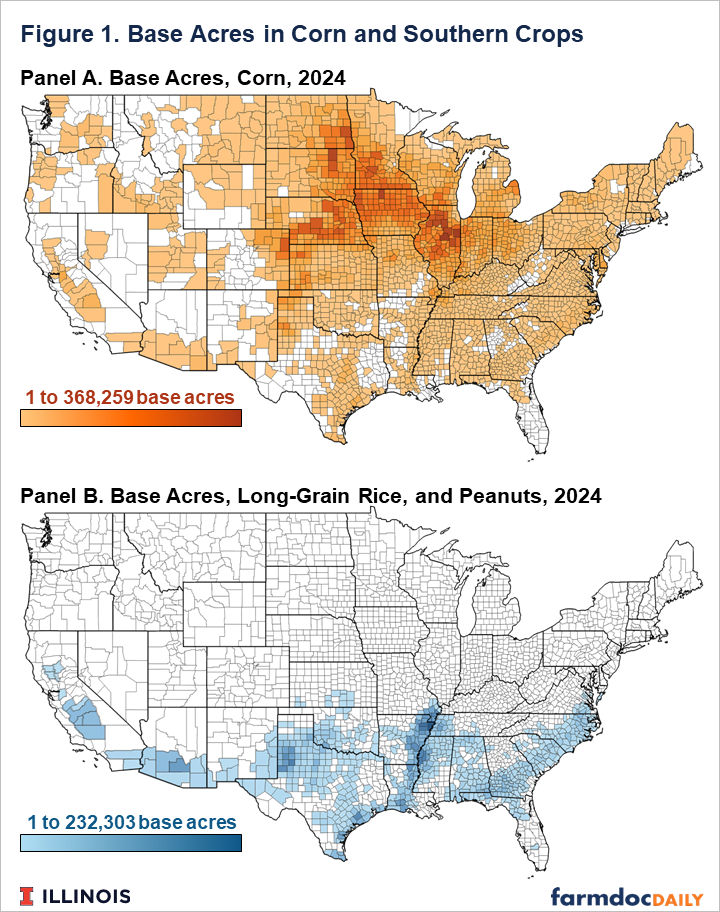

The above dynamics then have regional impacts. As one would expect, corn is concentrated in the Midwest (see Panel A of Figure 1). Of base acres in corn, 16% are in Iowa, 14% are in Illinois, 11% are in Nebraska, 9% are in Minnesota, and 7% are in Indiana. While concentrated in the Midwest, all states have some base acres in corn. On the other hand, seed cotton, rice, and peanuts are focused on the south (see Panel B of Figure 1). Of total base acres, 28% are in Texas, 18% are in Arkansas, 10% are in Georgia, 10% are in Louisiana, and 9% are in Mississippi. Southern crops are more concentrated, with 14 states accounting for 99% of base acres. By comparison, it takes 28 states to reach 99% concentration in corn.

House Agricultural Committee Proposal for a New Farm Bill

The House Agricultural Committee previously reported a version of farm bill reauthorization, and CBO has “scored” the proposal (CBO, August 2, 2024). CBO estimates that commodity title spending would increase by $44.8 billion, representing a 102% increase over the $43.9 billion estimate for current programs in the 2018 Farm Bill (see farmdoc daily, August 8, 2024 for further discussion of baseline spending).

CBO does not provide a breakdown of outlays by program crop. To provide those breakdowns, we also estimated outlays from changes in Federal programs. Our estimate was for a $40.0 billion increase, less than the $44.9 billion estimated by CBO. Modeling assumptions of prices and yields account for some of the difference. Moreover, our estimates hold base acres constant. CBO includes voluntary base acre updating. While our estimates are less than CBO, both CBO and our estimates point to large increases in Federal outlays for commodity titles under the House proposal.

Given our estimates, Federal outlays on commodity programs would increase from $43.9 billion to $84.0 billion, an increase of 91 percent (see Table 1). Outlays increase for all program crops, but the spending impacts diverge by crop. Corn has the lowest percentage increase, at 49%. The most significant percentage increases are for cotton at 190%, rice at 133%, and peanuts at 166%.

Disproportionate Impacts Across Crops

Outlays for commodity title programs increased because of increases in statutory reference prices. The House Bill also changed ARC by:

- increasing the coverage level from 86% to 90%, and

- Increasing the maximum payment from 10% to 12.5% of benchmark revenue.

The disproportionate results shown in Table 1 are mostly due to the changes to statutory reference prices. PLC provides a payment when the MYA price is below the effective reference price. The effective reference price is the higher of the:

- Statutory reference price, or

- 85% of the Olympic average of the five previous MYA prices, lagged by one year.

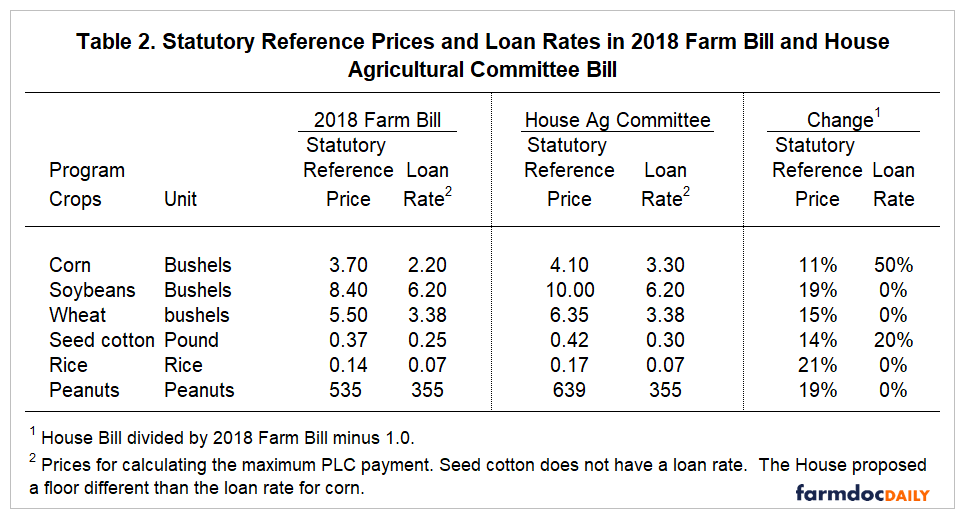

The effective reference price cannot exceed 115% of the statutory reference price. Payments are also capped at the effective reference price minus a floor, usually the loan rate. Corn, for example, currently has a loan rate of $2.20 per bushel. If the MYA price is below $2.20, the payment rate stops at the $2.20 loan rate rather than the lower MYA price.

The House Bill raised statutory reference prices for all crops. Of the major crops, the increase was less for corn than the other major crops. Corn’s statutory reference price increased from $3.70 per bushel to $4.10 per bushel, an increase of 11% (see Table 2). Soybean has a 19% increase, wheat a 15% increase, seed cotton a 14% increase, rice a 21% increase, and peanuts a 19% increase.

The House Bill also introduced a floor that differs from the loan rate for calculating the maximum PLC payment for corn. The floor is $3.30, $1.10 above the current loan rate of $2.20. A reason to add this floor to corn is to reduce estimated outlays for corn, the crop with the most base acres. The addition of the $3.30 floor reduced estimated Federal outlays by 11%, or $3.6 billion, from 2024 to 2034.

Summary

Changes in corn payments have a disproportionate impact on total spending because of the large number of base acres. The same could be said for soybeans and wheat as those crops also have large shares of total base acres. Seed cotton, rice, and peanuts have fewer base acres. As a result, program changes that increase per base acre payments result in smaller impacts on total outlays for seed cotton, rice, and peanuts. This arithmetic of the farm policy has had an impact on the politics associated with passing the Farm Bill. Larger relative increases in support for crops with smaller base acre shares are easier to fit within Congressional budget rules.

References

Congressional Budget Office. Cost Estimate. H.R. 8467, as ordered reported by the House Committee on Agriculture. August 2, 2024. https://www.cbo.gov/system/files/2024-08/hr8467.pdf

Coppess, J. "Reviewing the Congressional Budget Office Score of the House Farm Bill." farmdoc daily (14):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 8, 2024.

Schnitkey, G., C. Zulauf, N. Paulson, J. Coppess and B. Sherrick. "Base Acre Updating in the Next Farm Bill." farmdoc daily (14):87, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 7, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.