The Liquidity of Illinois Grain Farms: Working Capital to Gross Farm Returns by Farm Size

In our previous article (see farmdoc daily, December 11, 2024), we examined the trends in the ratio of median reported working capital to gross farm returns ratio across three regions of Illinois. Our findings indicate that Central Illinois has shown the least variability in liquidity compared to Northern and Southern Illinois. In contrast, Southern Illinois frequently faces liquidity challenges. These issues are primarily due to the region’s greater fluctuation in crop yields, which results in more significant income swings. In this article, we will examine the working capital to gross farm returns ratio by farm size using data from the Illinois Farm Business Farm Management (FBFM).

Liquidity refers to a farm business’s ability to generate enough cash or quickly convert assets into cash to meet its financial obligations as they become due. These obligations include operational expenses, debt payments, family living expenses, and taxes. There are various ways to measure liquidity; however, we will focus on the working capital to gross farm returns ratio. This ratio assesses how much working capital the farm has in relation to its size. Working capital is defined as the difference between current assets (i.e., cash and assets that are expected to be converted into cash within the next 12 months, which includes accounts receivable, inventory, and prepaid expenses) and current liabilities (i.e., obligations due within the next 12 months, such as accounts payable, short-term loans, current portion of term debt payments, and upcoming taxes). Gross farm returns are defined as the total value of agricultural output (accrual basis), which also includes government farm program payments. A farm with a working capital to gross farm returns ratio of 0.6 means that it has enough “cash” to replace 60% of gross farm returns in that year.

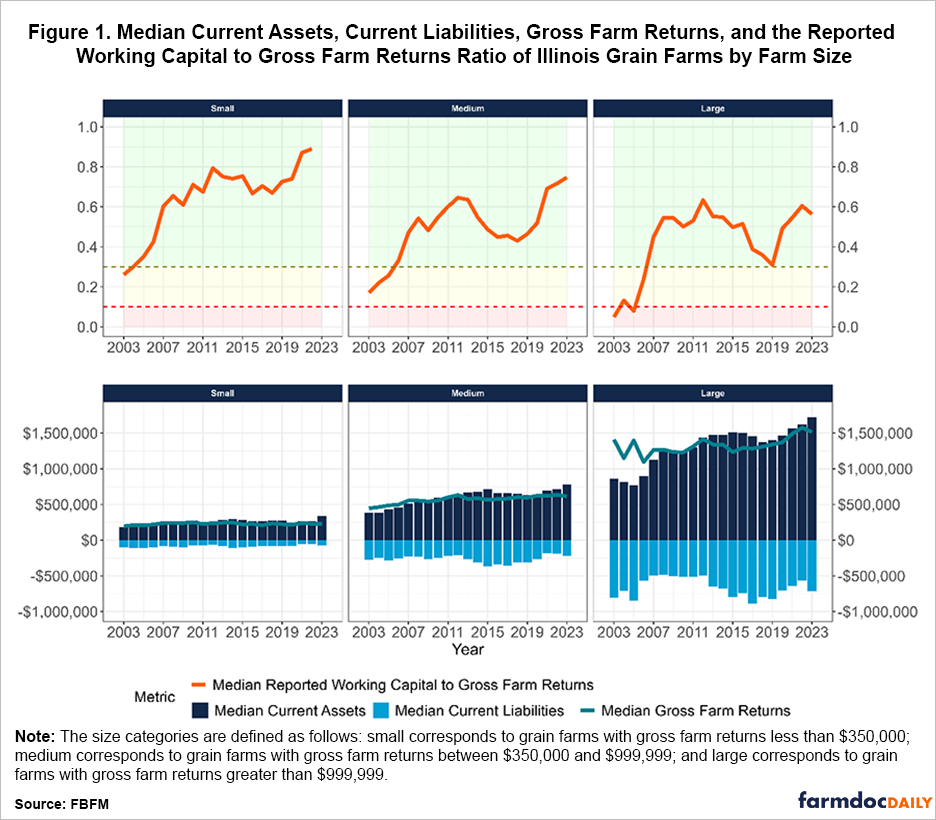

According to the Farm Financial Scorecard developed by the Center for Farm Financial Management, a farm with a working capital to gross farm returns ratio that is less than 0.1 is categorized as vulnerable, a ratio between 0.1 and 0.3 is categorized as cautionary, and a ratio that is greater than 0.3 is categorized as strong.[1] Therefore, the higher the ratio, the more liquid the farm is. We report this ratio by the size of their gross farm returns—small, medium-sized, and large. Small farms are defined as those with gross farm returns less than $350,000, medium-sized farms as those with returns between $350,000 and $999,999, and large farms as those with returns greater than $999,999. Lastly, in our figure below, we use the color-coding system of the Farm Financial Scorecard to indicate the category under which the median grain farm’s ratio belongs. The region shaded in red indicates a vulnerable ratio, while yellow indicates a cautionary ratio, and green indicates a strong ratio.

Figure 1 above shows the median current assets, liabilities, gross farm returns, and the working capital to gross farm returns ratio for Illinois grain farms, categorized by farm size. Over the past two decades, small farms have demonstrated the highest variation in their working capital to gross farm returns ratio (s.d. = 0.203) compared to medium-sized (s.d. = 0.156) and large farms (s.d. = 0.174). Despite this greater variability, small farms are the most liquid according to this measure. This higher liquidity position may be attributed to smaller farms often having additional off-farm income, which contributes to improved cash flow and overall liquidity.

Figure 1 also shows that medium-sized and large farms experienced the largest deterioration in liquidity in the 2010s. During this decade, declining grain prices resulted in lower ending grain inventory values. Although current assets declined as a result, current liabilities rose at a faster rate for medium-sized and large grain farms. This decline in liquidity was more pronounced for the median large farm. The medium-sized farm reached its trough in 2018, reporting a median working capital to gross farm ratio of 0.430 (strong). However, the median large farm reported a lower ratio in that year of 0.359 (strong), and an even lower ratio in 2019 of 0.309 (strong). The decline in liquidity for larger farms in 2019 was attributed not only to lower grain prices but also to the extremely wet spring, which prevented many of these farms from covering all their acres and led them to take prevent plant payments due to their inability to plant a crop.

Liquidity across all farm sizes began to rise in subsequent years. The improvement can be attributed to several factors, including the rise in farm incomes due to higher grain prices, particularly after the Russian invasion of Ukraine in 2022. Additionally, these price increases led to higher inventory values, large cash reserves, and lower operating debt. In 2023, the median grain farm reported a working capital to gross farm returns ratio of 1.13 (strong), while the median medium-sized farm reported a ratio of 0.747 (strong), which was an increase for both from the previous year. In comparison, the ratio declined for the median large farm, which came in at 0.563 (strong) in 2023.

Conclusion

In summary, Illinois grain farms have exhibited significant differences in liquidity trends over the past two decades, as shown by their median working capital to gross farm returns ratio. Although the median small farm demonstrated the highest variability in its ratio, it consistently reported a higher liquidity value compared to the other farm sizes. The median medium-sized and large farm experienced the sharpest declines in liquidity during the 2010s due to falling grain prices, with large farms experiencing the largest deterioration. However, liquidity across all farm sizes has improved in recent years, driven by higher grain prices, increased farm incomes, and stronger working capital positions.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Notes

[1] The Farm Financial Scorecard adheres to the guidelines set by the Farm Financial Standards Council.

References

Mashange, G., B. Zwilling and D. Raab. "The Liquidity of Illinois Grain Farms: Working Capital to Gross Farm Returns Ratio by Region." farmdoc daily (14):224, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 11, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.