Peru’s Blueberry Boom: More Land, More Labor, More Berries to Savor

Note: This article was written by University of Illinois Agricultural and Consumer Economics Ph.D. student Nicolás Pazos and edited by Joe Janzen. It is one of several excellent articles written by graduate students in Prof. Janzen’s ACE 527 class in advanced agricultural price analysis this fall.

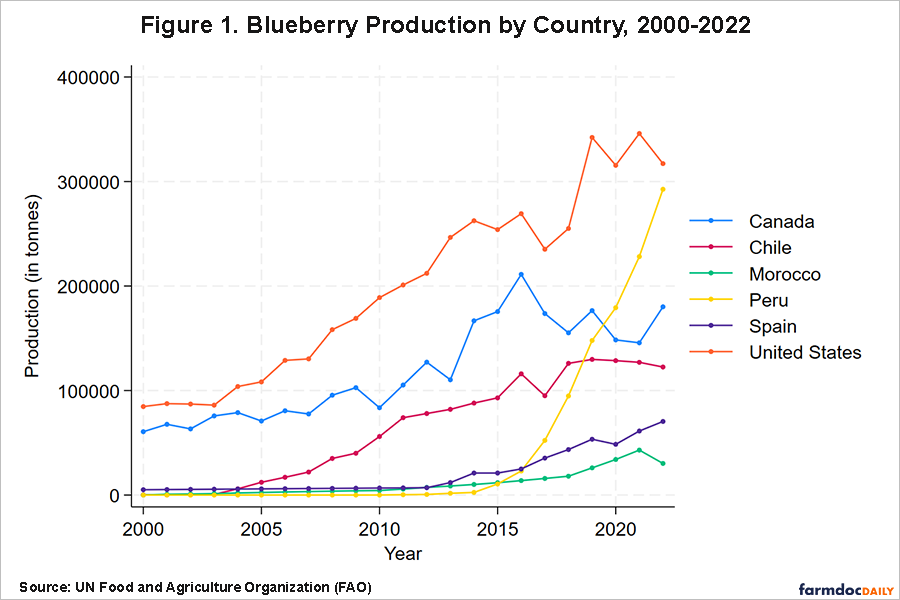

In the United States, it is now easy to find blueberries in supermarkets year-round as imports from the southern hemisphere fill gaps in fresh blueberry production in the US (Kramer, 2020). Many countries have produced more blueberries to meet international demand, but Peru’s exponential growth is especially impressive. Starting in 2013 with negligible production, Peru’s blueberry harvest quickly grew, surpassing the production of Spain in 2017, Chile in 2019 and Canada in 2020 (see Figure 1). Now, Peru rivals the US for the title of the world’s top blueberry producer and since about 90% of its production is exported, Peru is the top exporter.

This article discusses factors underpinning Peru’s blueberry boom and how they have changed the agricultural economy in Peru. International trade policy, agronomic and climatic conditions, and the coordinated action of farm groups and government have each contributed to the export-led growth in blueberry production in Peru. However, what is perhaps unique about this blueberry boom is how it unlocked a previously underutilized labor pool, rural women in Peru. As farm labor is growing increasingly scarce in the US and around the world (Ryan, 2023), the agriculture sector must think carefully about who will produce the food necessary to meet global demand. Peru provides a useful case study.

What Explains Peru’s Blueberry Boom?

Peru has a favorable growing season for blueberry production and exports. The temperate climate of coastal Peru allows producers to choose the most advantageous season to harvest blueberries. Most producers aim for peak harvest between September and November, just after the end of harvest in US and other northern hemisphere producers. This timing allows them to avoid direct competition with US supplies, instead filling a natural gap in that market.

Peru’s government has made several policy changes beneficial to blueberry production. It has become more open to international trade, signing numerous bilateral Free Trade Agreements (FTA), including a 2009 FTA with the US, now the destination market for around half of Peru’s blueberry exports. (Camacho, 2024) The government also played a key role through its agricultural sanitary agency, which coordinates control of pests and plant diseases, particularly in export shipments. Additionally, the government made large investments in irrigation projects to divert and efficiently distribute river water, which created new agricultural land in some previously arid places.

Production also benefitted from the introduction of new blueberry varieties well-adapted to the warmer Peruvian climate. These varieties were in the public domain, allowing producers to experiment and select varieties suitable to the varied altitudes and micro-climates in the country. The combination of well-adapted varieties and favorable climate – coastal Peru offers mild weather with little rain and moderate temperatures – allows these berries to grow in the open field, year-round. Figure 2 shows the growth in Peru’s blueberry yield per hectare; yields now exceed many other major producers. By 2017, Peru’s yield was already almost double that of other major producers such as Chile and the US.

The Blueberry Industry in Peru

Blueberries in Peru are produced mainly by large and medium sized companies. The export-oriented nature of this industry, which requires expertise in packing, refrigeration, and transportation, creates high barriers to entry. However, this does not mean that this industry is concentrated in few hands: As of 2024, there are over 300 firms exporting blueberries according to data from Proarándanos, the Peruvian Blueberry Grower and Exporter Association. An important factor for the proliferation of producers is that blueberry bushes grow relatively fast, being able to produce fruit in just a year. This made it easier for new producers to enter the market and quickly earn a return on their investment (Camacho, 2024).

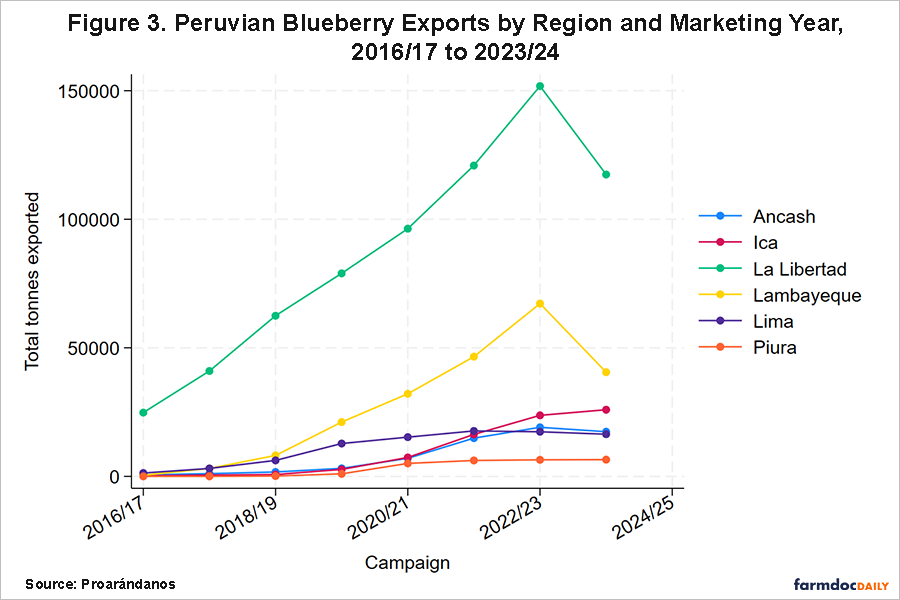

Although blueberry production can be found all along Peru’s coast, most of its production is concentrated in the northern coast, particularly in the regions of La Libertad and Lambayeque. Figure 3 shows export data from Proarándanos by marketing year which runs from May to April. About 80% of the total blueberry production is grown by the members of this association. La Libertad is the largest exporting region among members of this trade association, but production has also grown considerably in Lambayeque. Recently, growth has spread to other regions in the north such as Ancash and Piura, and to Ica in the south. The 2023/24 drop can be explained as the results of El Niño-driven adverse weather. Figure 4 shows the map of Peru, with the exporting regions identified according to the amount exported in 2022/23. La Libertad and Lambayeque are the areas where the most important irrigation projects were implemented, providing these areas with new agricultural land and cheap water access.

Jobs and Gender Gaps

One aspect of blueberry production in Peru is the need for labor, especially during the harvesting season. This contrasts with some other agricultural commodities whose production is more capital intensive. The wide-ranging harvest season for Peru’s blueberries also implies that the blueberry sector can generate permanent jobs in agriculture throughout the year. According to Proarándanos, the sector employed over 120 thousand people in the 2022/23 campaign.

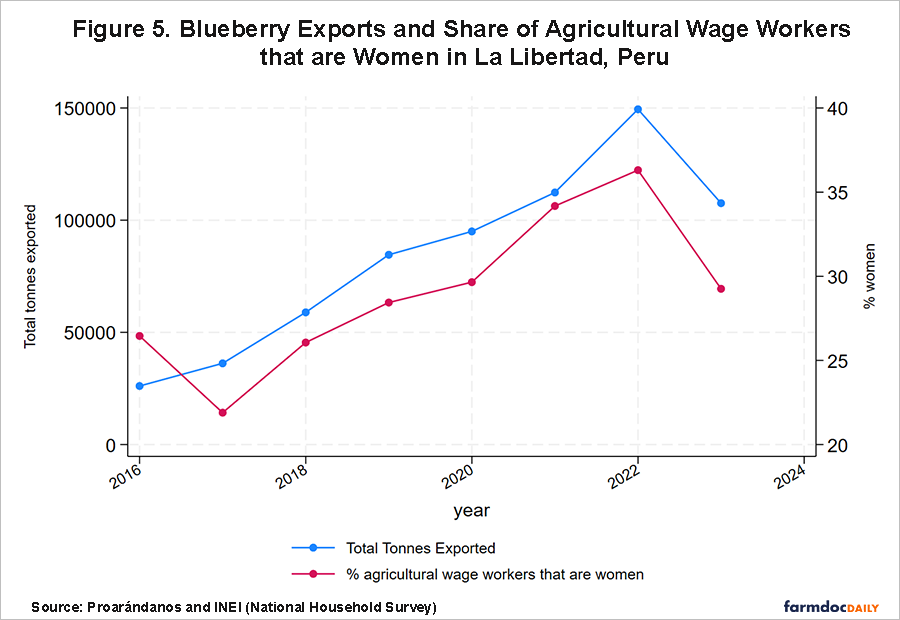

Blueberries in Peru are picked by hand, a process that needs to be performed with special care to not damage the fruit. This particular set of skills required from blueberry laborers, combined with an explicit commitment form the leaders of the sector to communicate social responsibility, has led the industry to hire more women than any other agricultural sector in the country. While only 25% of the agricultural wage workers in the country are women (according to INEI, Peru’s National Household Survey), this number grows to 60% of workers on blueberry farms. Focusing on the major production and export regions of La Libertad and Lambayeque, we see from national household survey data how womens’ agricultural labor force participation has changed with the rise of blueberry production. Figure 5 shows the change in percentage of the agricultural wage workers that are women, for largest producing region of La Libertad. As shown, the share of agricultural wage workers that are women has increased parallel to the increased blueberry exports from these areas, reflecting the importance of this new crop in generating jobs for rural women. Similar patterns emerge for other major producing regions.

Importantly, hourly employees at large exporting firms like those involved in the blueberry industry receive high wages compared to other sources of income, particularly for unskilled labor. The average wage of exporting agricultural firms exceeds the minimum wage by about 50%, and almost doubles the income of an independent small farmer (BCRP, 2018). Critically, working for export-oriented farms and agribusinesses is a source of a formal job in a setting where around 75% of the labor force is employed in informal jobs. Informal jobs lack important benefits such as social security; and are costly for the government as workers do not pay income taxes.

Broadly, prevalence of women as workers in blueberry production appears to offer benefits for all. Since women are overrepresented in the informal sector, the expansion of blueberry exports offers more higher wage jobs for women. At the same time, the blueberry producers in Peru also benefit from labor availability in a world where farm labor is becoming scarce in many regions.

Other Crops and the Future

Importantly, the national growth of blueberry production has not come at the expense of other exporting agricultural products. In fact, other important export crops have continued to grow in Peru in recent years. That includes the production of other specialty crops such as grapes and avocados. Other irrigation projects valued at 3bn USD are already planned for the next 2 years. These projects will unlock 200,000 hectares (494,210 acres) of new agricultural land in various valleys of the regions of Piura, Lambayeque, La Libertad, Arequipa and Moquegua. Given the availability of land, labor, water, and other inputs, Peru’s production of blueberries and other specialty crops is expected to continue to grow in the near future.

It is key to recognize that shifts in global agricultural demand and supply can have important consequences both for international food availability and for local labor markets. In the case of the blueberry market in Peru, firm-level investment, government-coordinated action, climate, land, policy, and labor availability combined to provide the country with important advantages relative to other producer nations. This allows consumers in the US and elsewhere to have improved access to fresh fruit at times of year when they otherwise would not. Additionally, the presence of the blueberry industry has generated many formal jobs within Peru. In contrast with other agricultural commodities, blueberries have provided more opportunities for women, potentially increasing gender parity. This serves as an example of how global agricultural trade can unlock new local jobs in low- and middle-income countries, which may both disincentivize migration and increase food access across the world.

References

Banco Central de Reserva del Perú (BCRP). (2018). “Reporte de inflación: Panorama actual y proyecciones macroeconómicas”, https://www.bcrp.gob.pe/publicaciones/reporte-de-inflacion.html

Camacho, M. (2024) “Peru: Blueberry Annual”, USDA Foreign Agricultural Service GAIN Report PE2024-0002, https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Blueberry%20Annual_Lima_Peru_PE2024-0002

Kramer, J. (2020). “Fresh blueberry supplies expand as US consumers develop a taste for year-round blueberries.” Amber Waves, https://www.ers.usda.gov/amber-waves/2020/december/fresh-blueberry-supplies-expand-as-u-s-consumers-develop-a-taste-for-year-round-blueberries/

Ryan, M. (2023), “Labour and skills shortages in the agro-food sector”, OECD Food, Agriculture and Fisheries Papers, No. 189, OECD Publishing, Paris. https://doi.org/10.1787/ed758aab-en.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.