Revisiting the RIN Cliff

The scale of the renewable diesel boom was so large that it led to a “RIN cliff” in 2023 and early 2024. As explained in our previous farmdoc daily article (May 31, 2023), a RIN cliff occurs when the total supply of biomass-based diesel (BBD) exceeds the U.S. Renewable Fuel Standard (RFS) mandates. When this happens, the D4 RIN price could in theory fall all the way to zero because no additional incentive beyond the competitive market price is needed to incentivize biomass-based diesel (FAME biodiesel + renewable diesel) production. However, this extreme scenario is not a stable equilibrium due to the magnitude of financial losses that BBD producers would incur. RIN prices must eventually rebound to a level that incentivizes sufficient production of BBD to meet the RFS mandates. Enough time has now passed since publication of our initial article on the RIN cliff to review how this extraordinary scenario unfolded and assess the prospects for this scenario occurring again in the future. This is the 21st in a series of farmdoc daily articles on the renewable diesel boom (see the complete list of articles here).

Analysis

The first step of the analysis is to compute the BBD demand ceiling implied by the annual renewable volume obligations (RVOs) for the RFS over 2023 through 2025. The U.S. Environmental Protection Agency (EPA) is responsible for proposing and enforcing RVOs (farmdoc daily, May 17, 2023). The EPA converts the statutory mandate volumes, where provided, into percentage standards through annual rulemakings. To ensure that annual RVOs are fulfilled, the EPA established a system of compliance based on Renewable Identification Numbers (RINs), which are tradable electronic certificates associated with a specific batch of biofuels (farmdoc daily, May 24, 2023). D4 RINs are used to demonstrate compliance with the mandate for BBD. Since D4 prices have always been positive, we can imply that the mandate for BBD has always been economically binding. Consequently, the RVOs always set the maximum level of demand for BBD in the U.S. (farmdoc daily, May 31, 2023). A RIN cliff occurs when production of BBD exceeds the demand ceiling set by the RVOs.

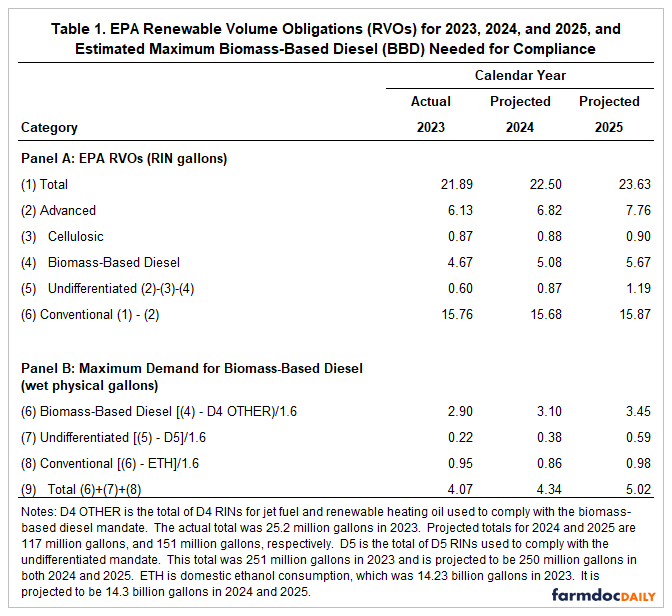

Table 1 presents the final RVOs for 2023 through 2025 as well as our computation of the maximum BBD needed for compliance with the RVOs. To begin, the volumes in Panel A are slightly different from those published in final rulemaking from the EPA. The reason is that the EPA provides a percentage standard to obligated parties rather than a volume standard. Percentage standards are computed by dividing volume standards by projected petroleum gasoline and diesel usage for a given year. If actual petroleum gasoline and diesel usage differs from the EPA projection, then implemented volumes will adjust up or down because the percentage standard is fixed after the final rulemaking is released. Total petroleum gasoline and diesel usage for 2023 was reported in May 2024 by the EPA to be 180.884 billion gallons. Multiplying this volume by the percentage standard for total renewable fuel in 2023 (11.96 percent) results in the total RVO of 21.89 billion gallons shown in line 1 of Table 1. Since the total volume obligation for petroleum gasoline and diesel in 2024 and 2025 is unknown at this time it must be projected. We make the simple assumption that the total declines by one-half percent in 2024 to 179.980 billion gallons and remains fixed at that level for 2025.

Panel A in Table 1 lists final implemented RVOs for 2023 and our projection of the implemented RVOs for 2024 and 2025. Line 1 lists the total RVO across all mandate categories, which increases from 21.89 billion gallons in 2023 to 23.63 billion gallons in 2025. Line 2 lists the RVOs for the advanced mandate, which is made up of the cellulosic (line 3), BBD (line 4), and undifferentiated (line 5) mandates. The EPA recently proposed that the cellulosic RVO for 2024 should be reduced to 0.88 billion gallons because cellulosic biofuel production is not expected to be large enough in 2024 to fulfill the original volume obligation of 1.13 billion gallons. We assume that this is the implemented level of the cellulosic RVO in 2024. In concert, we project the cellulosic RVO will be waived down to 0.90 billion gallons in 2025. We assume that the waived volumes for the cellulosic mandate in each year are added to the undifferentiated advanced mandate in line 5. The BBD RVO is reported by the EPA in physical gallons, which are converted to RIN gallons in Table 1 by multiplying by 1.6. This reflects a simplifying assumption that about half of BBD will be FAME biodiesel, with a RIN equivalence value of 1.5, and half will be renewable diesel, with a RIN equivalence of 1.7. The implemented RVOs for BBD increased by a billion RIN gallons from 2023 to 2025. The conventional RVO is shown on line 6, and it is the difference between the total and advanced RVOs. It ranges only marginally from 15.68 to 15.87 billion gallons.

Panel B in Table 1 provides estimates of the maximum number of BBD gallons needed to comply with the proposed RVOs. A key assumption in constructing this part of Table 1 is that BBD is the marginal gallon for filling the undifferentiated and conventional RVOs, as well as the BBD RVO. In essence, BBD is assumed to fill three different “buckets” in the RFS. Also note that the estimates in Panel B are computed in wet physical gallons to facilitate comparisons with physical production. Line 6 in Panel B estimates the amount of BBD needed to comply with the BBD RVO by first subtracting D4 RIN generation for “other jet” and “other heating oil,” and then dividing by 1.6. Total jet and heating oil D4 RIN generation was only 25 million gallons in 2023 but is projected to increase to 117 million gallons in 2024 and 252 million gallons in 2025.

A similar calculation for line 7 yields the maximum amount of BBD needed to comply with the undifferentiated RVO. A total of 251 million gallons of D5 RINs were retired for compliance in 2023. We assume nearly the same amount, 250 million gallons, is used for compliance in 2024 and 2025. Line 8 shows our estimates of the maximum amount of BBD needed to comply with the conventional RVO. Domestic ethanol consumption in the form of E10, E15, and E85 was 14.23 billion gallons in 2023. We assume that domestic ethanol consumption in 2024 and 2025 is 14.3 billion gallons, slightly larger than in 2023. Ethanol consumption is subtracted from the conventional RVO in Panel A, and the difference is divided by 1.6 to estimate BBD needed to fill the conventional RVO. In previous farmdoc daily articles this was labelled the “conventional gap” (e.g., July 19, 2017).

The key for our purposes is line 9 in Panel B of Table 1, which is the total BBD needed for compliance with the estimates of the implemented RVOs. The estimated maximum total is 4.07 billion (physical) gallons of BBD in 2023, 4.34 billion gallons in 2024, and 5.02 billion gallons in 2025. These are the maximum amount of BBD that can be supplied in the U.S. market without technically going over the RIN cliff. In other words, the demand ceiling for BBD in the U.S. ranges from about four to five billion gallons per year.

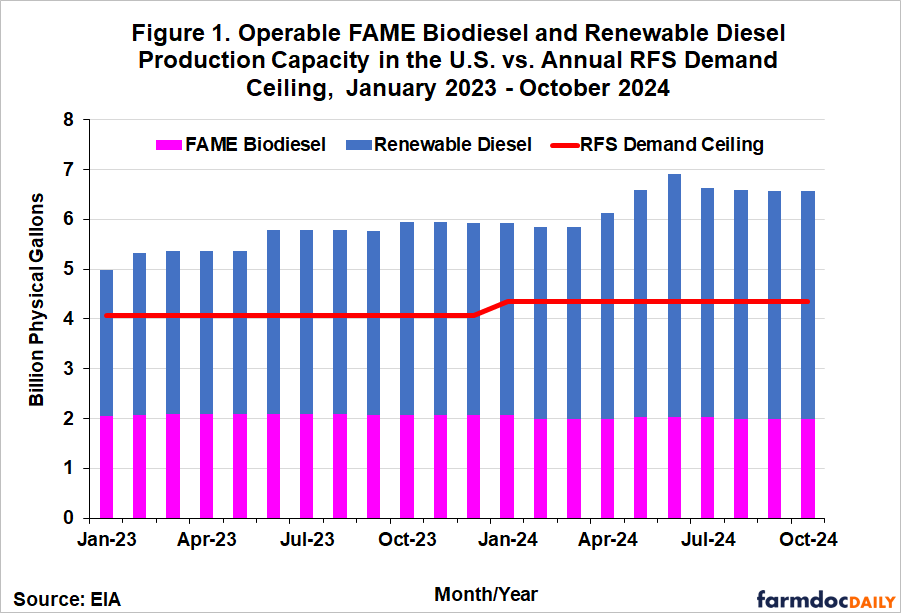

The next step in the analysis is to compare the demand ceiling estimates to different measures of the supply of BBD in the U.S. We begin with Figure 1, which compares the demand ceiling with monthly estimates of the operable capacity of FAME biodiesel and renewable diesel plants in the U.S. over January 2023 through October 2024, the latest available data. It is clear that operable capacity has substantially exceeded the demand ceiling since the start of 2023. The gap between the two has grown steadily over time, with a notable jump in the first half of 2024 as new renewable diesel capacity was brought online (farmdoc daily, November 6, 2024). Presently, the combined operable capacity of FAME biodiesel and renewable diesel is 6.6 billion gallons, over 1.5 billion gallons larger than the BBD demand ceiling for 2025 (5 billion gallons). There does not appear to be any shortage of operable capacity to meet the mandate for BBD in the near future.

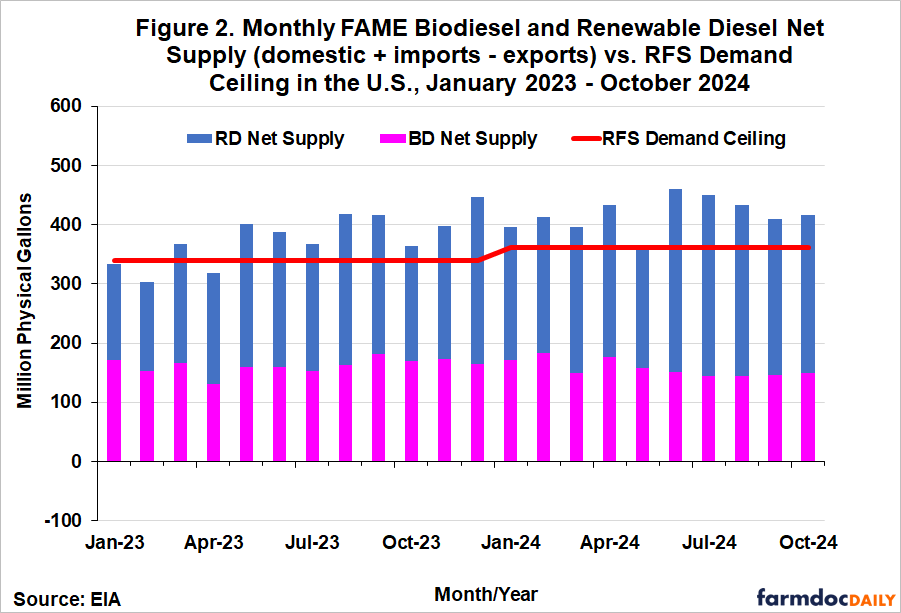

The capacity data in Figure 1 strongly suggests the potential of an oversupply of BBD but capacity is obviously not the same as production or supply. Figure 2 provides a direct comparison of supply in the physical BBD market to the demand ceiling. Specifically, the chart shows monthly net supply of FAME biodiesel and renewable diesel for January 2023 through October 2024. Net supply for both biofuels is defined as domestic production plus imports minus exports. All the data for the computation of net supply is provided by the Energy Information Agency (EIA) of the U.S. Department of Energy except for renewable diesel exports, which are estimated based on RIN retirements for export collected by the EPA. Note that the demand ceiling is presented in this chart on a monthly basis (annual/12) in order to match the net supply data.

The data in Figure 2 show that net BBD supply first exceeded the demand ceiling on a sustained basis in May 2023 and has been equal to or above the ceiling every month since. Monthly physical net supply of BBD over May 2023 through October 2024 has exceeded the demand ceiling by an average of 58 million gallons per month, slightly less than 700 million gallons on an annual basis. This is exactly the type of BBD over-supply that drives a RIN cliff scenario. It is interesting to observe that the gap between net BBD supply and the demand ceiling has narrowed after peaking in June 2024. Drilling down into the data reveals that this is almost entirely driven by a decline in biodiesel and renewable diesel imports. If this trend continues there is the possibility of net BBD supply and the demand ceiling being in balance during 2025, when the ceiling will increase to 418 million gallons per month. Net BBD supply was slightly less than 418 million gallons in both September and October 2024.

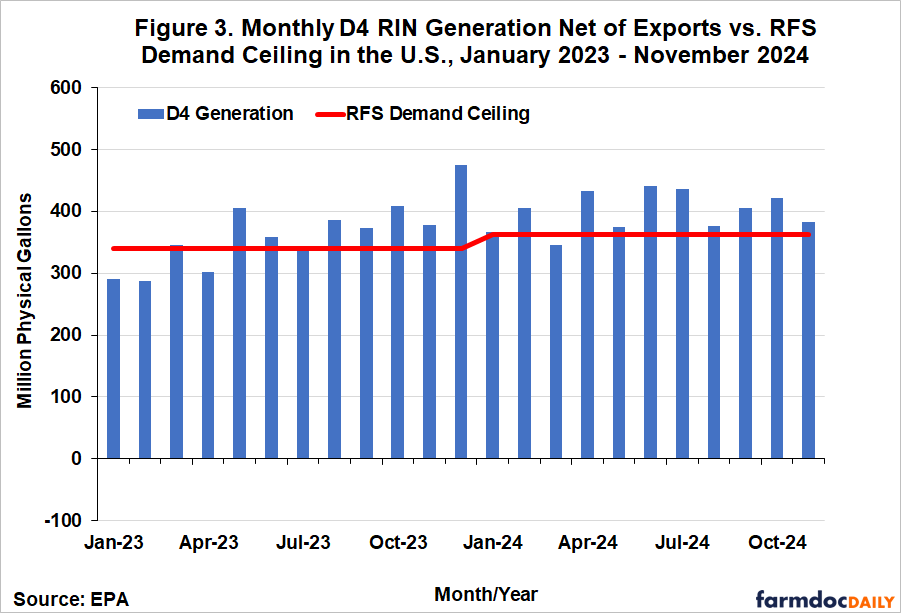

Figure 3 provides a comparison of monthly D4 RIN generation net of exports and the demand ceiling over January 2023 through November 2024. This is the most direct evidence relevant to the RIN cliff scenario because RINs are used for demonstrating compliance with the RVOs, not physical production. While it is obvious from comparing Figures 2 and 3 that D4 RIN production and physical net supply are closely related, they are not the same. The reasons for the differences include reporting schedules that do not necessarily match, and other technical issues related to retiring RINs for export. Overall, a similar picture emerges when comparing net D4 RIN generation to the demand ceiling. Net D4 generation first exceeded the demand ceiling in May 2023 and has been near or above the ceiling every month since. The gap between D4 generation and the demand ceiling over May 2023 through October 2024 averaged 44 million gallons, moderately lower than the gap for net physical BBD supply. Net D4 generation has been declining since last summer, presumably due to the decline in imports of BDD discussed above. It is also interesting to note that net D4 generation has been at or below the demand ceiling for 2025 (418 million gallons) since August 2024.

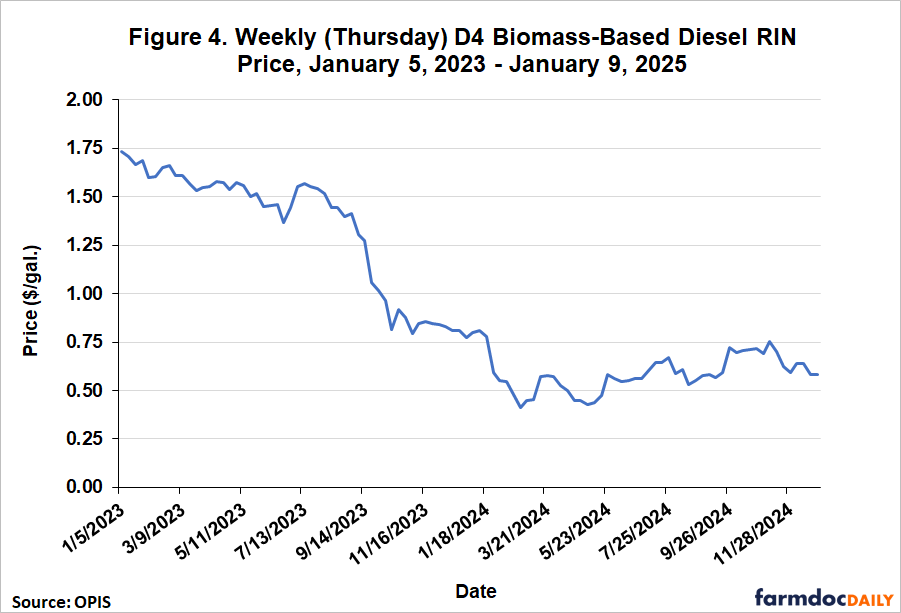

The last step of the analysis is to review the price of D4 RINs in light of the above comparisons of BBD supply and the demand ceiling implied by the RVOs. Figure 4 shows the weekly price of D4 RINs from January 5, 2023 through January 9, 2025. The key date for our present purposes is May 2023 when both net BBD supply and D4 RIN generation first exceeded the demand ceiling on a sustained basis. In May 2023, the D4 price averaged $1.54 per gallon. The price moved near this level through the summer of 2023, and then proceeded to literally fall off a cliff, declining to $0.82 by mid-October. After stabilizing for a few months, the D4 RIN price resumed its decline in the first quarter of 2024, reaching a low of $0.41 in late February. The total decline amounted to more than one dollar per gallon, or about two-thirds of the price in May 2023. Given the timing, there can be little doubt that the RIN price decline was driven by over-production of BBD.

An interesting question is why the D4 RIN price did not go even lower than it did. As discussed above, it is theoretically possible for the RIN price to go all the way to zero under the RIN cliff scenario. One explanation is related to the fact that RINs have a two-year life and can be “banked” for usage in the year after they are created. The inventory of carry-over RINs was widely thought to have been unusually low going into 2023 and the need to rebuild carry-over RINs back up to a more normal level may have been sufficient to absorb some of the over-supply of D4 RINs and prevent the price from plummeting even further. In any event, since bottoming in February 2024, the D4 RIN price has largely moved in a relatively narrow range from about $0.50 to $0.75 per gallon. One can infer that this price level has been sufficient to cap the growth in BBD supply and better balance this with demand.

Implications

The U.S. biomass-based diesel (BBD) industry went over a RIN cliff in May 2023. The price of D4 RINs plunged from around $1.50 per gallon to $0.40 over the span of a few months. The decline amounted to more than one dollar per gallon, or about two-thirds of the price in May 2023. The driving force behind this extraordinary event was an over-supply of biomass-based diesel (FAME biodiesel + renewable diesel) relative to the maximum demand implied by the annual renewable volume obligations (RVOs) for the U.S. Renewable Fuel Standard (RFS). Since the mandate for BBD is economically binding, the mandate volume is the ceiling for BBD demand in the U.S. The net physical supply of BBD over May 2023 through October 2024 exceeded the demand ceiling by an average of 58 million gallons per month, slightly less than 700 million gallons on an annual basis. It is clear in hindsight that the boom in BBD capacity and production in the U.S., largely associated with renewable diesel, was simply too much too soon relative to the demand ceiling implied by the RFS mandates. The good news is that there may be light at the end of the tunnel for BBD producers. Recent data show that BBD supply is now better balanced with the demand ceiling. Further, the demand ceiling increased at the start of 2025, and this opens the possibility of modest increases in BBD production that will not send the industry over another RIN cliff. The outlook, however, is clouded by policy uncertainty, particularly with regard to the new 45Z federal tax credit. There is likely to be a large swing in the volume of BBD imports depending on whether the credit is ultimately implemented or not, and the outcome could determine whether the U.S. BBD industry goes cliff diving again.

Disclaimer: The findings and conclusions in this publication are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy. This work was supported in part by the U.S. Department of Agriculture, Economic Research Service.

References

Gerveni, M., T. Hubbs, S. Irwin and S. Ramsey. "Updated Estimates of the Production Capacity of U.S. Renewable Diesel Plants Through 2026." farmdoc daily (14):202, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 6, 2024.

Gerveni, M., T. Hubbs and S. Irwin. "Is the U.S. Renewable Fuel Standard in Danger of Going Over a RIN Cliff?" farmdoc daily (13):99, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 31, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Overview of the RIN Compliance System and Pricing of RINs for the U.S. Renewable Fuel Standard." farmdoc daily (13):95, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 24, 2023.

Gerveni, M., T. Hubbs and S. Irwin. “Overview of the U.S. Renewable Fuel Standard.” farmdoc daily (13):90, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 17, 2023.

Irwin, S. and D. Good. "Filling the Gaps in the Renewable Fuels Standard with Biodiesel." farmdoc daily (7):130, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 19, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.