Projected Corn versus Soybean Returns in Illinois for 2025

Consistent with relative corn and soybean futures prices, the USDA’s Prospective Plantings report indicated US and Illinois farmers’ intentions to increase corn acreage and reduce soybean acreage in 2025. Illinois crop budgets still suggest an expected advantage for soybeans across all regions of the state for 2025. Uncertainty associated with US trade policy and rising tensions with major trade partners such as China could represent another factor leading farmers to increase corn acreage relative to soybeans. While planting intentions at this point are largely set, producers may still make some acreage adjustments in response to market indicators and conditions as the planting season gets underway.

Prospective Plantings and Market Indicators

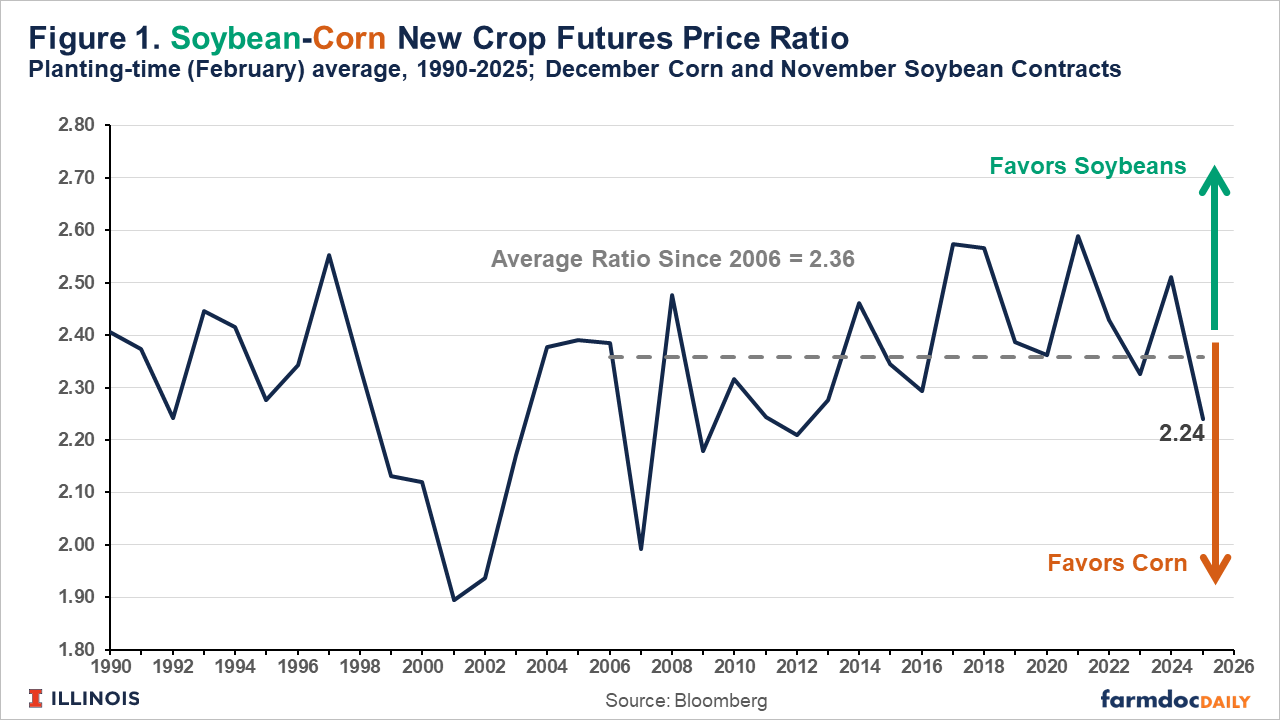

The USDA’s Prospective Plantings report for 2025 indicates that US farmers intend to plant 95.3 million acres of corn and 83.5 million acres of soybeans. This is an increase of 5% over corn acres in 2024 and a decrease of 4% over 2024 soybean acres. Consistent with those intentions is the futures price ratio of new crop soybeans to corn so far in 2025, favoring more corn acreage relative to soybeans.

Figure 1 shows the historical ratio of soybean to corn new crop futures prices from 1990 to 2025. The reported value is the average ratio of daily settlement prices of the November soybean contract to the December corn contract over the month of February of each year. The average ratio over the past 20 years has been 2.36. The ratio was above the 20-year average in all but one year (2023) from 2017 to 2024. The ratio for 2025 of 2.24 is the lowest it has been since 2012.

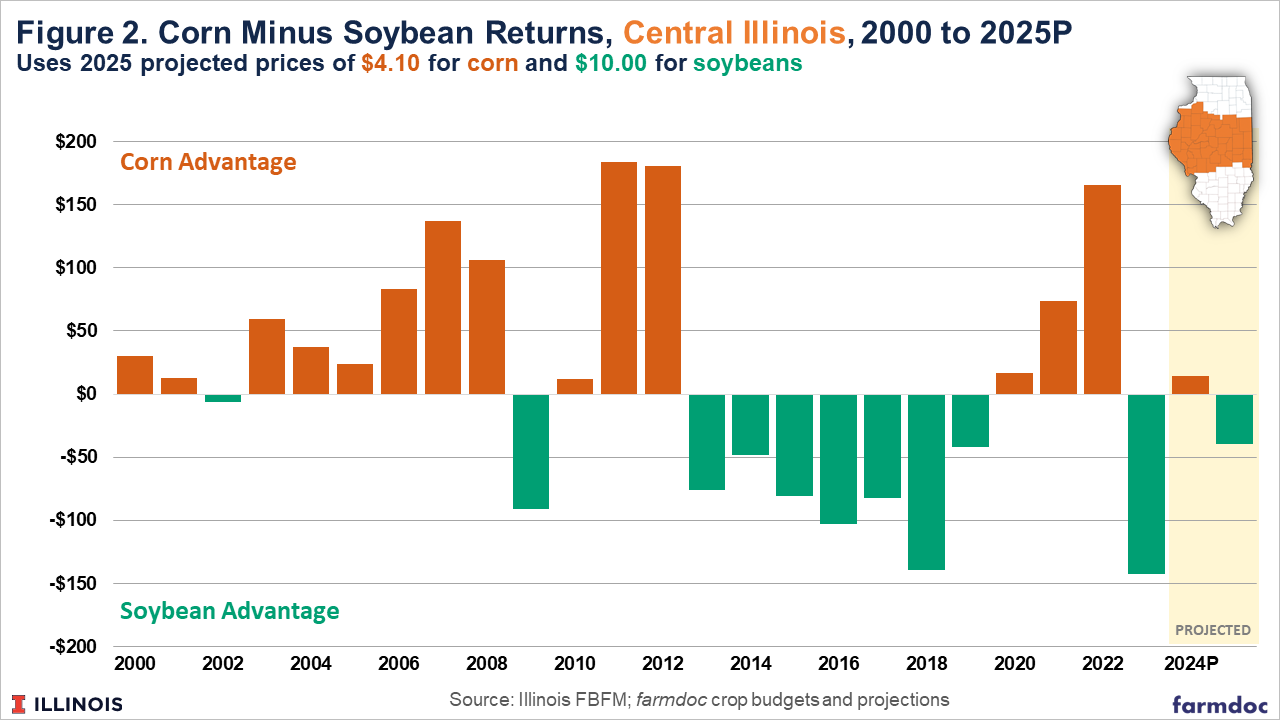

Corn Minus Soybean Returns in Illinois

Figure 2 reports historical corn minus soybean returns for grain farms enrolled in Illinois Farm Business Farm Management (FBFM) from 2000 to 2023, with projections for 2024 and 2025. Many of the most recent years with large advantages for corn returns coincide with high income years (2007-2008, 2011-2012, 2021-2022), while years where soybean returns had the advantage were associated with lower overall returns and incomes (2014-2019, 2023).

While market movements over the past few months have been relatively favorable to corn, soybean returns in central Illinois are still projected to be larger than corn returns for 2025. The projected soybean return advantage of $39 per acre (-$88 for corn and -$49 for soybeans) for 2025 is based on projected cash prices of $4.10 for corn and $10.00 for soybeans. A $30 ARC/PLC payment is included in return projections for 2025 but does not impact the comparison of corn and soybean returns since those payments are received on base acres and are not impacted by current planting decisions (see farmdoc daily from April 1, 2025). Return projections also assume trend yield levels for 2025, and do not include any crop insurance indemnities or ad hoc assistance payments.

Comparison of updated corn and soybean projections also indicate an advantage for soybeans in the other regions of Illinois for 2025. Projected soybean returns exceed corn returns by $47 per acre in northern Illinois (-$107 for corn, -$60 for soybeans), $25 per acre on low productivity land in central Illinois (-$101 for corn, -$76 for soybeans), and $14 per acre in southern Illinois (-$100 for corn, -$86 for soybeans).

Discussion

While market price movements over recent months have generally favored corn relative to soybeans, projected per acre returns continue to favor soybeans over corn across regions of Illinois for 2025. Still, Illinois farmers are expected to increase corn acres and reduce soybean acres in 2025. The USDA Prospective Plantings report indicates a 3% increase in corn acres in Illinois and a 3% reduction in soybean acres compared with the 2024 crop year.

Beyond the relative corn and soybean price relationships, uncertainty with respect to trade policy may also be a factor in US and Illinois farmers’ intentions to increase corn and reduce soybean acreage in 2025. The announcement of wide-ranging tariffs on the imports of goods to the US from virtually all trading partners on April 2nd prompted quick retaliatory action from China. The situation between the US and China further escalated this week with threats of further additional tariffs coming from both the Trump administration and China on April 7th. A global trade war, with heightened tensions between the US and China, would be likely to put US soybeans at a relative disadvantage to other crops. New crop corn futures have been relatively flat since April 2nd, while new crop soybean futures have declined by roughly $0.50 to below $9.90 as of April 7th.

Significant adjustments to acreage decisions have become less likely as the majority of input purchases have been made and the planting season for corn and soybeans gets underway across the US. However, spring weather and planting conditions, along with ongoing market developments, will continue to be monitored as they have the potential to cause smaller shifts in planted acreage from intentions.

References

Schnitkey, G., C. Zulauf, N. Paulson and B. Zwilling. "Projected Farm Income for 2025: Importance of Rental Arrangements on Farm Income." farmdoc daily (15):60, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 1, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.