Impacts of Premium Support Increase of Basic and Optional Units in House Reconciliation Bill

The House Reconciliation Bill includes provisions that would increase premium support rates on basic and optional units. Given that farmers do not change their policies, units, or coverage levels, we estimate this change would have increased Federal outlays and reduced farmers’ cost of premiums by $243 million for the 2024 crop year. This translates to an estimated increase in outlays of $2,178 million over CBO’s projection period from 2025 to 2034. Areas with higher total premiums — either because of higher-value crops or higher risk — would receive more benefits. The House Agriculture Committee chose not to propose increases in premium support rates on enterprise and whole-farm units, which are used on the majority of acres in much of the eastern United States.

Background on Premium Supports

Most farmers use farm-level products when insuring acres. Farm-level products include those under the COMBO plan such as Revenue Protection (RP), RP with the harvest price exclusion (RP-HPE), and Yield Protection (YP). The COMBO plan is available for most grain crops. The Actual Production History (APH) plan is a yield insurance available for specialty crops.

Farmers can make different unit choices when insuring farm-level products:

- Basic units — all of one crop in a county with the same ownership split

- Optional units — divisions of basic units, usually by township section,

- Enterprise units — all of one crop in a county, and can include multi-county units which go across county,

- Whole-farm units — combine all eligible crops in a county.

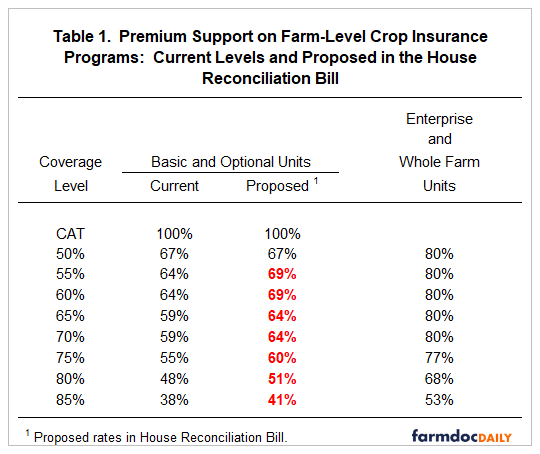

Premiums on federally insured crop insurance products are subsidized by the Federal government. Those support levels differ by coverage level and by unit. In the first column of Table 1, the current premium support rates are shown for basic and optional units. Premium support is 100% for Catastrophic coverage (CAT), a low-level coverage option. The 100% support means that farmers do not pay for CAT coverage, and the Federal government pays the entire premium. Premium support is the highest for lower coverage levels. For basic and optional units, the current premium support is 67% for the 50% coverage level, decreasing to 38% for the 85% coverage level. Enterprise and whole-farm units have a higher subsidy level than basic and optional units. For enterprise units, premium support is 80% at the 50% coverage level, decreasing to 53% for the 85% coverage level.

The House Reconciliation Bill proposes to increase premium support for basic and optional units (see Table 1). For example, premium support at an 85% coverage level is proposed to increase from 38% to 41% (see Table 1).

The Risk Management Agency (RMA) is tasked with setting total premiums on crop insurance products so that payments from products over time equal total premiums. The premium support does not change the total premium, but does change the portion that farmers pay. Take an 80% coverage level policy that RMA estimates to have $40 of expected payments, resulting in a $40 per acre total premium. Currently, the premium support for an 80% coverage level for basic and optional units is 48%. The farmer then pays $20.80 per acre, which equals the $40 total premium x ( 1 – .48 premium subsidy rate).

The impact of the proposed increase would be to reduce the farmer’s share of the total premium. For the 80% coverage level, premiums support would increase from 48% to 51%. The example farmer-paid premium would become $19.60 ($40 x (1 – .51)), a $1.20 reduction in farmer-paid premium. At the same time, Federal support and outlays would increase by $1.20 per acre.

Analysis

We evaluate the impacts of increasing premium support for basic and optional unit coverage using data from the RMA’s Summary of Business (SOB), a database on insurance results from the Risk Management Agency. The SOB data provides crop insurance use at the county level, broken down by crop, practice, unit, and coverage level. Data include acres, total premium, and premium support.

For 2024, we increase the premium support rates to those proposed in the House Reconciliation Bill for basic and optional units. This analysis will demonstrate the increase in premium support, given that farmers do not alter their buying behavior in response to the rate increases. In practice, an increase in premium subsidy rates would likely lead to higher coverage levels and a movement to basic and optional units, likely resulting in even larger increases in federal outlays for premium support.

The analysis presented below is conducted for all COMBO and APH products.

Total Increase in Premium Support

The total increase in premium support from the House Reconciliation Bill proposal is $243 million, meaning that farmers would pay $243 million less in insurance premiums, and Federal outlays would increase by $243 million. Total premium support in 2024 was $9,882 million. The increase in basic and optional units would result in a 2.4% increase in premium support.

If this change were implemented in 2025 and continued throughout the Congressional Budget Office (CBO) projection period through 2034, there would be nine additional years of basic and optional subsidies. That would increase spending by $2,178 million, 4% of the total $52,300 million increase in farm safety net spending estimated by the CBO for safety net changes (see farmdoc daily, May 22, 2025).

Regional Impacts

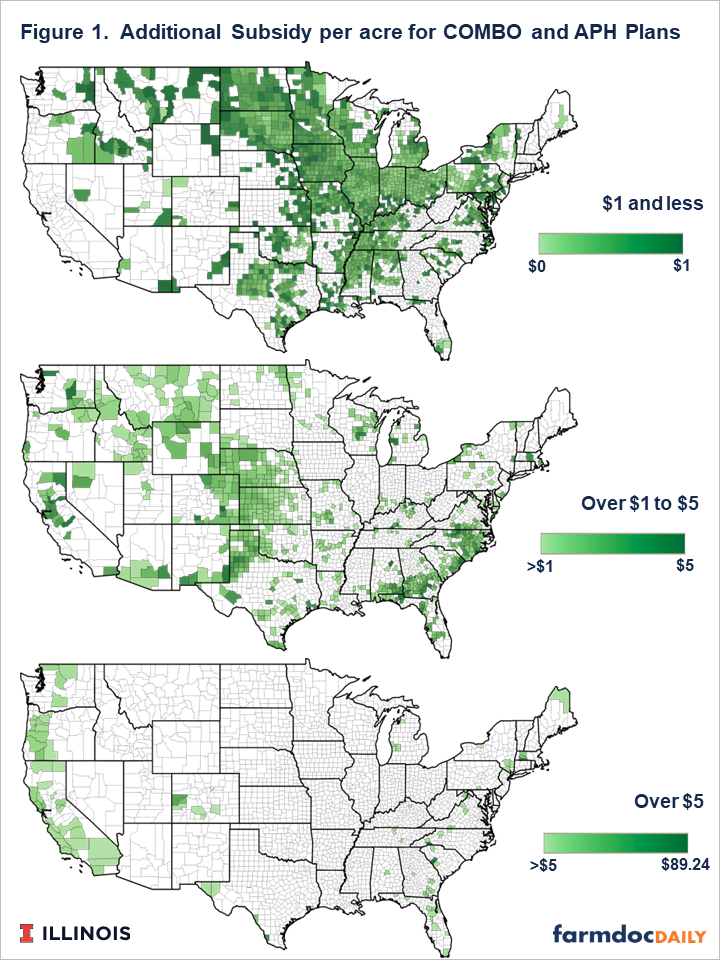

This would have differential impacts across crops and regions. Figure 1 shows an increase in premium support across counties divided by acres insured using the COMBO and APH products. Note that some acres will not have an increase in premium support because enterprise and whole farm units are used.

Most areas of the northern Great Plains, Midwest, and Mid-South will have less than a $1 per acre increase in premium support. Several areas will have larger impacts, including:

California and the West Coast: California has higher rates because specialty crops are a larger portion of their farm-level insurance. Almonds, for example, are insured. These specialty crops tend to have high value, which then results in higher total premiums. For example, the average total premium in Tulare County, California, is $179 per acre. An increase in premium support of 4% — the average of the increase across coverage levels for basic and optional units — is then $7 per acre.

Southern Great Plains: The southern Great Plains, including Nebraska, Kansas, Colorado, and western Texas, also have increases of over $1 per acre. These areas use a great deal of basic and optional units, and have higher risk. As a result, total premiums tend to be higher than for other parts of the country.

Southeast and Florida: The Southeast has greater use of optional and basic units and higher-risk crops. Peanuts are also a key crop in this region, which has high use of basic and options units, as further described in the next section.

Basic and Optional Unit Use

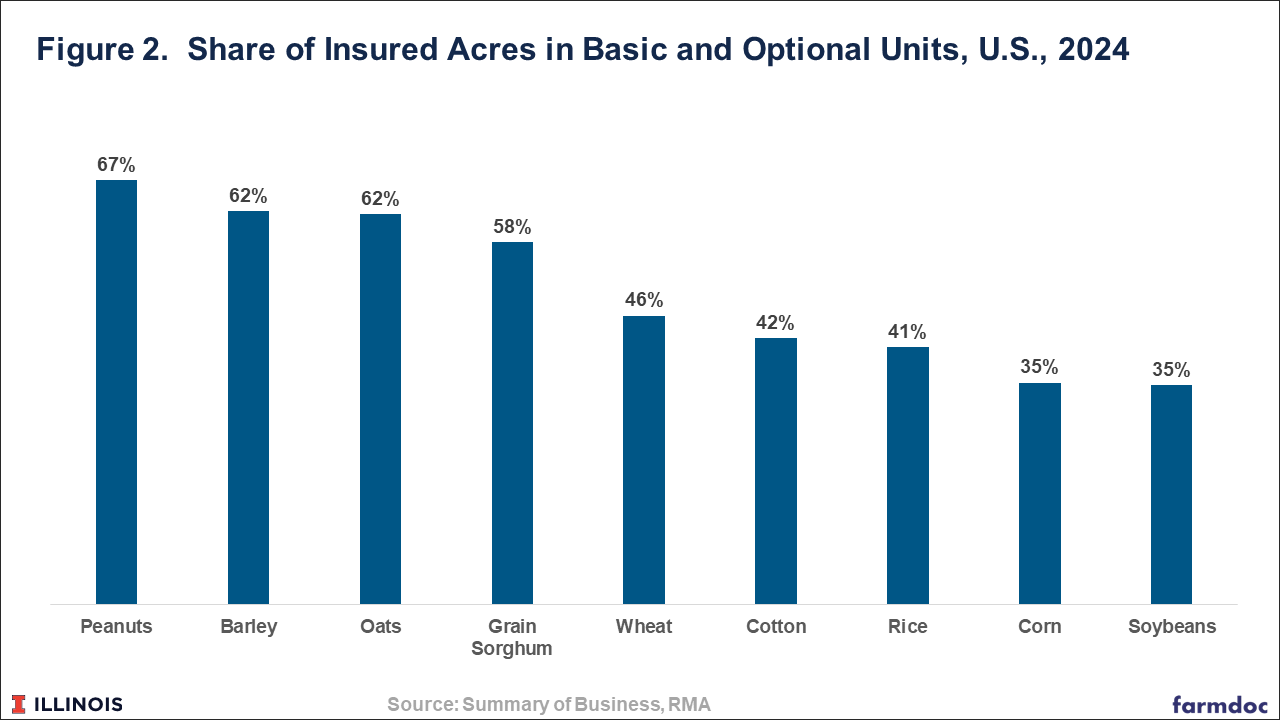

The House Reconciliation Proposal only increases premium support for basic and optional units. Use of units varies by crop (see Figure 2). Peanut farmers, for example, use basic and optional units on 67% of their insured acres. As a result, farmers with peanuts will be highly impacted by the premium support increase. On the other hand, corn and soybeans use low levels of basic and optional units. As a result, corn and soybean farmers will benefit less from the premium support increases.

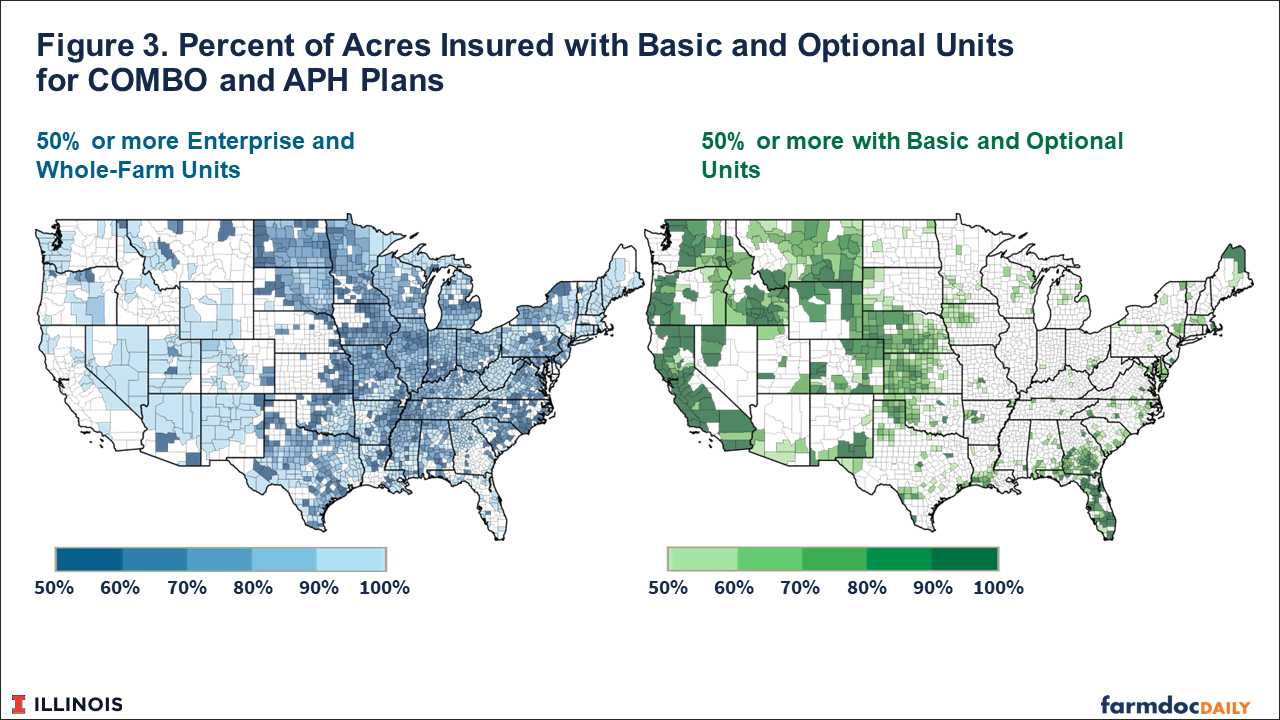

Differences in crop use and other factors lead to regional differences in unit use. Many counties have more than 50% of their acres in enterprise and whole-farm units (see Figure 3). Counties with more than 50% of their acres in basic and optional units tend to be in the west, southern Great Plains, and the southeast. Those same areas receive greater benefits from an increase in premium support for both basic and optional units.

Commentary

The proposed increases in premiums subsidy support for basic and optional units is estimated to increase Federal outlays by $2,178 million over the 10-year projection period from 2025 to 2034, or about 4% of the total increase in farm safety net spending estimated by CBO in the House Reconciliation Bill. Those budgetary estimates are made without considering any changes that could result from farmers’ changes in policies, units, and coverage as a result of the higher premium support rates for basic and optional units.

The proposal to increase rates on basic and optional units would provide greater direct benefits to producers who currently select those unit structures for their crop insurance choices and to areas with higher total premium rates. Higher premiums typically result from either higher valued crops or higher risk crops. Hence, this proposal would provide more support for higher-risk areas, a dubious goal if avoiding risky behavior is desired. This result of supporting higher risk areas is not specific to the House Bill. Any proposed percentage increases in premium support will have the same impact.

One could argue that as premium support is increased, the crop insurance program moves away from being primarily a risk management program to becoming more of an income support program (see farmdoc daily, September 4, 2024). Higher premium support rates provide more income support for higher-risk areas, a questionable practice.

This proposal also does not increase the premium support for enterprise or whole-farm units. The policy rationale is not apparent for increasing basic and optional unit rates while not increasing enterprise and whole-farm units. Enterprise and whole-farm plans have benefits in that premiums are lower due to greater acreage and crop diversification. An increase in basic and optional units would likely lead to a greater use of these units relative to enterprise and whole-farm units. Overall, that move does not appear to be desirable.

References

Coppess, J., G. Schnitkey, C. Zulauf and N. Paulson. "Reviewing the CBO Score of the House Reconciliation Bill." farmdoc daily (15):95, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 22, 2025.

Zulauf, C. and G. Schnitkey. "Crop Insurance as a Payment Program." farmdoc daily (14):160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 4, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.