Reviewing the CBO Score of the House Reconciliation Bill

The House of Representatives passed their budget reconciliation bill early in the morning on May 22, 2024; the final vote was close, 215 to 214 (1 voting present), and largely along party lines with two Republicans joining all Democrats in opposition to the bill (Tully-McManus and Scholtes, May 22, 2025; Bogage, Sotomayor, Choi, and Kane, May 22, 2025; Edmonson, Miller, and Jimison, May 22, 2025). The reconciliation effort now moves to the Senate. Independent analysis of the bill from the Congressional Budget Office (CBO) was recently released, providing CBO’s projections of the costs of each title and sections within each title (CBO, May 20, 2025). As previously discussed, the House reconciliation bill includes changes to Farm Bill programs in the jurisdiction of the House Agriculture Committee (farmdoc daily, May 20, 2025; May 14, 2025). This article adds to the discussion with a review of the CBO cost projections, or score, of the legislation.

Background

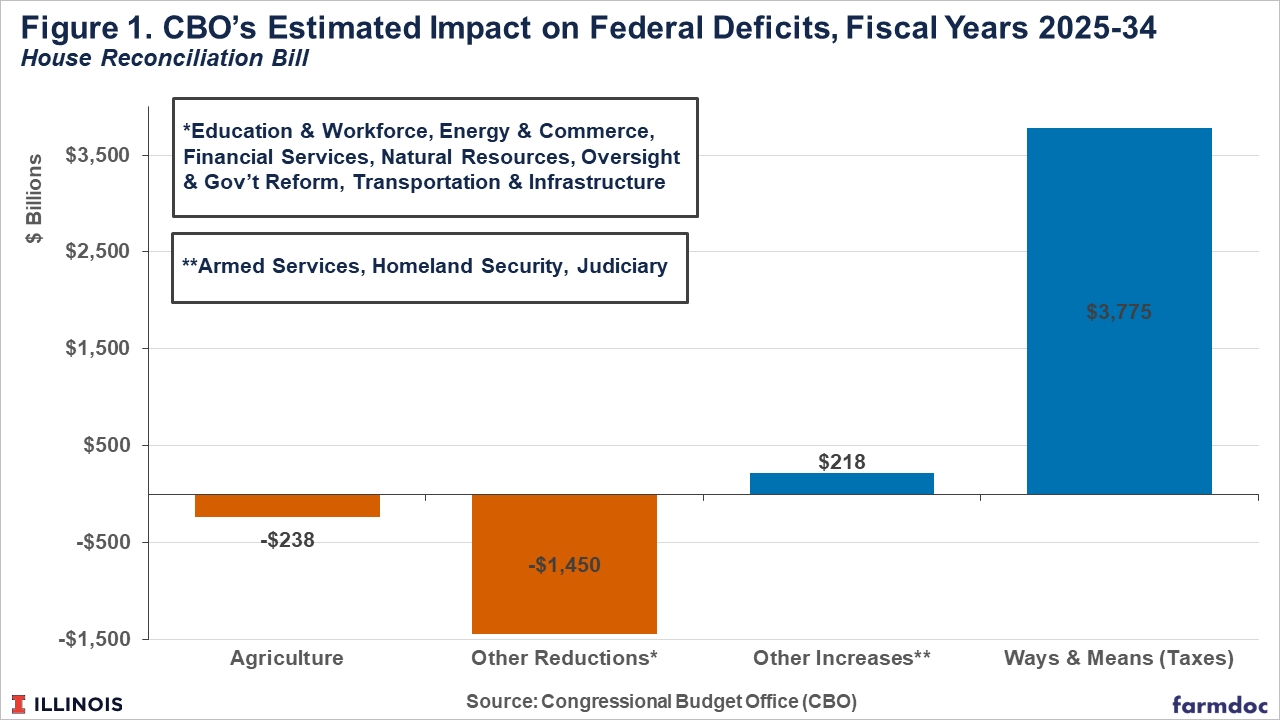

The topline projections by CBO for the House Reconciliation Bill are illustrated in Figure 1. In total, CBO projects the House Reconciliation Bill to spend an additional $3.99 trillion, most of it ($3.775 trillion) in the provisions that extend existing tax cuts that are set to sunset or add new provisions to reduce or alter taxes. The remaining expenditures are for immigration efforts (Homeland Security and Judiciary) and for the military (Armed Services). CBO also projects a total reduction in outlays or spending of $1.689 trillion. The net effect on the deficit, according to CBO projections, is that the bill will add $2.3 trillion to the national debt over the next 10 fiscal years (FY2025-2034). Note that CBO scored the bill against January 2025 baseline projections (CBO, January 2025).

Discussion

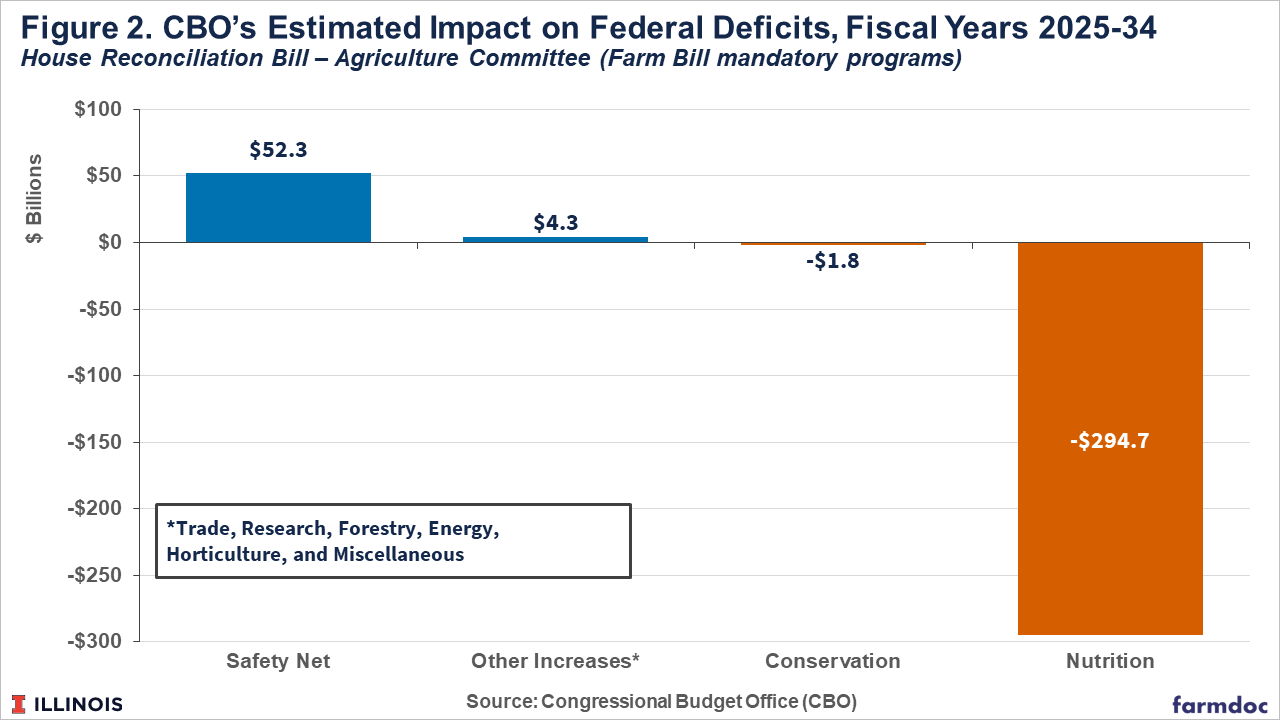

In total, CBO projects that the reconciliation bill will reduce outlays in the Agriculture Committee’s jurisdiction by a total of $238 billion over the 10 fiscal years (FY2025-2034). In total, CBO projects $318.7 billion in reductions to food assistance, primarily from the Supplemental Nutrition Assistance Program (SNAP), over 10 fiscal years. CBO separately added a total of $24 billion in interaction costs for a net savings from food assistance of $294.7 billion. The total spending on farm assistance is projected to increase by $56.4 billion over the 10 fiscal years, $52.3 billion of it for the farm safety net (program payments and crop insurance outlays). CBO notes that the costs of interactions are included in the score for those programs and are not broken out separately as for food assistance. Figure 2 illustrates the total changes in spending projected for food assistance, safety net or farm assistance, and other programs.

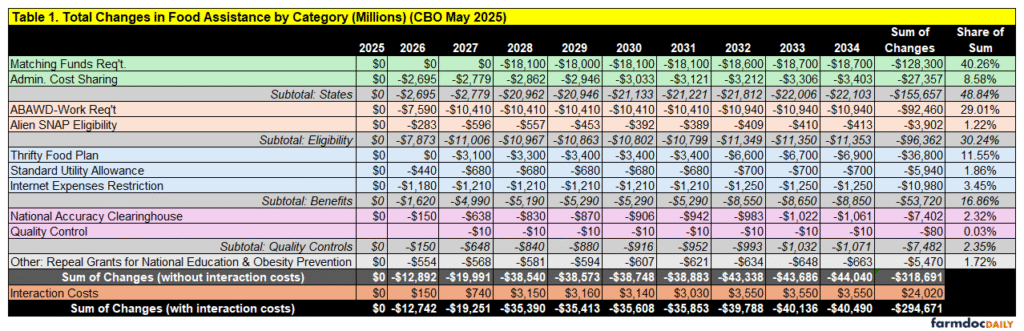

Table 1 provides a breakdown of the score for each provision of the changes to food assistance. Most of the spending reductions for food assistance are the result of shifting costs to the States, including a matching funds requirement ($128 billion reduction, 40% of the total) and administrative cost sharing ($27.4 billion reduction, 8.6% of the total). The next category of reductions are from changes to eligibility provisions, which are tightening work requirements for able-bodied adults without dependents (ABAWD) ($92.5 billion reduction, 29% of the total) and restricted eligibility for alien individuals ($3.9 billion reduction, 1.2% of the total). The third category are those for the calculation of benefits, which would reduce what recipients receive in food assistance. This category includes reductions in the thrifty food plan ($36.8 billion reduction, 11.6% of the total), reducing the standard utility allowance ($5.9 billion, 1.9% of the total), and restricting the inclusion of internet expenses ($10.98 billion reduction, 3.45% of the total). The final category includes provisions addressing quality controls ($80 million reduction, 0.03% of the total) and a national accuracy clearinghouse ($7.4 billion reduction, 2.3% of the total). Finally, the bill proposes repealing grants for national education and obesity prevention ($5.5 billion reduction, 1.7% of the total).

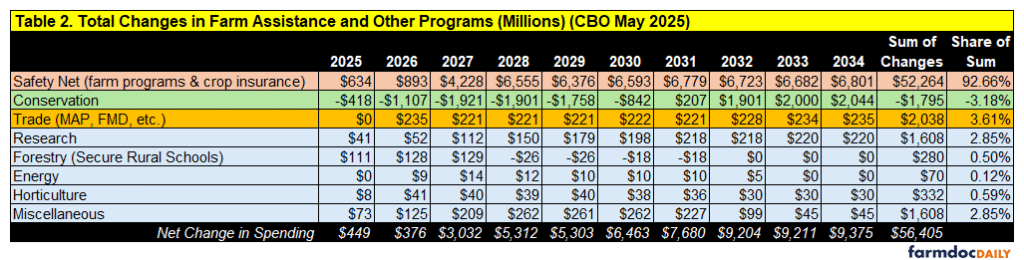

On the other side of the equation, the House reconciliation bill increases spending by a total of $56.4 billion in the ten fiscal years (FY2025-2034). Table 2 provides a breakdown of each individual provision’s cost projection. Almost all of the additional costs are for the farm safety net provisions ($52.3 billion increase, 93% of the total), predominantly increasing reference prices in PLC and program calculations in ARC-CO, as well as changes to crop insurance; while CBO does not break out which programs or crops received increases (or how much), we provided estimates in a previous article (farmdoc daily, May 20, 2025).

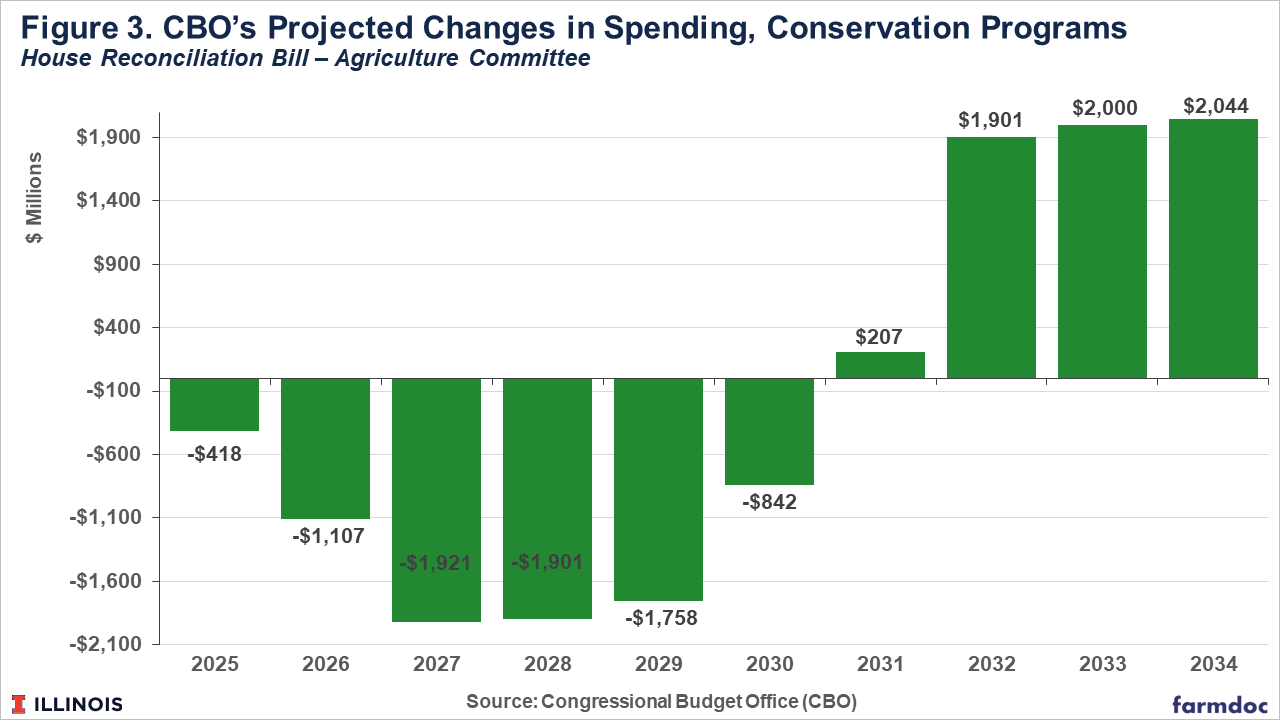

Finally, note that spending on the conservation programs is reduced overall by $1.8 billion, which is the result of rescinding the additional funding provided by the Inflation Reduction Act of 2022 and adding funding to the baseline authorizations. CBO projects spending on conservation to be reduced from FY2025 to FY2031 ($7.95 billion reduction) and increased in the years after the authorization (beyond FY2031) ($6.2 billion increase). The fiscal year changes in conservation spending are illustrated in Figure 3. As discussed previously, this represents a trade-off for conservation policy in which the increased funding available immediately from the IRA is traded for sustained funding over the long-term, with increases built into the baseline and continuing, potentially, into perpetuity (farmdoc daily, October 10, 2024; August 15, 2024).

Concluding Thoughts

The Congressional Budget Office (CBO) has projected changes in spending that would result from the House reconciliation bill if enacted into law. The bill has passed the House of Representatives and now moves to the Senate. This article has provided an initial review of the CBO projections. The independent, nonpartisan CBO analysis provides important information about the potential impacts of the House reconciliation bill. At the same time, CBO’s projections also raise many difficult questions about the decisions represented in that bill, for the Farm Bill but also the larger National fiscal situation.

For the Farm Bill, the CBO analysis leaves little room for optimism about the future of reauthorization. The bill violates one of the cardinal rules of Farm Bill politics by reducing food assistance to offset increases in farm assistance. If it were to become law, reconciliation will have effectively broken the larger Farm Bill coalition that has made reauthorization possible for over 50 years. That coalition began in 1964 when a deal in the House of Representatives allowed for enactment of the Food Stamp Act which, in turn, made possible enactment of legislation attempting to fix failed policies for cotton and wheat farmers; the coalition was formalized in the 1973 Farm Bill, which included Food Stamps reauthorization in the same legislative vehicle as reauthorization of farm assistance programs (Coppess 2018). The fate of these matters now awaits action in the U.S. Senate.

References

Bogage, Jacob, Marianna Sotomayor, Mathew Choi, and Paul Kane. “House approves Trump’s massive tax and immigration package.” The Washington Post. May 22, 2025. https://www.washingtonpost.com/business/2025/05/22/trump-tax-bill-house-republicans/.

Congressional Budget Office. “Estimated Budgetary Effects of a Bill to Provide for Reconciliation Pursuant to Title II of H. Con. Res. 14, the One Big Beautiful Bill Act.” Cost Estimate. May 20, 2025. https://www.cbo.gov/publication/61420.

Congressional Budget Office. “10-Year Budget Projections: Jan. 2025.” Budget and Economic Data. January 2025. https://www.cbo.gov/system/files/2025-01/51118-2025-01-Budget-Projections.xlsx.

Coppess, J. The Fault Lines of Farm Policy: A Legislative and Political History of the Farm Bill (University of Nebraska Press, 2018). https://www.nebraskapress.unl.edu/nebraska/9781496205124/the-fault-lines-of-farm-policy/.

Coppess, J. "Conservation Tradeoff: Inflation Reduction Act vs. Baseline." farmdoc daily (14):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 15, 2024. https://farmdocdaily.illinois.edu/2024/08/conservation-tradeoff-inflation-reduction-act-vs-baseline.html.

Coppess, J. and Y. Peng. "Conservation Tradeoff: EQIP in the Inflation Reduction Act and the House Farm Bill." farmdoc daily (14):185, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 10, 2024. https://farmdocdaily.illinois.edu/2024/10/conservation-tradeoff-eqip-in-the-inflation-reduction-act-and-the-house-farm-bill.html.

Coppess, J., C. Zulauf, G. Schnitkey, N. Paulson and B. Sherrick. "Reviewing the House Agriculture Committee’s Reconciliation Bill." farmdoc daily (15):89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 14, 2025. https://farmdocdaily.illinois.edu/2025/05/reviewing-the-house-agriculture-committees-reconciliation-bill.html.

Edmondson, Catie, Maya C. Miller, and Robert Jimison. “A victory for House Republican leaders sends the fight over tax and Medicaid cuts to the Senate.” The New York Times. May 22, 2025. https://www.nytimes.com/live/2025/05/22/us/trump-news-updates#trump-bill-house-vote-passes.

Schnitkey, G., N. Paulson, C. Zulauf and J. Coppess. "Spending Impacts of PLC and ARC-CO in House Agriculture Reconciliation Bill." farmdoc daily (15):93, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 20, 2025. https://farmdocdaily.illinois.edu/2025/05/spending-impacts-of-plc-and-arc-co-in-house-agriculture-reconciliation-bill.html.

Tully-McManus, Katherine and Jennifer Scholtes. “House Republicans pass ‘big, beautiful bill’ after weeks of division.” Politico.com. May 22, 2025. https://www.politico.com/news/2025/05/22/house-republicans-pass-big-beautiful-bill-after-weeks-of-division-00364691.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.