Trade Conflicts and Long-Term Consequences: Are Soybeans Doomed to Repeat History?

Trade disputes can be short-term disruptions, but history also suggests that even short-term disruptions can have lasting impacts—elevating new competitors and shifting the balance of global agricultural trade. The U.S.–China trade conflict, which began in 2018 and has escalated again in 2025 under Donald Trump’s second term, has revived concerns about the reliability of trade flows between the two largest global economies. The 1973 U.S. soybean embargo provides a valuable historical example. What started as a temporary policy decision triggered long-term consequences, leading key trading partners to rethink their dependencies and accelerate efforts to diversify suppliers. In this article, we examine both historical and recent U.S. tariff actions and analyze their long-term consequences for the international grain market.

Soybean Embargo in the 1970s

Misguided trade decisions during times of political turmoil, along with major policy shifts, are nothing new in American history and the 1973 U.S. soybean embargo was raised in an earlier article (farmdoc daily, May 30, 2019). In short, an El Nino event off the coast of Peru harmed the anchovy harvest in the winter of 1972-1973, at a time when anchovies were an important source of protein for animal feed. One result was a run on soybeans to replace the protein, contributing to a soybean price spike at a time when the Nixon Administration was also trying to control inflation and fend off Congressional investigations (Coppess 2018; Akihiko 2017; Madigan 1994).

Then, President Nixon implemented an embargo on soybean (and cottonseed) exports in June 1973. The embargo was short-lived but had far-reaching impacts; the Administration ended the embargo and reinstated contracts by October 1, 1973, when it became clear that the soybean crop was larger than expected. In response, the European Community—a major customer of U.S. soybean exports—began dishing out large subsidies to increase production of oilseed crops in Europe (Madigan 1994). Japan also responded and may have had the most far-reaching impacts.

At the time of the temporary embargo, U.S. farmers produced approximately 70% of the total world supply of soybeans. Japan was the largest importer of U.S. farm products, relying on imports for 97% of its soybean needs and U.S. farmers for 90%; the Administration added insult to injury by cancelling soybean contracts and acting without prior consultation with Japan (Akihiko 2017; Marlin-Bennett et al., 1992; Destler, 1978). The embargo raised questions in Japan about the U.S. as a reliable supplier of staple commodities.

Japan responded to its over-reliance on the United States by introducing the concept of food security and initiating policies to address it. One of the most far-reaching actions began in 1974 with the creation of the Japan International Cooperation Agency (JICA), which launched large-scale investments in Brazil’s Cerrado region to support soybean production (Akihiko, 2017). The Japanese bilateral program had limited impact on soybean production in the 1970s, but it helped pave the way for Brazil’s agricultural expansion in the years to come (Da Cunha and Farias, 2009; Hopkins, 1982). This effort, known as the Japan–Brazil Agricultural Development Cooperation Program—or PRODECER, in Portuguese—continued for roughly 20 years, with total investments amounting to billions of dollars financed by both governments (JICA Research Institute, 2010).

Japanese agronomists collaborated with Brazilian researchers from the Brazilian Agricultural Research Corporation (Embrapa), established in 1973, to introduce modern farming practices and soil correction techniques in the Cerrado—a region previously considered unsuitable for large-scale agriculture due to poor soil quality and limited infrastructure. At the same time, the Brazilian government encouraged internal migration, bringing farmers from the South to the Center-West. Government and private sector investments also improved logistics, enabling large-scale agricultural exports. Today, over 60% of Brazil’s total soybean production takes place in the Cerrado region (Conab, 2025).

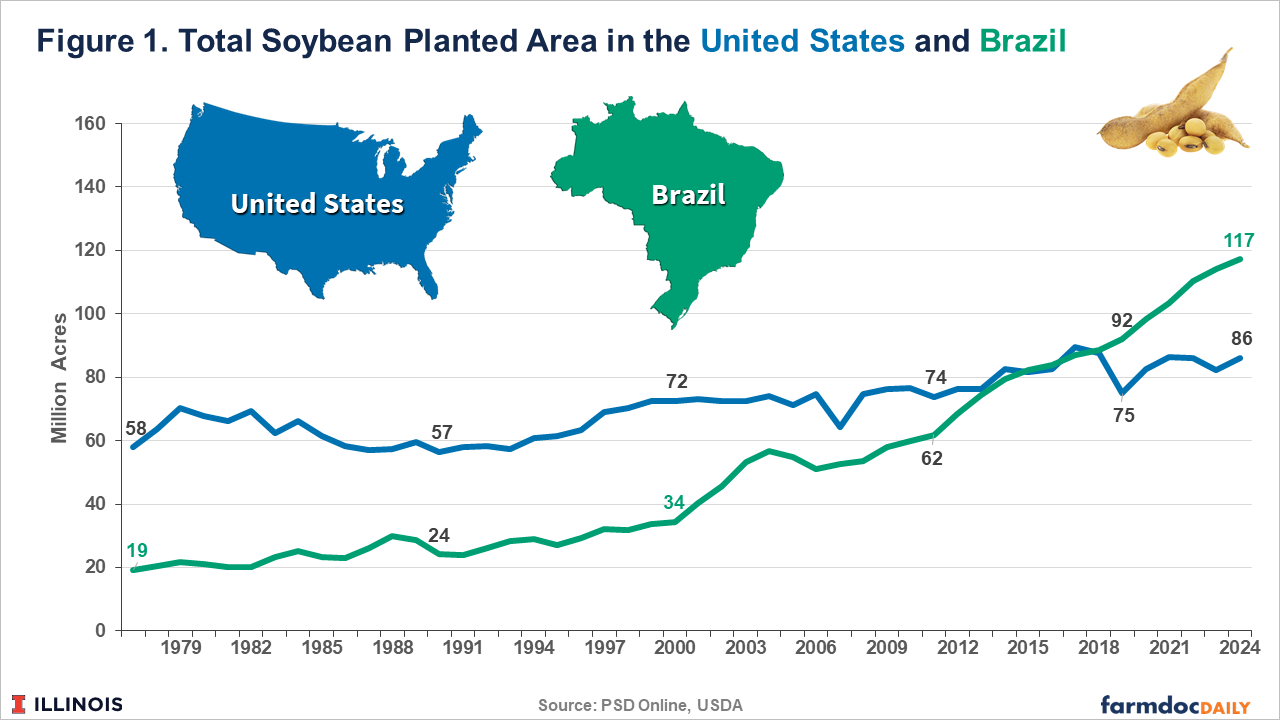

Further illustrating the long-run impacts, Figure 1 shows U.S. and Brazilian soybean harvested area from the years following the 1970s soybean embargo through 2024. Since then, Brazil’s soybean planted area has increased sixfold, from 19 million acres in 1977 to a record 117 million acres in the last crop season. Meanwhile, U.S. soybean planted area has grown 1.5 times, from 58 million acres in 1977 to 86 million acres in 2024 (see Figure 1).

Looking back in the 1970s from the vantage point of 1994, former Secretary of Agriculture Edward R. Madigan wrote that it was “hard to believe that the Peruvian anchovy harvest and the Watergate affair could impact on international trade negotiations occurring twenty years later, but those events did have a major effect on trade relations between the United States and the European Community” in the 1980s and into the early 1990s (Madigan 1994). As we analyze current challenges in trade and geopolitics, the experience of the 1973 embargo could imply that decisions made in certain moments can have far-reaching consequences for decades to come.

The US-China Trade War Implications

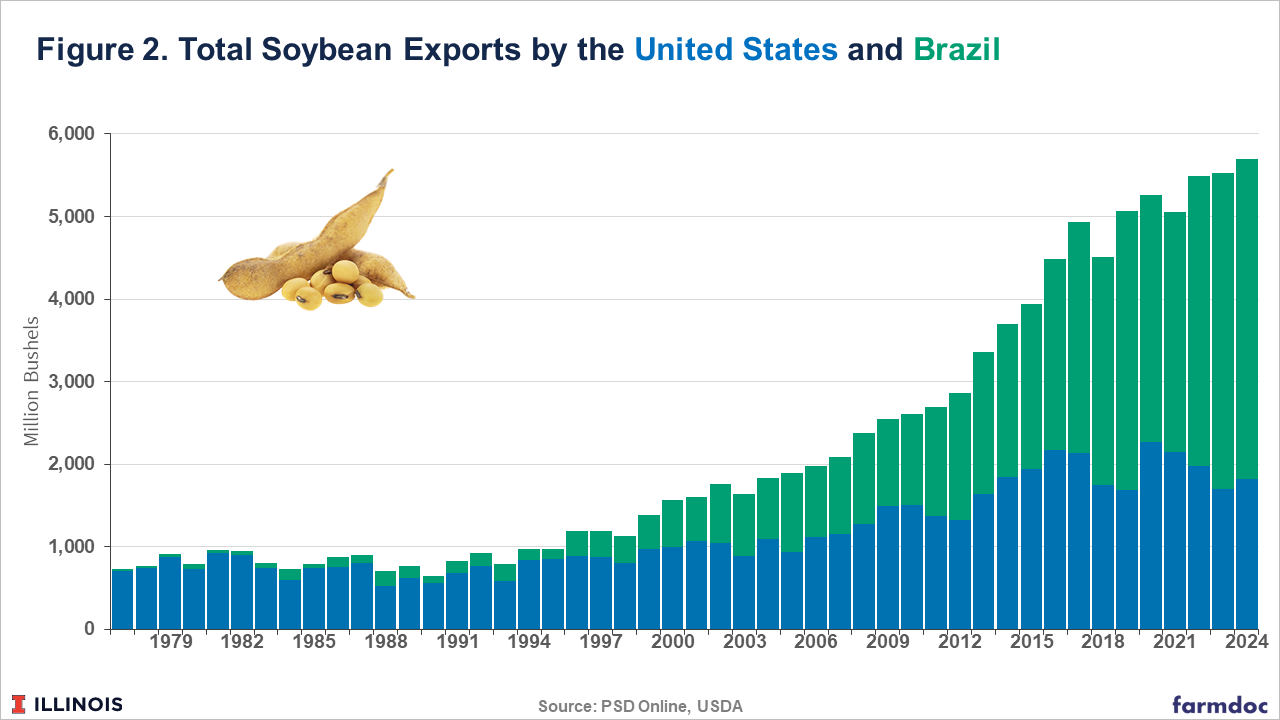

The United States used to be the world’s largest soybean exporter. In 2013, China became Brazil’s largest agricultural trading partner and Brazil surpassed the United States in soybean shipments for the first time (see farmdoc daily, February 20, 2024). Since then, Brazil’s share of the global soybean trade has continued to grow, with Brazilian soybean exports reaching a record 3.8 billion bushels in 2024. At the same time, American soybean exports were reduced to 1.8 billion bushels, less than half the Brazilian soybean export volume (see Figure 2).

The United States and Brazil together supply over 80% of global soybean exports, while China accounts for around 60% of total soybean imports. For both the U.S. and Brazil, soybeans are the top agricultural export to China. If we look back to 2017, before the first round of the trade war, Brazil has benefited from trade conflicts in terms of increased soybean exports. Brazil has boosted its soybean exports by almost 40%, from 2.8 billion bushels in 2017 to 3.9 billion bushels in 2024. Meanwhile, the United States has kept its exports at around 2 billion bushels. In other words, much of the growth in global soybean demand in recent years has been supplied by Brazilian soybeans.

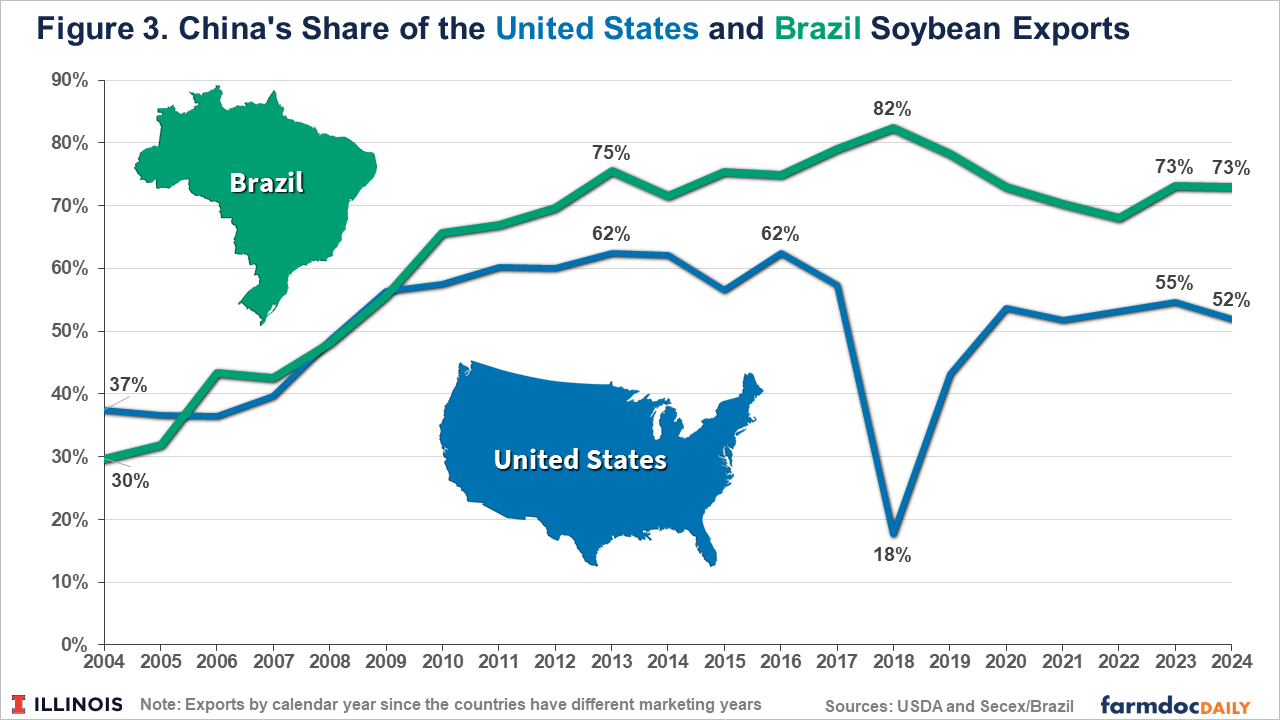

In 2018, the first year of the trade war when China implemented a 25% retaliatory tariff on the United States, Brazil’s share of soybean exports in China peaked at 82%, while the U.S. share dropped to just 18% (see farmdoc daily, January 21, 2025). In 2024, China accounted for 73% of Brazil’s soybean exports. Brazilian soybeans have also become more attractive to Chinese buyers due to the stronger U.S. dollar, which has made Brazilian soybeans more competitive in the last few years. Although China’s share of U.S. soybean exports has since recovered to around 50%, it remains below the pre-2018 level of 60% (see Figure 3).

Imports accounted for approximately 84% of the China’s soybean supply in 2024, with 67% of those imports coming from Brazil (see farmdoc daily, January 21, 2025). For 2025, Brazil is expecting a new record for soybean exports, driven by a record harvest of 6.1 billion bushels (see farmdoc daily, March 18, 2025) and stronger Chinese demand. In April, Brazil exported 561 million bushels of soybeans—4% more than in the same month last year, according to the Foreign Trade Secretariat (Secex). April alone accounted for 41% of total soybean exports during the first four months of the year, which reached 1,362 million bushels—up 1% compared to the same period in 2024.

Concluding Thoughts

While correlation may not be causation, it is also true that decisions leading to trade disruptions of key staple commodities can have long-term consequences. Like any negotiated relationship, trade depends on trust between trading partners that the other side will hold up its end of the bargain—there are almost no avenues for legal recourse or other methods to remedy breaches in the agreements or trust. A self-inflicted trade problem, like the 1973 soybean embargo or the most recent tariff conflicts, could breach not only existing trade agreements but also the necessary trust between trading partners.

Countries dependent upon imports of vital commodities will rationally respond by seeking supplies elsewhere and building trust in other trading partners. Those investments are unlikely to change quickly or easily. While it is too early to know the long-term impacts of the most recent trade and tariff dispute with China—and it is more unknown whether the current 90-day reprieve in the highest tariff rates with China will have any lasting impacts—the 1973 soybean embargo and the first round of the trade war provides some examples of what can happen. For agricultural exporters and policymakers alike, the lesson is clear: reliability matters just as much as competitiveness.

References

Akihiko, H. 2017. “Formation of Japan’s food security policy: Relations with food situation and evolution of agricultural policies.” Norinchukin Research Institute Co., Ltd., available online: https://www.nochuri.co.jp/english/pdf/rpt_20180731-1.pdf

Colussi, J., N. Paulson, G. Schnitkey and S. Cabrini. "Record Soybean Harvest in South America and Favorable Outlook for Exports." farmdoc daily (15):50, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 18, 2025.

Colussi, J., G. Schnitkey, N. Paulson and C. Zulauf. "U.S. Agricultural Trade Background Given Potential Tariffs." farmdoc daily (15):13, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 21, 2025.

Colussi, J., G. Schnitkey, J. Janzen and N. Paulson. "The United States, Brazil, and China Soybean Triangle: A 20-Year Analysis." farmdoc daily (14):35, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 20, 2024.

Conab, National Supply Company. Crops Time Series. Soybean Production. Brasília, Brazil. May 2025.

Coppess, J. 2018. The Fault Lines of Farm Policy: A Legislative and Political History of the Farm Bill (University of Nebraska Press). Available online: https://www.nebraskapress.unl.edu/university-of-nebraska-press/9781496205124/.

Coppess, J. "A Brief Review of the Consequential Seventies." farmdoc daily (9):99, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 30, 2019.

Da Cunha, R. C., & Farias, R. D. S. (2009). Diversificação esquecida? Elementos causais da expansão da soja na pauta exportadora agrícola brasileira entre 1974 e 1979. MERIDIANO47, 8.

Destler, Ivan M. "United States food policy 1972–1976: Reconciling domestic and international objectives." International Organization 32, no. 3 (1978): 617-653. https://doi.org/10.1017/S002081830003188X.

Hopkins, R. F. 1982. Food Policymaking. Proceedings of the Academy of Political Science, 34(3), 12-24.

Japan International Cooperation Agency. (2010, October 1). PRODECER: Japan–Brazil cooperation for agricultural development of the Cerrado region. JICA Research Institute. https://www.jica.go.jp/english/jica_ri/news/topics/2010/post_14.html

Madigan, E.R. 1994. “Adverse Consequences of Trade Embargoes,” 27 Creighton L. Rev. 941 (1994).

Marlin‐Bennett, Renée, Alan Rosenblatt, and Jianxin Wang. "The visible hand: The United States, Japan, and the management of trade disputes." International Interactions 17, no. 3 (1992): 191-213. https://doi.org/10.1080/03050629208434779

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.