Brazil’s Agricultural Expansion: Where Are Soybean Yields Headed?

Brazil ‘s increase in total production has been driven first by increases in acres and intensifying land use (see farmdoc daily, April 9, 2024). In addition to expanding acreage, increasing yields is the other alternative to boost production. In recent years, Brazil’s soybean yield levels have been comparable to those in the United States. But where has this growth been most significant in recent decades, and where is there still room to grow? This article examines how soybean yields have evolved across Brazil’s main growing regions and identifies areas with further growth potential, along with possible implications for U.S. and global markets.

Historical Soybean Trend Yields in Brazil

Figure 1 shows the annual soybean yields in Brazil and the United States for the period 1974 through 2023, according to data from the U.S. Department of Agriculture (USDA) and Brazilian Institute of Geography and Statistics (IBGE, acronym in Portuguese). At a national level, over the last five decades, Brazil’s soybean yield growth has been faster than the United States, and yield levels in the two countries have been about the same in recent years. The linear yield trends indicate annual average yield increases of 0.61 bushels for Brazil and 0.51 bushels for U.S. (see Figure 1). This finding aligns with several earlier farmdoc daily articles (December 16, 2020; January 26, 2017; November 2, 2016).

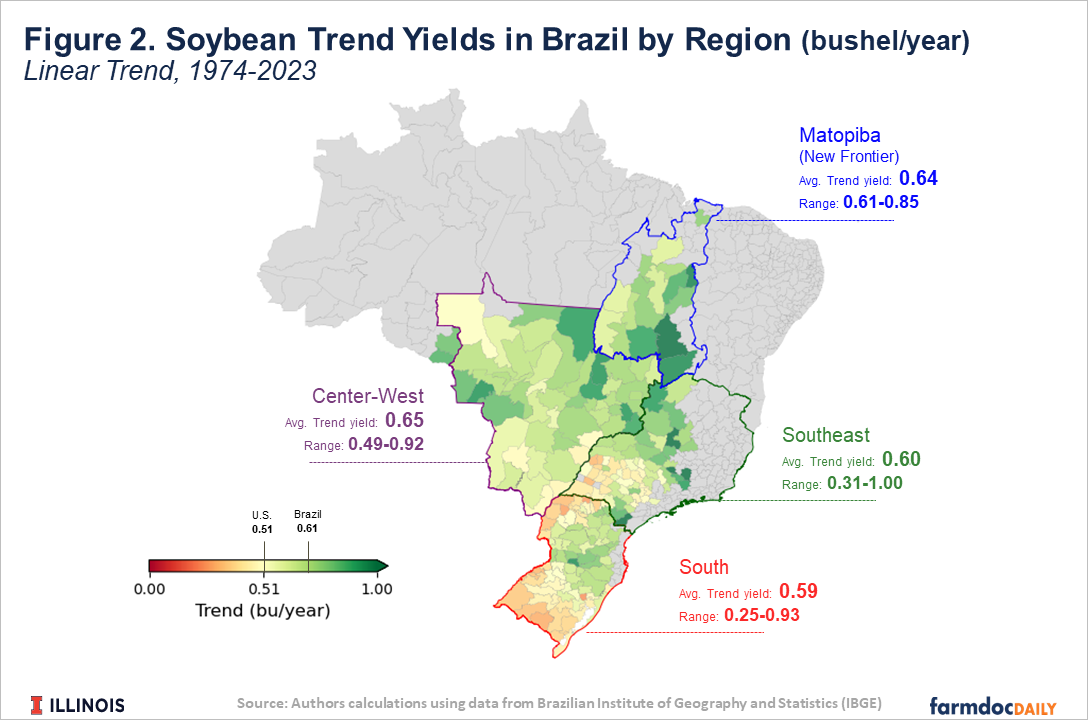

The yield trend can be thought how average yields evolve over time and are usually seen as the impact of investments in technology—such as machinery, seeds, pesticides, and fertilizers—as well as evolving management practices and advancements of scientific research, while holding other factors as constant (i.e., weather). Despite the overall linear trend, soybean yield trend in Brazil has shown significant regional variations, with some regions increasing yields faster than others. Since 1974, there has been no negative growth, although some regions in the South show trends that are close to zero. We discuss this variation focusing on four different regions, as illustrated in the Brazilian map below (see Figure 2).

In the Southern Brazilian states, soybean early-established areas—accounting for 28% of total national production in 2023/2024 crop season (Conab, 2025)—have experienced an annual average yield increase of 0.59 bushels from 1974 to 2023, slightly below the national average (see Figure 2). This lower performance is primarily due to higher climate variability in the region, particularly in the southern part of Rio Grande do Sul (the southernmost part of Brazil), where historically lower rainfall levels contrast with the wetter conditions in the northern part of the state. In addition, we do see a lot of variation within this region, with trend yields ranging from 0.25 to 0.93.

The Center-West states, which includes the largest soybean state of Mato Gross, accounts for nearly 50% of the nation’s soybean production in 2023/2024 crop season (Conab, 2025). The average trend yield from 1974 to 2023 is 0.65 bushels per year, 6.6% higher than the national average (see Figure 2). This strong performance is primarily attributed to lower climate variability in the region, with well-defined wet and dry seasons. Additionally, larger farm sizes compared to the national average provide greater capacity for investment in new agricultural technologies, which can further enhance land productivity. Although there is some variability in trend yields, the lowest value remains in line with the U.S. trend yield.

Matopiba—a region comprising the state of Tocantins and parts of Maranhão, Piauí, and Bahia— is another region that has been increasing yields recently. From 1974 to 2023, annual average yield increases reached 0.64 bushels, 5% higher than the Brazilian trend yield (see Figure 2). Soybean production in this region accounted for approximately 14% of the total harvest in Brazil in 2023/2024 (Conab, 2025). This area is known as the “new frontier”, where cropland has been expanding primarily over pastureland. Since the region has relatively “young” crops, yields may not have reached their full potential yet.

Most of the recent land cultivation in Matopiba has been driven by highly mechanized and professional operations, marking a stark contrast to historical agricultural frontier expansion in the country (see farmdoc daily, March 30, 2021). Furthermore, the highest average yield increases—especially in the dark green area on the map—are attributed to significant investments in irrigation in western Bahia. IBGE does not differentiate irrigated and non-irrigated soybean production. According to the National Water Agency, Brazil has 3.5 million acres under central pivot irrigation, representing less than 1.9% of the crops planted area (Conab, 2024). Although this is a small share, central pivots are highly concentrated in the eastern part of Matopiba, contributing to its higher yield trend.

Lastly, the Southeast is marked by moderate growth, but also with a highly variable trend yield. While the average yield trend is 0.59, there are subregions with trend yields ranging from 0.31 to 1.00 (see Figure 2). This region, which account for 8% of total national production in 2023/2024 crop season (Conab, 2025), is known by other crops such as sugar cane, and a great part of it does not double crop.

Regional Yield Trends and Future Growth Potential

To better understand the implications of this yield growth potential, Figure 3 combines trend yields and the average of the last five crop years for the U.S., Brazil and its regions. Compared to the U.S. national yield trend, all regions in Brazil are experiencing faster growth, on average.

When comparing yield levels (x-axis of Figure 3), we see that the average of the last five years in Brazil is slightly lower than in the U.S. This is due to a poor past crop year in Brazil, especially in the Center-West region, which is the country’s main soybean-producing area. Both Matopiba and South have lower yields than the U.S, while the Center-West and Southeast had greater yields than the U.S.

The South region is more vulnerable to climate variability, and its soybean yields remain below the national average. As one of the earliest areas of agricultural expansion, its fields are more established or “older.” While yields continue to grow, they are unlikely to surpass the national average.

In the Southeast, soybean cultivation faces strong competition from other high-value crops, such as sugarcane and citrus. Despite this, the region maintains above-average soybean yields. This can be attributed to a form of natural selection—areas with lower yields likely shift to more profitable or better-suited crops, leaving only the most productive subregions for soybean production, which raises the regional average.

When it comes to future growth, the Southeast exhibits significant variability in yield trends and has limited room for acreage expansion. As a result, both the South and Southeast are expected to make only a marginal contribution to Brazil’s overall soybean production growth.

The Center-West and Matopiba are the key regions driving future agricultural production, collectively accounting for approximately 65% of Brazil’s national output in 2023/2024 crop season. Both regions also have significant potential for soybean expansion, particularly through the conversion of pastureland into cropland (see farmdoc daily, April 9, 2024). Soybeans grown on converted pastureland may take more than a year to reach full ‘cropland’ yield potential (TNC, 2019), contributing to a higher yield trend during these transition years.

Nevertheless, even if yield growth slows as the region matures—whether due to diminishing returns or reaching a productivity plateau—Matopiba still has room to improve. Its yields could rise to levels approaching those of the Center-West, boosting Brazil’s overall soybean productivity. Finally, the Center-West available pasture for expansion suggests that its trend yield growth should be further sustained, as recent converted fields trends tend to be higher in first years. When coupled with its already higher than U.S. yield levels, it justifies its pivotal position in Brazil’s soybean production future growth.

It is important to note that trend yields are highly sensitive to the time period analyzed, with longer periods generally producing more stable results (see farmdoc daily, April 16, 2024). Consequently, caution is needed when using these trends to project yields far into the future. Finally, the U.S. also exhibits regional differences in soybean production, and comparisons with specific areas could highlight variations in trend yields and yield levels between the two countries.

Aside of yields, Brazil’s ability to sustain long-term yield and production growth will also rely on strategic investments in infrastructure, research, and policies that support efficiency and resilience across its diverse soybean-growing regions, though these are topics for future farmdocs articles.

Conclusion

Brazil’s soybean production has experienced significant yield growth over the past decades, with regional disparities in their importance for future growth. While the South and Southeast are expected to contribute marginally, the Center-West and Matopiba regions remain central to Brazil’s continued expansion, both cropland conversion and through yield improvements. Despite the regional disparities, all regions in Brazil are experiencing faster growth on average compared to the U.S. national yield trend. As Brazil’s soybean yields approach U.S. levels, other factors such as sustained investment in technology, infrastructure, policies and management practices will be crucial in determining the country’s long-term role in global soybean markets.

References

Agência Nacional de Águas e Saneamento Básico. (2017). Atlas Irrigação: Uso da Água na Agricultura Irrigada. Brasília, DF: ANA. Retrieved from https://arquivos.ana.gov.br/imprensa/publicacoes/AtlasIrrigacao-UsodaAguanaAgriculturaIrrigada.pdf

Colussi, J., N. Paulson, G. Schnitkey, C. Zulauf and J. Baltz. "Potential for Crop Expansion in Brazil Based on Pastureland and Double-Cropping." farmdoc daily (14):69, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 9, 2024.

Colussi, J. and G. Schnitkey. "New Soybean Record: Historical Growing of Production in Brazil." farmdoc daily (11):49, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 30, 2021.

Companhia Nacional de Abastecimento (CONAB). (2025, February). Monitoring of the Brazilian Grain Harvest, Volume 12, 2024/25 Harvest, No. 5, Fifth Survey. Brasília, DF: CONAB. Retrieved from https://www.conab.gov.br/info-agro/safras/graos

Good, D., T. Hubbs and S. Irwin. "Assessing South American Corn and Soybean Yield Risks: Exploring the Data Sources." farmdoc daily (6):207, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 2, 2016.

Hubbs, T., S. Irwin and D. Good. "Assessing Argentina Soybean Yield Risks: Historical Deviations from Trend." farmdoc daily (7):14, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 26, 2017.

Irwin, S. "Revisiting South American Corn and Soybean Yield Trends and Risks." farmdoc daily (10):212, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 16, 2020.

Paulson, N., G. Schnitkey and C. Zulauf. "Variability in Trend Estimates for US Corn Yields." farmdoc daily (14):72, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 16, 2024.

The Nature Conservancy (TNC). (2019, November). Incentives for sustainable soy in the Cerrado. Retrieved from https://www.nature.org/content/dam/tnc/nature/en/documents/TNC_IncentivesforSustainableSoyinCerrado_Nov2019.pdf

Zulauf, C., J. Colussi, N. Paulson and G. Schnitkey. "Exploring Yield Growth: US Crops in a Global 21st Century Context." farmdoc daily (14):56, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 20, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.