2025 Grain Farm Return Prospects at the Beginning of July with a New Commodity Title

Grain farm returns for 2025 are re-estimated using the latest commodity prices and commodity title payments estimated using parameters contained in the One Big Beautiful Bill (OBBB). From February to the first three days of July, Chicago Mercantile Exchange (CME) settlement prices fell $.39 per bushel for corn and $0.13 for soybeans. Significantly higher PLC/ARC payment results under the OBBB commodity title. The new commodity title results in significantly higher projected PLC/ARC payments. Even with increased commodity title payments, 2025 farm returns are projected to be low, likely continuing the negative returns in 2023 and 2024. A brightening of the outlook is possible; still, it seems best to plan for ways to decrease costs for 2026. Given the current outlook, cash rents in 2026 are expected to remain under pressure.

Price Changes and Price Expectations

Price changes for the 2025 crop are gauged by using settlement prices of Chicago Mercantile Exchange (CME) harvest-time contracts (December for corn and November for soybeans). Settlement prices from July 1st to 3rd are used as current price expectations for the 2025 crop and are compared to the projected prices for 2025 crop insurance. Projected prices are based on settlement prices of the same futures contracts during February and are used to set minimum crop insurance guarantees.

The 2025 projected price for corn is $4.70 per bushel. From July 1 to 3, settlement prices of the December contract averaged $4.31. From February to the first three days of July, the December futures contract declined by $0.39 ($4.41 the July 1-3 price – $4.70 projected price). A $4.31 futures price is consistent with a harvest-time cash price of around $4.00. Typically, cash prices rise from harvest-time lows, resulting in our current estimate of a 2025 market-year average cash price of $4.10 per bushel.

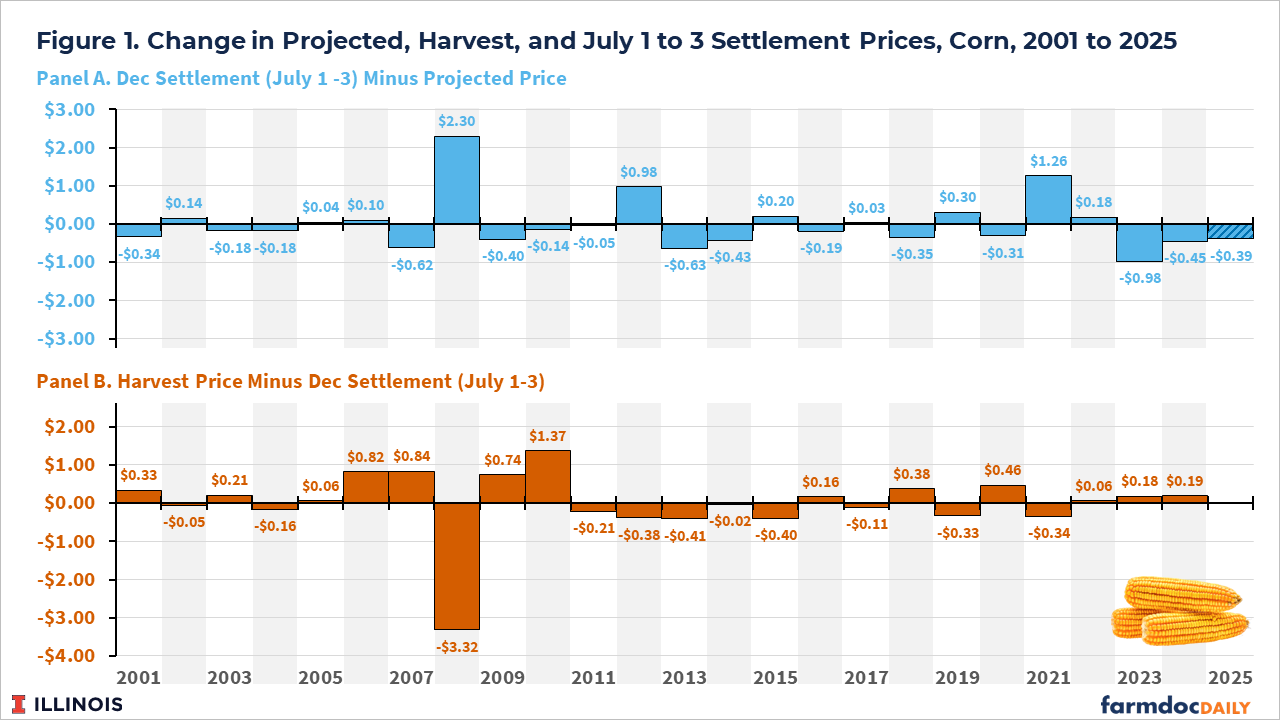

The -$.39 per bushel change in 2025 is slightly less than the last two years (see Panel A of Figure 1). Prices declined $.98 in 2024 and $0.45 in 2024. The last time prices changed more than $1.00 was in 2021, with dry weather in South America being a particular culprit for that change. In 2012, the July 1-3 settlement was $ 0.98 per bushel above the projected price, as the probability of a significant drought was already evident. Adverse weather conditions could still considerably lower yields in 2025, particularly in local areas. However, the weather up to this point does not suggest a 2012-style drought, which is likely contributing to the $.39 price decline, as a significant weather risk is mitigated.

The harvest price is set using settlement prices during October. Since 2010, changes from July 1-3 to October have generally fallen within $ 0.50 of the July price (see Panel B of Figure 1). Larger changes occurred between 2006 and 2010, a period when ethanol use was increasing. Given the last 15-year history, one would expect the harvest insurance price to be within $.50 of the $4.31 July 1-3 price. That, of course, still is an extensive range which will have significant impacts on profitability. At this point, a likely culprit for higher prices will be lower yields and vice versa.

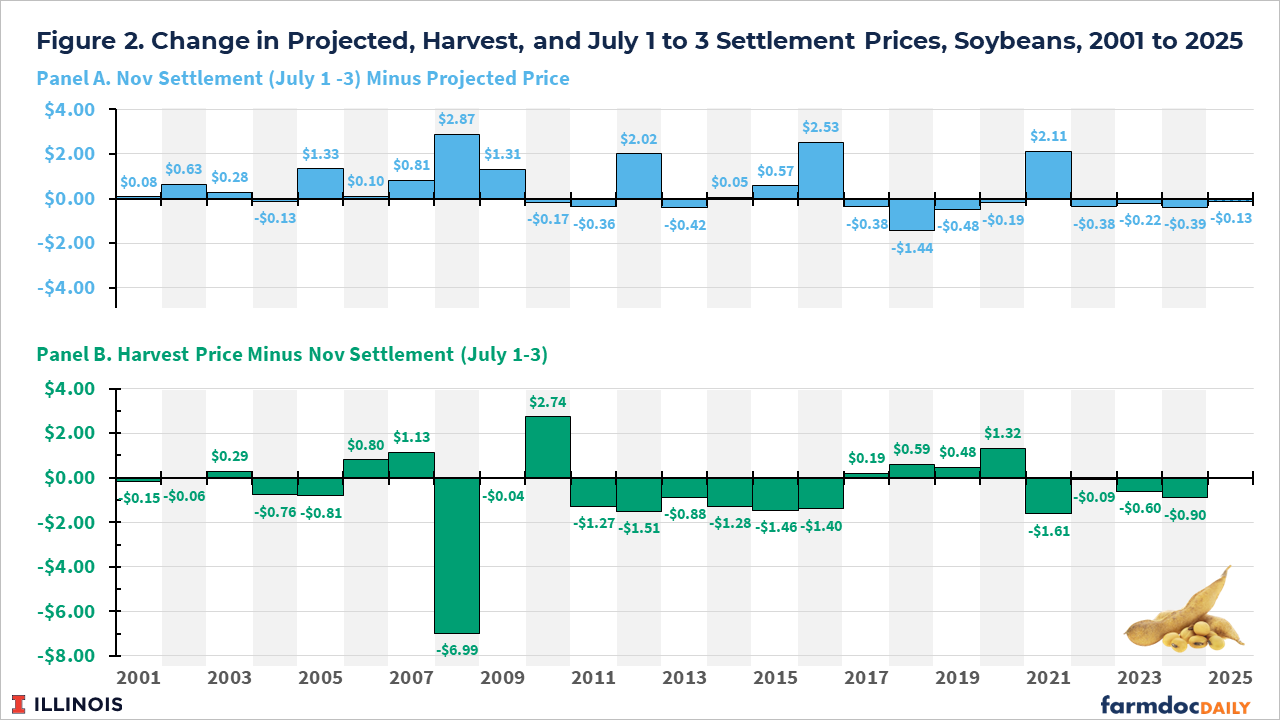

The 2025 projected insurance price for soybeans is $10.54 per bushel. The average settlement price of the November contract for July 1-3 is $0.13 lower at $10.41 per bushel. Similar to corn, the decline from the projected pricing period to July 1-3 is not as large as in recent years (see Panel A of Figure 2). The price declined by $0.80 per bushel in 2022, $0.22 in 2023, and $0.39 in 2024. A $10.41 harvest futures price is consistent with a $10.00 cash price. Similar to corn, prices tend to be lowest at harvest, resulting in a projected market-year average price of $10.20 per bushel.

The harvest price — based on October settlements of the November contract — can vary from July 1-3 prices. Since 2010, all but two of the harvest prices for soybeans have been within $1.50 of the July 1-3 price (see Panel B of Figure 2). However, a $1.50 range is extensive, and the ending harvest price will have a significant impact on profitability. Notably, more of the soybean prices have been below the July 1-3 settlement. This may again be the case this year, as there is significant downside risk, as ongoing trade tensions between China and the US could significantly alter the price.

PLC / ARC Payments

The One Big Beautiful Bill (OBBB) was recently passed by Congress and signed into law by President Trump on July 4, 2025. This Bill changed commodity title programs and has the potential to increase commodity title payments. Those changes include:

- Price Loss Coverage: Increases the statutory reference price for 2025 crop year corn from $3.70 to $4.10 and for 2025 crop year soybeans from $8.40 to $10.00.

- The effective reference price is now 88% of the 5-year Olympic Average, lagging one year. The percentage was 85% for the 2018 Farm Bill.

- Agricultural Risk Coverage — County Option (ARC-CO). The coverage level was increased from 86% to 90%. The maximum payment was increased from 10% of benchmark revenue to 12% of benchmark revenue.

- Farmers will receive the higher of the PLC or ARC-CO payment for 2025, recognizing the fact that farmers signed up for the programs under the 2018 Farm Bill. Farmers will make yearly choices for the 2026 crop year and thereafter.

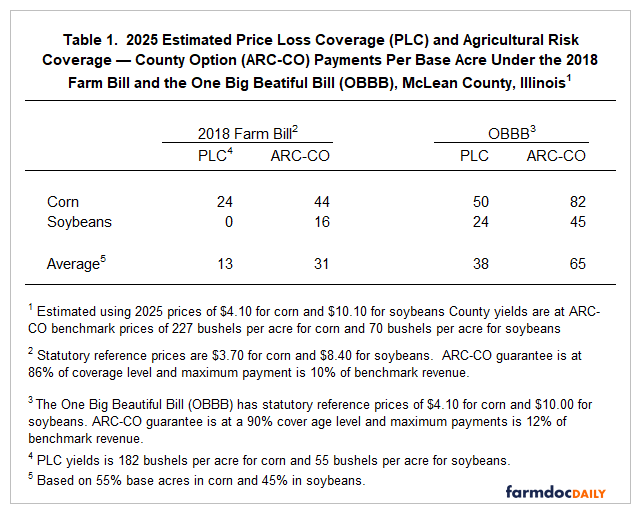

We estimated the impacts of those changes on PLC and ARC-CO payments in McLean County, Illinois, for both corn and soybeans (see Table 1). Our estimates use market-year prices of $4.10 for corn and $10.20 for soybeans. The 2025 yields were set at ARC-CO benchmark levels. Changes in estimated payments using the new 2025 commodity program parameters are:

- PLC, Corn: PLC payments for corn increase from $24 per base acre under the 2018 Farm bill to $50 per base acre under the OBBB. Effective reference prices increase due to the rise in cap. Under the 2018 Farm Bill, the effective reference price was capped at $4.26 (15% of the $3.70 reference price). The effective reference price is now capped at $4.72 (15% of the $4.10 statutory reference price). The effective reference price under OBBBA is $4.42, or 88% of the fivey-year Olympic average. The effective reference price under the 2018 Farm Bill was at $4.26.

- PLC, Soybeans: PLC payments are projected to increase from $0 to $24 per base acre. The 2025 effective reference price is $10.71, a $0.37 increase over the 2018 effective reference price of $10.34

- ARC-CO, Corn: ARC-CO payments increase from $44 per base acre to $82 per base acre. Both the higher 90% coverage level and wider maximum payment range lead to higher expected payments.

- ARC-CO, soybeans: ARC-CO payments increase from $16 per base acre to $45 per base acre. As with corn, the larger expected payment is due to the increased coverage level and payment range.

Our estimate of average ARC-CO payments under the OBBB is $65 per base acre, given that 55% of base acres are in corn and 45% are in soybeans. The $65 per base acre payment is $34 higher than the average $31 per base acre payment under the 2018 Farm Bill.

Importantly, the 2025 commodity title payments, if any, will not be paid until October 2026. Any PLC/ARC payment that will be received this year in October 2025 are associated with the 2024 crop. For McLean County, a major production area in central Illinois, commodity title payments for 2024 are estimated to be $0 per base acre for both corn and soybeans. ARC/PLC payments are generally not expected to be large for most central Illinois counties for the 2024 crops (see farmdoc daily, May 13, 2025).

Projected Returns

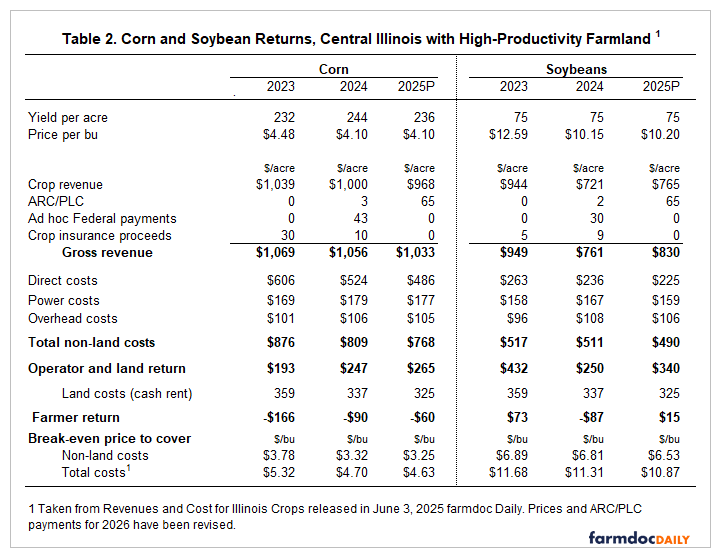

We used the revised prices and commodity title payments to estimate 2025 farmer returns using 2025 Crop Budgets for cash-rented farmland on high-productivity land in central Illinois (see Table 2). These budgets include a $4.10 corn price and $10.20 soybean price. The corn price is lowered by $.10 and the soybean price by $.05 from the release of our spring budgets. Yields remain at trend levels of 236 bushels per acre for corn and 75 bushels per acre for soybeans. At this point, higher yields do not seem warranted, given the relatively early stage of the growing season.

The estimated 2025 PLC/ARC payments of $65 per acre are larger than the Emergency Commodity Assistance Program (ECAP) payments for of per acre for corn and $30 per acre for soybeans. The ECAP payments appear as ad hoc Federal payments in Table 2 for the 2024 year.

Costs and cash rent have not been altered from the previous budget release (see farmdoc daily, June 3, 2025). Farmer returns are estimated at -$60 per acre for corn and $15 per acre for soybeans (see Table 2). Those returns will result in further financial deterioration on farms if other sources of income do not exist to cover losses from cash rent farmland. The -$60 return for 2025 corn is an improvement from the -$166 corn return for 2023 corn and -$90 return for 2024 corn. For soybeans, the +$15 return is much lower than the +$73 return in 2023 but an improvement from the -$46 return estimate for 2024.

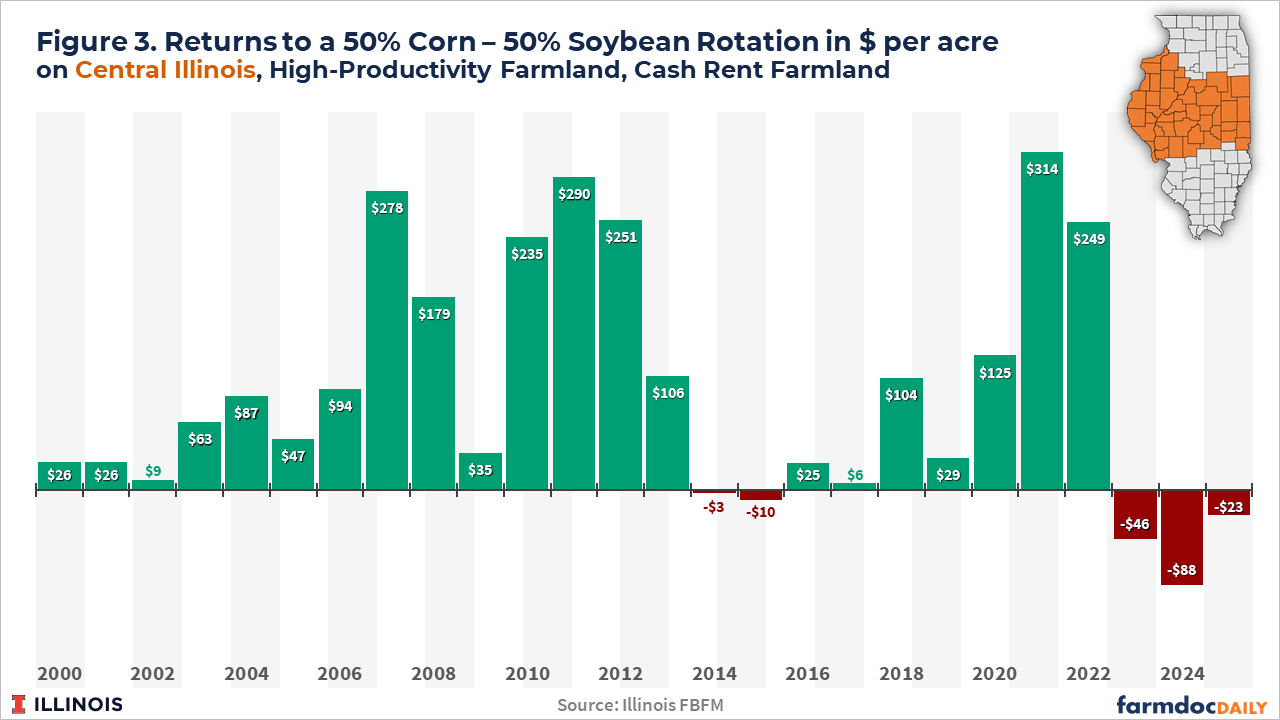

Farms with 50% acres in corn and 50% in soybeans — a typical situation in central Illinois — will have -$23 return from cash-rented farmland. Figure 3 places that -$23 return in a longer-term perspective. As can be seen, the last three years have been negative, with returns of -$46 in 2023, -$88 in 2024, and a projected -$23 return in 2025. Those are three of the lowest years since 2000.

Commentary

At this point, returns on Midwest farms are projected to be negative, resulting in continued financial deterioration, particularly on farms with a large percentage of their acres in cash rent. Those results occur even with the inclusion of PLC/ARC payments estimated using provisions in the OBBB. For McLean County in central Illinois, the revised commodity title increases estimated payments from $31 per base acre to $65 per base acre.

The farm income outlook could brighten, particularly if an unforeseen event raises commodity prices. Those events are unpredictable. Some brightening may occur due to demand and supply conditions. Attention is now focused on crop size, which will come into more precise focus in the next month.

Still, it seems reasonable to expect a continuing low-return environment. Currently, break-even prices given normal yields are near $4.60 per bushel for corn and $10.90 for soybeans. The larger estimated ARC/PLC payments for 2025 provide some relief. However, if prices remain near $4.00 for corn and $10 for soybeans occur — as seems likely — cost-cutting measures will need to be implemented, particularly if ad hoc Federal payments are not continued. Current levels of 2025 and 2026 futures contracts do not suggest corn and soybean prices will exceed break-even levels in the near future. That situation will make 2026 cash rent negotiations and input purchasing difficult.

References

Paulson, N., G. Schnitkey, B. Zwilling and C. Zulauf. "Spring Revision to 2025 Illinois Crop Budgets." farmdoc daily (15):101, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 3, 2025.

Paulson, N., G. Schnitkey and C. Zulauf. "2024 NASS County Corn and Soybean Yields." farmdoc daily (15):88, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 13, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.