Impact of Leverage on Rates of Return

Increasing financial leverage will increase expected returns as long the marginal returns from the use of loans exceeds the cost of borrowing. In favorable economic times, higher leverage can improve financial performance and stimulate farm growth. However, in unfavorable economic times, leverage can cause business performance to deteriorate rapidly. Thus, higher leverage may increase expected returns and financial risk. Given this risk/return relationship, what is the optimal level of farm debt? This is a very difficult question to answer. The answer depends on numerous factors including current liquidity and solvency positions, repayment capacity, length of repayment period and interest rate, stability of income, skill and experience of each operator, age and health of operators, and operator’s risk aversion level (Langemeier, 2020).

This article examines changes in net worth and rates of return for farms with a debt to asset ratio below 0.40 and for farms with a debt to asset ratio above 0.40. Annual FINBIN data from 2007 to 2024 for crop farms were utilized in the study. In addition to comparing rates of return between the two leverage categories, the impact of the increase in interest rates since 2022 will be discussed.

Changes in Net Worth and Rates of Return

As discussed in Langemeier (2025), there are three major changes that contribute to an increase or decrease in net worth: change in retained earnings, change in contributed capital, and change in market valuation. The change in retained earnings measures the amount of net income in a particular year that is kept in the business. The change in capital contributions accounts for gifts, debts forgiven, and capital contributions and distributions. The change in market valuation subtracts the change in deferred liabilities from the change in the market value of capital assets. Deferred liabilities represent an amount that is owed if an asset is sold.

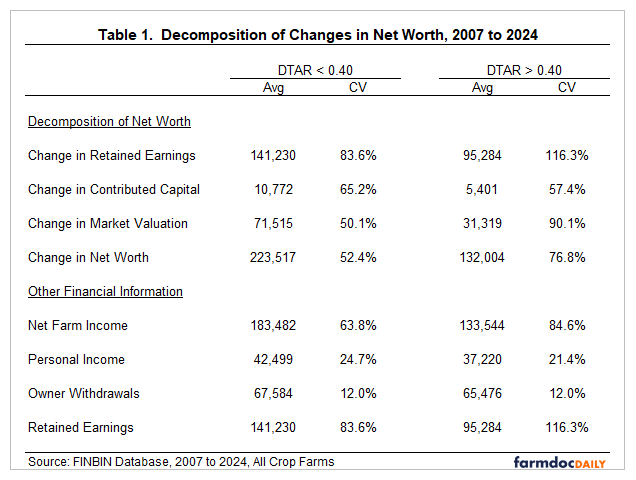

Table 1 contains the average and coefficient of variation (standard deviation divided by average) for the change in net worth and its component over the time period for farms with a relatively low debt to asset ratio (debt to asset ratio less than 0.40) and for farms with a relatively high debt to asset ratio (debt to asset ratio greater than 0.40). The retained earnings computation included both net farm income and personal income. Approximately 63 percent of the change in net worth for the low debt farms can be attributed to retained earnings. For the high debt farms, approximately 72 percent can be attributed to retained earnings. The high debt farms tended to be relatively larger than the low debt farms, but owned a smaller percentage of their total acres operated. As expected, the coefficients of variation for the change in retained earnings and the change in net worth were larger for the high debt farms. These relationships illustrate the positive relationship between leverage and financial risk.

In addition to changes in net worth, Table 1 contains summary statistics for net farm income, personal income, and owner withdrawals. Personal income and owner withdrawals were substantially less variable than net farm income or retained earnings. Net farm income for the high debt farms was relatively more variable. The ratio of retained earnings to net farm income was approximately 0.77 for the low debt farms and 0.71 for the high debt farms, which indicates that the low debt farms retained a higher percentage of their net farm income. On average, net farm income represented approximately 23 percent of gross farm income for the low debt farms and approximately 16 percent of gross farm income for the high debt farms. The net farm income ratio measures financial efficiency thus, the low debt farms were more financially efficient than the high debt farms.

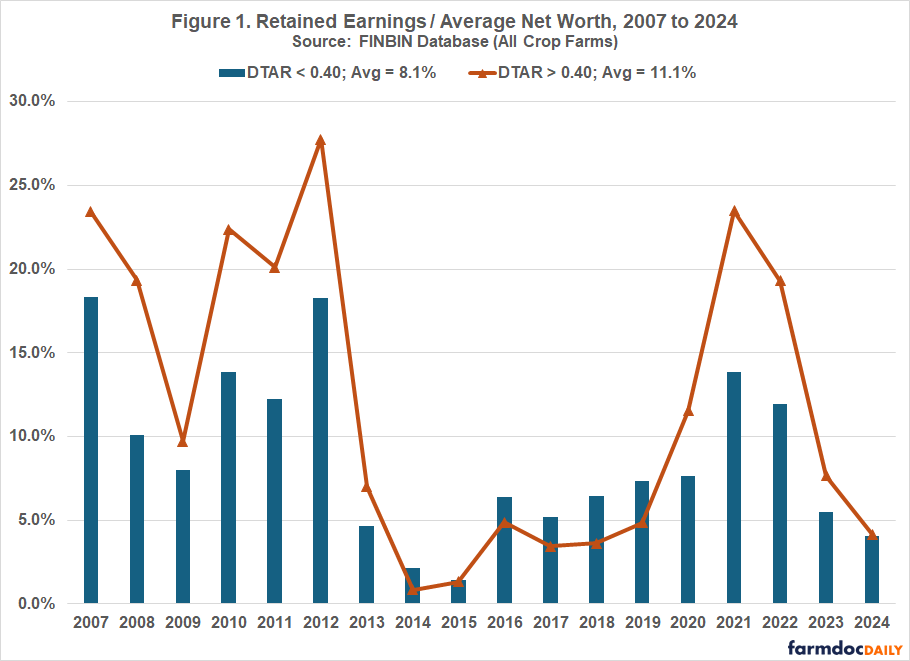

Figure 1 illustrates retained earnings as a percentage of average net worth for both farm categories. Obviously, there is a lot of variability in this measure for each group of farms. However, the variability is higher for the high debt to asset ratio farms. The average performance measure for the high debt farms at 11.1 percent is higher than the average performance measure for the low debt farms (8.1 percent). As noted above, leverage improves financial performance in a good economic environment. The relationship between the average performance measures point to the strong financial performance exhibited by farms since 2007. Relatively low interest rates experienced during most of the study period likely contributed to the relatively strong performance of the high debt farms.

To further examine the relationship between financial performance and leverage, we will discuss relative rates of return on equity between farms with various debt to asset ratios in 2024, a relatively low net farm income year. In 2024, all crop farms had an average rate of return on equity of 1.3 percent. For low and high debt farms, the average rate of return on equity was 1.6 and 0.9 percent, respectively. Notice that the rate of return is lower for the high debt farms. For a group of farms with a debt to asset ratio greater than 0.60 (a subset of the high debt farms), the rate of return on farm equity was a negative 3.8 percent. Again, in a low net income year, financial performance is inversely related to leverage.

Historical and Projected Interest Rates

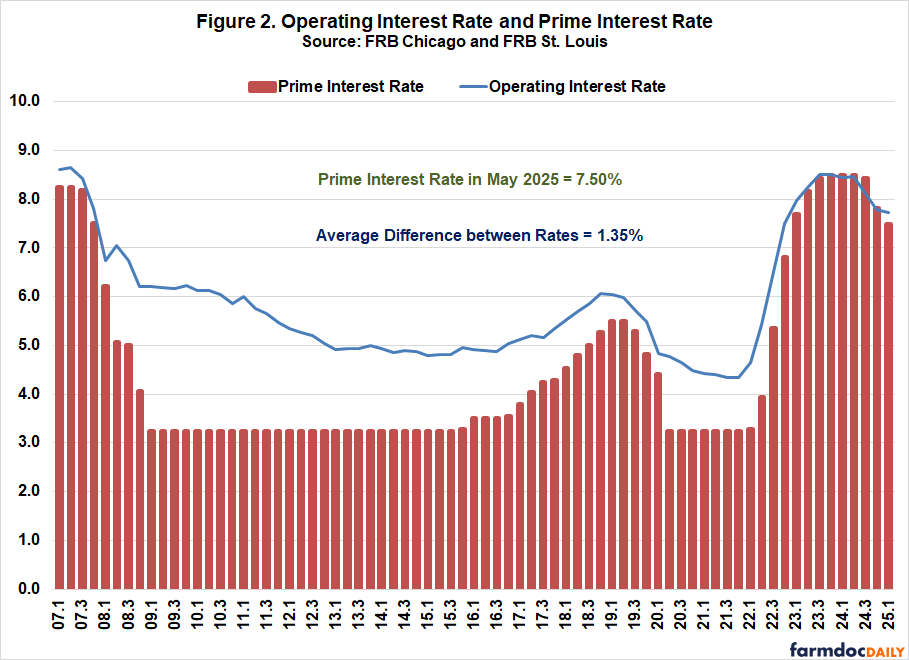

Interest rates were historically low from 2008 to 2022. Figure 2 illustrates the quarterly agricultural interest rate for operating loans as reported by the Federal Reserve Bank of Chicago as well as the quarterly prime interest rate (Federal Reserve Bank of St. Louis). The agricultural interest rate dropped from 8.38 percent in 2007 to 6.69 percent in 2008. The drop in the prime interest rate was even sharper (8.05 percent to 5.09 percent). These two interest rates did not climb back above 8 percent until 2023. In 2023 and 2024, the annual operating and prime interest rates were approximately 8.25 percent.

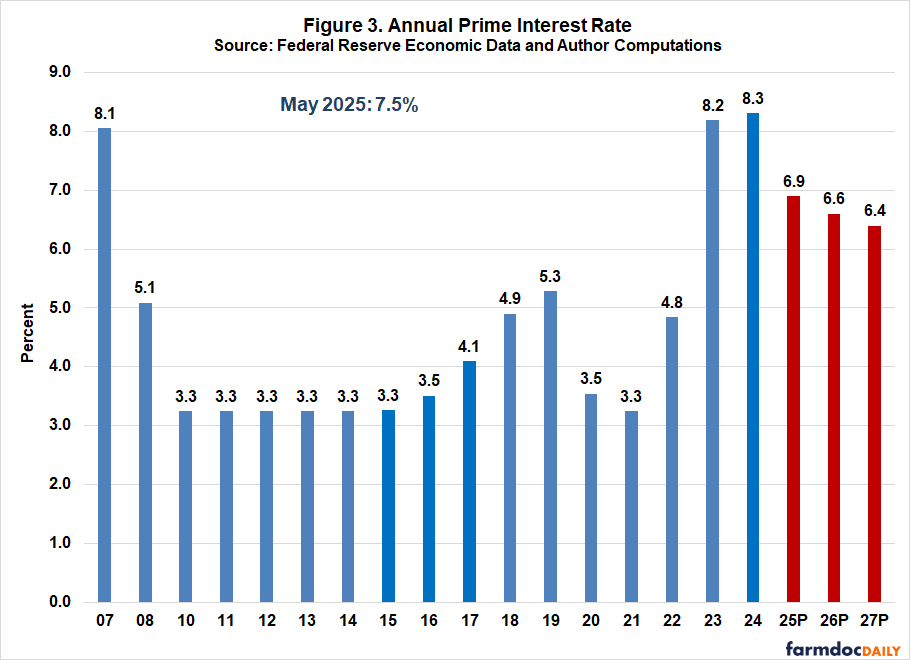

Figure 3 illustrates historical and projected prime interest rates. The projections were computed by adding 3 percentage points to the latest fed fund rate projections made by the U.S. Federal Open Market Committee. Three percentage points represent the long-run difference between the prime interest rate and the federal funds rate. As illustrated in Figure 3, the prime interest rate is expected to decline in the next couple of years. However, the rate is expected to remain well above the rates experienced from 2008 to 2022.

What are the implications of relatively higher interest rates on leverage? First, higher interest rates increase the hurdle needed for new capital purchases. Second, higher interest rates increase the probability that repayment of term debt will run into a snag. Again, it is important to point out that optimal debt levels depend on many factors and are farm specific. Having said that, higher interest rates do suggest that extra caution is needed when debt to asset levels are above 0.40.

Concluding Comments

High debt to asset ratio farms had a lower net farm income ratio during the 2007 to 2024 period than low debt to asset ratio farms. However, retained earnings as a percentage of average net worth was higher for the high debt to asset ratio farms. For a substantial proportion of farms, leverage increased both financial performance and financial risk during the 2007 to 2024 period. It is important to note that interest rates were unusually low from 2008 to 2022. These low interest rates made leverage more attractive than it would have been otherwise. Interest rates increased rather dramatically in 2023 and are expected to remain above the level experienced from 2008 to 2022 for the foreseeable future. Given this new interest rate environment, farms may want to reevaluate the proportions of debt and retained earnings used for expansion and for investment in new endeavors. Investments that made sense when interest rates were very low may not make as much sense in the current environment.

References

Center for Farm Financial Management, University of Minnesota, FINBIN web site, accessed April 23, 2025.

Langemeier, M. “How Much Debt Can a Farm Carry?” Center for Commercial Agriculture, Department of Agricultural Economics, Purdue University, September 2020.

Langemeier, M. "Decomposition of Changes in Net Worth." farmdoc daily (15):94, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 21, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.