Impacts of the Commodity Title Changes Under the One Big Beautiful Bill Act (OBBBA) for Midwestern Farms in 2025

We discuss the changes made to the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) programs in the commodity provisions of the budget reconciliation legislation known as the One Big Beautiful Bill Act (OBBBA). For the 2025 crop year, the new commodity title provisions are expected to increase payments by significant amounts. Those payments, however, will not be received until October 2026.

Commodity Title Changes

In the OBBBA, Congress extended the commodity title programs through 2031, with retroactive changes made to the 2025 commodity year (note: the suspension of permanent price support authority was not extended and expires with the 2025 crop year unless Congress takes further action). The choices farmers made for 2025 will not be used. Instead, the OBBBA changes will be applied to the 2025 year, and farmers will receive the higher of PLC or ARC at the County Level (ARC-CO) payments. For 2026 to 2031, farmers will make annual choices between PLC and ARC.

The OBBBA continues PLC and ARC payment programs but changes some of their parameters, including: 1) statutory reference prices and loan rates, 2) effective reference price, and 3) ARC coverage level and payment range.

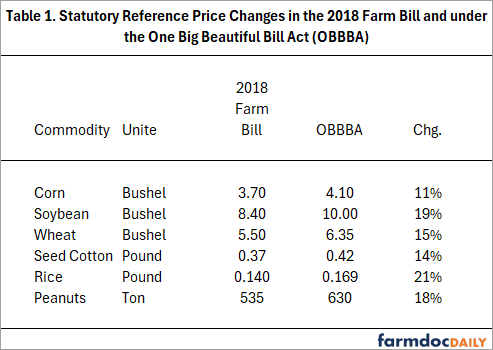

Statutory Reference Prices and Loan Rates

For the years up to 2031, statutory reference prices are increased from 2018 levels for all program crops (see Table 1). Corn’s reference price is increased from $3.70 to $4.10 per bushel, an increase of 11%. The soybean reference price was increased from $8.40 to $10.oo per bushel, an increase of 19%. Wheat’s statutory reference price was increased from $5.50 per bushel to $6.35, an increase of 15%. These statutory reference prices will remain in place through the 2030 crop year. Starting with the 2031 crop year, all statutory reference prices will be increased by 0.5% per year.

In addition, loan rates are increased by 10%, meaning that:

- Corn’s loan rate increased from $2.20 per bushel to $2.42.

- Soybean’s loan rate increased from $6.20 per bushel to $6.82.

- Wheat’s loan rate increased from $3.38 per bushel to $3.72.

For Midwest crops, loan rates are used primarily to obtain loans on grain held in storage. Those increases will allow a 10% higher loan amount on each bushel.

Effective Reference Price Calculations

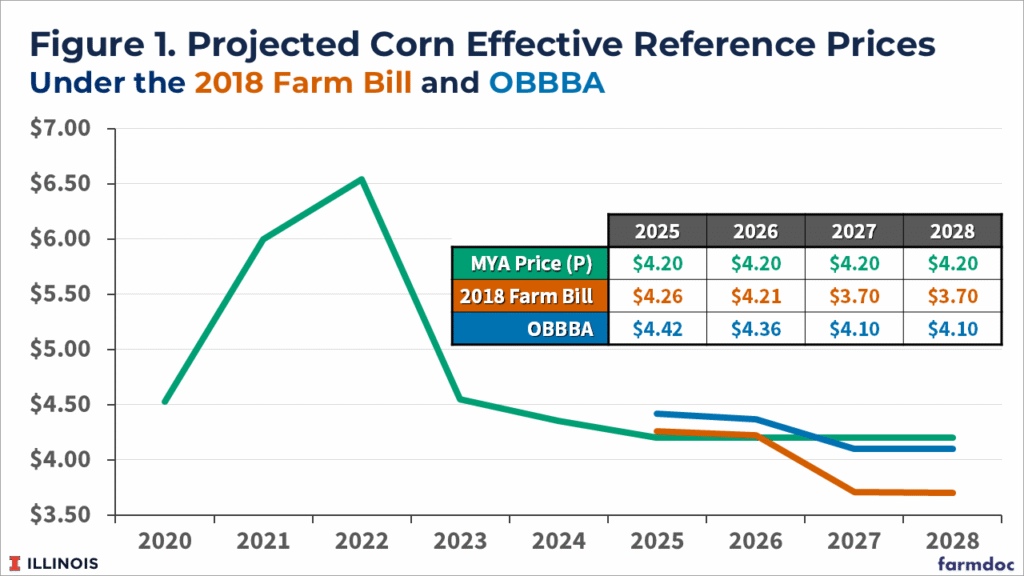

Payments on PLC occur when the market year average (MYA) price is below the effective reference price. Under the OBBBA, the effective reference price for a crop year is the higher of (a) the statutory reference price (see Table 1) or (b) 88% of the Olympic average price (excludes high and low price) for the five most recent completed crop years but capped at 115% of the statutory reference price. Compared to the 2018 Farm Bill, the OBBBA increases the percentage of the Olympic average from 85% under the 2018 Farm Bill to 88% under the OBBBA.

Effective reference prices under OBBBA will be higher than those had the 2018 Farm Bill continued, primarily because of the higher statutory reference prices. Figure 1 shows estimates of effective reference prices into the future, given that MYA prices are at $4.20 in 2025 (latest WASDE estimate) and the following years. A $4.30 MYA price is used for 2024. Under these prices, differences in effective prices are:

- For the 2024 crop year: $4.42 under OBBBA versus $4.26 under the 2018 Farm Bill. All prices from 2020 through 2023 are known, so the $4.42 effective reference price is known. The $4.42 is $.16 higher than the $4.26 under the 2018 Farm bill because the higher percentage applied (88% instead of 85%) to the Olympic average.

- For the 2026 crop year: a projected $4.36 under the OBBBA versus $4.21 under the 2018 Farm Bill.

- For the 2027 crop year: a projected $4.10 under OBBBA versus $3.70 under the 2018 Farm Bill. At current price projections, the price escalator would have no impact and the effective reference price would return to the statutory level.

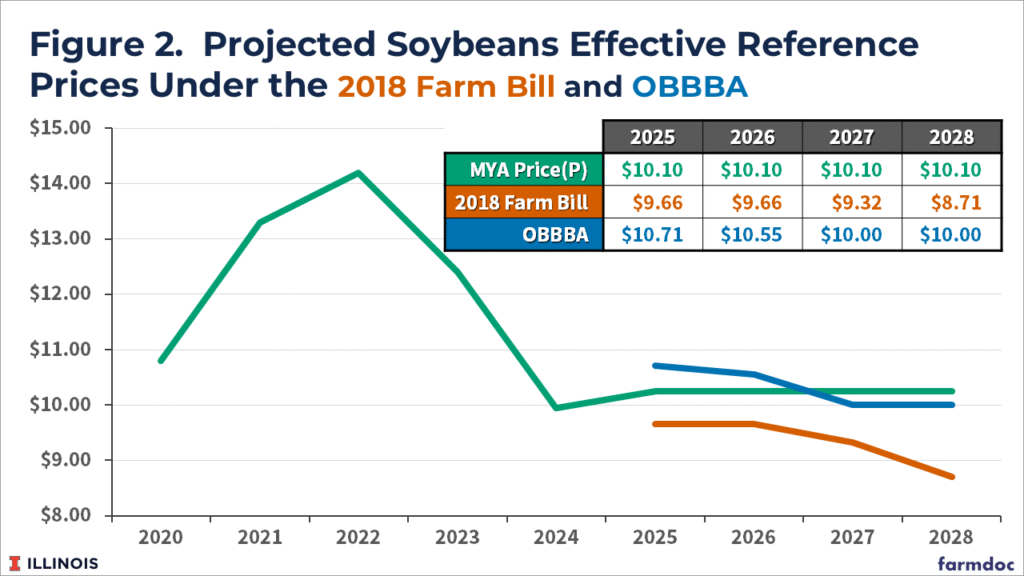

- Figure 2 shows estimates of effective prices for soybeans given that MYA prices are at $10.10 in 2025 (latest WASDE estimate) and each year after. An MYA price estimate of $10.00is used for 2024. Under these prices, differences in effective prices are:

- 2024: $10.71 under OBBBA and $9.66 under the 2018 Farm bill. All prices from 2020 through 2023 are determined, so the $10.71 effective reference price is known. The $10.71 is $1.05 higher than the $9.66 effective reference price under the 2018 Farm bill.

- 2026: $10.50 under the OBBBA versus $9.66 under the 2018 Farm Bill

- 2027: $10.00 under OBBBA versus $9.32 under the 2018 Farm Bill. Similar to corn, current price projections would return the reference price to statutory level for soybeans by 2027.

ARC Coverage Levels and Payment Ranges

Agricultural Risk Coverage at the county level (ARC-CO) is a crop-specific county revenue program. The OBBBA made two changes to ARC-CO:

- The OBBBA increased the guarantee from 86% of benchmark revenue under the 2018 Farm Bill to 90%. Under OBBBA, ARC-CO triggers payments if actual revenue (MYA price times county yield) falls below 90% of the benchmark revenue (product of benchmark price and trend-adjusted benchmark yield for the county).

- ARC-CO payments were limited to 10% of the benchmark revenue under the 2018 Farm Bill. The limit now is 12% of the benchmark revenue. In other words, ARC-CO covers a band from 90% down to 78% of benchmark revenue.

Impacts on 2025 Commodity Title Payments

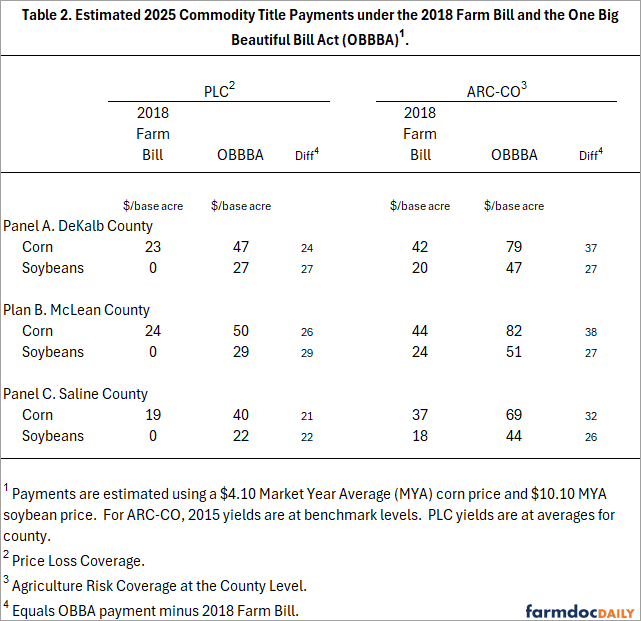

If payments are triggered, PLC and ARC will make higher payments under the OBBBA than under the 2018 Farm Bill. We estimated 2025 commodity title payments for three Illinois Counties using the following assumptions:

- The 2025 Market Year Average (MYA) prices are $4.10 for corn and $10.10 for soybeans. Those prices will be determined during the 2025 marketing year, which begins in September 2025 and ends in August 2026 for both corn and soybeans.

- Yields for ARC-CO are at their benchmark yields, meaning yields are average

- PLC yields are at the average for the counties.

Actual prices and yields will vary from those assumptions. Higher prices will tend to lower PLC payments, and vice versa. Higher revenue, either through higher yields or higher prices, will result in lower ARC-CO payments, and vice versa.

Table 2 shows estimates for three counties: DeKalb in northern Illinois, McLean in central Illinois, and Saline in southern Illinois. Patterns between PLC and ARC-CO payments are the same across counties. Results will be discussed for DeKalb County,

- PLC, Corn: PLC payments for corn increase from $23 per base acre under the 2018 Farm bill to $47 per base acre under the OBBBA.

- PLC, Soybeans: PLC payments are projected to increase from $0 to $24 per base acre.

- ARC-CO, Corn: ARC-CO payments increase from $42 per base acre to $79 per base acre. The higher 90% coverage level under OBBA causes the increase.

- ARC-CO, soybeans: ARC-CO payments increase from $20 per base acre to $47 per base acre. The higher 90% coverage level under OBBA causes the increase.

For 2025, our current estimates show ARC-CO as the highest paying alternative. Our estimate of average ARC-CO payments for DeKalb under the OBBB is $65 per base acre, given that 55% of base acres are in corn and 45% are in soybeans. The $65 per base acre payment is $37 higher than the average $38 per base acre payment under the 2018 Farm Bill.

Importantly, the 2025 commodity title payments, if any, will not be paid until October 2026. Any PLC/ARC payment that will be received this year in October 2025 is associated with the 2024 crop. ARC/PLC payments for 2024 are generally not expected to be large for most Illinois counties (see farmdoc daily, May 13, 2025).

Summary

Passage of the OBBBA does not require any actions on the part of farmers currently. While the Act retroactively changes the 2025 commodity program, farmers do not have to make updates to their PLC and ARC-CO decisions, and will receive the higher of the two payments. Current estimates suggest an increase of $25-$30 in per acre payment rates for corn and soybeans in Illinois, roughly a doubling of commodity title program payments compared with payments under the 2018 Farm Bill.

While doubling, those payments will not eliminate the fact that returns are projected to be negative for cash rent farmland in the Midwest (see farmdoc daily, July 8, 2025). Costs remain high, and prices are insufficient to cover all expenses, particularly for cash-rented farmland. This situation is likely to be made worse by the increase in farm program payments and crop insurance coverage discussed herein, particularly coming after the additional $10 billion in economic ad hoc assistance provided last year by Congress and paid out this spring. Unless the revenue outlook improves, or something drives down the costs farmers are paying, the cost squeeze will continue on Midwest farms.

References

Paulson, N., G. Schnitkey and C. Zulauf. "2024 NASS County Corn and Soybean Yields." farmdoc daily (15):88, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 13, 2025.

Schnitkey, G., N. Paulson and C. Zulauf. "2025 Grain Farm Return Prospects at the Beginning of July with a New Commodity Title." farmdoc daily (15):124, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 8, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.