Shifting Trade Patterns and Higher Crude Oil Prices Brighten Prospects for U.S. Ethanol and Corn

In a previous farmdoc daily article (June 11,2014) we concluded that the recent shift in the U.S. net ethanol trade balance, particularly since October 2013, has contributed to the continuation of high ethanol prices relative to corn prices and the resulting historically large margins for ethanol producers. Here we examine some of the details of the shifting trade pattern. In addition, we discuss the potential implication of this shift along with the recent increase in crude oil prices for the prospects of U.S. ethanol production and corn consumption.

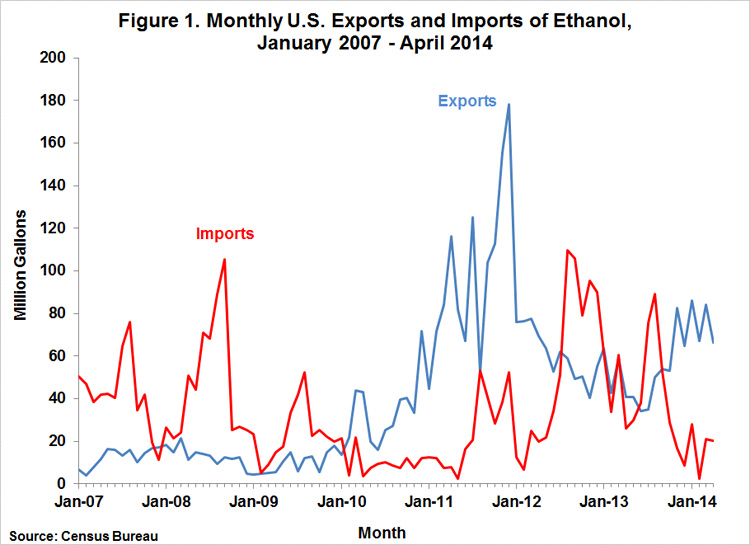

Figure 1, which was included in last week’s article, clearly reveals the recent decline in U.S. ethanol imports and expansion in U.S. exports starting in October/November 2013. Imports and exports were evenly balanced in September 2013, but net exports were 25 million gallons in October 2013 and averaged nearly 60 million gallons per month from November 2013 through April 2014. U.S. imports are almost entirely from Brazil, directly or indirectly through countries in the Caribbean Basin Initiative. The decline in imports since late 2013 reflects the declining role of Brazilian ethanol in meeting the advanced biofuels portion of the Renewable Fuels Standards (RFS) in favor of biodiesel.

U.S. ethanol exports during the period November 2013 through April 2014 totaled 451 million gallons, 184 million gallons more than during the previous six months. The U.S. Census Bureau reports U.S. ethanol exports by country of destination, so that the destination of the recent increase in imports of U.S. ethanol can be identified. As shown in Figure 2, the growth was dominated by Brazil, with smaller increases by India, the Philippines, the United Arab Emirates, and South Korea. A few countries imported less U.S. ethanol during the most recent six month period, but the declines were relatively small, the largest being a 5 million gallon decline by Norway.

Based on trade data from SECEX, Brazilian ethanol exports to all destinations other than the U.S. declined by 74 million gallons during the most recent six month period. We do not have access to trade data for other countries, but assuming that exports from other countries are minimal, much of the recent growth in U.S. exports (110 million gallons of the total of 184 million gallons) was apparently due to an increase in total imports by countries other than the U.S. and Brazil.

The increase in net exports of U.S. ethanol has been an important contributor to the recent increase in U.S. ethanol production. Monthly ethanol production has returned to near the record levels of late 2011 and the U.S. Energy Information Administration (EIA) reported record large weekly production for the week ended June 13, 2014.

Prospects for a continuation of the positive trade balance depend on a number of factors, but two will be most important. One is the relationship between ethanol and gasoline prices. The recent run-up in crude oil and wholesale gasoline prices and the decline in wholesale ethanol prices (Figure 3) have made ethanol attractively priced as an octane enhancer and as a substitute for other gasoline feedstocks. A continuation of that favorable price relationship would be expected to increase both world consumption of ethanol and exports of U.S. ethanol. A second factor is the fate of the biodiesel tax credit. If that tax credit is extended, biodiesel will continue to be favored in meeting the RFS for advanced biofuels resulting in minimal imports of Brazilian ethanol. Prospects seem favorable for both of these conditions to continue. Monthly U.S. trade data will be monitored closely to see if the favorable trade balance in fact does continue.

Much of the discussion about domestic ethanol consumption is centered on the EPA’s final rulemaking for the renewable fuel mandates for 2014 and beyond. That discussion tends to imply that the EPA rule making represents both a minimum and maximum for domestic renewable biofuel (ethanol) consumption. However, there is growing opportunity for domestic ethanol consumption to expand beyond both the E10 blend wall and mandated consumption levels due to higher gasoline prices relative to ethanol prices. Positive blending margins should incentivize the expansion of consumption of higher blends of ethanol, both E15 and E85. The pace of expansion will be determined by expectations for the duration of favorable blending margins and the speed at which the deployment of infrastructure can be put in place. The duration of higher crude oil prices will be influenced by the extent and duration of production interruptions in the Middle East.

Implications

The USDA has forecast that the amount of U.S. corn used for ethanol production during the current corn marketing year that ends August 31 will equal the record use of 5.05 billion bushels reached in 2011-12. Use is projected to remain at that level in the 2013-14 marketing year. The current pace of ethanol production, along with positive prospects for both exports and domestic consumption of higher ethanol blends suggest that corn use will exceed the projections for both years. An extended period of higher crude oil and gasoline prices and low corn prices could result in surprisingly large amount of corn used for ethanol production. While unheard of to this point, there could even be some production capacity issues. The Renewable Fuel Association estimates the current U.S. nameplate ethanol production capacity at 14.875 billion gallons. Ethanol production for the week ended June 13, 2014 was reported at 285.768 million gallons, which represents an annual pace of 14.86 billion gallons. It is premature at this point to project a continuation of the sharp increase in U.S. ethanol production currently being experienced and a substantial increase in corn consumption, but the economic incentives now in place certainly suggest careful monitoring of the situation. In addition, higher levels of ethanol production resulting in larger quantities of distillers’ grains would offset some portion of any increase in corn consumption for ethanol. Still, it appears the corn market may be reflecting expectations for corn consumption that are too low.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.