The Deferred Tax Monster

Because agriculture producers can use cash accounting for federal and state income tax purposes, there is a recognizable difference between taxable farm income and accrual farm income. These differences can have an immense impact on tax liability, earnings, and net worth not always recognized on farm financial statements. Part of your operations annual business assessment should include calculating the amount of deferred tax liability, in order to be well aware of the possibilities that could be triggered.

Deferred taxes are the result of reconciling the tax basis of balance sheet assets and the market value of the same assets. A situation that might require a farmer to sell all assets at the same time is not typical, but if that was the case, what might be the resulting tax liability? By estimating your deferred tax liability, you can be more knowledgeable of the how your farm business would be affected.

For this work, we have taken a group of farms from the Illinois FBFM database and made some assumptions on tax rates. The current part of estimated average deferred tax liabilities includes self-employment tax as well as income tax. Favorable capital gain tax rates are used where appropriate along with ordinary income tax rates in the calculation of estimated average deferred taxes on intermediate and long term assets.

In Graph 1, the increase in average deferred tax liabilities in the past thirteen years is shown by the type of asset. Prior to 2006 and the ethanol mandate, the three asset types were increasing at similar rates but not at the rates experienced in later years. From 2006-2012, there is much variation in the current part of the deferred tax liability and that variation occurs at a generally higher level. Causes for this include the increased value of crop in inventory due to generally higher prices. The end of this era seems to be 2012 which is the year of the drought and the crop insurance that came with that short crop. Beyond 2012, the current part of the deferred tax liability declines due in part to lower commodity prices.

Graph 1 also shows that the intermediate and long term part of deferred tax liabilities was increasing at a steadier rate and without the volatility seen in the current part of the deferred tax liability. As with the current part of the deferred tax liability, beginning in 2012 the increase in deferred taxes is mitigated. Over the thirteen years shown on Graph 1, the average annual increase in deferred taxes is $38, 595.

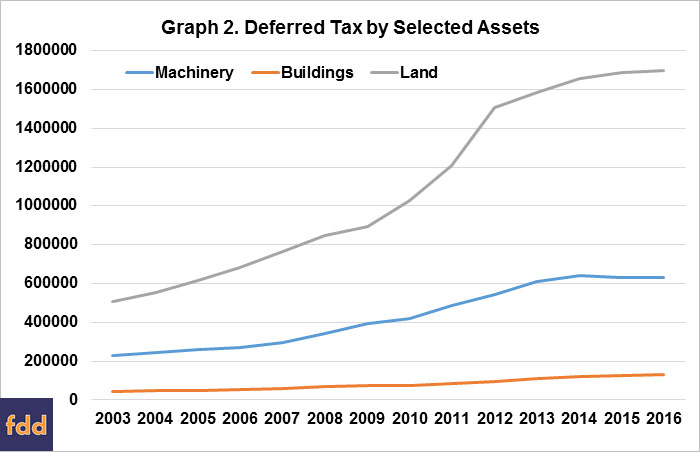

Graph 2 depicts the increases in deferred tax for machinery, buildings and land. The increases in deferred taxes for machinery and machinery are trumped by the increases in deferred taxes on land. The increase in deferred taxes on machinery are in part due to the use of the IRS Code Section 179 Expense Election and Bonus Depreciation. Invoking the use of either or both of tax policies has the tendency to reduce the tax basis much earlier than the use of ordinary tax depreciation. The increase in the long term part of deferred taxes is due to sustained increases in land values.

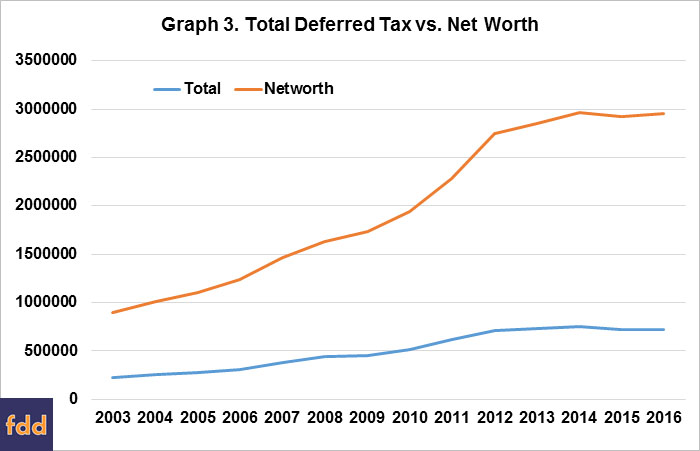

In production agriculture, it is customary to prepare financial statements without the presence of the deferred tax liability. In turn, we review our ratios and benchmarks without recognizing the tax liability as well. Keep in mind that there is a ‘claim’ on your net worth due to your deferred tax liability – we just don’t typically recognize it. Some believe that deferred tax is not real and prefer to look at financials without it present. They may be true, but events that can trigger deferred tax liabilities need to be acknowledged considering the impact this might have on your financial condition.

Graph 3 shows deferred taxes as compared to net worth. In percentage terms, 2008 deferred tax was 27.3% of net worth – which was the high – while 2016 recorded deferred tax as 24.5% of net worth.

Summary

The waistline of the deferred tax monster has increased over time. It also appears that the rate of increase in the accumulation of deferred tax liabilities is lessening. Time will tell if there will be increases in deferred tax liabilities.

The authors would like to acknowledge that data used in this study comes from the local Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,700 plus farmers and 60 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM staff provide counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217.333.5511 or visit the FBFM website at www.fbfm.org.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.