RIN Stock Update Under Alternative RFS Implementation Scenarios

The most recent RIN stock update (farmdoc daily, May 17, 2017) included an estimate of just over 2 billion total RINs available for 2017 compliance purposes. Today, those estimates are updated with current data from the Environmental Protection Agency’s EMTS system, and biofuel trade data from the Energy Information Administration and the Department of Commerce.

The potential impact of changes to the Renewable Fuel Standard implementation for the 2014 to 2016 compliance periods stemming from the July 28, 2017 ruling of the US Court of Appeals are also examined. Specifically, alternative scenarios for how the EPA might remedy the situation are examined in terms of the ability of obligated parties to use existing RIN stocks to comply with increased mandate levels for the 2014 to 2016 compliance periods.

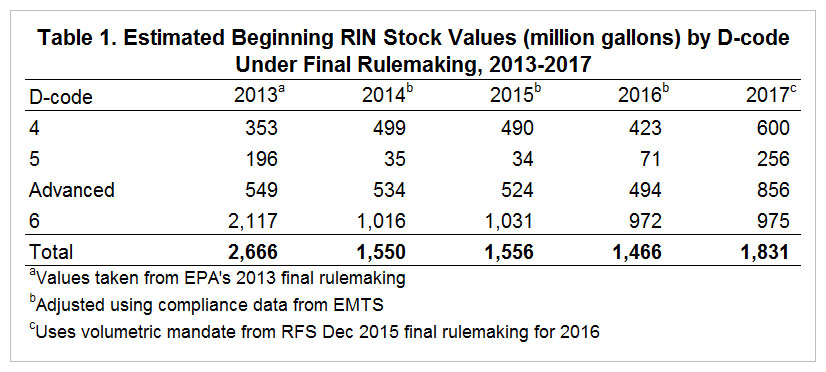

RIN Stock Estimates Update

Table 1 reports an update to the previous RIN stock estimates provided in May. The beginning stock estimates for 2016 and 2017 have been revised down due to updates and changes to data on non-compliance retirements, as well as updated trade data. The revisions are quite substantial, with reductions of 88 million and 249 million in 2016 and 2017, respectively. The 2016 reduction is driven primarily by an increase in denatured ethanol exports reported for 2015. The 2017 reduction is driven by an increase in denatured ethanol exports for 2016 as well as an increase in non-compliance retirements for both D4 and D6 RINs for 2016.

Alternative Implementation Scenarios

In the August 9, 2017 daily post, Scott Irwin and Darrel Good discussed the Appeals Court ruling which found the EPA’s reduction to the renewable fuel volume requirements in their 2015 final rulemaking was an incorrect interpretation and application of the “inadequate domestic supply” waiver provision. As noted by Irwin and Good, it is not clear as to how the Court’s ruling will result in changes to the implementation of the RFS for the 2014, 2015, and 2016 compliance periods. Their article defined two alternative implementation scenarios which are provided along with the 2015 final rulemaking volumes in table 2.

The “shuffle” scenario shifts a portion of the advanced mandate to the implied conventional portion of the mandate. Relative to the 2015 final rulemaking, the advanced mandates for each year are lower but the total mandate volumes for each year are larger. The “Top Off” scenario assumes that the advanced portion of the mandate remains at the same levels as those in the 2015 final rulemaking, while the total mandate is raised for each year. Both scenarios eliminate the waivers of the implied conventional portion of the overall mandate, returning them to the original statutory levels outlined in the Energy and Independence and Security Act of 2007 (14.4 billion gallons in 2014, and 15 billion gallons in 2015 and 2016).

Relative to the 2015 final rulemaking volumes, the shuffle scenario increases total mandate volumes by 650 million in 2015, 840 million in 2015, and 120 million in 2016. This amounts to an expected increase of 1.61 billion additional RINs needed for compliance if implementation rules were changed for all three years.

Table 3 provides estimates of the impact on RIN stocks if the shuffle scenario was implemented for 2014, 2015, and 2016. With the larger total mandate levels in the shuffle scenario, RIN stocks are drawn down to just over 400 million by 2017. The larger conventional mandate component would use up the entire stock of D6 RINs while also requiring use of a portion of existing advanced (D4 and D5) stocks.

The top off scenario increases total mandate volumes by 790, 950, and 500 million gallons in 2014, 2015, and 2016, respectively. This amounts to an increase of more than 2.2 billion additional RINs need for compliance if implementation rules were changed for all three years.

Table 4 provides estimates of the impact on RIN stocks if the top off scenario was implemented for 2014, 2015, and 2016. The increase in the total and conventional component mandates would completely exhaust RIN stocks in meeting the larger mandate requirements. Use of the borrowing provision of the RFS would be needed to fulfill compliance needs for the increased volumes for both the 2015 and 2016 compliance periods.

Finally, the most popular opinion is that the Court of Appeals ruling will only apply to the 2016 compliance period, and that the EPA’s remedy will be to simply increase the total mandate by 500 million gallons. This would effectively increase the conventional component of the 2016 mandate to the original statutory level of 15 billion gallons. Table 5 provides RIN stock estimates for this implementation scenario. Relative to the implementation of the 2015 final rulemaking (table 1), the only change is to the estimated D6 and total stock availability at the beginning of 2017, which both decline by 500 million gallons.

Summary

The Court of Appeals ruling against the EPA’s interpretation and application of the “inadequate domestic supply” waiver provision in their 2015 final rulemaking suggests that changes to RFS implementation for the 2014 to 2016 compliance periods will be required. What remains unclear is exactly how EPA will attempt to provide a remedy. At one extreme, the ruling may lead to changes which impact all three years for which the waiver provision was used – 2014, 2015, and 2016. However, popular opinion suggests the Court’s ruling may only result in changes to implementation for 2016.

For the shuffle and top off scenarios considered, available RIN stocks would not be sufficient to meet the greater compliance requirements if implemented for all three years. If implementation changes are only made for 2016, the use of existing RIN stocks to meet the increased compliance requirement of an additional 500 million gallons for just 2016 would be more feasible.

Note that the estimates of the impact on RIN stock levels due to changes to RFS implementation and compliance requirements were estimated as if the mandate levels for 2014 to 2016 were adjusted retroactively. Put another way, the RIN stock scenarios presented here assume that obligated parties would be required to meet greater mandate requirements entirely with existing RIN stock levels. Given the potentially substantial changes the ruling may require, EPA’s remedy is more likely to be implemented through adjustments to mandate levels over a period of multiple years. Thus, those implementation changes could potentially be met with a combination of existing RIN stocks and increased biofuel production and blending in future years.

References

Americans for Clean Energy. v. Environmental Protection Agency (2017)

http://cases.justia.com/federal/appellate-courts/cadc/16-1005/16-1005-2017-07-28.pdf?ts=1501255947

Energy Independence and Security Act of 2007, Public Law 110-140, December 19, 2007

https://www.gpo.gov/fdsys/pkg/PLAW-110publ140/pdf/PLAW-110publ140.pdf

Environmental Protection Agency. "Renewable Fuel Standard Program: Standards for 2014, 2015, and 2016 and Biomass Based Diesel Volume for 2017; Final Rule." Federal Register 80(239), December 14, 2015. https://www.gpo.gov/fdsys/pkg/FR-2015-12-14/pdf/2015-30893.pdf

Environmental Protection Agency. "Public Data for the Renewable Fuel Standard." https://www.epa.gov/fuels-registration-reporting-and-compliance-help/public-data-renewable-fuel-standard

Irwin, S. and D. Good. "EPA Interpretation of the "Inadequate Domestic Supply" Waiver for Renewable Fuels Ruled Invalid: Where to from Here?" farmdoc daily (7):144, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 9, 2017.

Paulson, N. "2017 First Quarter RIN Update." farmdoc daily (7):91, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 17, 2017.

USITC Interactive Tariff and Trade DataWeb. https://dataweb.usitc.gov/scripts/user_set.asp

U. S. Energy Information Administration. "Petroleum & Other Liquids: Exports." http://www.eia.gov/dnav/pet/pet_move_exp_dc_NUS-Z00_mbbl_m.htm

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.