CFAP Payments to Date and Possible Future Ad Hoc Farm Payments

In May, the USDA announced the Coronavirus Food Assistance Program (CFAP) to compensate farmers for market losses concurrent to the ongoing coronavirus pandemic. USDA projected making $16 billion in CFAP payments to farmers. In this article, we analyze CFAP payments made to date, consider whether actual payments will reach this budgeted $16 billion amount by the time the application period ends on September 11, 2020, and discuss the prospect of further ad hoc farm payments in 2020. Across all crops and livestock, CFAP payments to August 24 are 58% of budgeted. For corn and soybeans, payments are 77% and 59% of budgeted amounts, respectively. we estimate CFAP payments for corn and soybeans made through the end of the current sign-up period will fall short of the amount budgeted by approximately $547 million. The reason for this shortfall is the ‘eligible inventory’ criteria used to determine the quantity eligible for payment.

Defining CFAP Payment Eligibility

We focus on CFAP payments for non-specialty crops, including corn and soybeans, and for livestock, specifically cattle, dairy, and hogs. Commodities are eligible for CFAP payments if their benchmark price fell by more than 5% in the period between January 13-17 and April 6-10, 2020. This period roughly spans the onset of the coronavirus pandemic and the initial impact on commodity prices and supply chains. (Program details and example payment calculations are available at: farmdoc daily, May 22, 2020; May 28, 2020; June 9, 2020.) Farmers receive payments equal to inventory or sales of the commodity times the payment rate per unit”. Payment rates are a percentage of the observed price decline between the mid-January and mid-April periods referenced above. Implicitly, these payment rates attribute a given proportion of the observed price decline to the market disruption that resulted from efforts to address the coronavirus pandemic.

Farmers receive payments only on eligible quantities of the commodity. Eligible quantities are those inventory or sales units which USDA deemed affected by the price decline discussed above. For non-specialty crops, eligible quantities are crop inventories held by the farm on January 15, 2020 that remain subject to price risk. This caused some initial confusion when the program was announced because supporting documentation did not define what was meant by subject to price risk. USDA later clarified that crop inventories contracted for sale at a set price as of January 15, 2020were not eligible with the exception of basis contracts and deferred price contracts. Because USDA does not collect data on inventories that meet these eligibility criteria, it estimated eligible inventory was 50% of 2019 production for all non-specialty crops and capped eligible inventory for a given operation at 50% of that operation’s 2019 production.

For dairy, eligible quantities are actual milk production for the first and second quarter of calendar year 2020 (with each quarter’s production paid different rates.) For cattle and hogs, eligible quantities are actual sales between January 15 and April 15, and maximum inventory held between April 16 and May 15, 2020. (Again, the actual sales and inventory amounts are paid different rates.)

CFAP payments are subject to limits on the amount that can be paid to any individual, corporation, or partnership. CFAP payments are also limited because individuals or entities with adjusted gross income exceeding $900,000 are ineligible for payments. To further ensure CFAP payments did not exceed budget constraints, USDA initially paid farmers a partial payment of 80% of the calculated payment amount. On August 11, 2020, USDA announced that beginning August 17, 2020, it would automatically issue the remaining 20% of the calculated payment to previous recipients and any subsequent applications would receive 100% of the calculated payment.

Comparing Actual and Budgeted CFAP Payments by Commodity

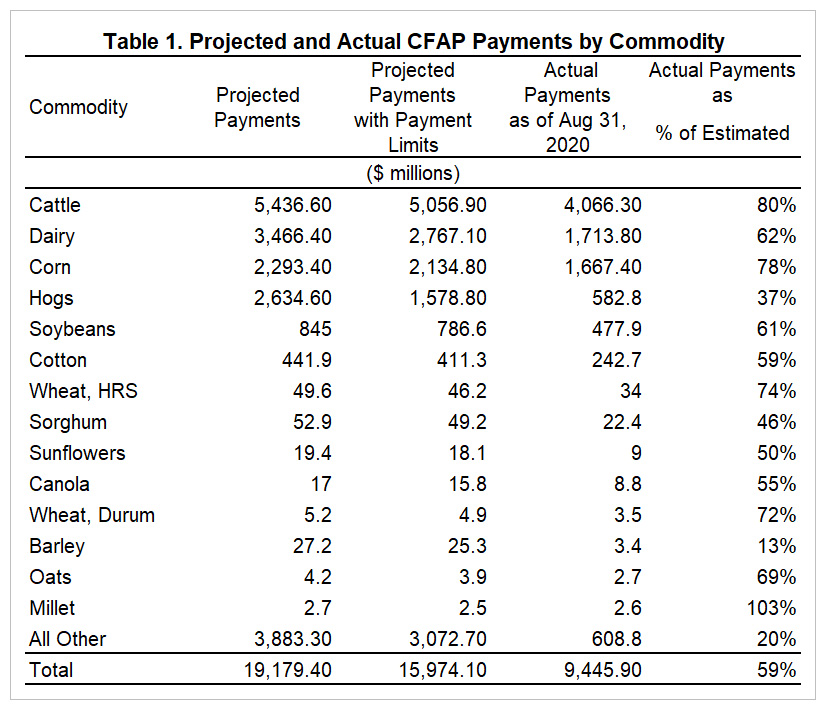

USDA’s projected $16 billion in CFAP payments are the sum of commodity-level payment projections based on assumed eligible quantities, less expected payment reductions due to payment limits. (These can be found here) In aggregate, USDA projected $19.2 billion in CFAP payments. It expected payment limits to reduce total payments by 17% to $16.0 billion. The payment limit discount factor varied across commodities depending on farm size in different production sectors. (Payment limits reduced projected cattle and non-specialty crop payments by 7%, dairy payments by 20%, and hog and pig payments by 40%.)

Using CFAP Payment data released by USDA via the CFAP Dashboard, We compare payments made as of August 31, 2020 to payments projected when the program was announced. We present this data by commodity for livestock and non-specialty crops. The first column of Table 1 shows projected commodity-level payments using given payment rates multiplied by estimated inventory or sales quantity. The second column shows the effect of adjustments made by USDA to account for the likely effect of payment limits. These estimated payments show that cattle and dairy were expected to receive about half of all CFAP dollars. Non-specialty crops were expected to receive about $3.5 billion of CFAP dollars, with corn, soybeans, and cotton receiving the lion’s share of payments. Note that wheat receives only a small share of estimated payments, as only two classes, hard red spring and durum, are eligible for payments. Hard red and soft red winter wheats (which make up the majority of US wheat production) were not eligible because they did not experience a greater-than-5% price decline between January and April.

The third column of Table 1 shows actual payments to August 31. In general, actual payments to date fall well short of the amount budgeted. Payments across all commodities were $9.4 billion compared to $16.0 billion in total projected payments; 59% of budgeted CFAP dollars have been paid. For cattle and corn, payments under CFAP through August 31 were about 80% of projected levels. This is higher than other commodities. Payments to date (as a percentage of budgeted) are lower for other non-specialty crops and dairy – most in the range of 45-75%. Actual payments are much smaller than estimated for hogs and pigs (36% of estimated) and specialty crops (which comprise the bulk of ‘Other’ commodities, where only 20% of estimated payments have been made.) Note that actual payments given in Table 1 include both the initial 80% payment and the later 20% payment. Between August 10 and August 17, actual payments jumped from $7.0 billion to $9.0 billion as USDA issued second-part payments to those who had already made CFAP applications.

Impact of ‘Eligible Inventories’ Requirement on CFAP Payments

With less than two weeks until the application deadline, it appears many CFAP dollars are still unpaid. Before concluding that farmers have been sluggish to apply for CFAP, we must address one major reason why actual CFAP payments may not equal projected payments. Recall that the USDA relied on approximations of the quantity of each commodity eligible for payments. In the case of non-specialty crops, ‘unpriced inventory’ on January 15, 2020 was approximated as 50% of 2019 production. However, some farms may have held far less than 50% of 2019 production in inventory on January 15, 2020. Farms that held more cannot receive payments on inventories above the 50% of production cap. Therefore, non-specialty crop CFAP payments are likely to be less than the budgeted amount because the eligible inventory criteria limits how much some farms receive relative to the quantity used by USDA in its budgeting process.

How much is the ‘eligible inventory’ definition limiting CFAP payments? Does it explain why payment progress is greater for some commodities like corn than others like soybeans? To fully answer these questions, we would need to know farm-level inventories as of January 15, 2020 and the portion of these that were ‘unpriced’. This cannot be observed, so we approximate it using USDA-reported on-farm grain stocks as of December 1, 2019 and March 1, 2020. We take the mid-point of these two quantities as a best-guess of on-farm inventories on January 15, 2020. This amount may over- or under-state actual unpriced inventory. Some farm inventory may be held off-farm (for example, grain delivered on a deferred price contract), while some on-farm stocks may not be unpriced (for example, stored grain hedged using futures contracts or forward contracted for delivery later in the marketing year).

Table 2 shows on-farm inventory relative to the 50% of production quantity for corn and soybeans. For corn, inventory is 85% of the 50% of production level; for soybeans, it is 71%. Therefore, likely CFAP-eligible inventory for corn is closer to the 50% of production estimate used by USDA than for soybeans and actual CFAP payments are likely to be closer to the amount budgeted for corn than for soybeans.

Comparing actual inventory to production explains in part why payment progress has been greater for corn than for soybeans. On-farm stocks, which approximate CFAP-eligible inventory, were larger for corn than for soybeans as a proportion of production. Recall from Table 1 that CFAP payments to date are 78% of budgeted for corn and just 61% for soybeans. Table 2 suggests that these shortfalls are in part due to how USDA defined eligible inventory. Even if farmers signup every eligible bushel, actual CFAP payments are likely to fall substantially short of budgeted quantities, especially for soybeans, because the budgeted quantities overestimate the number of bushels that could receive a payment.

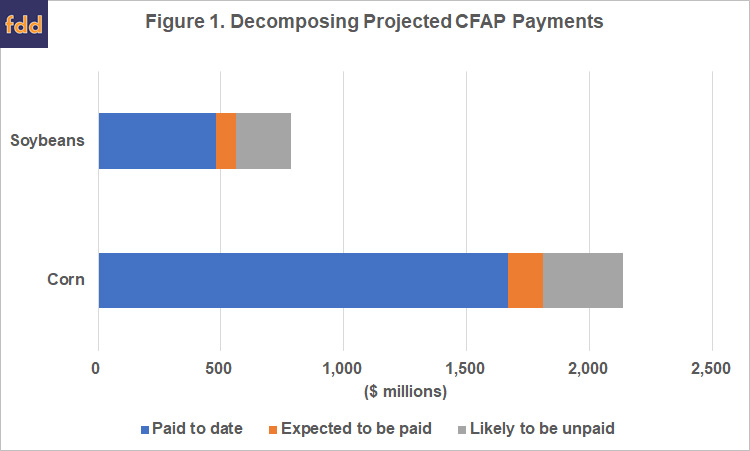

Using actual payments to date and the proportion of bushels likely to receive a payment based on the definition of eligible inventory, we can estimate by how much actual CFAP payments for corn and soybeans will fall short of USDA-budgeted projections. Figure 1 visualizes the likely CFAP payment shortfall for corn and soybeans due to eligible inventories being smaller than assumed. We expect $322 million in budgeted corn payments and $226 million in budgeted soybean payments to be unpaid because eligible inventories are less than the 50% of production quantity used in the CFAP budgeting process. While the shortfall is greater as a percentage of budgeted payments for soybeans, it is larger in absolute dollars for corn. To put these numbers in some context, if the expected $547 million payment shortfall for corn and soybeans were divided equally across every US corn and soybean acre, the shortfall is just over $3/acre.

Conclusion

We find CFAP payments are unlikely to exceed the projected $16 billion by the time the program’s extended sign-up period ends on September 11, 2020. For non-specialty crops, this is in part caused by the USDA definition of the quantity eligible for payments, that is bushels of eligible inventory. For corn and soybeans, we estimate approximately $547 million (or 19%) of projected payments will go unpaid.

What happens to these funds? Secretary of Agriculture Sonny Perdue has hinted at the possibility of a second round of CFAP payments (here) though no details are as yet available. Earlier FDD articles (farmdoc daily June 10, 2020) have assumed further ad hoc payments for corn and soybeans are forthcoming. Our analysis suggests there will be unpaid CFAP funds, creating an impetus to pay out those funds as additional ad hoc payments to farmers in 2020.

References

Paulson, N., G. Schnitkey, J. Coppess, C. Zulauf and K. Swanson. "Coronavirus Food Assistance Program (CFAP) Rules Announced." farmdoc daily (10):95, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 22, 2020.

Schnitkey, G., K. Swanson, J. Coppess, N. Paulson and C. Zulauf. "MFP and CFAP Payments, Corn and Soybean Uses, and Future Farm Profitability." farmdoc daily (10):106, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 10, 2020.

Schnitkey, G., K. Swanson, N. Paulson, C. Zulauf and J. Coppess. "Making CFAP Applications for Grain Farms." farmdoc daily (10):98, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 28, 2020.

Swanson, K., N. Paulson, G. Schnitkey, J. Coppess and C. Zulauf. "CFAP Applications for Livestock and Dairy." farmdoc daily (10):105, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 9, 2020.

Wiesemeyer, J. “USDA’s Perdue: More CFAP Aid Coming for Livestock Producers.” Pro Farmer. August 14, 2020. https://www.profarmer.com/markets/policy/usdas-perdue-more-cfap-aid-coming-livestock-producers

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.