First Look at Crop Insurance Decisions for 2024

Given corn and soybean futures prices during the first half of February, projected crop insurance prices will be much lower than in 2023, resulting in lower per acre premiums in 2024. Premiums are likely to be 16 to 18% for lower for corn policies and 10 to 12% lower for soybean policies based on current estimates for in Champaign and Jefferson Counties in Illinois. Since lower insurance prices also result in lower guarantees per acre, farmers may wish to increase their coverage levels with the premium savings. The 2024 insurance premium examples in this article are generated with the Excel-based Crop Insurance Decision Tool which can be used to generate premium estimates for crops in many States in the Midwest and Southeast regions of the US. The web-based Crop Insurance Premium Calculator has also been updated for 2024.

2024 Projected Prices and Volatility Factors

The projected insurance prices for corn and soybeans are based on average settlement prices on each crops’ harvest contract during the month of February. Through February 9th, 2024, the December corn contract has averaged $4.74 per bushel. This is $1.17 below the $5.91 projected price for the 2023 crop year, a decline of nearly 20%. The November soybean contract has averaged $11.73 per bushel or $2.03 below the $13.76 projected price in 2023, a decline of nearly 15%. The lower projected prices will have the effect of lowering premium costs relative to 2023 since premiums are proportional to the value of the liability being insured.

Price volatility factors, a measure of the potential movement in prices between now and when the contracts expire, also impact premium costs. Higher volatility factors lead to increased premium costs and vice versa. Through February 9th, the volatility factors for corn and soybeans in 2024 have been 0.19 and 0.14, respectively. These are slightly higher than the volatility factors of 0.18 and 0.13 that were used to set premiums in 2023. Note that final volatility factors are based on the average implied volatilities over the last 5 trading days in February and, like projected prices, finalized values will likely differ from the values used here to estimate premiums.

2024 Estimated Premium Cost Examples

The Excel-based Crop Insurance Decision Tool is used to generate 2024 farmer-paid premium estimates for corn and soybeans for two Illinois county examples. Champaign County is in east-central Illinois and is an example of a relatively high-productivity and low-risk area. Jefferson County is in southern Illinois and is an example of a relatively low-productivity and high-risk area. Premium costs are based on current projected price and volatility estimates for 2024 through February 9th.

We focus on Revenue Protection (RP), the most popular product in Illinois (see farmdoc daily from November 17, 2020), as the individual insurance plan and also include example premium estimates for the Supplemental and Enhanced Coverage Options (SCO and ECO). SCO and ECO provide supplemental area protection and require use of an underlying individual plan of insurance. SCO was introduced in the 2014 Farm Bill and provides area protection from 86% down to the coverage level of the underlying policy (see farmdoc daily from February 27, 2014). ECO, first offered for the 2021 crop year, was created and implemented through section 508(h) of the Federal Crop Insurance Act and provides area protection from either 90% or 95% down to 86% (see farmdoc daily articles from November 24, 2020 and January 24, 2024). The tables report premium cost estimates for each of the policies (RP, SCO, ECO-90, and ECO-95) on their own and also for various RP + supplemental plan combinations. While the supplemental plan (SCO and ECO) premium estimates are reported separately in the tables below for illustration purposes, they must be combined with an underlying individual plan and cannot be purchased individually on their own.

Estimated Corn Premiums

The upper panel of Table 1 reports farmer-paid RP premium estimates for a representative farm in Champaign County with a trend-adjusted actual production history (TA-APH) crop insurance yield of 200 bushels per acre. Premium estimates are provided for RP coverage levels ranging from 70% to 85% (columns in yellow) along with the supplemental area plans (columns in blue), and plan combinations (columns in green), at those RP coverage levels.

At an 80% coverage level, RP is estimated to cost just over $11 per acre. Adding SCO to the 80% RP plan would cost an additional $5.46 per acre for a total premium cost of nearly $17 per acre. Increasing RP coverage to 85% would increase premium cost to nearly $23 per acre, while the cost of adding SCO coverage would decline to around $1 additional per acre for a total premium cost of $24 per acre.

ECO-90 for Champaign County is estimated to cost $9.58 per acre in 2024, while ECO-95 is estimated at just over $26 per acre. RP and supplemental combination premium estimates range from around $17 per acre for 80% RP + SCO to nearly $43 per acre for 80% RP + SCO + ECO-95. This increases to a range of $24 per acre (RP+SCO) to nearly $50 per acre (RP+SCO+ECO-95) with 85% RP as the individual coverage level.

The current estimates of 2024 premiums for corn policies in Champaign County are 16 to 18% lower than premiums based on the 2023 projected price of $5.91 and volatility factor of 0.18.

The lower panel of Table 1 reports farmer-paid premiums for the same policies and combinations but for a representative farm in Jefferson County, Illinois with a TA-APH yield of 140 bushels per acre for corn. Farms located in areas of southern Illinois like Jefferson County are subject to greater yield variability resulting in higher premium rates and higher premium costs per dollar of coverage.

A 75% RP policy is expected to cost between $14 and $15 per acre, with an additional cost of SCO of around $9.50. Increasing coverage to 85% would increase the RP premium to $43 per acre and reduce the SCO premium to around $1 per acre.

ECO-90 (ECO-95) is estimated to cost around $8 ($19) per acre in Jefferson County for 2024. Combinations of RP and the supplemental plans could range in cost from $24 per acre (RP+SCO) to $43 per acre (RP+SCO+ECO-95) at a 75% RP coverage level, increasing to a range of $44 (RP+SCO) to $63 (RP+SCO+ECO-95) per acre with 85% RP.

Premiums in 2024 are estimated to be 17-19% lower for corn in Jefferson County compared with what they would be at the 2023 projected price of $5.91 and volatility of 0.18.

Estimated Soybean Premiums

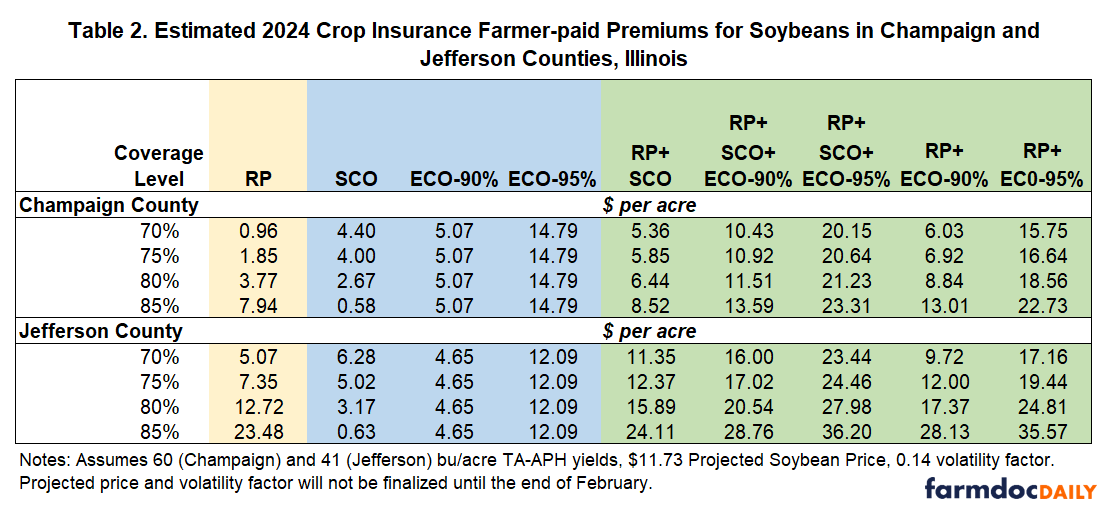

Table 2 reports expected farmer-paid premiums for soybean policies on representative farms in Champaign (upper panel) and Jefferson (lower panel) Counties in Illinois, respectively. The soybean premium estimates are based on TA-APH yields of 60 (Champaign) and 41 (Jefferson) bushels per acre.

Similar to corn, the lower projected price coupled with the slight potential increase in volatility factor compared with 2023 values results in lower premium costs anticipated for the same policies and coverage levels in 2024.

Premium costs for soybean policies in Champaign County are currently estimated to be around 10% lower for 2024 than if the projected price and volatility factors were at their 2023 levels ($13.76 and 0.13). The relative cost reductions are slightly larger, around 12% in most cases, for soybean policies in Jefferson County.

Discussion

While the expected premium cost savings can be viewed positively, particularly given current projections for much lower return levels in 2024 compared with recent years (see our 2024 crop budgets and farmdoc daily from January 9, 2024), producers should also keep in mind that the revenue guarantees those premiums purchase are also going to be much lower than in 2023.

Using the Champaign County farm as an example, an 85% revenue guarantee at a $4.74 projected price and 200 bushel per acre TA-APH yield is $806 per acre (0.85 x $4.74 x 200 = $806), or roughly $200 less per acre than the $1,005 guarantee for the same policy at a price of $5.91 (0.85 x $5.91 x 200 = $1,005). In general, at current projected prices estimates, revenue guarantees available for corn policies will be 20% lower than in 2023. Guarantees will be 15% lower than for soybeans.

To increase insurance guarantees, producers may consider re-allocating the relative premium savings to alternative policy options with higher coverage in terms of revenue per acre. This could involve purchasing a higher individual plan coverage level, such as moving from 80% to 85%, if possible.

The supplemental area plans, SCO and ECO, might also be worth considering for 2024 to increase the amount of revenue coverage per acre. These can be used to increase the total coverage level to 86% (SCO), or as much as 90% or 95% (ECO). Policy combinations involving lower individual coverage with the supplemental plans can help generate more premium savings and/or result in similar total premium costs as higher individual coverage on its own. For example, shifting from 85% RP to 80% RP + SCO + ECO often results in comparable total premium cost. However, producers need to consider the basis risk implications of reductions in individual farm-level coverage and greater reliance on area-based coverage. Areas with greater yield risk are often associated with greater basis risk. Previous farmdoc daily articles from March 2, May 5, and May 6, 2021 provide more detailed discussion on these policy combination alternatives and basis risk in Illinois.

Summary

While projected prices and volatility factors will not be finalized until the end of the February price discovery period, lower corn and soybean prices seem very likely to result in lower farmer-paid premium costs for crop insurance policies for 2024 compared with 2023. On the one hand, lower premium costs will provide some welcome relief given much lower return projections for 2024. On the other hand, the lower prices and premiums also mean less coverage in terms of the revenue guarantees per acre that can be achieved at a given coverage level.

Producers should begin to take a look at their crop insurance options for 2024. Some farmers may consider re-allocating the relative premium savings in 2024 to increase total coverage via higher coverage levels on individual plans and/or use of the supplemental coverage options offered by SCO and ECO. Consideration of SCO, specifically, will need to be incorporated into producers’ commodity program decisions since eligibility is limited to acres enrolled in the Price Loss Coverage (PLC) program.

Updated versions of the farmdoc crop insurance tools are now available (Excel-based version here; web-based version here) to begin analyzing different crop insurance scenarios, and estimates of the resulting premium cost, for 2024.

References

Paulson, N. and J. Coppess. "2014 Farm Bill: The Supplemental Coverage Option." farmdoc daily (4):37, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 27, 2014.

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "The New Enhanced Coverage Option (ECO) Crop Insurance Program." farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Paulson, N. and G. Schnitkey. "Revised 2024 Crop Budgets." farmdoc daily (14):6, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 9, 2024.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Revenue Protection: The Most Used Crop Insurance Product." farmdoc daily (10):198, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 17, 2020.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "RP, ECO, and SCO Tradeoffs." farmdoc daily (11):29, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 2, 2021.

Tsay, J., N. Paulson and G. Schnitkey. "Supplemental Area Insurance and Basis Risk Measures: Part I." farmdoc daily (11):72, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 5, 2021.

Tsay, J., N. Paulson and G. Schnitkey. "Supplemental Area Insurance and Basis Risk Measures: Part II." farmdoc daily (11):73, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 6, 2021.

Zulauf, C., G. Schnitkey, J. Coppess and N. Paulson. "US Farm Commodity Insurance Program Trends." farmdoc daily (14):16, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 24, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.