Revised 2024 Crop Budgets

Illinois crop budgets for 2024 have been revised from their initial release in August (farmdoc daily, August 29, 2023). The main revision in the budgets is a reduction in the corn and soybean prices assumed for both 2023 and 2024, resulting in lower return and profitability projections. Current farmer return expectations are negative for both corn and soybeans across all regions for 2024 for cash rented land at average cash rent levels, suggesting cost adjustments will be needed in 2024 and beyond. As is always the case, actual returns can vary from projections made this early in the year.

Updated Crop Budgets

Updated 2023 and 2024 projections are provided in two publications in the Management section of farmdoc. The 2024 Crop Budgets are prepared for three regions – northern Illinois, central Illinois, and southern Illinois. Central Illinois is further broken out into budgets for high-productivity and low-productivity farmland. Budgets for all regions include projections for corn-after-soybeans, corn-after-corn, soybeans-after-corn, soybeans-after-soybeans, and wheat. A budget for double-crop soybeans is included for all regions except northern Illinois. The second publication – Revenue and Costs for Illinois Grain Crops – reports yearly revenues, costs, and returns of producing corn, soybeans, wheat, and double-crop soybeans by region of Illinois. These budgets represent averages regardless of the preceding crop and are summarized from farms enrolled in Illinois Farm Business Farm Management (FBFM) for the 2017 to 2022 crop years, while projections are provided for 2023 and 2024.

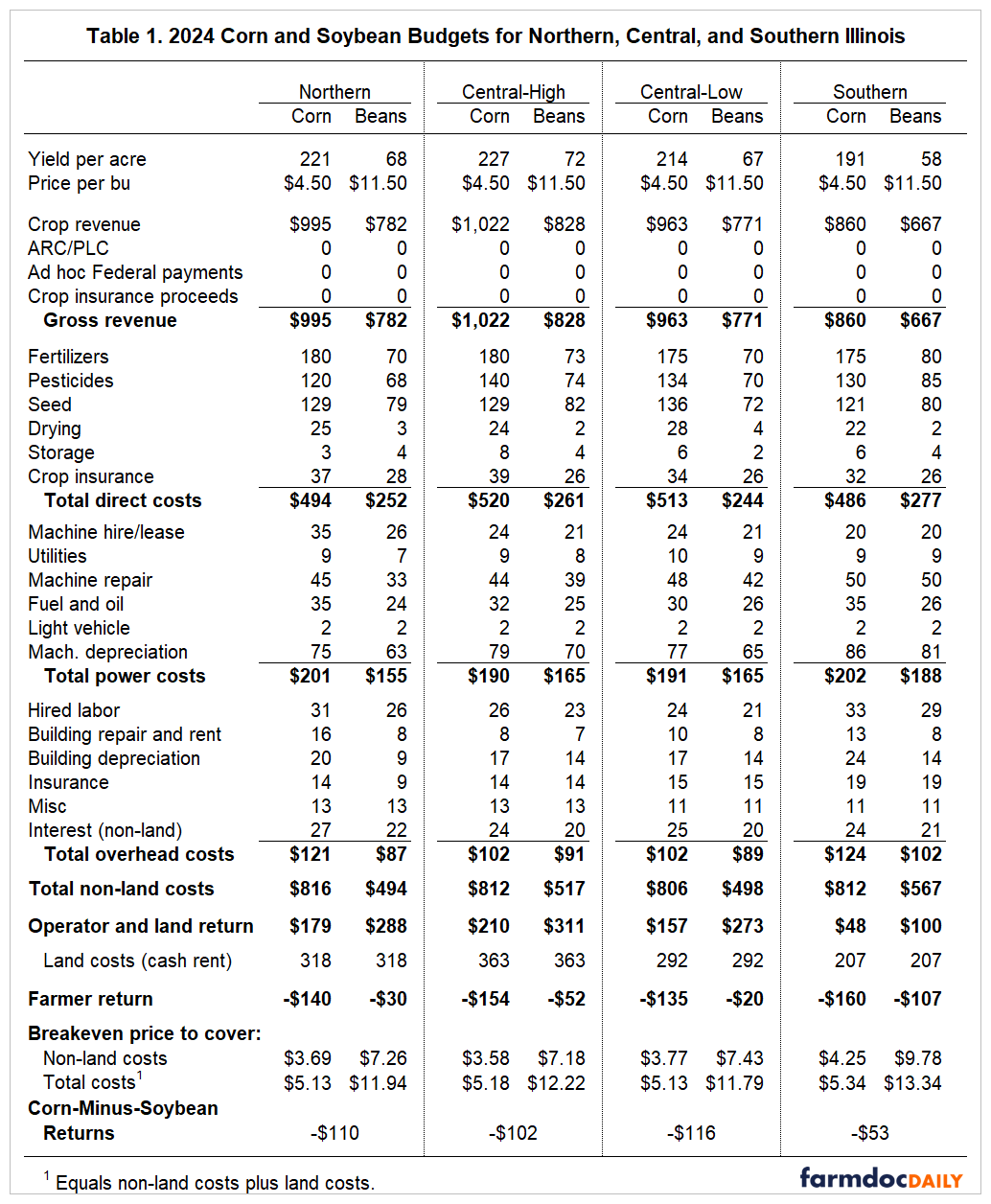

Table 1 provides the updated 2024 budget projections for corn and soybeans across the four regions of Illinois (northern, central high-productivity, central low-productivity, and southern).

These updated projections are based on the following updated assumptions:

- Projected 2024 prices of $4.50 per bushel for corn and $11.50 for soybeans. These are roughly consistent with fall grain bids as of early January, futures markets, and current projections from the USDA for the 2024/25 marketing year. These prices represent significant downward revisions from those used in the August budget release ($4.80 for corn, $12.80 for soybeans).

- Yields for 2024 are assumed to be at trend levels which come from estimates based on historical yields. Over time, corn yields have increased at an average rate of about 2.0 bushels per year while soybean yields have increased at a rate of about 0.5 bushels per year.

- Non-land costs are based on historical expenses on Illinois farms, adjusted and updated based on current and expected price levels for inputs.

- Reported land costs are based on projected average cash rents by region which rely on trends in historical data.

Operator and Land Returns

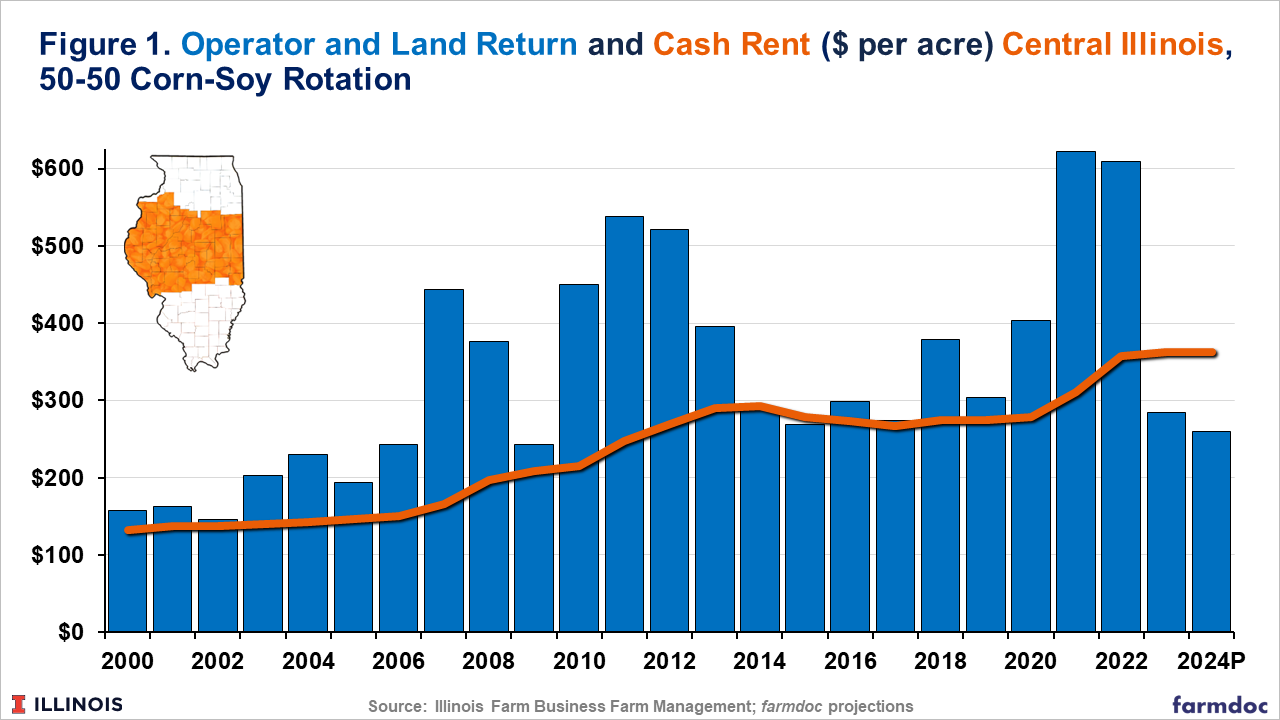

Operator and land returns represent the amount remaining for the farmer and land costs after paying all non-land costs. Operator and land returns are currently projected to return to levels experienced during the 2014 to 2019 period when commodity prices had declined from higher levels in the late 2000s and early 2010s (see Figure 1). Projected operator and land returns are below average cash rent levels in each region, resulting in negative farmer return levels.

Corn versus Soybean Returns

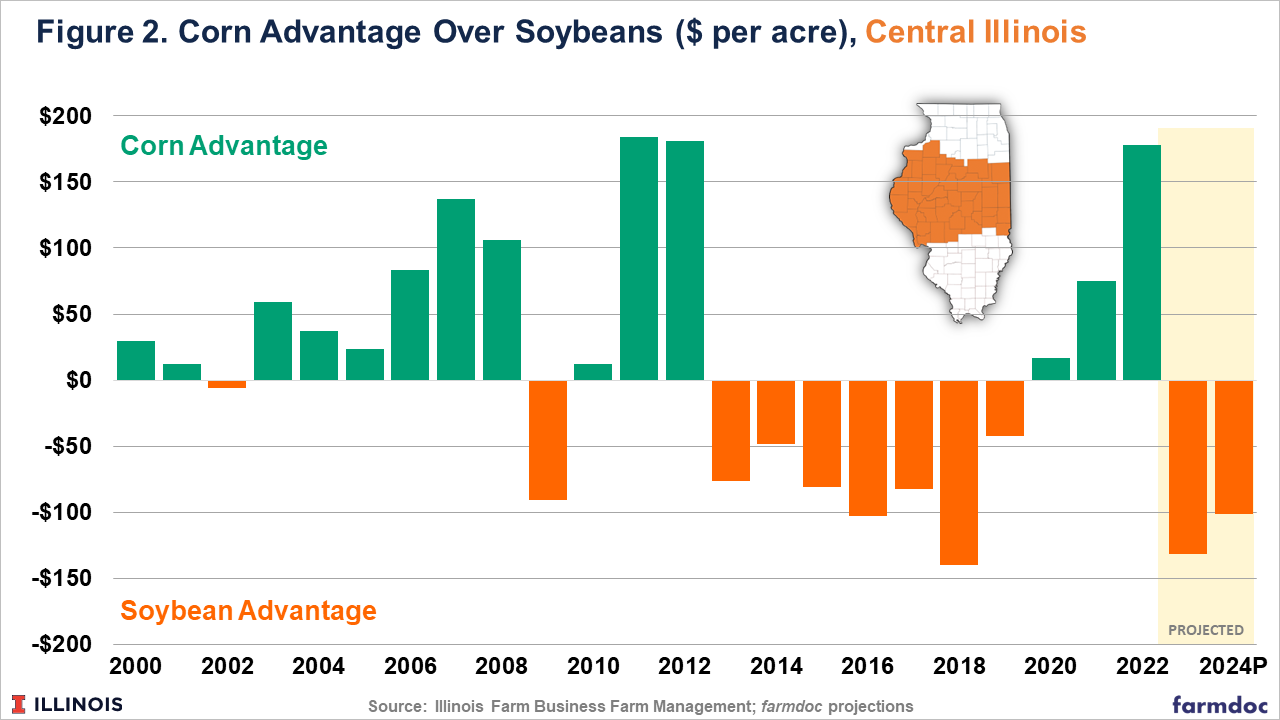

Figure 2 reports a historical comparison of corn and soybean returns for central Illinois. The bars represent corn minus soybean returns so that positive values (green bars) indicate an advantage to corn and negative values (orange bars) suggest an advantage for soybeans. Return projections for 2024 suggest a fairly significant advantage for soybeans of just over $100 per acre. Soybeans are projected to have an advantage across all regions – more than $100 per acre in northern Illinois and central Illinois low-productivity, and just over a $50 advantage for soybeans in southern Illinois.

Production Costs and Break-Even Prices

Recent articles have covered the increase in production costs for corn and soybeans in Illinois (farmdoc daily, September 26, November 14, December 5, and December 19, 2023). Non-land costs in central Illinois have increased from an average of around $600 per acre from 2014 to 2021 to more than $800 in 2022. Non-land costs are projected to be even higher for 2023, with a projected return to the $800 range for 2024 with the decline being driven mainly by expectations for lower fertilizer costs. Total costs (non-land plus average cash rent) in central Illinois have increased from an average of around $875 per acre from 2014 to 2021 to $1,166 in 2022. Total costs are projected to surpass $1,200 per acre for 2023 and decline back to 2022 levels for 2024.

Break-even prices to cover non-land and total costs in 2024 are reported towards the bottom of Table 1. Projected non-land production costs imply break-even prices for corn in the $3.60 to $3.80 range and soybeans in the $7.20 to $7.40 range for northern and central Illinois. Projected break-even prices to cover non-land costs for southern Illinois are even higher at $4.25 for corn and nearly $9.80 for soybeans. Break-even prices to cover total costs exceed $5 per bushel for corn in all regions, are around $12 per bushel for soybeans in northern and central Illinois, and exceed $13 per bushel for soybeans in southern Illinois.

Commentary

The January revisions to 2024 crop budgets for Illinois suggest negative average farmer returns to cash rented farmland for corn and soybeans in all regions of the state. For 2024, our projections do not include any commodity title payments (ARC/PLC) as price levels are above those that would trigger payments. Crop insurance payments are also not included as guarantees have not been set for 2024. Current futures price levels suggest significantly lower insurance prices and guarantees in 2024 than in 2022 and 2023. Additional commodity support may come in the form of disaster assistance programs, such as those in the Emergency Relief Program (ERP) which occurred for 2020, 2021, and 2022. Those payments would require additional legislative or administrative actions. While prices may increase, or support payments may occur, current projections suggest cost adjustments are needed to improve return levels.

The situation represents a much tighter margin environment than was experienced over the 2021 to 2022 crop years when return and income levels were excellent, reaching record levels in 2022. Lower corn and soybean prices create the need to identify areas to be more efficient from a production cost standpoint across all areas. While lower prices for fertilizer products, relative to the 2022 and 2023 crops years, provide some relief, lower corn prices in particular suggest that application rates should be revisited. For example, the Maximum Return to Nitrogen (MRTN) calculator can help illustrate how lower corn prices might suggest reduced application rates to optimize profitability.

Land costs are another potential target to attempt to reduce production costs. Negotiating lower cash rents can be difficult but can be aided by open communication between farmer tenants and landowners. Shifting to a variable cash lease design is another option which can result in return and risk sharing between the farmer and landowner that will adjust to market conditions through time (see farmdoc daily from September 20, 2022, and January 31 and October 24, 2023 for more information).

References

Paulson, N., G. Schnitkey, C. Zulauf, J. Colussi and J. Baltz. "The Rising Costs of Corn Production in Illinois." farmdoc daily (13):175, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 26, 2023.

Paulson, N., G. Schnitkey, C. Zulauf and J. Baltz. "Comparing Fixed Cash, Variable Cash, and Share Rents for 2024." farmdoc daily (13):195, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 24, 2023.

Paulson, N., G. Schnitkey, C. Zulauf and J. Colussi. "The Rising Costs of Soybean Production in Illinois." farmdoc daily (13):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 14, 2023.

Paulson, N., G. Schnitkey, J. Colussi and C. Zulauf. "Implications of Rising Power Costs for 2024." farmdoc daily (13):220, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 5, 2023.

Paulson, N., C. Zulauf, G. Schnitkey and J. Colussi. "Rising Overhead Costs Driven by Labor and Interest." farmdoc daily (13):230, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 19, 2023.

Schnitkey, G., C. Zulauf, N. Paulson, K. Swanson, J. Coppess and J. Baltz. "A Straight-Forward Variable Cash Lease with Revised Parameters." farmdoc daily (12):145, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 20, 2022.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Variable Cash Rental Arrangements in 2023." farmdoc daily (13):16, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 31, 2023.

Schnitkey, G., N. Paulson, C. Zulauf and J. Baltz. "2024 Crop Budgets." farmdoc daily (13):157, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 29, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.