The 2025 Crop Insurance Decision Tool: Lower ECO Farmer-Paid Premium

The 2025 Crop Insurance Decision Tool has been released to aid in crop insurance decisions. It is a Microsoft Excel workbook that can be downloaded from farmdoc (here). It provides farmer-paid premiums for different federally regulated policies administered through the Risk Management Agency. Using 2024 projected prices and volatilities, farmer-paid premiums for most policies would be similar to last year, except those related to the Enhanced Coverage Option (ECO). ECO’s premiums will be lower because of an increase in premium support.

2025 Crop Insurance Decision Tool

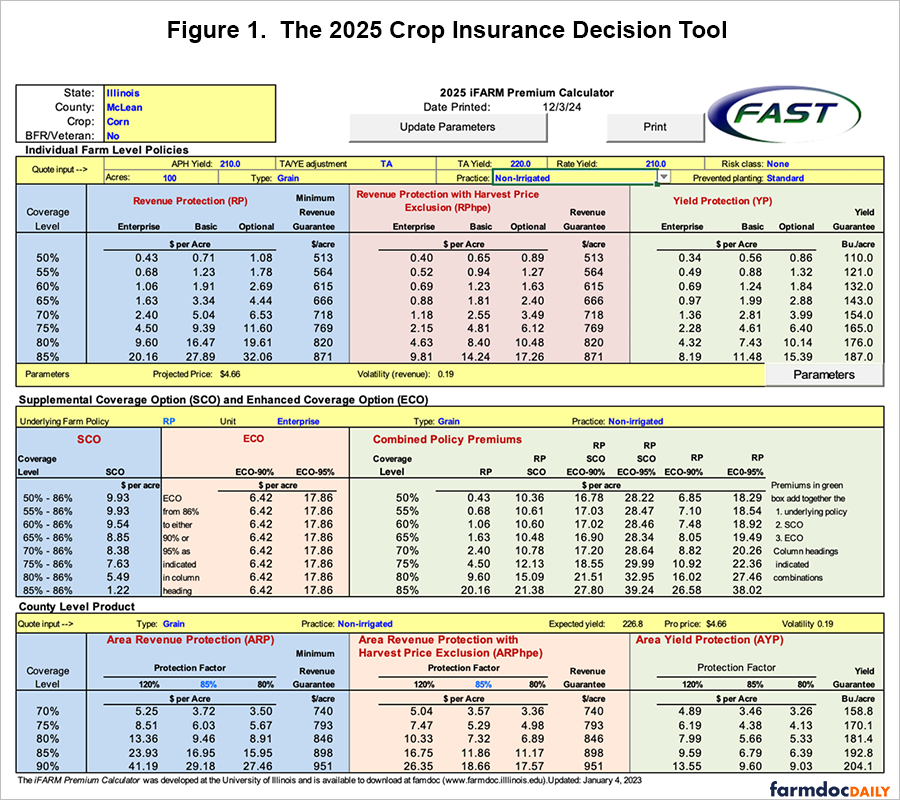

Figure 1 shows the premiums that are available from the 2025 Crop Insurance Decision Tool. Premiums shown in Figure 1 are calculated using 2025 rates released by the Risk Management Agency (RMA). These premiums are not final as projected prices and volatilities have yet to be set. Figure 1 uses the projected price and volatility for 2024. If the user wishes, the projected price and the volatility can be changed. When projected prices and volatilities are known at the end of February, premiums also will be known for 2025. By the March 15 deadline, farmers can change crop insurance choices from the previous year.

Users of the premium calculator can change items with blue text and yellow shading. All counties are available for states from the Great Plains east. Further description of the input into the premium calculator is available here in a January 19, 2021, farmdoc daily article.

2024 Premium Changes

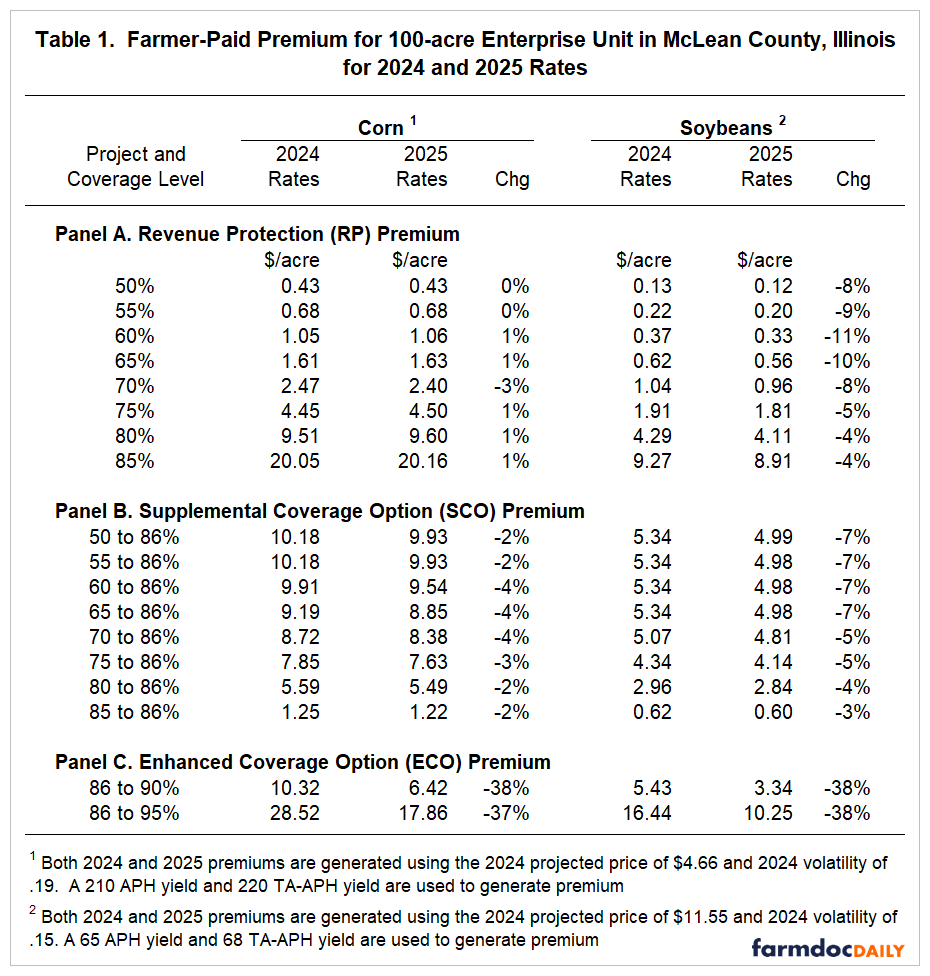

Table 1 shows farmer-paid premiums for 2024 and 2025 generated using the respective rates for McLean County, Illinois. For both years, the 2024 projected prices and volatilities are used.

Given the same projected prices and volatilities, farmer-paid premiums shown in Table 1 reflect changes in rates made by the Risk Management Agency (RMA) and changes in premium support levels. Panel A shows the premium for Revenue Protection (RP) policies. In McLean County, an RP policy at an 85% coverage leave will increase from $20.05 in 2024 to $20.16 in 2025, an increase of 1%. On the other hand, a soybean RP policy will decrease from $9.27 per acre in 2024 to $8.91 in 2025, a decrease of 4%. Corn premiums will increase in McLean County, and soybean premiums will decrease. Rate changes in other counties will vary from those. Overall, though, rate changes led to small dollar value changes in most Midwest states.

Panel B shows the Supplemental Coverage Option (SCO) premium (see farmdoc daily, February 17, 2014). SCO is a county-level coverage that can be added to the farm-level coverage offered by RP (more generally, a COMBO product plan, which also includes Yield Protection or RP with the harvest price exclusion). If RP is purchased at 70%, SCO will offer coverage from 70% up to 86%, denoted as “70% to 86%” in Panel A. An SCO product from “70% to 86%” coverage has an $8.72 per acre farmer-paid premium in 2024 and a $8.38 premium in 2025, a reduction of 4%. For McLean county, all SCO products associated with RP have premium reductions associated with lower rates.

The Enhanced Coverage Option (ECO) also provides county coverage from 86% to 90% or 95%. ECO has significant farmer-paid premium reductions from 2024. For example, ECO from 86% to 95% had a farmer-paid premium of $28.52 in 2024. In 2025, that premium declines to $17.86, a reduction of 37%. A similar reduction exists for soybeans. Those reductions occurred because premium support was increased from 44% of total premium to 65% of total premium (see farmdoc daily, November 5, 2024)

Summary

Farmer-paid premiums for 2025 can be generated using the recently released Crop Insurance Decision Tool. The most noticeable change resulting from ratings and premium support adjustments from 2024 will be lower ECO premiums. Given their lower premiums, farmers may wish to add ECO. A future article will evaluate situations in which it may be advisable to consider SCO and/or ECO coverage.

References

Paulson, N. and J. Coppess. "2014 Farm Bill: The Supplemental Coverage Option." farmdoc daily (4):37, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 27, 2014.

Schnitkey, G., R. Batts, K. Swanson, N. Paulson and C. Zulauf. "Release of the 2021 Crop Insurance Decision Tool." farmdoc daily (11):8, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 19, 2021.

Schnitkey, G., N. Paulson, C. Zulauf, B. Sherrick and B. Goodrich. "Impacts of Higher Premium Support Rates on ECO Performance." farmdoc daily (14):201, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 5, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.