The New Base Acre Provisions in the 2025 Farm Bill

This articles continues the discussion begun in the July 1, 2025 farmdoc daily of the new base acre provision in the 2025 Farm Bill. The provision is systematically laid out. Several implementation questions that USDA, FSA (US Department of Agriculture, Farm Service Agency) may need to address are noted. An indicator of new base acres is calculated for the US and states. “Indicator” rather than “estimate” is used given the implementation questions. The 30 million acre cap on new base acres will likely be exceeded, necessitating pro-rating of new base acres. States in the Plains and Midwest are likely to add the largest number of new base acres. States with few base acres are likely to have the highest percent increase. States with peanuts and rice will receive more payments from these high per acre payment crops. There appears to be something for nearly every state. Farms that currently have a close match between their planted and base acres stand to gain the least, and thus are relative losers among farms. And, the US taxpayer will need to finance the expected large increase in Federal outlays for commodity programs.

New Base Acre Provisions

Eligibility

- A current covered program commodity must have been planted some year during 2019-2023.

Calculating and Allocating New Base

- Planted acres must exceed September 30, 2024 total base acres of all covered commodities, excluding unassigned generic cotton base.

Planted acres of a FSA farm equal- 2019-2023 average, all years included, of acres planted or prevented from being planted to covered program commodities on the FSA farm; plus

- The lesser of

- 15% of total acres on the FSA farm or

- 2019-2023 average, all years included, of acres planted or prevented from being planted to eligible noncovered commodities on the FSA farm.

- Eligible noncovered commodity acres are acres planted or prevented from being planted to commodities other than covered commodities, trees, bushes, vines, grass, or pasture (including cropland that was idle or fallow), as determined by the Secretary of Agriculture.

- For an eligible FSA farm, new base acres equal [(planted acres from above) plus (unassigned generic cotton base) minus (total September 30, 2024 base acres)].

- No new program commodities are created. New base acres are allocated among current covered commodities planted on the FSA farm over 2019-2023 using the following ratio:

[(2019-2023, all years included, average of acres planted and prevented planted to a given covered commodity) to (2019-2023, all years included, average of total acres planted or prevented planted to all covered commodities on the FSA farm)]. - Other than under an established practice of double cropping covered commodities with FSA, an owner cannot include both covered commodities planted or prevent planted on the same acre. The owner must choose which one is used to calculate the 5-year average.

Limits

- A FSA farm’s total base acres cannot exceed its total acres.

- Added base acres for the US are capped at 30 million. If the cap is effective, an across-the-board, pro-rated reduction is applied to all new base acres.

PLC (Price Loss Coverage) Payment Yield of New Base Acres

- A FSA farm’s current PLC yield for a crop is used. If the farm has no PLC yield, average PLC yield for the county in which the farm is situated is used. If no county PLC yield exists, current FSA methods for this situation are used.

Implementation Questions

In our discussions concerning the new base acre provisions, the following questions emerged. Some may already have answers of which we are not aware.

- How are unassigned generic cotton base acres to be treated in determining eligible new base acres? Are they to be given preference and thus a new base acre even if the cap is effective? Or, are they added to eligible noncovered commodity acres?

- If an unassigned generic cotton base acre is planted to either a covered commodity or an eligible noncovered commodity, are both counted, making each generic acre eligible for two new base acres?

- Will base acres be added to farms that have no current base acres?

- How is “total acres on a farm” defined? It is not modified with any exclusions in the legislation. Is it restricted to planted acres or tillable (i.e. potential planted) acres? Does it include land in CRP? Does it include trees, bushes, vines, grass, and pasture? The latter are clearly excluded when determining acres planted to eligible noncovered program commodities.

- What is an eligible currently noncovered commodity? For example,

- How are acres in hay treated? Hay is often harvested multiple years after planting. Does an acre of hay count toward eligible noncovered crop acres only in the year it is planted or all years that it is harvested? The approach taken could establish a precedent for the addition of future crops that are harvested multiple years after planting.

- In the definition of eligible noncovered commodity acres, is the parenthetical phrase “(including cropland that was idle or fallow)” modifying “pasture,” in which case they are not eligible, or modifying “noncovered commodity acres”, in which case they are eligible?

- Are sugarcane and sugar beets eligible noncovered commodities? They currently have their own commodity support program but the legislative text does not exclude them as eligible noncovered commodities.

- Is tobacco an eligible noncovered commodity? If so, this would in essence undo the elimination of tobacco as a covered commodity in the 2002 Farm Bill, again raising the question, “Should the Federal Government subsidize the production of tobacco?”

- Are hemp or marijuana eligible noncovered commodities?

Calculation of New Base Acre Indicator

The only way to provide a reasonably accurate estimate of new base acres is to know how FSA will answer the numerous implementation questions that exist, such as the ones noted in the preceding section. However, to provide perspective on the importance of this 2025 Farm Bill provision, we calculate an “indicator” of new base acres. We are reluctant to call it an “estimate.”

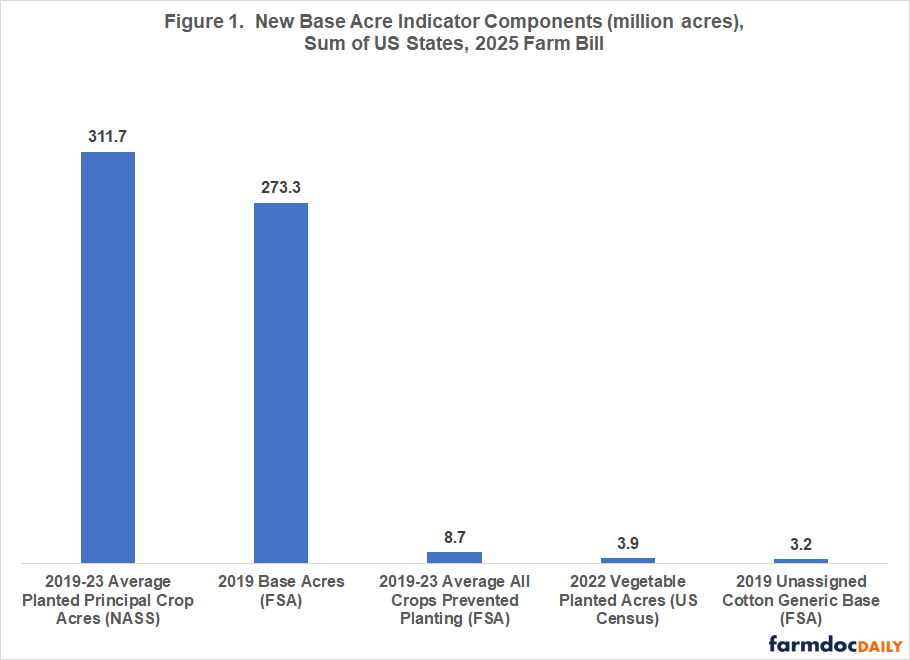

Figure 1 presents the components we used to calculate the indicator. Acres not in “trees, bushes, vines, grass, and pasture” are assumed to equal acres planted to principal crops reported by USDA, NASS (National Agricultural Statistics Service) plus all acres prevented from being planted reported by USDA FSA plus land planted to vegetables reported in the 2022 Census of Agriculture (see Data Note 1). Principal crops include tobacco, sugar cane, and sugar beets (see Data Note 2). Base acres are for the 2019 crop year. Unassigned generic cotton base acres are added to our calculation of acres not in “trees, bushes, vines, grass, and pasture.” CRP acres are not included in any of our calculations.

New base acres are first calculated without the “15% limit of total farm acres”. This calculation is:

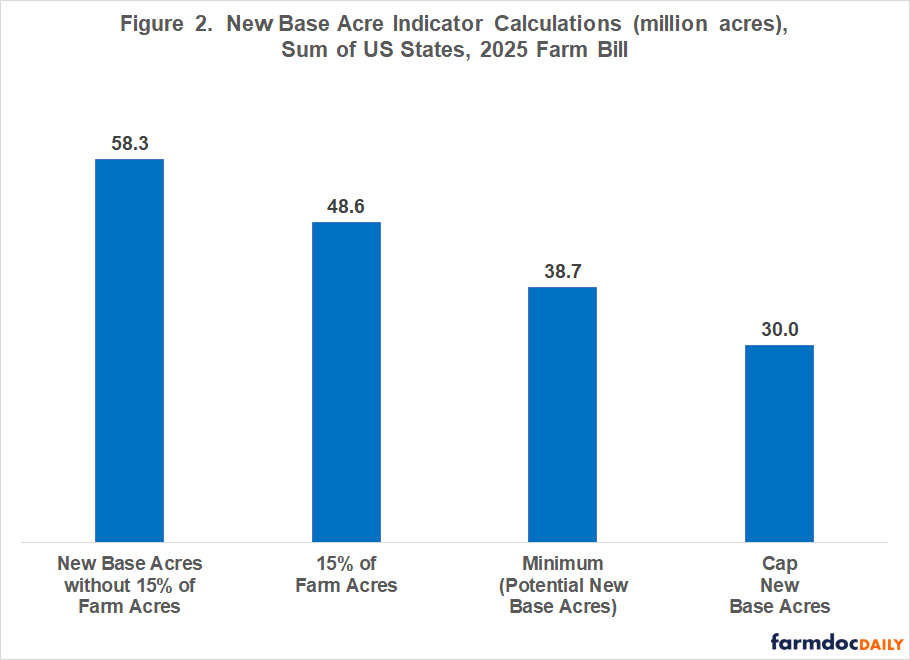

[(principal crop acres plus prevented planted acres plus vegetable acres plus unassigned cotton generic base acres) minus (base acres minus unassigned cotton generic base acres)].It is made by state. The sum across the 50 states is 58.3 million acres (see Figure 2).

We assume total acres on a farm equal the sum of acres that could become new base acres, i.e. acres planted or prevent planted to current covered commodities and to eligible noncovered commodities. They are further assumed to equal principal crop acres plus prevented planted acres plus land in vegetables. Applying 15% to this sum by state results in 48.6 million acres across the 50 states.

Taking the smaller of the two calculations described in the two preceding paragraphs by state results in 38.7 million acres. This is our indicator of potential new base acres. It is larger than the 30 million acre cap on new base acres. A pro-rating factor of 77.49% (30/38.7) is applied to the 38.7 million acres of potential new base by state to end up with 30 million acres of new base.

New Base Acre Indicator by State

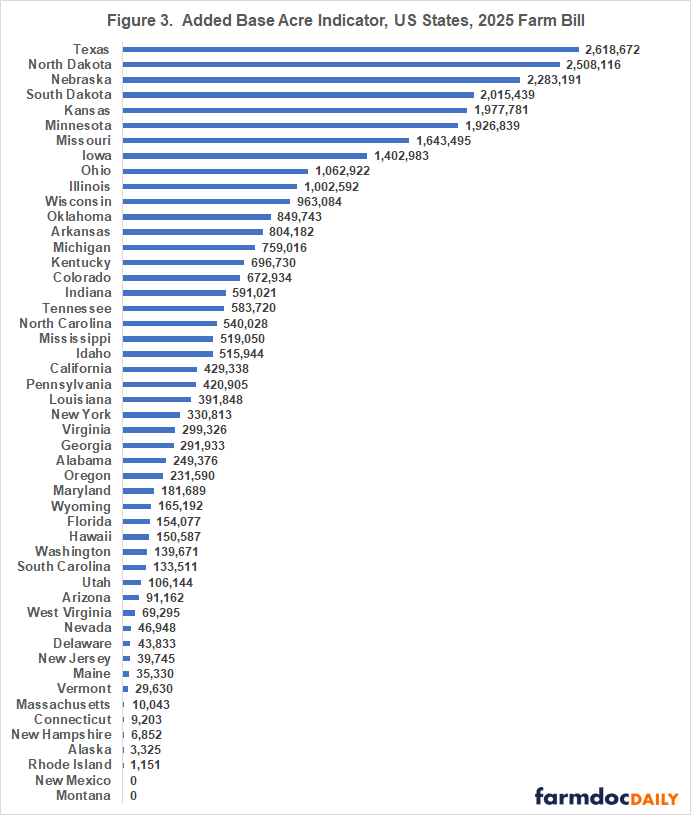

The five states with the largest number of indicated new base acres are located in the US Plains (see Figure 3). Taken together, Texas, North Dakota, Nebraska, South Dakota, and Kansas account for 38% of the indicated new base acres. The next five largest states are in the Midwest Corn Belt. Taken together, Minnesota, Missouri, Iowa, Ohio, and Illinois account for 23% of the indicated new base acres. In total, the top 10 states have a 61% share of indicated new base acres. Montana and New Mexico have no indicated new base acres. Their base acres, excluding unassigned generic cotton base, exceed the sum of their principal crop, prevented planted, vegetable, and unassigned generic cotton base acres. These two states will, however, have added base acres because some individual farms in each state will have eligible base acres that exceed their current base acres.

Percent New Base Acre Indicator by State

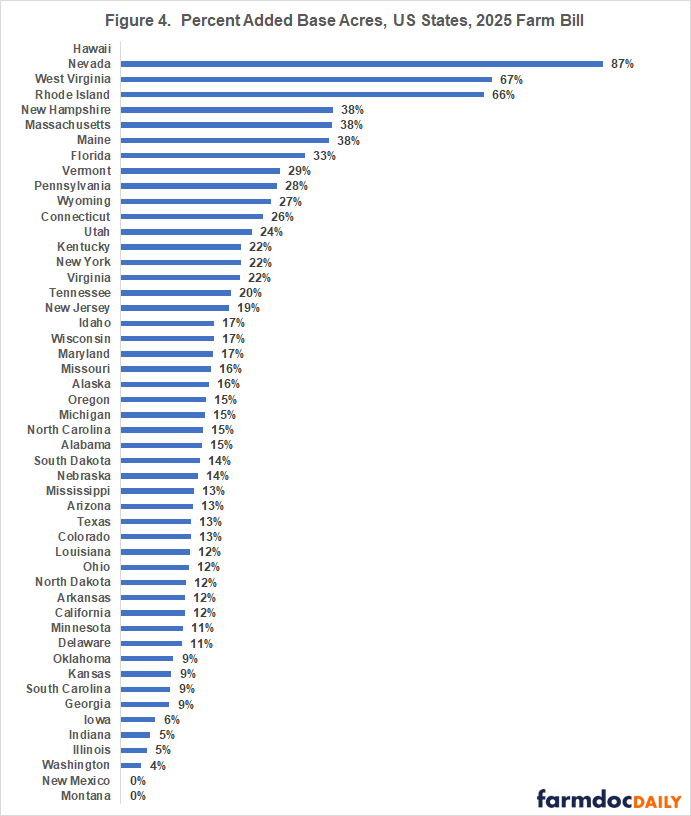

A different perspective emerges if the indicated new base acres are expressed as a percent addition to existing base, including unassigned generic cotton base. States with smaller current base acres have the largest percent increases (see Figure 4). Among the 10 states with the largest number of indicated new base, Missouri has the highest percent increase at 16%. Next highest is 14% for South Dakota and Nebraska. Smallest percent increase among the 10 states is Illinois at 5%, with Iowa at 6%. A percent increase could not be computed for Hawaii because it has no current base acres.

Policy Discussion

The new base acre provision in the 2025 Farm Bill is arguably its most important provision because it is a major expansion of commodity program payments to current noncovered crops and thus a major expansion of the footprint of commodity programs. It rebalances to some degree the government payment incentive to plant current program crops (farmdoc daily February 24, 2025).

If the 30 million cap is effective, as this study suggests it will be; the history of government programs, not just farm programs, suggests Congress will eventually add base acres for over-cap acres. Moreover, it is reasonable to speculate that this is the first step in expanding commodity programs to all US crop acres.

The new crop base acre provision creates no new covered program commodities. New base acres are assigned to current covered commodities, which will increase their base acres even when a crop’s base acres currently exceed the crop’s planted acres. As such, the wedge between base and planted acres is increased. The question of creating new program commodities could emerge in the future if the cost of commodity programs becomes an issue and if creating new covered commodities notably reduces cost.

The preceding also implies that, because payments have varied considerably across current covered commodities, a state’s gain from new base acres will depend on their current program crops. Using data from FSA for the 2014-2023 crop years, commodity program payment per base acre per year averaged $108 for peanuts and $85 for long grain rice vs. $14 for corn and $5 for soybeans.

Each of the main farm program areas gain something from the new base acre provision. Plains and Midwest states benefit from a larger number of new base acres. States with peanuts and long grain rice base benefit from more base acres in high paying crops. Small base acre states benefit from a higher percent increase in base acres. Finally, commodity programs are expanded to some current non-program crops. There appears to be something for every state.

The US taxpayer will need to finance the expected large increased in Federal outlays for commodity programs (farmdoc daily May 22, 2025). Farms that currently have a close match between their planted and base acres stand to gain the least, and thus are relative losers among farms. This is particularly true for farms with a notable share of base acres in corn since corn has one of the smallest increase in statutory reference price (farmdoc daily May 22, 2025). It is not clear how many farms are in this situation, but it may not be a small number since current corn base is roughly 95 million. The history of farm policy suggests future farm bills will try to balance this imbalance in some way. One potential way is to make FSA farms that add no new base acres eligible for updating their PLC payment yield.

Data Notes

- The US Census of Agriculture reports multiple vegetable crops planted on the same acre in a given year as only one acre of land in vegetables.

- Principal crops are barley, canola, chickpeas, corn, cotton, dry edible beans, hay, oats, peanuts, potatoes, proso millet, rice, rye, sorghum, soybeans, sugar beets, sugarcane, sunflower, tobacco, and wheat. Harvested acres are used for hay, sugarcane, and tobacco. Acres include acres of unharvested small grains planted as cover crops and double cropped acres.

References and Data Sources

Coppess, J., G. Schnitkey, C. Zulauf and N. Paulson. “Reviewing the CBO Score of the House Reconciliation Bill.” farmdoc daily (15):95, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 22, 2025.

US Department of Agriculture, Farm Service Agency. June 2025a. ARC/PLC Program Data. https://www.fsa.usda.gov/programs-and-services/arcplc_program/arcplc-program-data/index

US Department of Agriculture, Farm Service Agency. June 2025b. Crop Acreage Data. https://www.fsa.usda.gov/news-room/efoia/electronic-reading-room/frequently-requested-information/crop-acreage-data/index

US Department of Agriculture, National Agricultural Statistics Service. June 2025. QuickStats. http://quickstats.nass.U.S.da.gov/

Schnitkey, G., C. Zulauf, N. Paulson and J. Coppess. “Reconciliation Bill Proposals to Add Base Acres.” farmdoc daily (15):120, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 1, 2025.

Zulauf, C., D. Orden, J. Coppess, G. Schnitkey and N. Paulson. “Are US Commodity Program Payments Impacting Planted Acres?” farmdoc daily (15):35, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 24, 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.