Should US Growers Look to Africa as the Next Big Market? Selected Import Markets for Soybeans, Meal, and Oil

Introduction

The Soybean Innovation Lab (SIL) introduces readers to the question whether Sub Saharan Africa (SSA) presents a new market opportunity for US soybean growers. This article wraps up a three-part series on the topic of Africa as a potential export market for US soybeans. The African market presents a very complex landscape. While it is large, diverse, and growing rapidly, there exists great uncertainty, significant business risks, and demand for soybean and associated products are just beginning to emerge.

This first article in the series focused on the larger food and oil trends dominating the African continent (see farmdoc daily from November 13, 2025). The second article delved into the import flows of soybean, oil, and meal into Africa (see farmdoc daily from November 19, 2025). Today’s third and final article discusses four specific country examples – Egypt, Ghana, Nigeria, and Tanzania – touching on their imports of soy and soy products, logistics infrastructure, and existing policies on genetically modified soybean imports. We also include a list of additional readings on the subject of food and agricultural trade and Africa.

Import Markets for Soybeans, Meal, and Oil

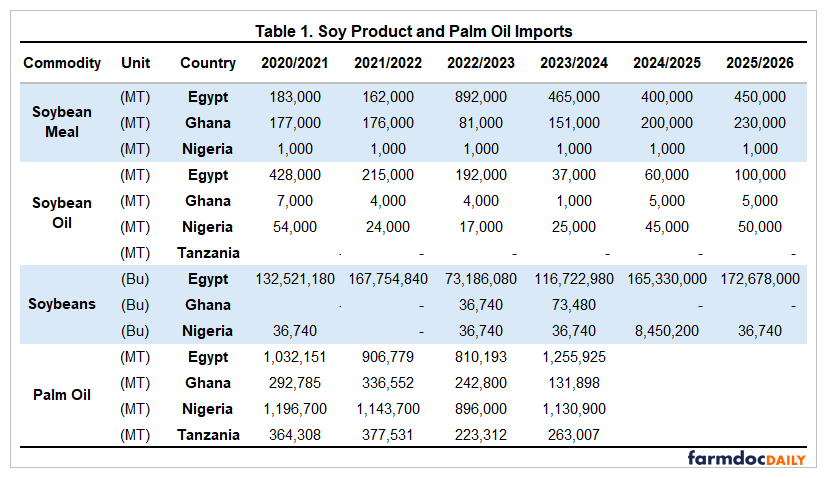

Egypt

Since 2020 soybean import demand in Egypt has been rising at a compound annual growth rate (CAGR) of 4.5% and now amounts to over 172 million bushels a year (Table 1). Import growth will continue to be driven by an influx of foreign currency and growing domestic demand for soy ingredients and soy-based products. U.S. soybeans accounted for almost 70% of Egypt’s total soybean imports over the past five years and that is likely to continue due to the freight advantage over South America.

Soybean oil and meal import demand are relatively minimal and reflect Egypt’s commitment to domestic crush. Local processors supply the Egyptian market with approximately 850,000 metric tons of soybean oil and 3.7mmt of soybean meal. Soybean oil imports amount to 8% of palm oil imports, which are 1,255,925 metric tons, and 47% larger than domestic soy oil output.

Egypt charges no import tariffs on raw oilseeds like soybeans, sunflower seed, and palm kernel, but there are 5% tariffs on oilseed meal and cake, and 2% tariffs on soybean and sunflower seed oil. There are no tariffs on crude cottonseed and palm oil (Morgan, 2025). Egypt’s major ports, Alexandria (including El Dekheila), Damietta, and the ports within the Suez Canal Economic Zone, are critical for handling the nation’s grain and dry bulk imports.

Nigeria

Domestic consumption of soybeans in Nigeria continues to increase. Nigeria’s crush capacity has expanded to 875,000 metric tonnes annually, about 19% of Egypt’s capacity, and is expected to continue to grow. With a strong demand for animal feed, and edible oils, Nigeria’s demand for soybeans is estimated to be over 99 million bushels annually, or 57% of Egyptian soybean imports, significantly outstripping domestic crush capacity. A soybean oversupply situation of 46% with respect to domestic crush has Nigeria currently importing almost no raw soybeans or soybean meal, and importing 50,000 mt or 22% of its domestic soybean oil needs (Bielecki, 2024a). Soybean oil imports amount to 4% of palm oil imports, which are approximately 1.1 mmt.

Nigeria’s imports are largely limited by the availability of hard currency, which is strictly controlled by the government. Generally, Nigeria imposes high tariffs and other trade restrictions on many oilseed products, primarily to protect local producers and manage foreign exchange reserves. The specific tariffs and import eligibility have been more flexible with raw, rather than processed, oilseed imports, particularly to address food shortages and supply chain issues.

Nigeria has several major seaports that handle grain and dry bulk commodities, with the busiest terminals located in Lagos. However, port congestion, inefficient operations, and aging infrastructure have historically presented challenges, though concessioning of terminals and new ports like Lekki aim to improve efficiency.

Ghana

Ghana imports almost no raw soybean and very little soybean oil (~5,000 mt). Meal imports at 230,000 mt are equivalent to 10.8 million bushels of grain. Soybean oil imports amount to only 4% of Ghana’s palm oil imports, which total 132,000 mt, or almost 27 million bushels of soybean grain equivalent.

According to a May 2023 USDA report (Taylor, 2023), Ghana’s import tariff regime for soybeans is described as unfavorable and this has kept imports low. An import VAT duty is applied to the Cost Insurance Freight (CIF) value, and other taxes and levies are then calculated based on the CIF value plus the import duty, creating a cumulative rate that can exceed 23% in many cases. Ghana’s primary commercial ports are Tema and Takoradi. Recent upgrades have increased capacity at both ports for various cargo types.

Tanzania

Tanzania has limited oilseed processing facilities, most of which is crushing local sunflower production. Domestic production of oilseed cannot meet domestic demand, therefore the country has historically relied on imports from neighboring countries like Zambia and Malawi, although these can be subject to supply chain disruptions due to poor roads (Koster, 2025).

The Tanzania feed market annually needs approximately 135,000 mt of soybean meal, or 173,000 mt of grain equivalent, primarily for poultry. The largest imported supplies come from Zambia, followed by India and Malawi (Koster, 2025). With Tanzania ports being located on the eastern coast of Africa, the country is at a freight disadvantage for trade with the U.S.

Tanzania’s annual demand for edible oils is around 570,000 mt, while the domestic processors supply only 31% of demand or 180,000 mt, leading to a substantial import dependency (Koster, 2025). Most of the domestic oil production comes in the form of sunflower oil as the nation only produces 1.9 million bushels of soybean or 1.2% of domestic edible oil demand. Imported oil fills the gap and comprises no soy and 287,000 mt of palm oil or about 50% of national annual demand for edible oil.

Tanzania applies a 10% customs duty on crude soybean oil, which was recently introduced to align with duties on other crude oils like sunflower and cotton seed. Tanzania’s primary port for handling grain and dry bulk cargo is the Port of Dar es Salaam, which manages about 95% of the country’s international trade.

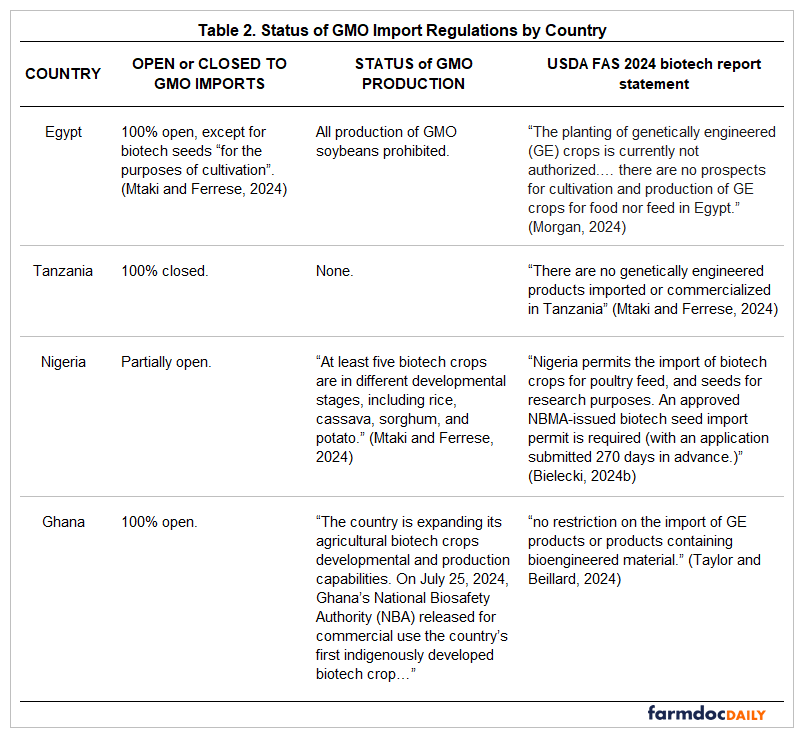

The State of GM Regulations across Four Selected Countries in Africa

Although GM (genetically modified) crops were initially regarded as a technological blessing for reducing food insecurity, many African countries have created regulatory barriers, either to their importation or to their domestic production. And these regulations in Africa “vary widely in their approaches, ranging from cautious approval to outright prohibitions” (Mmbando, 2024). “Countries like Kenya have embraced GMOs for food security, while others, such as Tanzania and Uganda, remain cautious and in opposition. The regulatory challenges, coupled with infrastructural and economic barriers, continue to hinder widespread adoption in the region” (Escasura, 2025).

Egypt allows the importation of 100% of biotech crops except for seeds used for cultivation (Table 2). Currently, Egypt has strict rules against planting genetically modified (GMO) soybeans, but allows their importation for animal feed, provided they are approved for consumption in the country of origin. The country has been considering an end to its ban on growing GMOs due to factors like grain prices, but a lack of a comprehensive biosafety law and public opinion have slowed progress.

Ghana is open to GM imports whether that be grain or seed. Ghana’s parliament in 2011 passed legislation to allow the use of GMO technology in agriculture. With their open stance toward biotech crops, the country has increased its production capabilities. Ghana’s National Biosafety Authority (NBA) recently approved the commercialization of 14 new genetically modified products comprising eight maize events and 6 soybean events (Taylor and Beillard, 2024).

Nigeria places more restrictions on grain imports compared with Egypt and Ghana. It permits the import of biotech crops for Biotechnology and Other New Production Technologies Annual poultry feed, and seeds for research purposes. An approved NBMA-issued biotech seed import permit is required and needs to be submitted 270 days in advance. There are currently five biotech crops in different developmental stages, including rice, cassava, sorghum, and potato. A Bt corn product called Tela Maize has been registered and commercially released in Nigeria (see https://sciencenigeria.com/tela-maize-transforming-lives-of-nigerian-farmers/ ).

Tanzania maintains the most stringent GM regulations of the four where no GM products may be imported or commercialized in the country. While the country allows limited, contained research and has the legal framework for GMO approval, the stringent liability requirements for any potential harms have prevented the commercial release of any GM agricultural products.

References

Goldsmith, P., G. Allen and M. Doherty. "Should US Growers Look to Africa as the Next Big Market? Understanding Africa’s Food and Oil Demand Trends." farmdoc daily (15):210, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 13, 2025.

Goldsmith, P., G. Allen and M. Doherty. "Should US Growers Look to Africa as the Next Big Market? Understanding Africa’s Soy Import Demand." farmdoc daily (15):214, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 19, 2025.

Morgan, J. 2025. "Oilseeds and Products Annual - Egypt." USDA FAS Global Agricultural Information Network. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds+and+Products+Annual_Cairo_Egypt_EG2025-0013.pdf

Bielecki, C. 2024a. "Oilseeds and Products Annual - Nigeria." USDA FAS Global Agricultural Information Network Report: NI2024-0006. April 17, 2024. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds%20and%20Products%20Annual_Lagos_Nigeria_NI2024-0006

Taylor, J. 2023. "Ghana Oilseeds Voluntary 2023." USDA-FAS Report GH2023-0006. May 15, 2023. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Ghana+Oilseeds+Voluntary+2023_Accra_Ghana_GH2023-0006.pdf

Koster, H. 2025. Personal communication. Koster Trading & Consulting. October 22, 2025.

Mmbando, G. 2024. “The adoption of genetically modified crops in Sub‑Saharan Africa: challenges, opportunities, and regulatory considerations for sustainable agricultural development.” GM Crops Food. 15(1):1–15.

Escasura, J.C. 2025. “Policies After Promises: Challenges and Opportunities in GM Crop Adoption in Sub-Saharan Africa.” Science Speaks blog by ISAAA. July 23. https://www.isaaa.org/blog/entry/default.asp?BlogDate=7/23/2025

Taylor, J. & Beillard, M.J. 2024. “Agricultural Biotechnology Annual – 2024.” USDA FAS GAIN Ghana Report: GH2024-0012. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Agricultural%20Biotechnology%20Annual_Accra_Ghana_GH2024-0012

Mtaki, B. & Ferrese, D. 2024. “Biotechnology and Other New Production Technologies Annual.” USDA FAS GAIN Tanzania Report: TZ2024-0006. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Biotechnology+and+Other+New+Production+Technologies+Annual_Dar+Es+Salaam_Tanzania_TZ2024-0006.pdf

Morgan, J. 2024. “Biotechnology and Other New Production Technologies Annual Country Annual.” USDA FAS GAIN Egypt Report: EG2024-0027. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Biotechnology%20and%20Other%20New%20Production%20Technologies%20Annual_Cairo_Egypt_EG2024-0027.pdf

Bielecki, C. 2024b. “Biotechnology and Other New Production Technologies Annual.” USDA FAS GAIN Nigeria Report: NI2024-0016. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Biotechnology%20and%20Other%20New%20Production%20Technologies%20Annual_Lagos_Nigeria_NI2024-0016.pdf

Appendices

A Reference List of Relevant Literature Focused on Food and Agriculture Trade in Africa

Biotechnology

- Giddings, L. V., Atkinson, R. D., & Wu, J. U. (2017). Suppressing growth: how GMO opposition hurts developing nations. Washington: Information Technology and Innovation Foundation, 2016.

- Ngongolo, K., & Mmbando, G. S. (2025). Adoption of genetically modified crops in Sub-Saharan Africa: challenges, opportunities, and regulatory considerations for sustainable agricultural development. Discover Sustainability, 6(1), 641.

Demographics

- Cockx, L., Colen, L., De Weerdt, J., & Gomez Y Paloma, S. (2019). Urbanization as a driver of changing food demand in Africa: evidence from rural-urban migration in Tanzania. European Commission, Joint Research Centre (JRC), Seville, Spain

- Cohen, B. (2004). Urban growth in developing countries: a review of current trends and a caution regarding existing forecasts. World development, 32(1), 23-51.

- Linard, C., Tatem, A. J., & Gilbert, M. (2013). Modelling spatial patterns of urban growth in Africa. Applied Geography, 44, 23-32.

Food and Agriculture

- Enilolobo, O. S., Babalola, B. A., Nnoli, I. T., Ajibola, A. A., & Okere, W. (2022). Food security in Africa: The role of agricultural import and export. African Journal of Housing and Sustainable Development, 3(1).

- Falcon, W. P., Naylor, R. L., & Shankar, N. D. (2022). Rethinking global food demand for 2050. Population and Development Review, 48(4), 921-957.

- Jayne, T. S., & Sanchez, P. A. (2021). Agricultural productivity must improve in sub-Saharan Africa. Science, 372(6546), 1045-1047.

- Mwangi, E. N. (2021). Determinants of agricultural imports in Sub-Saharan Africa: A gravity model. African Journal of Economic Review, 9(2), 271-287.

- Rakotoarisoa, M., Iafrate, M., & Paschali, M. (2011). Why has Africa become a net food importer (Vol. 10). Rome, Italy: FAO.

- Simola, A., Boysen, O., Ferrari, E., Nechifor, V., & Boulanger, P. (2022). Economic integration and food security–The case of the AfCFTA. Global Food Security, 35, 100651.

- Wudil, A. H., Usman, M., Rosak-Szyrocka, J., Pilař, L., & Boye, M. (2022). Reversing years for global food security: A review of the food security situation in Sub-Saharan Africa (SSA). International Journal of environmental research and Public Health, 19(22), 14836.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.