Price vs. Revenue Farm Safety Net

Introduction

An issue of disagreement during the 2012 Farm Bill debate is whether the farm safety net should focus on revenue or price. Until the ACRE program was enacted in the 2008 Farm Bill, farm programs focused on price. This article compares price and revenue programs, focusing on the key role played by the correlation between changes in price and changes in yield. The examination finds that converting to a revenue based farm safety net likely will likely increase the effective risk management provided by the farm safety net and will likely result in more support being provided to Southern crops.

Importance of Price-Yield Correlation

It is common to think of revenue per acre as (price times yield). However, this perspective is not appropriate if the objective is to manage risk. Risk management seeks to manage the negative impacts of changes. The risk of a negative change in revenue depends not only on the risk of an adverse change in price or yield, but also on the correlation between the changes in price and the changes in yield. The price-yield correlation is important to understanding both the management of revenue risk and the design of public policy to help farmers manage risk.

Figure 1 presents the correlation between year-to-year percent changes in average U.S. yield per planted acre and year-to-year changes in average U.S. price over the 1973 through 2006 crop years for barley, corn, upland cotton, oats, peanuts, rice, sorghum, soybeans, and wheat. Planted acres for corn and sorghum are adjusted for acres harvested for silage. Yield per harvested acre is used for oats because oats is often planted as a cover crop. The 1973-2006 crop seasons are analyzed because prices were stationary over this period. Stationarity is an important consideration to maintain the validity of statistics calculated over time.

The price-yield correlations vary substantially among the crops, ranging from -0.21 for upland cotton to -0.78 for soybeans (see Figure 1). A negative correlation means that year-to-year percent changes in U.S. average price and U.S. average yield are inversely related: if yield increases, then price usually decreases, and vice versa. The closer a correlation is to -1, the more closely the percent changes in price and yield are related to each other. The higher negative correlations for U.S. soybeans and feed grains (corn, sorghum, barley, and oats) were expected because of the importance of these U.S. crops in world trade. The price-yield correlations are lowest for the crops associated with the U.S. South. In addition, the correlations for soybeans, sorghum, oats, and corn are different than the correlations for peanuts and upland cotton at the 95% statistical confidence level. Ninety-five percent is a commonly-used statistical test level.

It is possible that these correlations have been influenced by U.S. farm programs that existed over the 1973-2006 analysis period. Since U.S. farm programs are different today and will likely change in the future, this constraint on any analysis that uses historical U.S. data for crops needs to be kept in mind. Because of this concern, several alternative analyses were conducted. The results of these analyses, particularly the relative ordering of values across crops, generally held.

Price Variability vs. Revenue Variability

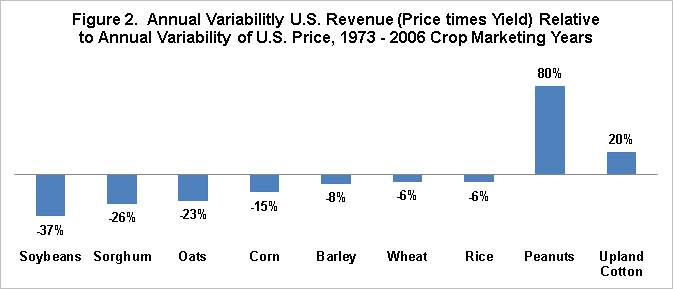

Even though the variability of revenue includes the variability of yield as well as the variability of price, a large enough negative correlation between price and yield changes can result in the variability of revenue being less than the variability of price. This situation is often referred to as the “natural hedge.” U.S. revenue is less variable than U.S. price for all the crops examined in this study except for peanuts and upland cotton (see Figure 2). Variability in Figure 2 is measured as the percent difference between the standard deviation of the year-to-year percent changes in revenue and price. Standard deviation is a commonly-used measure of risk. To illustrate the interpretation of the values in Figure 2, standard deviation of the year-to-year percent changes in U.S. revenue for soybeans (12%) was -37% less than the standard deviation of the year-to-year percent change in the U.S. price of soybeans (19%). (Calculation: -37% = (1-(12%/19%))

Comparing Figures 1 and 2 reveals the expected relationship: the more negative is the U.S. price-yield correlation, the less variable is U.S. revenue relative to U.S. price. For example, soybeans and sorghum have the most negative yield-price correlation and the lowest U.S. revenue variability relative to U.S. price variability. On the other hand, upland cotton and peanuts have the lowest yield-price correlation. They are also the only two crops in this study for which U.S. revenue variability exceeded U.S. price variability.

Peanuts stand out as a deviation from the generally consistent relationship between the price-yield correlation in Figure 1 and the variability of revenue relative to price in Figure 2. A key reason is the 1980 crop year. U.S. average yield per planted acre of peanuts declined by 53% from the yield for 1979, then rebounded by an almost identical 55% in 1981. The next highest year-to-year yield decline was 26% in 1993. Eliminating 1980 from the analysis reduced the difference in revenue variability relative to price variability for peanuts from 80% to 39%, or by half.

Policy Implications

The correlation between price and yield and the resulting impact on revenue vs. price variability has important implications for farm policy. One implication is that a revenue program with identical parameters to a price program should be less costly. The reason is the high negative price-yield correlation for soybeans and corn. These two crops account for over 50% of all U.S. crop acres.

This implication is examined by using the parameters specified in the Senate Farm Bill for the County Agricultural Risk Coverage (ARC) program and applying them to a program for U.S. revenue and U.S. price. Thus, per acre payment from a Revenue ARC program equals: [(89% times 5-year Olympic moving average of U.S. price times 5-year Olympic moving average of U.S. yield) minus (U.S. yield times U.S. price for the crop year)]. Per acre payment from a Price ARC program equals: {[(89% times 5-year Olympic moving average of U.S. price) minus (U.S. price for the crop year)] times (5-year Olympic moving average of U.S. yield)}. The revenue payment per acre and price payment per unit of crop are capped at 10%. Payment is made on 80% of planted acres. Payments are estimated at the U.S. national level over the 1978 to 2006 crop year. The reason for starting with 1978 instead of 1973 is that a 5-year Olympic average is calculated of U.S. price and U.S. yield.

For the 9 crops examined in this study, payments from the Price ARC program totaled $22.7 billion over the 1978-2006 crop years (see Figure 3). In comparison, payments by the Revenue ARC program totaled $18.5 billion, or 18% less. Thus, as expected, payments from the revenue program were less than payments from a price program with identical parameters.

However, farm bills work with a budget constraint and it is reasonable to assume that Congress will spend the entire allotted budget for a given program area. Thus, another perspective and one that is probably more appropriate is that spending on a revenue program would be made the same as spending on a price program by increasing the coverage of a revenue program. For example, to achieve the same level of spending on price and revenue ARC programs, the coverage level would be 91.5% for a Revenue ARC program in contrast to the 89% coverage rate for the Price ARC program (see Figure 4). Thus, for the same cost to the U.S. government, the Revenue ARC program would provide more risk protection than the Price ARC program.

Another policy consideration is that the distribution of payments across crops will vary for identically parameterized price and revenue programs. Due to similar yield-price correlations, payments are grouped together for soybeans, sorghum, oats, and corn; for barley, wheat, and rice; and for peanuts and upland cotton.

The share of payments going to soybeans, sorghum, oats, and corn was higher for the price ARC program than for the identically parameterized revenue ARC program (see Figure 5). This finding reflects the greater variability of U.S. price than U.S. revenue for soybeans, sorghum, oats, and corn, which in turn reflects the high negative price-yield correlation that exists for these crops.

On the other hand, the share of payments going to upland cotton and peanuts was higher for revenue ARC program than for the identically parameterized price ARC program (see Figure 5). This finding reflects the greater variability of U.S. revenue than U.S. price for peanuts and upland cotton, which in turn reflects the low negative price-yield correlation that exists for these crops.

The middle price-yield correlation group of barley, wheat, and rice had more payments under a revenue ARC program. The likely reason is the large savings generated by the high negative price-yield correlations for soybeans, sorghum, oats, and corn, in combination with the large share of U.S. acres devoted to these crops.

Upland cotton had a disproportionate change in its share of payments. It accounted for 6.4% of Price ARC payments and 10.5% of Revenue ARC payments. To assess how sensitive the change in the distribution of payments was to the large change for upland cotton, it was removed from the analysis. While the size of the redistribution effect was smaller, the same redistribution of payments from soybeans, sorghum, oats, and corn to the other crops was observed when upland cotton was removed from the analysis.

Summary

Revenue programs are a more encompassing risk management program than price programs because revenue includes yield as well as price. In addition, because the large acreage crops of corn and soybeans have a more negative price-yield correlation than most of the other program crops, a revenue program will cost less if identically parameterized to a price program. These savings can be used to increase the coverage level of a revenue program relative to a price program, further enhancing the ability of revenue programs to provide risk management assistance relative to price programs.

The price-yield correlation varies by a statistically significant amount across U.S. crops historically associated with the farm safety net. It is most negative for the Midwestern and northern Plain State crops and is closest to zero for the Southern crops of upland cotton, peanuts, and rice. The differences in price-yield correlation mean that the variability of revenue is relatively greater for the Southern crops while the variability of price is relatively greater for the Midwest and northern Plain state crops. Because variability is a key factor in determining payments by a risk management program, revenue programs should make relatively more payments to the Southern crops while price programs should make relatively more payments to the Midwest and northern Plain state crops.

In conclusion, converting from a price based farm safety net to a revenue based farm safety net likely will increase the effective risk management provided by the farm safety net and likely will result in relatively more support being provided to Southern crops. These implications reflect that revenue risk is not just about price risk and yield risk, but also about the correlation between price risk and yield risk.

Sources for Figures: calculated using data from U.S. Department of Agriculture, National Agricultural Statistics Service, QuickStats, available at http://www.rma.usda.gov/data/sob.html

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.