Expense Election (IRS Code Section 179): Where are we going and where have we been?

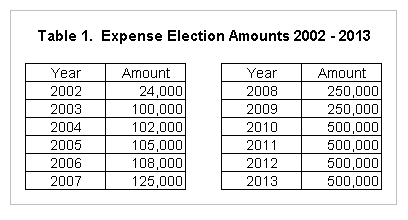

The Internal Revenue Code Section 179, or Expense Election, will fall to $25,000 indexed for inflation in 2014. This is a drastic change over the last four years that have been $500,000 and could impact the way you tax plan for 2013. The last time we have seen these levels was in 2002 when it was $24,000. Table 1 shows the expense election levels from 2002 to 2013. What impact will this history of using a larger expense election amount have on tax years 2014 and beyond? Let’s look at farms from Illinois Farm Business Farm Management.

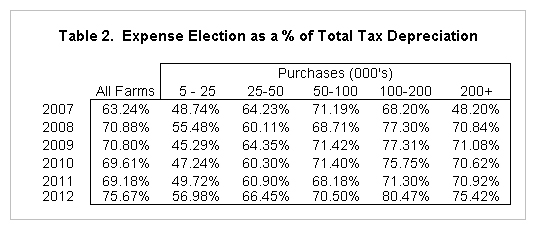

Farms in this study include Illinois grain and livestock farms that were sole proprietors and had their sources and uses balance within .5% of each other. The majority of these farms were grain farms. In Table 2, we look at the expense election amount taken by the farm as a percentage of total tax depreciation for that farm. Tax depreciation includes regular depreciation on depreciable assets; expense election amounts; and any bonus depreciation. The all farms group includes all farms that met the above criteria, whether or not they had any capital purchases. The rest of the table shows the different percentages based on the level of all capital purchases made on the farm.

In general, the more years of a higher expense election or the more purchases (up to $200,000), then we see the greater the percentage of expense election to total tax depreciation. Farms that were purchasing $100,000 to $200,000 of capital assets have the greatest percentage over time. Therefore, based on 2012 numbers, if there was no expense election in 2014, we could assume 76% reduction in the tax depreciation expense. If we assume a 92% reduction in the expense election, we could assume a 70% (.92 x .7567) reduction in the tax depreciation expense. For the group that has capital purchases of $100,000 to $200,000, based on 2012 with a 92% reduction in the expense election, we could assume a 74% reduction in the tax depreciation expense.

The expense election as a percent of total tax depreciation has become a large percentage because many farmers have relied on the expense election as a current year tax deduction, which has led to less items being purchased and depreciated over the depreciable life of the asset. This means there is little carry over depreciation and expense election makes up the majority of this tax deduction. If farmers are using the expense election on financed capital purchases, then they will have to make principal payments and will not have any carryover depreciation to offset the farm income used like they would if they would have depreciated the asset over its depreciable life. As we are tax planning for 2013 keep in mind this information. If you are planning on making some capital purchases in 2014 for a tax deduction, you may want bring in some income into 2013 and make that purchase this year to utilize the much higher expense election.

The authors would like to acknowledge that data used in this study comes from the local Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,700 plus farmers and 60 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM staff provide counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217.333.5511 or visit the FBFM website at www.fbfm.org.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.