IFES 2013: Income, Financial Outlook, and Adjustments in 2014

This is a presentation summary from the 2013 Illinois Farm Economics Summit (IFES) which occurred December 16-20, 2013 at locations across Illinois. A complete collection of presentations including PowerPoint Slides (PPT), printable summaries (PDF) and interviews are available here.

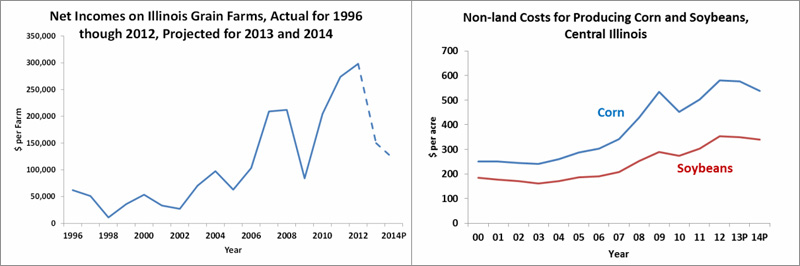

Grain farm incomes in 2013 and 2014 are projected to be significantly lower than in 2010, 2011, and 2012. From 2010 to 2012, net incomes on Illinois grain farms averaged well above $200,000 per farm. Net incomes in 2014 are projected to average near $125,000 per farm.

Commodity Prices and Costs

Lower projected commodity prices are the primary cause of lower incomes. Corn prices received on Illinois grain farms enrolled in Farm Business Farm Management (FBFM) averaged near $5.20 per bushel for crop produced in 2010, $6.24 per bushel for 2011 crop, and $6.60 per bushel for 2012 crop. Corn prices are projected to average near $4.50 per bushel for both the 2013 and 2014 production years. Over $1.00 per bushel price declines will significantly reduce gross revenues on Illinois farms.

Somewhat mitigating commodity price declines are projected lower non-land costs. Non-land costs have increased dramatically in recent years. In 2006, non-land costs for producing corn in central Illinois on high-productivity farmland were $302 per acre. In 2010, non-land costs averaged $452 per acre, in increase of over $150 per acre from 2006 levels. Non-land costs continued to increase in 2011 and 2012, reaching $402 in 2011 and $581 per acre in 2012. The 2012 non-land cost level is $279 per acre higher than 2006 cost levels. Non-land costs for corn are projected at $537 per acre for 2014, down by $44 per acre from 2012 levels. This cost decrease is predominately caused by lower fertilizer prices. In autumn2013, anhydrous ammonia in Illinois has averaged around $685 per ton, down by almost $200 per ton from the average $873 level in 2012. Diammonium Phosphate (DAP) prices are near $510 per ton in autumn 2013, compare to an average of $611 for 2013. Potash prices are near $480 per ton, down from an average level of $580 for 2012.

Net Incomes and Stress

Even with cost declines, 2014 incomes are projected lower because gross revenue declines are larger than cost declines. Note that while the projected 2014 net income is significantly below 2010-2012 levels, it is still higher than average incomes during the 2001-2006 time period. For most farms, lower incomes will not cause financial stress, particularly as most farms have built financial reserves during the past several years. However, there will be a cohort of farms that face financial stress. These farms have large percent of their acres cash rented at high cash rent levels. Almost by necessity, these farms will have to lower cash rents so as to not face large losses in 2014.

Adjustments

As a result of lower incomes, two adjustments likely are needed in many farms. First, expenditures on machinery and other capital items must be reduced. From 2010 to 2012, capital expenditures on grain farms enrolled in FBFM averaged over $100 per acre. This compares to an average capital expenditure near $45 per acre in the early 2000s. Much of the higher recent expenditures can be explained by higher incomes and the desire to shelter incomes from taxes through depreciation and expensing resulting from machinery purchases. Now, reductions in machinery purchases are necessary as incomes have declined. Second, cash rents on some parcels of farmland likely will need to decrease, particularly on parcels with above average cash rents. Over the past several years, cash rents have adjusted upward as a result of higher returns to farmland. Some of the higher cash rents are now above levels supported by farmland returns. Farmers will have to choose to lower these rents, or subsidize losses from high-rent farmland from other parts of their operations.

References

- The slides for this presentation can be found at:

- http://www.farmdoc.illinois.edu/presentations/IFES_2013

- For current farm management information:

- http://www.farmdoc.illinois.edu/manage/index.asp

- Projected 2013 and 2013 Operator and Farmland Returns

http://www.farmdoc.illinois.edu/manage/index.asp - 2014 Returns for Corn under Drought, median, and High Yield Scenarios

https://farmdocdaily.illinois.edu/2013/10/2014-returns-for-corn-under-dr.html

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.