IFES 2014: Do Risk Management Decisions Change?

This is a presentation summary from the 2014 Illinois Farm Economics Summit (IFES) which occurred December 15-19, 2014 at locations across Illinois. A complete collection of presentations including PowerPoint Slides (PPT), printable summaries (PDF) and interviews are available here.

Should Crop Insurance and Risk Management Decisions Change under the New Farm Bill?

The 2014 Farm Bill gives farmers the opportunity to enroll farms in commodity programs that have a “risk management” emphasis. Given this emphasis, should farmers alter other risk management such as crop insurance, marketing, and farmland rental decisions? The short answer is no. It is unlikely that crop insurance, marketing, and farmland rental decisions should change as a result of new Federal commodity programs. The importance of making good risk management decisions is more important than ever, but the decisions most farmers will make under the new farm bill are largely separable from the decisions required for election of the commodity program options.

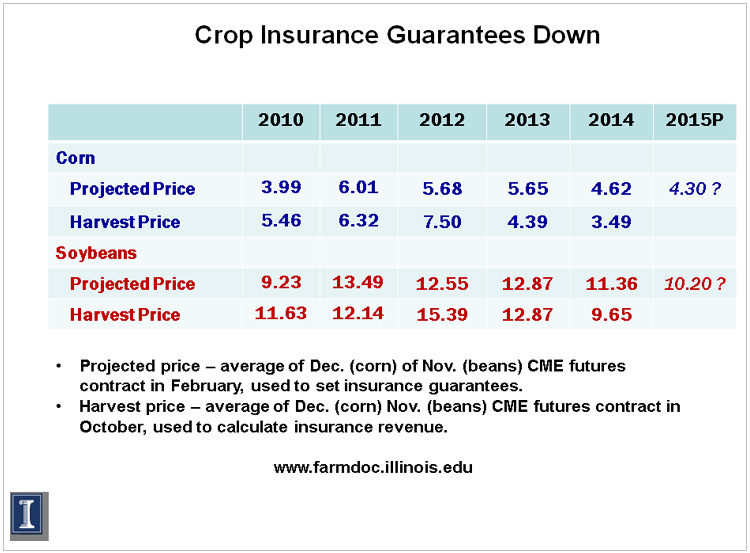

In actuality, the single most impactful change from 2013 to 2014 is the likely reduction in projected prices used to determine guaranteed revenues. In 2014, the projected price for corn was $4.62. The 2015 projected price will be set in February based on settlement prices of the December 2015 Futures contract. The December 2015 corn contract currently is trading near $4.18 per bushel. A $4.18 projected price would be 10% below the 2014 projected price of $4.62. This 10% price decrease then translates into an 10% decrease in minimum revenue guarantees on Revenue Protection, given no changes in guarantee yields and coverage levels, although some will see some increases in their APH levels following 2014 harvest. A $4.18 projected price would be the lowest since 2010, when the projected price was $3.99. As a result, farmers will face more risks from lower revenue in 2015 than they did in 2014.

Aside from Supplemental Coverage Option (SCO), farmers will have the same crop insurance products available in 2015 that were available in 2014. In 2014, most corn and soybean acres were insured using Revenue Protection (RP) policies at a fairly high levels. Making a similar choice in 2015 likely would be advisable, and if price levels persist, insurance is likely to look more affordable and higher coverage elections are likely advisable.

This session will discuss the relatively weak linkages between SCO and traditional crop insurance choices, and provide a sense of the price environments under which SCO and/or ARC make the greatest payments. Additionally, pressures on rental arrangements are likely to occur with some potential to tie payments to revenue including crop insurance revenue analogs.

Additional Resources

- The slides for this presentation can be found at:

- http://www.farmdoc.illinois.edu/presentations/IFES_2014

- For more information see:

- https://farmdocdaily.illinois.edu/

- http://farmbilltoolbox.farmdoc.illinois.edu/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.