Release of 2015 Crop Insurance Decision Tool: Higher Premiums in 2015

The 2015 Crop Insurance Decision Tool is available for download from the FAST section of farmdoc (click here for download). This January release will quote corn and soybean premiums for the COMBO an ARPI products, as well as provide quotes for the Supplemental Coverage Option (SCO). A YouTube video demonstrating the tool is available here. The 2015 Tool is used to calculate premiums for compassion to 2014 premiums.

Premiums for Corn in 2014 and 2015

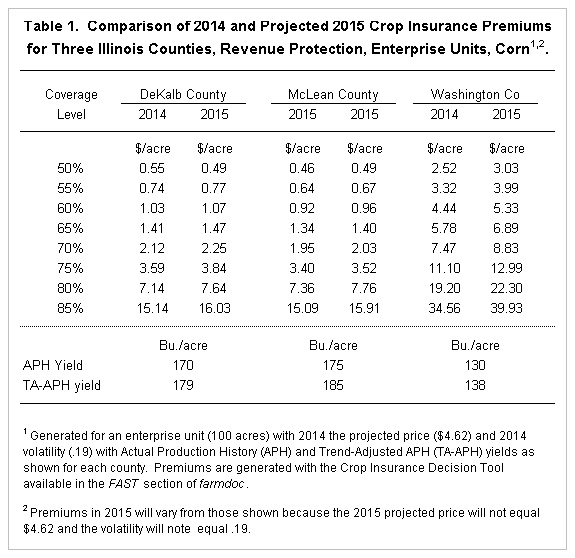

Table 1 shows a comparison for 2014 and projected 2015 Revenue Protection (RP) premiums in three Illinois Counties: DeKalb, McLean, and Washington Counties. DeKalb County is in northern Illinois, McLean County in central Illinois, and Washington County is in southern Illinois. These per acre premiums are for corn given that 100 acres are insured using an enterprise unit. The Actual Production History (APH) and Trend-Adjusted APH (yields) are set near the average for each county. Each county’s APH and TA-APH yields are shown in Table 1. The 2015 projected price is set at $4.62, the 2014 projected price. Similarly, the 2015 volatility is set at .19, the 2014 volatility. Setting these value at 2014 levels allow examination of how rate changes made by the Risk Management Agency (RMA) impacts premiums.

In most cases, 2015 projected premiums are higher than 2014 premiums. At an 80% coverage level, the 2014 premium in DeKalb County is $7.14 per acre while the 2015 premium is $7.64 per acre (see Table 1), a 7% increase over the 2014 premium. At an 80% coverage level, McLean County’s 2015 premium is 5% higher than the 2014 premium. Washington County’s 2015 premium is 16% higher than the 2014 premium.

Any number of factors could have caused the increase in premium. One factor is the inclusion of 2012 losses in the calculation of premiums. RMA uses a loss cost methodology in calculating premiums. Performance in 2012 entered into rate calculation for the first time in setting 2014 premium. Due to the drought, 2012 crop insurance losses were large, likely influencing rate determination.

The 2015 premiums will vary from those shown in Table 1 because the projected price and volatility will vary from 2014 values. A lower projected price, as now seems likely, will lower premium. A higher (lower) volatility will increase (decrease) premium.

SCO premiums

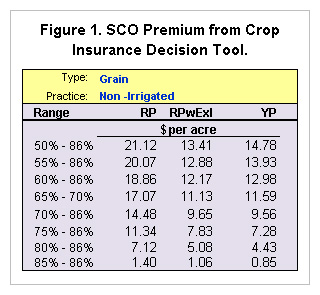

The 2015 Crop Insurance Decision Tool will provide premiums for Supplemental Coverage Option (SCO). SCO is a new crop insurance product that is available in certain situations (farmdoc daily August 5, 2014).

Figure 1 shows an example of SCO premiums. Note that three sets of premiums exist: one for when the underlying product is Revenue Protection (RP), one for RP with harvest price exclusion, and one for Yield Protection. For example, suppose a farmer purchases RP at an 80% coverage level and wishes to purchase SCO. One SCO product would be available providing coverage from 86% to 80%. This SCO product is indicated as “80% — 85%” in the 2015 Crop Insurance Decision Tool and would have a cost of $7.12 per acre. More discussion of the use of SCO will be provided here in the future.

Summary

The 2015 Crop Insurance Decision Tool is now available for use. It provides premiums for corn and soybeans. A new feature is quotes for SCO. Final quotes can be made after February when 2015 projected prices and volatilities will be set.

References

Schnitkey, G., and N. Paulson. "Supplemental Coverage Option (SCO) in Wheat." farmdoc daily (4):145, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 5, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.