Risk Reductions Possible by Hedging 2012 Grain Production in the Summer of 2011

It has been suggested that farmers consider locking in profits for the 2012 production year (see, for example, here). Current commodity price and cost levels suggest it may be possible to lock in profits. To lock in profits, both gross revenue and input costs must be dealt with. As much as possible, gross revenue must be managed to eliminate downside risk. Similarly, input costs must be managed so as to eliminate the possibility of higher costs. This article examines the extent to which gross revenue risk can be reduced by hedging grain and purchasing crop insurance. A future article will examine the process of locking in input costs.

In this article, the highest per acre minimum revenue is determined for corn on a typical farm in Illinois. The highest minimum revenue is found by using the following two tools:

- Hedge grain now, and

- Plan on purchasing a Revenue Protection (RP) crop insurance product for 2012 production.

The presentation of this strategy is not an endorsement to follow this strategy. Other risk management strategies that include hedging grain over time may have more beneficial impacts in the long run. The minimum revenue is examined to illustrate the lowest revenue that can currently be locked in.

These two positions are selected because they are simple to implement. Hedging grain will protect against price declines. The RP policy will provide protection in two cases: 1) when prices decline and 2) when yields decline and prices increase, potentially leading to hedging losses that cause minimum revenues to decline. The plan to purchase crop insurance is not without uncertainties, as the exact terms, projected price, and costs of 2012 policies are not known.

Situation

To make the example concrete, the minimum revenue is determined for the following situation:

- Corn yield for 2012 is expected to by 180 bushels per acre.

- A Revenue Protection (RP) policy with an 85% coverage level will be purchased in 2012. At this point, the projected price for this crop insurance product is not known, as the projected price will be set based using December 2012 futures prices during February 2012.

- The Actual Production History (APH) yield for the RP policy is 170 bushels. Two important points about the APH yield. First, it is not known with certainty as the APH yield is based on historical yields, and the 2011 yield will enter the calculation of the 2012 APH yield. Second, the APH yield lags the expected yield of 180 bushels per acre, thereby not fully covering the expected yield on the farm.

- Hedging will be accomplished by selling Chicago Mercantile Exchange (CME) futures contracts that mature in December 2012. The position will be offset near harvest in 2012. Forward contracts could be used to accomplish the same risk gains as from futures contracts. Another alternative is the use of options contracts. However, 2012 crop options contracts have high costs, causing options contracts to result in lower minimum revenues than use of futures contracts.

- The futures price used in hedging is $6.00. This is near the price of the December 2012 CME futures contract at the beginning of July.

- The cash price at 2012 harvest is assumed to be $.30 per bushel below the futures price. This indicates that “expected” cash price for 2012 delivery is $5.70 per bushel ($6.00 futures price – $.30 basis).

Expected and Minimum Revenue for a Planned 85% RP Purchase

Given the above situation, the expected revenue from an acre is $1,026 per acre:

- $1,026 crop revenue = 180 bushel yield x ($6.00 futures price – .30 basis).

Crop revenue will vary from this expectation if actual yield differs from 180 bushels, the futures price differs from $6.00 per bushel, or the basis differs from $.30 per bushel. Obviously, it is highly likely that these three variables will vary from their expectation.

Hedging grain during the summer of 2011 will reduce downside revenue risks. With important caveats, the lowest possible revenue can be obtained by hedging up to the yield guarantee offered by the planned insurance product. For an 85% RP policy, the hedging amount is 144.5 bushels per acre (170 bushels per acre x .85 coverage level). At this amount of hedging, the minimum revenue equals:

- $824 per acre = 144.5 bushels x ($6.00 futures price – .30 basis).

Caveats to the Minimum Revenue

The above minimum revenue of $824 per acre is based on a couple of important assumptions:

- The basis between futures and cash prices remains at -$.30 per bushel. A widening basis would lower the minimum revenue.

- Grain quality does not cause yield damage not protected for by crop insurance. For example, aflatoxin can cause damage to corn that would not be covered by the crop insurance product. The above calculation of the minimum revenue does not consider grain quality.

- Price at harvest does not exceed 2 times the projected price. Harvest prices in the RP policy are capped at 2 times the harvest price. Hence, the RP policy will begin to have lower minimum revenues under extreme price increases.

Minimum Revenues for Different Hedging Amounts and Coverage Levels

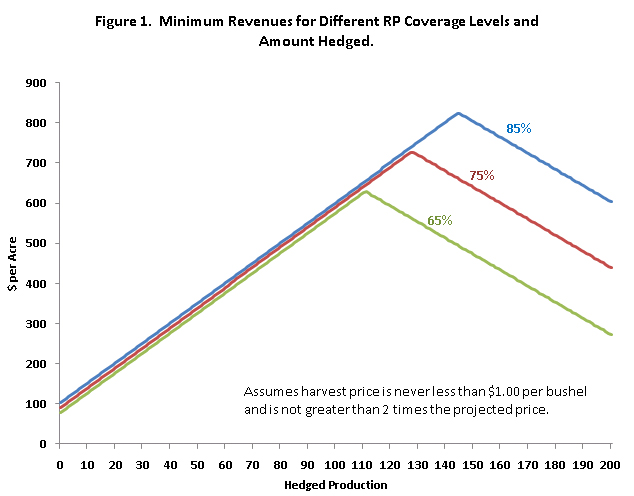

For different amounts hedged, minimum revenues will increase in a linear fashion up to the maximum at the APH yield times the coverage level (see Figure 1). Hedging above the yield guarantee will result in lower maximum revenues. When grain amounts are hedged below the yield guarantee, the insurance policy provides protection against cases in which yields are below the yield guarantee and prices are above hedged levels. The RP insurance product provides against these cases because of its guarantee increase provision. When amounts are hedged above these levels, the RP policy does not provide protection for price increases on bushels hedged above the guarantee.

Minimum revenues are lower if the planned insurance purchase is at a lower coverage level (see Figure 1). For a 75% coverage level, the minimum revenue is $726 per acre and occurs when 128 bushels per acre are hedged. For a 65% coverage level, the minimum revenue is $629 per acre and occurs when 111 bushels are hedged.

Most individuals likely will not hedge up to the amounts that currently result in the minimum revenue. Figure 1 is useful in these situations as it shows the minimum revenue that can be obtained by hedging grain currently.

Concluding Comments

This article illustrates a process by which a per acre minimum revenue, with important caveats, can be established for the 2012 corn crop. This minimum requires hedging up to the yield guarantee offered by the crop insurance product. This is not a recommendation to follow this practice, as risk efficiency likely will be increased by hedging grain over time. Moreover, hedging large amounts of grain now may not reduce risk if the cost side is not controlled as well.

Still, it is possible to lower the possibility of low revenues by hedging grain now. However, there still is risk. In the above example, the minimum revenue is around $200 per acre below the expected revenue ($1,026 expected revenue compared to $824 minimum revenue). Input purchases and cash rental decisions could place total costs above $824 per acre. Hence, there is a possibility of losses for the 2012 year even after setting a minimum revenue.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.