Trends in Gasoline and Ethanol Prices

In recent posts (see October 6 and November 2), we began exploring basic pricing relationships in the energy markets. The first post examined crude oil and gasoline prices. The second post looked at the relationship between crude oil and natural gas prices. Now we push on closer to agriculture and look at the crucial relationship between gasoline and ethanol prices.

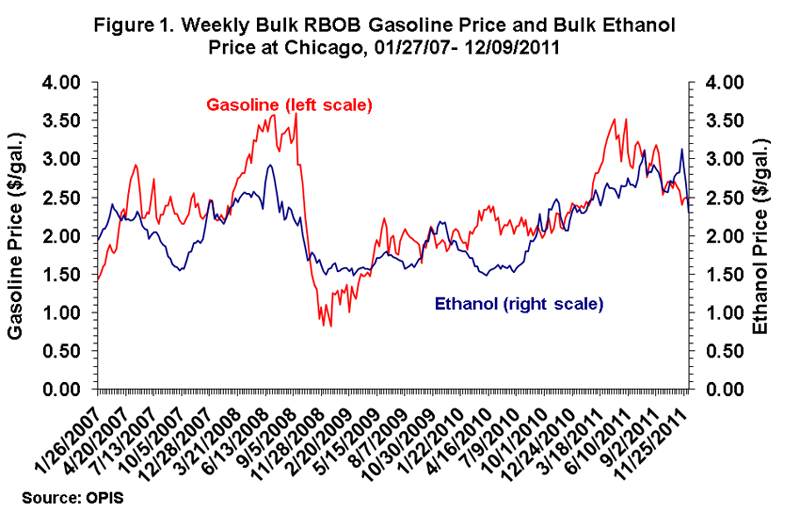

The red line in Figure 1 shows the weekly (Thursday) wholesale price of gasoline (RBOB) for Chicago, the same series we used in our comparison of gasoline and crude oil prices. The blue line in Figure 1 is the weekly (Thursday) wholesale price of ethanol in Chicago. Since ethanol is blended with other refined products to produce gasoline it is no surprise that the price of ethanol tends to move with the price of gasoline (and also with the price of crude oil to the extent gasoline and crude oil move together). The correlation coefficient between the two series, 0.74, confirms this impression (correlation coefficients range from -1 to +1).

While there is a general tendency for gasoline and ethanol prices to move together, there is also a good bit of variability in the relationship. This is illustrated in Figure 2, which shows the difference between the wholesale gasoline and ethanol prices in Chicago. The figure shows that gasoline prices have been as much as $1.44 above ethanol and $0.78 below ethanol since 2007. However, the general tendency is for gasoline prices to exceed ethanol prices. The average difference is $0.22 and the split is about 70/30.

Charts like Figure 2 are used to track the “blending margin” between gasoline and ethanol. A positive difference means market blending economics favor ethanol and vice versa. In recent years it has been profitable to blend ethanol in gasoline about 70% of the time. Since this computation does not account for the added incentive to blend ethanol available in the form of the blenders’ tax credit, it has indeed been profitable to blend ethanol in recent years. With the tax credit set to expire at the end of this month, the difference between the market price of wholesale ethanol and gasoline will play an even more important role in the valuation of ethanol.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.