The Truly Amazing Continuing Story of Natural Gas Prices

In a post last November, the dramatic decline in the price of natural gas relative to the price of crude oil was highlighted. The dramatic break in the relationship was attributed to rising production associated with a new technique known as hydraulic fracturing, or fracking for short, which is the use of liquids forced into deep rock formations to “crack open” previously unreachable deposits of natural gas.

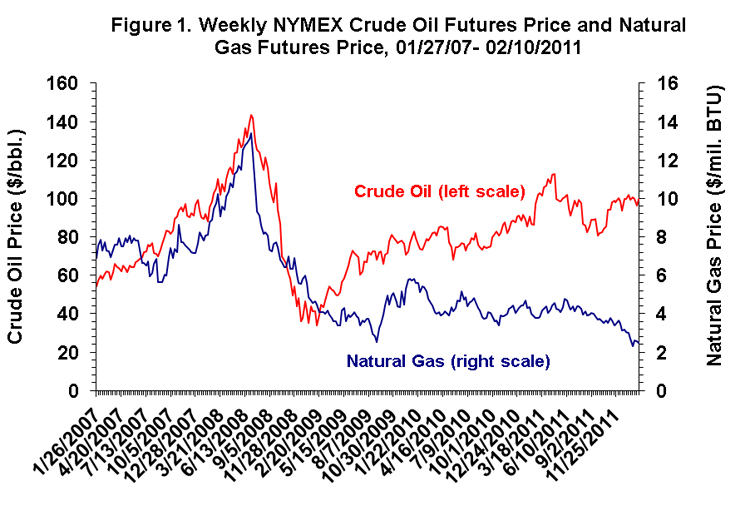

The trend highlighted last November has accelerated substantially. Figure 1 shows one benchmark for the price of crude oil in the U.S., the nearby price of NYMEX crude oil futures prices on a weekly (Thursday) basis since early 2007. The second line charted in Figure 1 is the nearby price of NYMEX natural gas futures prices, also on a weekly (Thursday) basis. Previous to early 2009 crude oil and natural gas prices tended to move in tandem, but then prices for the two markets clearly decoupled. While crude oil prices have fluctuated in a narrow range this winter between $90 and $100 per barrel, natural gas prices have plummeted to under $2.50 per million BTU. The mild winter has undoubtedly contributed to weak natural gas prices along with continuing production increases associated with the fracking revolution.

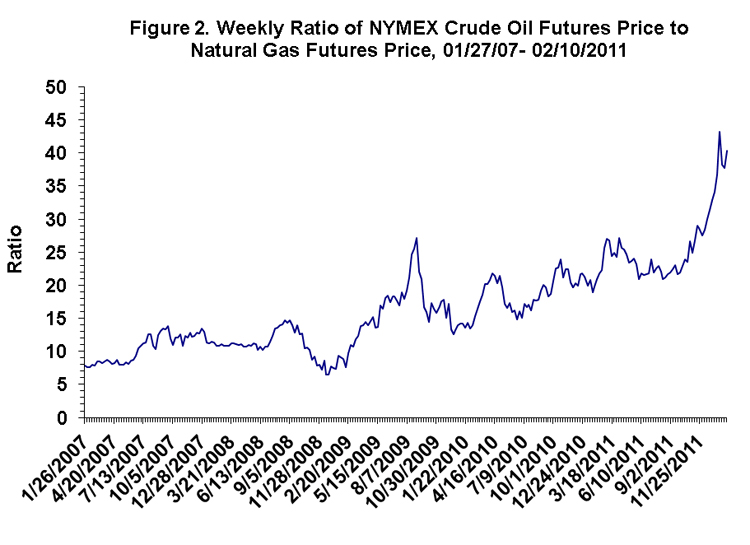

The truly stunning change in the relative price of natural gas is highlighted in Figure 2, which shows the ratio of crude oil to natural gas price. The average ratio was about 10 until 2009, meaning it took about 10 units of natural gas to purchase one barrel of crude oil. Since that time the ratio has steadily trended upward reaching a peak of 43 in late January. It now takes about four times as many units of natural gas to buy one barrel of crude oil as it did as recently as 2009!

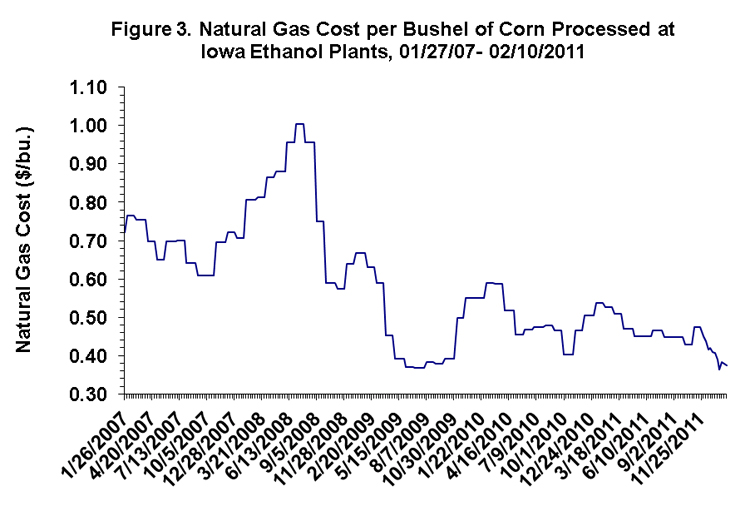

An example of how this impacts agricultural markets is shown in Figure 3, which presents an estimate of the weekly natural gas cost of processing a bushel of corn at a representative Iowa ethanol plant. These costs peaked at about $1 per bushel in 2008 when both crude oil and natural gas prices were rising in tandem. Since natural gas prices have trended down even as the economy (and crude oil prices) recovered from the “Great Recession,” natural gas costs for ethanol producers have continued to slide right along with natural gas prices. In recent weeks, estimated natural gas costs have dropped below $0.40 per bushel of corn processed. If natural gas prices had maintained the pre-2009 pricing relationship with crude oil, this cost would be roughly twice as high today. While the dynamic relationship between corn, ethanol, and natural gas prices is complex (see the paper here), there is certainly the possibility that some of the increased cost could be passed back to corn producers in the form of lower corn prices.

Since the price of natural gas affects costs in agriculture in numerous ways (e.g., drying, electricity, fertilizer) the downward trend in natural gas prices will help reduce cost pressures over time. This is good news during a period when many costs of production have risen rapidly.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.