Grain Farm Income Prospects Given Drought Conditions in 2012

Low corn and soybean yields are increasingly likely as hot, dry weather is forecast to continue over much of the corn-belt during the critical corn pollination period. Lower yields then lead to questions about grain farm incomes in 2012. Grain farm incomes likely will be above projections made in winter of 2012, assuming that crop prices increase if crop yields are below trend-line levels. However, some farms will suffer losses. Farms that did not purchase crop insurance could face losses. Also, grain farms that have hedged a great deal of expected production could have lower incomes than those farms that have not pre-harvest hedged as much grain.

Income Projections

These conclusions are reached by simulating 2012 net farm income under drought conditions for a farm typical of northern and central Illinois. This farm has 1,200 tillable acres, with 10 percent of the acres owned, 60% cash rented, and 30% share rent. Cash rent is $295 per acre. The farm has non-land costs of $514 per acre for corn and $306 per acre for soybeans. Debt level is $480,000. The farm purchases Revenue Protection (RP) crop insurance at an 80% coverage level for both corn and soybeans. The Trend Adjusted Actual Production History (TA-APH) yield is 180 bushels per acre for corn and 50 bushels per acre for soybeans.

Net farm incomes under drought conditions are compared to two base cases.

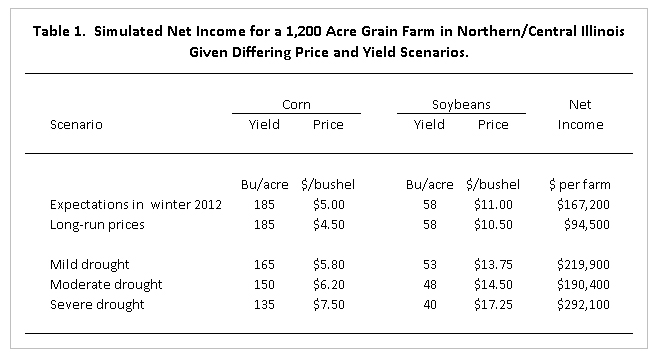

- 2012 winter expectations of net incomes. During winter, 2012 income for the farm was simulated using a corn yield of 185 bushels per acre and a soybean yield of 58 bushels for soybeans, the expected yields for this farm. These expected yields likely would have led to a reduction of corn prices from 2011 levels. Prices of $5.00 per bushel for corn and $11.00 per bushel for soybeans were used for winter projections. In May when yield prospects were favorable, forward bids for fall delivery of corn reached $5.00, suggesting that the winter projected prices were reasonable given that trend line yields occur. The winter yields and price result in net income of $167,200 (see Table 1).

- Incomes given long-run prices. Below trend yields for corn in 2010 and 2011, severally reduced wheat yields in Russia in 2010, and low soybean yields in South America in 2011 have led to prices above long-run projections in recent years. Estimates of long-run prices are $4.50 per bushel corn price and a $10.50 per bushel soybean price in projections. These prices result in $94,500 of net farm income, below the $167,200 income in the base case (see Table 1).

Drought Scenarios

Scenarios include a mild drought (165 bushels per acre corn yield), a moderate drought (150 bushels per acre corn yield), and a severe drought (135 bushels per acre corn yield). Because of the widespread nature of the dry weather, prices are assumed to increase as yields decrease. The mild drought scenario has a corn price of $5.80 per bushel, the moderate drought a 6.20 price, and the severe drought has a $7.50 price.

The mild drought scenario represents continuing dry weather, but eventually a return to more normal weather that includes some rains during the growing season. Net income under this scenario is forecast at $219,900; above the income given winter expectations (see Table 1). While yields under the mild drought case are lower than winter expectations, higher prices offset yield declines.

A moderate drought has 150 bushels per acre corn yield and 53 bushels per acre soybean yield. Expected prices are increased to $6.20 per bushel for corn and $14.50 per bushel for soybeans. Net income is projected at $190,400, below the income projected for the mild drought and above the income given winter expectations.

A severe drought has a corn yield of 135 bushels per acre and a soybean yield of 40 bushels per acre. Widespread yields at these levels likely would result in dramatic increases in corn and soybean prices. A $7.50 corn price and a $17.25 soybean price are used in this scenario. Given these prices, income under a severe drought is projected at $292,100, up considerably from winter expectations. Crop insurance payments are occurring under this scenario. As a result, further yield declines would not have much of an impact on incomes because lower crop revenue is offset by higher crop insurance proceeds.

Caveats

The above scenarios suggest that many farmers would not have lower incomes due to lower yields. There are three important cases in which incomes could decline:

- Farms that have no crop insurance or crop insurance at low coverage levels would have lower incomes, particularly at very low yield levels.

- Farms that hedged a large portion of expected production could face income losses. By hedging, farmers would not benefit from assumed price increases. Take, for example, the case in which 50% of expected production is hedged at average price available in the spring 2012: 92 bushels of corn hedged at $5.40 per bushel and 29 bushels of soybeans hedged at $13.00 per bushel. Under severe drought, this farm would have $126,000 of net farm income, considerably below the $292,100 income with no pre-harvest hedging.

- The above scenarios presume that prices increase as a result of lower yields. If price responses do not occur, incomes would be much lower than presented here.

Summary

Grain farm incomes may not be adversely impacted on many farms if there are higher prices associated with lower yields, a reasonable assumption given the widespread nature of dry weather this year. Somewhat ironically, lower yields this year may postpone the return to lower prices, as another supply disruption will keep grain stocks at low levels. This could then lead to 2013 price expectations above long-run levels and higher than would be the case had trend-line yields occurred in 2012. This conclusion, however, is based on the assumption that no long-run reductions in consumption occur, which could be the case if very high prices occur in 2012. Reduced consumption would then result in lower incomes in 2012 than presented above. It could also lead to lower grain farm incomes in future years.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.