Current Farmland Prices in Line with Farmland Returns and Interest Rates

Farmland prices continue to increase. U.S. Department of Agriculture (USDA) (see here) estimates the average 2012 Illinois farmland price at $6,800 per acre, 17 percent higher than the $5,800 price in 2011. The Chicago Federal Reserve Bank (FED) (see here) estimates price increases at 15 percent between July 1, 2011 and July 1, 2012 for northern and central Illinois farmland. At the same time farmland prices have increased, cash rents have increased and interest rates have decreased, thereby supporting the increases in farmland prices.

Cash Rents and Interest Rates

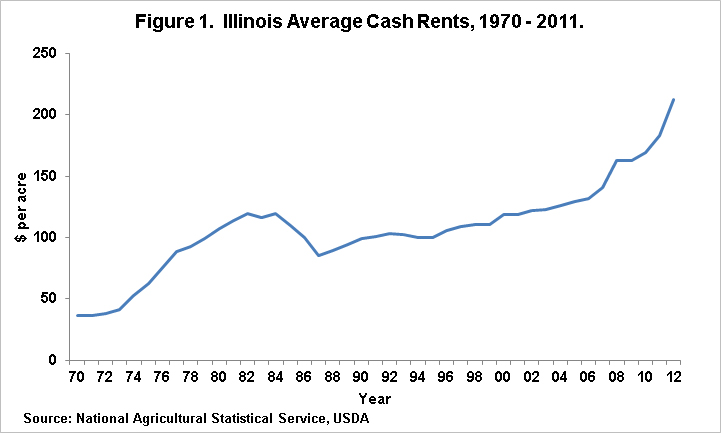

As cash rents increase, returns to farmland increase, generally leading to higher farmland prices. USDA estimates the average 2012 cash rent in Illinois at $212 per acre, 16 percent higher than the $183 per acre rent in 2011. The 2012 increase continues a series of years of large increases in cash rents (see Figure 1). Since 2005, cash rents have increased by 64 percent.

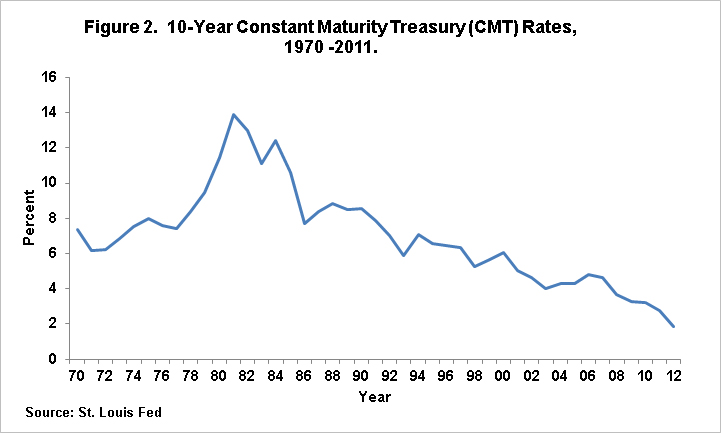

Decreasing interest rates also support increasing land prices because decreasing interest rates signal lower returns to fixed income assets that are alternatives to farmland, and because lower interest rates lower debt payments on farmland purchases. Interest rates have decreased in 2012. The 10-year Constant Maturity Treasury (CMT) rate so far this year has averaged 1.87 percent. This 1.87 percent rate compares to a 2.79 percent rate for 2011. Interest rates have been on a general downward trend since the mid-1980s (see Figure 2), thereby supporting increases in farmland prices.

Capitalized Values Compared to Farmland Prices

A capitalized value represents the discounted cash flows from farmland, taking into consideration cash rents and interest rates (see here for more detail). For an asset with an infinite life, a widely used capitalized formula has capitalized value equal to the cash rent divided by an interest rate:

- Capitalized value = cash rent / CMT 10-year rate.

This formula assumes that cash rents and interest rates remain the same as current values throughout the future.

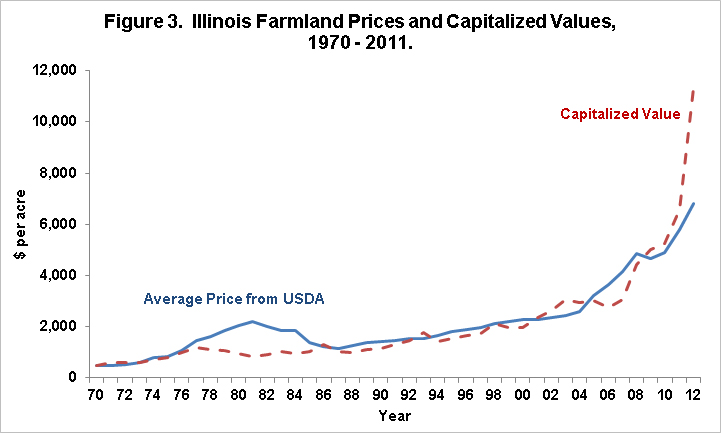

Capitalized values were significantly below prices during the early 1980s (see Figure 3). In 1980, for example, USDA estimated the average land price at $2,041 and the capitalized value was $933 per acre. The lower capitalized value indicated that farmland prices were above fundamentals suggested by cash rents and interest rates. Subsequently, farmland prices decreased in each year from 1981 to 1987.

Between 1987 through 2010, prices and capitalized values followed each other closely, indicating that farmland prices were closely following changes in farmland returns and interest rates as represented by the capitalization formula. The largest deviation occurred in 2007, when farmland price was $1,100 above the capitalized value. This year was at the end of the period in which there was large interest in developing farmland for commercial purposes and at the beginning of period of higher farmland returns caused by higher commodity prices.

Since 2009, capitalized values have been above farmland prices, suggesting that fundamentals would support higher farmland prices than currently observed in the market. The difference reached $4,537 per acre in 2012, when the capitalized value of $11,337 per acre and farmland price of $6,800.

Much of the reason for the high 2012 capitalized value is the low interest rate. To illustrate, capitalized values are calculated for differing interest rates using the 2012 cash rent of $212 per acre:

- A 2.79 percent rate occurred in 2011. The capitalized value using this 2.79 percent rate is $7,598 per acre, 33 percent lower than the $11,337 capitalized value using a 1.87 percent 10-year CMT rate.

- A 3.21 percent rate occurred in 2010. The capitalized value using this rate is $6,604 per acre. The $6,604 per acre capitalized value is below the current farmland price of $6,800.

- The average 10-year CMT rate since 1990 is 5.32 percent. The capitalized value given a 5.32 percent rate is $3,984 per acre, 41 percent lower than the current farmland price of $6,800 per acre.

Summary and Commentary

While farmland prices have increased rapidly in recent years, comparison of farmland prices to capitalized values suggest that farmland prices are supported by current cash rent and interest rate levels. In the future, decreases in farmland returns or increases in interest rates could lead to farmland price decreases. At this point, neither return decreases nor interest rate increases seem eminent. In my opinion, rising interest rates pose the largest risk that could lead to farmland price decreases in the future. Current interest rates are very low and even small interest rate increases cause large declines in capitalized values. Moreover, the last time farmland prices decreased was in the 1980s, when interest rates were rising. It can be argued that rising interest rates had as much impact on farmland price declines during the 1980s as did decreasing farmland returns.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.