What Price of Crude Oil Makes Ethanol Production Profitable?

There has been a great deal of interest this summer in the ethanol market, RFS mandates, and corn use for ethanol production. This reflects the impact of the historic drought of 2012 in the Midwest and concerns about how reduced corn supplies will be allocated across consumption categories. The focus of this post moves from the short-term to the long-term. In particular, we are interested in analyzing the basic economic question of how high do crude oil prices have to be in order for ethanol production in the U.S. to be profitable. Sometimes this simple but important issue is lost in the blizzard of daily market data and analysis. The answer also helps provide a frame of reference for thinking about the longer-term outlook for the market demand for ethanol.

In order to assess ethanol plant profitability for different crude oil prices, we use the same model of a representative Iowa plant as in earlier ethanol-related posts. To review, the final model incorporates these key assumptions:

- 100 million gallon annual ethanol production capacity

- Plant construction costs of $2.11 per gallon of ethanol production capacity

- 40% debt and 60% equity financing

- 8.25% interest on 10-year loan for debt financing

- A total of $0.60 fixed costs per bushel of corn processed

- Non-corn variable costs of $1.05 per bushel of corn processed

- 2.80 gallons of ethanol produced per bushel of corn processed

- 17 pounds of dried distillers grain (DDGS) produced per bushel of corn processed

This model is meant to be representative of an “average” ethanol plant constructed in the last five years. There is certainly substantial variation in capacity and production efficiency across the industry and this should be kept in mind when viewing profit estimates from the model.

Given the model’s technical parameters and costs, we only need two prices to compute ethanol production profits. The first is the price of corn, the feedstock for the plant, and the second is the price of ethanol, the main output product. We don’t need the price of DDGs, another output product, because we assume a constant ratio of DDG to corn prices (98%, the average for recent months). So, if we assume a corn price then implicitly we are also assuming a DDG price. We are going to assume three different levels of the price of corn for the analysis: $4, $6, and $8 per bushel. So where do we get ethanol prices?

We explored the linkage from crude oil to gasoline to ethanol in earlier posts found here and here. Give the long-run focus of the present post, a simple model of these linkages is used. The first part assumes that the wholesale price of gasoline is 3.33% of the WTI crude oil futures price. The second part assumes that price of ethanol at the plant level is 78% of the wholesale gasoline price. Both percentages are approximately equal to the average percentages from June-August 2012. All one has to do is multiply the two together and we have a way to link the price of crude oil to the price of ethanol. Specifically, the price of ethanol is assumed to be 2.6% of the price of crude oil.

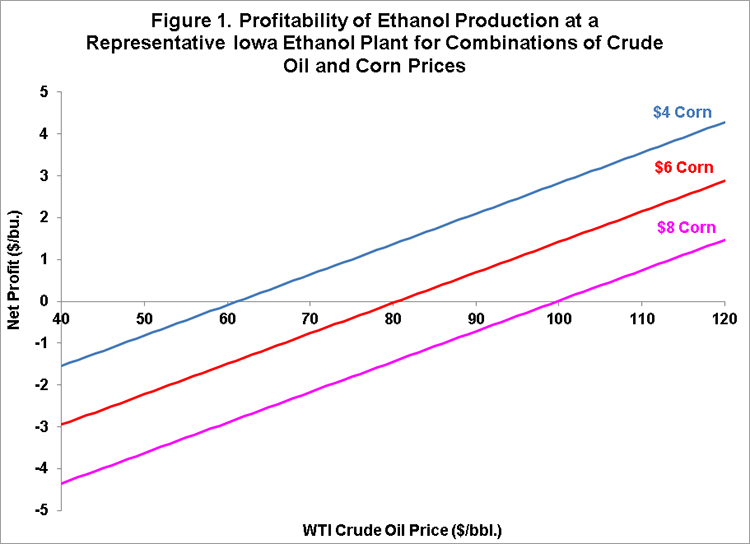

Figure 1 presents the profitability of ethanol production at the representative Iowa ethanol plant for combinations of crude oil and corn prices. Given the price of corn, each line shows the net profit (after variable and fixed costs) per bushel of corn processed into ethanol for crude oil prices ranging from $40 to $120 per barrel. Our main interest is the point at which each line intersects the horizontal axis, which is the zero net profit line. Above the horizontal axis the equity owners of the plant are in the “black” and below the line they are in the “red.” For corn prices of $4, $6, and $8 per bushel, net profits are positive if crude oil prices are above $62, $81, and $100 per barrel, respectively. While there is considerable uncertainty about the long-run price of crude oil, it seems unlikely that prices will go much below $60 for an extended period of time. This means that corn prices are likely to be supported at $4 or better. If one expects substantially higher crude oil prices, as many analysts do, then corn prices may be supported at even higher levels. This is consistent with the argument that we are indeed in a new era with a permanently higher average price for corn. The analysis also highlights the difficulty of sustaining the current price of corn, around $8, without crude oil prices above $100. Otherwise, ethanol producers are just covering variable and fixed costs or worse.

There are a couple important caveats to the present analysis. First, actual linkages between crude oil, gasoline, and ethanol prices are highly variable. The linkages assumed here are representative of long-term averages but they can change substantially over time. Second, some of the extreme combinations of crude oil and corn prices shown in Figure 1 would be unlikely to occur in reality. Consider a corn price of $4 and a crude oil price of $120. If this combination were to occur it would likely be short lived as upward pressure would be applied to corn prices due to the relatively high value of ethanol. The market would equilibrate these relationships such that prices do not get too far “out of line.” In this light, the present analysis is best thought of as a “what if” game with corn prices fixed.

Conclusion

The level of energy prices plays a central role in determining the long-run profitability of ethanol production in the U.S. This analysis shows that crude oil prices above $60 per barrel will provide support for corn prices at or above $4 per bushel. If crude oil prices are higher, as many analysts expect, this is likely to further pressure corn prices upward. This has important implications for other users of corn, such as the livestock industry, that now compete with the transportation fuel use of corn. It also points towards the importance of continued public and private investment in technologies to increase the efficiency of corn production.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.