Does the Biodiesel Tax Credit Change the Advanced Biofuels Landscape?

In an earlier post we highlighted the importance of the advanced biofuels Renewable Fuels Standard (RFS) for the current and future demand for biodiesel and biodiesel feed stocks. The RFS for 2013 is expected to require a minimum blending of 1.28 billion gallons of biodiesel and 2.75 billion gallons of all advanced biofuels. The difference between the minimum biodiesel requirement and the minimum total requirement is referred to as undifferentiated biofuel. That requirement can be met by Brazilian ethanol, biodiesel, or cellulosic ethanol. Since cellulosic ethanol is not available in any substantial quantities, the requirement will be met by either Brazilian ethanol or domestic biodiesel. In a separate post we illustrated that imported Brazilian ethanol was a cheaper alternative for meeting the undifferentiated advanced RFS than the domestic production of biodiesel. Those economic conditions implied that Brazilian ethanol imports would be maximized (estimated at 830 million gallons) in 2013 and would limit domestic biodiesel production to the minimum RFS requirement of 1.28 billion gallons. In addition, the impending ethanol blend wall near 13.3 billion gallons implies that Brazilian ethanol imports would limit the production of U.S ethanol to 13.17 billion gallons (assuming exports of 700 million gallons) in 2013.

Since those earlier posts, the $1.00 per gallon blenders’ tax credit for biodiesel has been reinstated for 2013 (retroactive to 2012). On the surface, the availability of the tax credit would seemingly swing the economic advantage for meeting the undifferentiated biofuels component of the RFS in 2013 away from Brazilian ethanol to domestic biodiesel. If so, Brazilian ethanol imports in 2013 would be less than previously forecast and possibly close to zero; domestic biodiesel production would be larger than previously forecast and as large as 1.833 billion gallons; and domestic ethanol production would be larger than previously forecast and as large as 14 billion gallons.

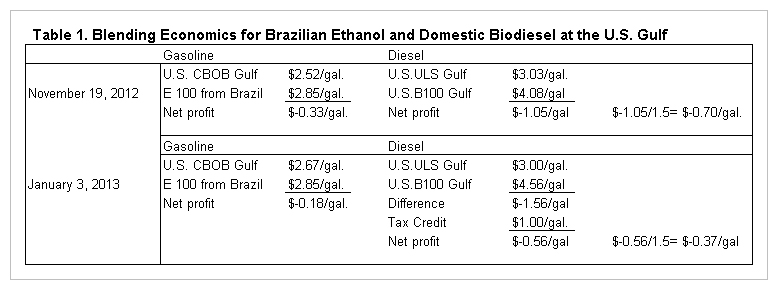

So how have the relative blending economics of Brazilian ethanol and domestic biodiesel changed since our post of a month ago? The changes are summarized in Table 1 where CBOB is conventional gasoline blendstock, E100 is 100 percent anhydrous ethanol shipped to a Gulf terminal from Brazil (including freight costs), ULS is ultra low sulfer diesel, and B100 is 100 percent biodiesel. The final comparison of blending economics includes the division of biodiesel profits by 1.5 since biodiesel is worth 1.5 gallons of ethanol in RFS math.

Blending of both Brazilian ethanol and domestic biofuels result in a loss to the blender. The loss, however, is still smaller for Brazilian ethanol than for biodiesel, even after accounting for the tax credit. The advantage of Brazilian ethanol over biodiesel was smaller on January 3, 2013 ($0.19/gallon) than on November 19, 2012 ($0.36/gallon) but the difference was still substantial. Part of the benefit of the tax credit has been offset by higher prices for biodiesel.

Implications

The reinstatement of the blenders’ tax credit for biodiesel initially resulted in higher soybean oil prices under the assumption that the tax credit would result in biodiesel production and blending in excess of the minimum requirement of 1.28 billion gallons in 2013. While higher biodiesel prices might stimulate biodiesel production, those higher prices offset the incentive to blend more than the minimum amount of biodiesel in 2013. As a result, our earlier conclusions about likely ethanol imports, domestic biodiesel production, and domestic ethanol production in 2013 are unchanged. Rapidly changing price relationships, however, underscore the importance of monitoring blending economics for advanced biofuels as the year progresses. Given today’s price relationships and the reinstated tax credit, a decline in the price of biodiesel of as little as 25 cents would flip the economics of RFS advanced biofuels compliance in favor of biodiesel.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.