GRIP-HR: A Good Product for 2013

Group Risk Income Plan with the Harvest Revenue Option (GRIP-HR) has features that make it an attractive crop insurance product this year. GRIP-HR will make large payments in a drought year, a concern of many farmers as dryness extends across much of the western corn-belt and Great Plains. GRIP-HR also will make large payments if prices decline, a distinct possibility given large projected plantings of corn. Large planting, combined with normal yields, would lead to large supplies and potentially large price declines. Under the price decline scenario, GRIP-HR will make larger payments than Revenue Protection (RP), the most popular crop insurance product. Herein, payments of GRIP-HR and RP are compared under different yield and price scenarios.

Scenarios Examined

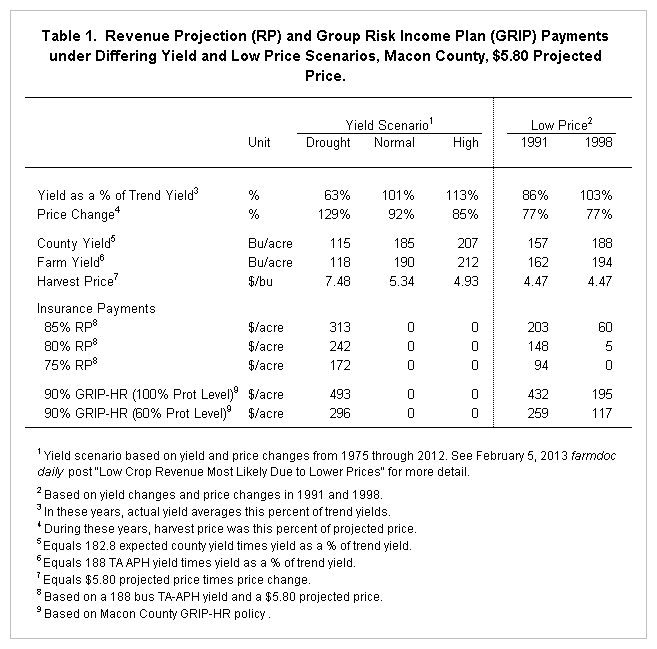

RP and GRIP-HR payments are generated for a Macon County farm using a $5.80 projected price, close to the closing prices of Chicago Mercantile Exchange contracts during the first half of February. The farm has a 188 bushel Trend Adjusted Actual Projection History (TA APH) yield. The expected yield for GRIP-HR is 182.8 bushels per acre.

GRIP-HR has higher premiums than RP. Premiums for an enterprise unit of RP are $21.86 per acre for an 85% coverage level, $10.63 per acre for an 80% coverage level, and $5.14 for a 75% coverage level. GRIP-HR payments are generated for a 90% coverage level with protection levels varying from 100% to 60%, the highest and lowest protection level. The premium is $55.48 per acre for the 100% protection level and $33.29 for the 60% coverage level.

Payments are generated under three yield scenarios representing outcomes that have occurred between 1975 through 2012 (see the February 5, 2013 farmdocDaily post entitled “Low Crop Revenue Most Likely Due to Lower Prices” for more detail here). These scenarios are:

- Drought years like 1983, 1988, and 2012. During these years, yields average 63% of trend yield and harvest price is 129% of projected price (see Table 1). This implies a county yield of 115 bushels per acre (182.8 expected county yield x .63), a farm yield of 118 bushels per acre (188 TA APH yield x .63), and a harvest price of $7.48 per bushel ($5.80 projected price x 129%).

- Normal yield years in which yields average 101 percent of trend yields and harvest price averages 92% of projected price. In this scenario, county yield is 185 bushels per acre, farm yield is 190 bushels per acre, and harvest price is $5.34 per bushel (see Table 1).

- High yield years in which yields average 13% higher than trend yield and the harvest price is 85% of projected price. Under this scenario, county yield is 207 bushels per acre, farm yield is 212 bushels per acre, and harvest price is $4.93 per bushel (see Table 1).

In addition, payments are generated under two low price years. In both 1991 and 1998, the harvest price is 77% of the projected price. Yield is 86% of trend yield in 1991 and 103% in 1998. In both years, the harvest price is estimated at $4.47 per bushel. Yields in the 1991 scenario are below expected yield (county yield is 157 bushels per acre and farm yield is 162 bushels per acre) while the 1998 scenario has near normal yields (county yield is 188 bushel per acre and farm yield is 194 bushel per acre). The year 1998 is significant in that it began a series of low price years, leading to low farm incomes and large government payments.

Insurance Payments

The drought year generates large insurance payments. RP has a payment of $313 for an 85% coverage level, $242 per acre at the 80% coverage level, and $172 per acre at the 75% coverage level (see Table 1). GRIP-HR also makes large payments: $493 per acre at a 100% protection level and $296 per acre at the 60% protection level. Even at the lowest protection level, GRIP-HR makes payments roughly the same as the 85% coverage level.

Neither RP nor GRIP-HR makes payments in the normal and high yield scenarios.

- Under the 1991 and 1998 year scenarios, GRIP-HR makes larger payments than RP. In a year like 1991, GRIP-HR makes a $432 per acre at the 100% protection level and a $259 per acre at the 60% protection level. RP makes a $203 per acre payments at the 85% coverage level, $148 at the 80% coverage level, and $94 per acre at the 75% coverage level.

- Under the 1998 scenario, GRIP-HR again makes larger payments than RP. GRIP-HR makes a $195 per acre payments at the 100% protection level and $117 per acre payment at the 60% protection level. RP makes a $60 per acre payment at the 85% coverage level, $5 per acre at the 80% coverage level, and $0 per acre at the 75% coverage level.

- Under low prices, GRIP-HR makes larger payments than RP because of its 90% coverage level, 5% higher than the highest coverage level under RP. The 5% coverage level difference causes $.29 per bushel higher prices to make payments.

Caveats

GRIP-HR is a county level product that does not have replant or prevented planting provisions. County yields are not perfectly correlated with farm yields; hence, it is possible to have a low farm yields and the county yield does not generate an insurance payment. GRIP-HR makes payments in the year after crop is harvested. For example, GRIP-HR has not made payments for the 2012 year because 2012 county yields have not been released by U.S.D.A.

Summary

GRIP-HR has a number of attractive features given the wide outcomes that can occur in 2013. GRIP-HR will still provide protection in drought years. There is a perception, not supported by historical evidence, that there is a higher probability of drought in 2013, leading to the desire for drought protection.

While drought protection may be desired, the feature of providing better price protection than RP makes GRIP-HR attractive this year. Large plantings of corn and near normal yields across the corn-belt could result in lower prices. This period of lower prices could last several years, given that yields are near normal around the world.

While GRIP-HR has a number of attractive features, it does have higher premium costs than RP. RP will provide excellent overall revenue protection, with the caveat that GRIP-HR will make larger payments in price decline years. If RP is used, taking a high coverage level seems advisable.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.