ACRE Payments in Illinois in 2012 and 2013

ACRE, or the Average Crop Revenue Election, is a revenue based program contained in the 2008 Farm Bill. The 2008 Farm Bill made ACRE available through the 2012 crop year. Last year, the 2008 Farm Bill was extended to the 2013 crop year and some farmers choose to enroll in ACRE for 2013. In Illinois, ACRE payments are not likely for corn, soybeans, or wheat in 2012. There is a reasonable chance for ACRE payments for corn and soybeans in 2013.

ACRE State Benchmark Revenue Calculations

ACRE makes payments when a crop’s state revenue, as measured by the state yield times the national market year average (MYA) price, is below state benchmark revenue. If this state benchmark is met, a farm benchmark also must be met before ACRE will make payments on a farm-basis. This post deals with the chance of the state revenue being below the state benchmark revenue.

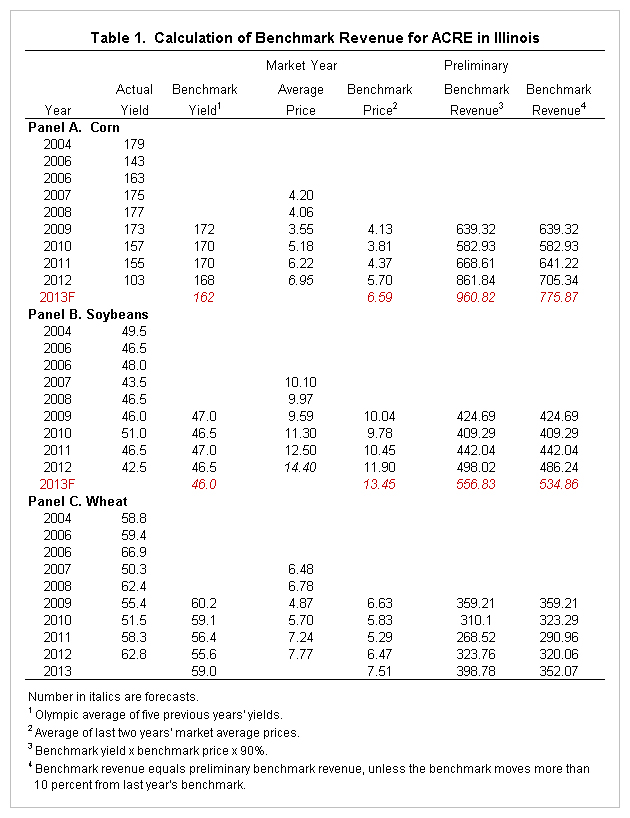

Table 1 shows the calculation of state benchmark revenues for corn, soybeans, and wheat in Illinois for the years from 2009 through 2013. The 2012 state guarantee for corn is $705.34. The benchmark is arrived at through a two-step process. First, the benchmark yield (Olympic average of the previous five state yields) times the two-year average of MYA prices times .90 gives preliminary benchmark revenue. The 2012 preliminary guarantee for corn is $861.84, which equals the 168 benchmark yield times the $5.70 benchmark price times .90. Second, the preliminary benchmark revenue is compared to the previous year’s benchmark revenue. Benchmark revenue cannot go up or down more than 10% from one year to the next. In 2011, the benchmark revenue for corn is $641.22, meaning that 2012 benchmark revenue cannot be above $705.34 ($641.22 x 1.1). Since $861.84 is greater than $705.34, benchmark revenue is capped at the limit of $705.34.

With near certainty, 2013 benchmark revenues will be capped at the upward movement of 10 percent for corn, soybeans, and wheat in Illinois. Therefore, even though the 2012 market years for corn and soybeans have not come to an end, the 2013 benchmark revenues can be calculated with near certainty as a 10 percent increase from last years’ benchmarks. For this not to be the case, the 2012 MYA corn price would have to be below $3.87 per bushel and the soybean price below $11.35 per bushel. With the market year ending in August, it is extremely unlikely that prices below these levels will occur. State benchmark revenues for 2013 will be $775.87 per acre for corn, $534.86 per acre for soybeans, and $352.07 per acre for wheat.

2012 ACRE Payments

For corn, state ACRE payments will occur if state revenue is below $705.34 per acre. The 2012 actual corn yield is 103 bushel per acre, meaning that MYA price will have to be below $6.84 per bushel before ACRE pays. Current WASDE estimates place the midpoint of the estimate of 2012 price at $6.95 per bushel. ACRE payments for corn are unlikely in 2012.

For soybeans, state ACE payments will occur if state revenue is below $486.24 per acre. The 2012 state yield is 42.5 bushels per acre, meaning that the 2012 MYA price will have to be below $11.44 per bushel. The current WASDE midpoint for 2012 soybean price is $14.40 per bushel, significantly above $11.44. ACRE payments for soybeans in 2012 are unlikely.

For wheat, 2012 benchmark revenue is $320.06 per acre. State revenue is $487.96 per acre(62.8 bushel yield x $7.77 MYA price). Because state revenue is above benchmark revenue, ACRE will not pay for wheat in 2012.

2013 ACRE Payments

ACRE payments for 2013 are more speculative, as the 2013 marketing year has not begun for corn and soybeans and there remains considerable uncertainty as to the levels of 2013 corn and soybean yields.

For corn, ACRE payments will occur when state revenue is below $775.87. If Illinois corn yields average 162 bushels – the Olympic average for the previous five-years – the 2013 MYA price would have to be below $4.79 for an ACRE payment occurs. For a 170 bushel yield – close to an average Illinois corn yield – the MYA price would have to average price $4.56. Prices below these levels are possible. A simulation model in the Acre Payment Estimator – a FAST Microsoft Excel spreadsheet available for download from the farmdoc website – indicates that there is a 44 percent chance of an ACRE payment in 2013. The average ACRE payment times .85 is $31 per acre.

For soybeans, ACRE payments will occur in 2013 when state revenue is below $534.86 per acre. At a 46 bushel state yield – the five-year Olympic average – the 2013 MYA price would have to be below $11.62 per bushel for an ACRE payment to occur. For a 48 bushel yield, the MYA price would have to be below $11.14 per bushel. The simulation in the 2012 Acre Payment Estimates indicates that there is a 15 percent chance of ACRE payments in 2012. The average payment times .85 is projected to be $6 per acre.

For wheat, the National Agricultural Statistical Service reports the 2013 Illinois wheat yield calculated on a planted acre basis as 63 bushels per acre. At a 63 bushels yield, MYA price would have to be below $5.42 per bushel. WASDE indicates that range of the 2013 price to be $6.45 to $7.75. Given this range, it is unlikely that wheat payments will occur for ACRE.

Summary

In Illinois, ACRE payments for the 2012 crop year are unlikely. There is a reasonable chance for corn and soybean payments in the 2013 year. If 2013 payments occur, they will be paid after October, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.