Fertilizer Costs Move Down

In the August 1st Illinois Production Cost Report, the U.S. Department of Agriculture reported an average Illinois price for anhydrous ammonia of $793 per ton, a diammonium phosphate (DAP) price of $558 per ton, and a potash price of $541 per ton. These prices are down over 5% from two-week earlier prices. The downward movement in prices holds the promise that fertilizer costs in 2014 will be lower than those in in recent years.

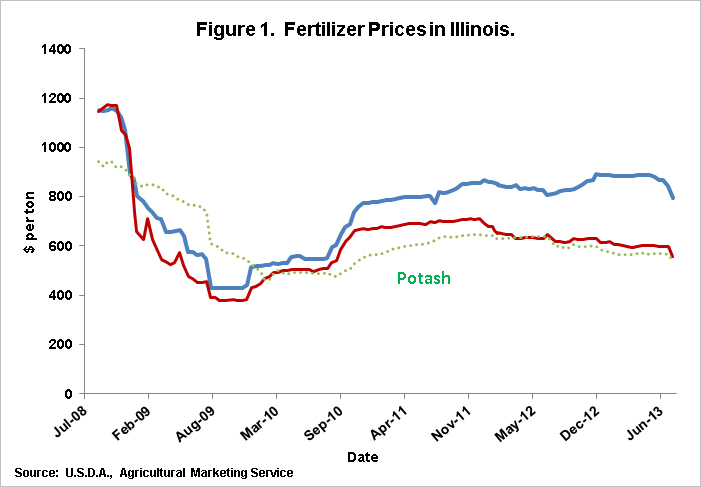

Fertilizer Prices in Illinois

Figure 1 shows a history of fertilizer prices in Illinois from August 2008 till the present. Fertilizer prices were the highest in fall 2008, with anhydrous ammonia prices above $1,200 per ton. From these levels, prices fell until late summer 2009, with anhydrous ammonia price reaching a low of $498 per ton. From these lows, fertilizer prices rose and reached plateaus. During the period when much of the fertilizer for the 2013 crop was purchased – August 2012 till June 2013 – fertilizer prices averaged $868 per ton for anhydrous ammonia, $613 per ton for DAP, and $582 per ton for potash.

As well as being lower than two-week earlier prices, reported prices on August 1, 2013 prices are below fertilizer prices during 2013. The August 1st per ton anhydrous ammonia price of $793 per ton is 9% below the average 2013 price and 6% below the July 18th price. The August 1st DAP price of $558 per ton is 9% below the average 2013 price and 7% below the July 18th price. The August 1st potash price of $540 per ton is 5% below the average 2013 price and 8% below the July 18th price.

Two primary reasons exist for falling fertilizer prices. First, anhydrous ammonia manufacturing is being built because nitrogen fertilizer manufacturing has been profitable in recent years. Margins have been high because nitrogen fertilizer prices have remained high while natural gas, the major cost in nitrogen production, has had its price decline. Ammonia prices likely remained high because of limited ammonia manufacturing capacity that restricted increases in supply while nitrogen fertilizer use increased in recent years because of more corn and wheat acres. Increases in ammonia capacity reduce manufacturing constraints, potentially leading to lower nitrogen fertilizer prices.

Second, a Russian phosphate company by the name of Uralkali exited a partnership agreement that controlled 43 percent of potash exports. The breakup of this cartel likely leads to lower potash prices. After the breakup, stock prices fell on Potash Corp., Agrium Inc., and Mosaic Co. – three publically traded fertilizer manufactures. Bloomberg news (available here) reported that wholesale potash prices fell by 18% from year earlier levels.

Impacts on Per Acre Fertilizer Costs

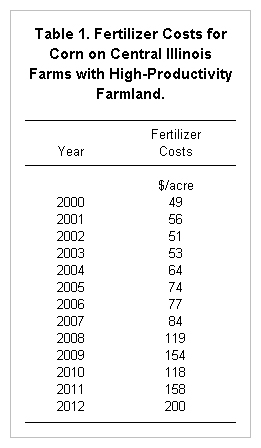

Per acre fertilizer costs for corn in central Illinois have been high in recent years. From an average cost of $60 per acre in the early 2000s, fertilizer costs have increased to $200 per acre in 2012 (see Table 1). These cost increases largely follow fertilizer prices, although the 2012 costs were about $30 to $40 higher than those implied by fertilizer prices.

The average fertilizer prices of 2013 point to fertilizer costs in 2013 of $155 per ton. The August 1st prices imply a fertilizer cost per acre of $141 per acre. Further declines are possible. A $700 per ton ammonia price, a $500 per ton DAP price, and a $475 potash price implies per acre fertilizer costs for corn of $126 per ton.

Summary

Significant declines in fertilizer costs are possible for the 2014 crop. Fertilizer costs that averaged $200 per acre in 2012 could be in the $125 to $150 range for 2014. Fertilizer cost declines will partially offset projected 2014 revenue declines caused by lower corn and soybean prices. However, net returns for 2014 crop production are projected lower than returns in 2010 through 2012 even given fertilizer price declines.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.