Big Picture View of the Crop Safety Net Debate

Overview

The farm bill is currently in Conference to determine if compromises can be reached over differences in the House and Senate farm bills (see the November 14, 2013 post by Carl Zulauf and Jonathan Coppess, “2013 Farm Bill Update – November 2013,” available here). A tendency at this stage in the process is to focus on specific program differences. However, it is just as important to keep the bigger picture in view. This post takes a big picture view of the crop safety net that appears to be emerging from the current farm bill debate.

Historical Perspectives

A key factor in any policy decision is recent history. Recent history of the crop safety net contains a notable programmatic shift. Specifically, during the current 2008 farm bill period, insurance has been the dominate crop safety net program. Net insurance payments above premiums paid by farms were 8.0 times higher than countercyclical program payments (see Figure 1). In stark contrast, countercyclical program payments (including oilseed and market loss assistance payments to counter the Asian financial crisis) were 5.6 times higher than net insurance payments during the 1996 farm bill and 2.8 times higher than during the 2002 farm bill.

This shift in programmatic emphasis is important. Because its price is reset each year based on current market conditions, crop insurance is a single-year risk instrument. More specifically, it provides assistance for yield or revenue risks that occur between planting and harvest. In contrast, price and yield components of countercyclical programs are either fixed by Congress or determined by moving averages that adjust only partially with changes in the market. Hence, countercyclical programs are designed to provide assistance against multiple-year declines in price or revenue.

Many factors lie behind the shift in emphasis from multiple-year risk to single-year risk. One of, if not, the most important factor is the large increase in the price of crops since 2005. This increase has not only reduced spending on countercyclical programs as market price rose above the policy target prices but also increased spending on insurance as the value of insured crops rose.

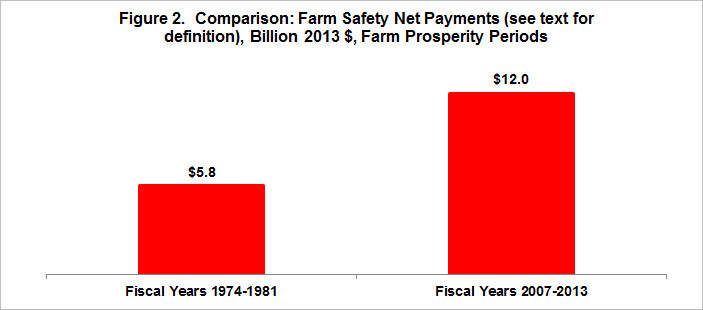

Another useful historical perspective is presented in Figure 2. It contains for the 1970 and current period of farm prosperity the combined expenditures on net crop insurance payments plus U.S. Department of Agriculture, Commodity Credit Corporation expenditures on farm programs (excludes spending on conservation programs as well as such items as interest and administrative expenses). The amounts are expressed in constant 2013 dollars to remove the impact of inflation. This measure of spending on the crop safety net has been $6.2 billion more per year during the current period of farm prosperity, or approximately double the amount during the 1970 period of farm prosperity. The major reason for this difference is direct payments, which did not exist during the 1970s. They account for over 75% of the spending difference during the two periods of prosperity.

Proposed Changes in Crop Safety Net

Consistent with recent history, the House and Senate propose to increase spending on crop insurance by, respectively, $0.9 and $0.5 billion above current baseline expenditures over the 10 fiscal years between 2014 and 2023. The House and Senate also propose to spend, respectively, $1.7 and $2.1 billion more per year on countercyclical programs. These funds come from the elimination of direct payments. Interestingly, the House and Senate both redirect $2.6 billion from the eliminated direct payments to other field crop safety net programs. The rest (approximately $1.5 billion) is directed to other farm bill items or budget savings. [The budget numbers are from Jim Monke, “Budget Issues Shaping a Farm Bill in 2013,” Congressional Research Service Report, October 21, 2013 (available here).]

Summary Observations

The biggest change the proposed farm bills are making in the crop safety net is the elimination of direct payments. However, over 60% of the eliminated direct payments remain in spending on the safety net for field crops. Between 65% (House) and 81% (Senate) of these dollars are used for multiple-year programs (Title 1 Commodities) while the remainder is shifted to single-year programs (Title 11 Crop Insurance). Clearly, a key policy question is how much of the eliminated direct payments should remain in multiple-year programs and how much should be shifted to single-year programs? This specific 2013 farm bill issue is however part of a much larger farm bill issue — What is the right mix of single-year and multiple year risk programs? This broad policy issue has received little direct attention up to this point in the debate, but could emerge as a key farm policy issue if crop prices continue their decline of the last few months.

A second observation is that the U.S. has spent more on the crop safety net during the current than 1970 period of farm prosperity. Economic analysis suggests this higher spending will at least partially find its way into higher cost of land and other inputs and could potentially contribute to any excesses that have emerged during this period of prosperity. It will be interesting to see what, if any, consequences this larger spending on the crop safety net has for the U.S. crop sector going forward.

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.