Planning For a Lower Revenue 2014

Every year begins with the same clean slate and a new promise of ‘things to come’ and success in your personal and professional life. That fresh clean slate brought about a new calendar year and the completion of the production and harvest of the 2013 crop is one the good things about being involved in the annual production cycle here in the Midwest. Like the Cubs…there is always next year if things didn’t go as you planned for 2013. But those ‘things to come’ don’t happen randomly unless you are a regular purchaser of lottery tickets!…and I’m not sure that a prudent management plan includes the purchase of more lottery tickets to attain personal /professional success for 2014 and the years to come after that.

Production and Revenue Risk

We are soon to begin the 19-day period in February where the base price for 2014 crop insurance products will be set. Barring circumstances that are unknown at the present, we will face the reality that our revenue assurance guarantees will be at lower levels than in the past. Think ahead and plan to deal with those lower revenue levels. It may be that expenses (farm and non-farm) that were ‘necessary’ in the past will be more of a luxury in 2014 and future years.

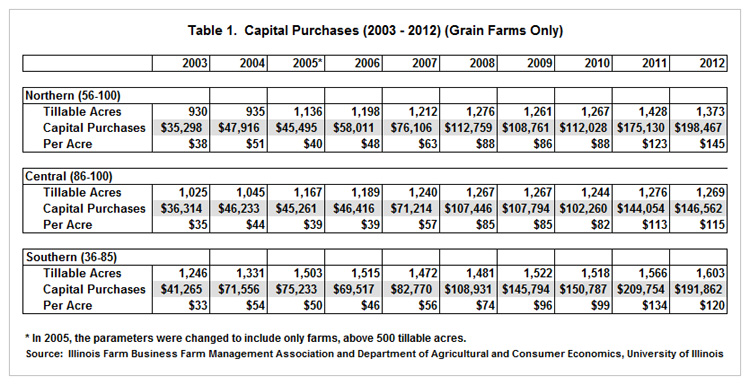

With the same thought of controlling expenses, now more than ever is the time to think about a capital budget for your farm operation. A time-table of your future capital purchases (with a budgeted purchase costs) will help you preserve your working capital…there might be other uses for that hard-earned working capital. We’ve had the chance to accumulate working capital since 2006; we (and our bankers) will be glad to have that financial cushion as we face the potential of lower revenue streams. Our data reveals that capital assets have been purchased at high levels for several years. The higher incomes of the recent past may have led us to be lax in making a capital budget for our long lasting assets on the farm. The IRS gave us incentives (that worked very well) to advance some of what might have been purchased in the future. It strikes me that now is a good time to find your Excel file that you’ve used in the past to plan the timing and expense of your capital purchases. Thinner margins and fewer IRS incentives will lead to more prudent purchases (made according to plan) if one is to have a hope of being profitable. See Table 1 for a recent history of average capital purchases for Illinois grain farms.

Accounting

Vow to not use the two-shoebox method! Many are now gathering information for the 2013 year only to discover they wish they had done a better job with their financial and production record keeping. The road to good financial recordkeeping (and other places) is paved with good intentions; but good intentions help little in creation of financial documents that will help you manage your operation better. There are very good farm accounting software programs that will allow you to reconcile to your bank statement so that there is no ‘slippage’ in tracking either your income or your expenses. There are no substitutes for good accounting records; they are vital to marking your financial progress. An accrual income statement and a balance sheet are the first two documents needed in evaluating your financial progress and are good documents to place in the hands of your lenders. Strive to keep better financial and production records with the idea that you will use a period of five-years of these documents to create a better picture of your farms financial health. Lower revenue makes it vital to account for every dollar you’ve earned.

One last idea for a first of the year review….

If it has been more than three years since you (and your bride) reviewed your wills and power of attorney documents, please locate those documents and review them. Your review may not reveal changes to be made, but the review will keep fresh in your mind your intentions as stated in these documents. At the present, we retain some permanency in our estate tax law (or at least there isn’t an expiration date), 2014 would be a good time to review for estate planning. Keep in mind that if you live in Illinois, the estate tax exemption amount is $4 million which is lower that the 2014 federal inflation-adjusted level of $5,340,000.

The authors would like to acknowledge that data used in this study comes from the local Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,700 plus farmers and 60 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM staff provide counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217.333.5511 or visit the FBFM website at www.fbfm.org.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.